Charging Up: The Top Stocks for Electric Car Battery Investments

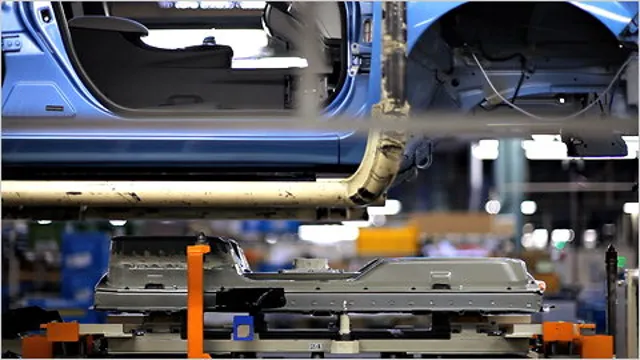

Looking for the best electric car battery stocks to invest in? With the rise of electric vehicles on the horizon, investing in electric car battery stocks has never been more timely. Electric vehicles are quickly gaining popularity and becoming mainstream. It’s a classic case of demand-pull where the demand for electric vehicles instantly translates to demand for electric car batteries.

However, with the current market and vast options available, it can be overwhelming to choose the right stocks that can best benefit your investment portfolio. The ever-increasing competition between manufacturers such as Tesla, Panasonic, and LG Chem has created complex dynamics in the market, making it difficult to determine the best electric car battery stocks to invest in. But don’t worry! Our team of experts has researched and compiled an updated list of the best electric car battery stocks to look out for in 202

We’ve covered top-rated stocks focusing on the latest battery technologies and innovations, key market players, and the current trends in the industry. Investing in electric car battery stocks can be lucrative, but it can also be uncertain, making our guide on the best electric car battery stocks a must-have for any investor who wants to make informed decisions. