Juicing Up Your Portfolio: The Top Electric Car Battery Companies Stocks to Invest In

Electric cars are quickly becoming the norm, and with that comes an increasing demand for reliable and efficient batteries. As a result, stock investors have turned their attention to electric car battery companies as a potentially lucrative opportunity. The continuous evolution of technology and battery innovation has paved the way for companies like Tesla, Panasonic, and LG Chem to become major players in the battery industry.

But with so many options available, which electric car battery company stocks are worth investing in? In this blog, we’ll provide an insightful analysis of the top electric car battery companies, their stocks, and what makes them worth considering for investment. So strap in and let’s explore the world of electric car battery stocks together!

Overview

Are you considering investing in electric car battery companies stocks? With a growing demand for cleaner energy alternatives and advancements in technology, electric vehicles (EVs) are becoming more commonplace. As a result, the demand for electric car batteries has skyrocketed, opening up investment opportunities in the electric car battery industry. Some of the key players in this industry that are worth considering when investing in electric car battery stocks include Tesla, BYD, and CATL.

Tesla alone accounted for roughly 24% of all EV sales in 2020, making it a key player in the electric car battery market. Other electric car battery companies to watch include LG Chem and Panasonic. It’s important to do your research and keep a close eye on the market trends in order to make informed investment decisions in the electric car battery industry.

By staying informed and investing wisely, you could potentially reap the benefits of this industry’s growth.

The Rise of Electric Vehicles

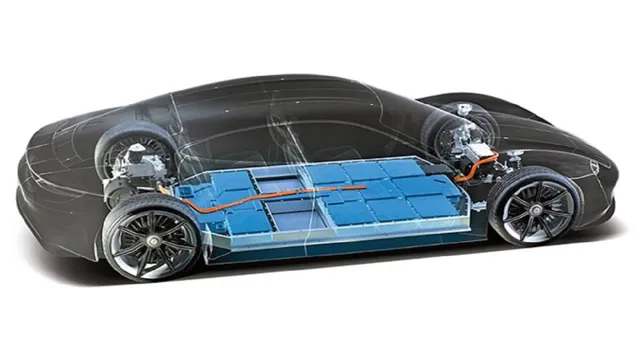

Electric Vehicles In Modern Era Electric vehicles have been on the rise for the past few years, and it’s not hard to see why. As we strive towards a more sustainable future, electric cars offer a way to reduce our carbon footprint. They run entirely on electricity, meaning they produce zero emissions, making them environmentally friendly and easy on the wallet.

Not to mention, they offer a smooth and quiet ride with lower maintenance costs due to fewer moving parts. Electric cars are also becoming more affordable, with government incentives and increased competition driving down prices. As more people continue to embrace this technology, we can expect to see even more advancements and innovations in the future.

The world is taking advantage of this opportunity to move toward a greener and more prosperous future, and electric vehicles are leading the way.

The Importance of Battery Technology

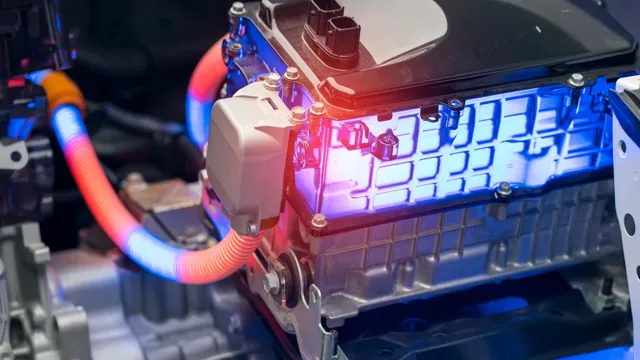

Battery technology is crucial in today’s world as our reliance on portable devices continues to grow. From smartphones to laptops, electric cars to renewable energy sources, batteries play a significant role in powering the devices that keep us connected and advance our society. The evolution of batteries has gone hand in hand with technological advancements, leading to high-capacity, longer-lasting, and more efficient batteries.

However, challenges such as the environmental impact of battery production, the limited lifespan of batteries, and the need for safe disposal have arisen. As a result, researchers are continually working to find sustainable and innovative solutions to these problems. Overall, it’s apparent that the development of battery technology is essential in meeting the energy demands of today’s world and driving progress towards a sustainable future.

Top Electric Car Battery Companies

If you’re looking to invest in electric car battery companies stocks, you’ll be happy to know that there are several top players in the game. One of the most prominent companies is Tesla, who not only produces electric cars but also develops their own battery technology. Their patented “Megapack” and “Powerpack” systems are used for energy storage in both residential and commercial settings.

Another major player is Panasonic, who partnered with Tesla to produce the batteries for their vehicles. Along with supplying Tesla, Panasonic also produces batteries for other car manufacturers such as Toyota. LG Chem is another leading electric car battery company, producing batteries for major automobile companies including General Motors and Hyundai.

With the rise in popularity of electric vehicles, these companies are set to continue growing in the future.

Tesla Inc. (TSLA)

If you are planning to buy an electric car, then you might want to consider the battery technology used by the car manufacturer. Tesla Inc. is one of the leading companies in the electric car industry, and it uses lithium-ion batteries to power its cars.

However, there are also other electric car battery companies that are worth taking a look at. For instance, LG Chem is a South Korean company that provides batteries to various electric carmakers. Its batteries are known for their high performance and energy density.

Another company that is worth mentioning is Panasonic, which has partnered with Tesla to provide batteries for its electric cars. Panasonic’s batteries are also used by other electric car manufacturers, such as Toyota and BMW. Ultimately, the choice of electric car battery company will depend on your specific needs and preferences.

But it’s important to remember that the right battery technology can greatly impact the performance and efficiency of your electric car.

BYD Company Limited (BYDDY)

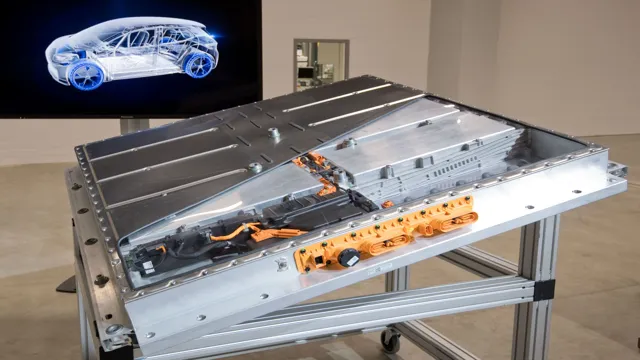

As electric cars become more popular, demand for high-performance batteries is on the rise. One of the top electric car battery companies is BYD Company Limited (BYDDY). Based in China, BYD has been producing electric vehicle batteries since 2008 and has become a major supplier in the industry.

Their batteries are used in a variety of electric cars, including the popular BYD e What sets BYD apart from other companies is their vertical integration, which means they control the entire battery manufacturing process. This gives them greater control over quality and allows them to quickly adapt to changes in the market.

Additionally, BYD has a strong commitment to sustainability and is working to reduce the environmental impact of their manufacturing processes. As electric cars continue to gain popularity, BYD is poised to be one of the leading battery companies in the industry.

LG Chem Ltd. (LGCLF)

When it comes to electric cars, one of the most important factors to consider is the battery. And when it comes to top electric car battery companies, LG Chem Ltd. (LGCLF) is definitely a name that comes up quite frequently.

They are a South Korean company that produces not only batteries for electric cars but also for mobile device batteries, stationary batteries, and more. Their batteries are known for their high performance, long lifespan, and energy efficiency. In fact, some of the top electric car brands in the world, such as Tesla and General Motors, use LG Chem’s batteries in their vehicles.

With their reputation for innovation and quality, it’s no wonder they are among the best in the industry.

Stock Performance and Analysis

Electric car battery companies stocks have been a hot topic in the stock market for the past few years. With the growing demand for electric vehicles, the success of companies involved in the manufacturing of electric car batteries is inevitable. Companies like Tesla, Panasonic, and LG Chem have seen a remarkable performance in their stocks in recent years.

However, it is important to note that the performance of these stocks can also be affected by various factors such as raw material prices, market competition, and government policies. Additionally, investors should also consider the financial health and growth potential of these companies before investing in their stocks. As the market for electric cars continues to grow, investments in electric car battery stocks can be a lucrative opportunity for investors who make informed decisions.

Current Market Trends

Stock performance and analysis are always hot topics in current market trends. Investors are always looking for the best opportunities to invest their money, and understanding how particular stocks are performing can help take informed decisions. Various factors can influence stock performance, such as company earnings, global events, government policies, and the performance of the industry as a whole.

It’s essential to conduct a fundamental analysis of stocks, which involves analyzing the financial statements, management, and industry performance of a particular company. Technical analysis is another method of analyzing stock performance that involves analyzing charts and plots of price movements to identify patterns that can help predict future performance. Keeping track of the stock market is crucial, so investors can make informed decisions about their investments.

By keeping an eye on stock performance and analysis, you can identify trends that will help you make the right decision at the right time, as investing is all about timing.

Stock Performance of Top Companies

Stock Performance and Analysis When it comes to the stock performance of the top companies, there are many factors that can influence it. From market trends and economic indicators, to company-specific events and industry changes, there are multiple variables that can make a stock’s price rise or fall. Keeping an eye on these factors and analyzing them can provide valuable insights into future performance.

Some of the most successful investors use analytical tools and techniques to predict future market trends and stock prices. One such tool is Technical Analysis, which involves studying charts and patterns to predict future stock prices. Another tool is Fundamental Analysis, where investors analyze financial statements and company reports to assess the long-term health and profitability of a company.

By understanding these tools and the factors that can influence stock performance, investors can make informed decisions on how to allocate their resources and maximize their returns.

Investment Opportunities and Risks

When assessing investment opportunities and risks, it’s important to analyze a stock’s performance. You can use several metrics to do so, including price-to-earnings ratio, earnings per share, and market capitalization, among others. However, you should also consider other factors that may impact the stock’s performance, such as industry trends, economic conditions, and news events.

For example, a company that operates in an industry that is likely to grow in the future may have greater potential for growth than one in a stagnant industry. Similarly, a company that has a strong management team may be more likely to succeed than one with a weak or inexperienced team. As with any investment, there is always some degree of risk involved, and it’s up to you to determine if the potential reward is worth it.

So, always do your research and analysis before investing your hard-earned money.

Conclusion

In a world where sustainability and eco-friendliness are more important than ever, electric car battery companies stocks may be one of the smartest investments you can make. These companies are at the forefront of a rapidly emerging market and are helping to pave the way for a greener future. Plus, with the potential for increasing government regulations and consumer demand, the sky’s the limit for these forward-thinking and innovative companies.

As they continue to push the boundaries of what’s possible in battery technology, we all stand to reap the benefits in a cleaner, more sustainable world.”

FAQs

What are some of the top electric car battery companies to invest in?

Some of the top companies in this space include Tesla, Panasonic, LG Chem, Samsung SDI, and BYD Co Ltd.

How has the performance of electric car battery company stocks been in recent years?

Despite some volatility, the electric car battery sector has seen strong growth, with some stocks significantly outperforming the wider market.

What factors affect the stock prices of electric car battery companies?

Factors affecting stock prices include company financials, demand for electric vehicles, government regulations, and technological advancements.

What risks should investors be aware of when considering investing in electric car battery company stocks?

Potential risks include competition from other battery producers, changing government policies, and the potential for technological advancements leading to obsolescence.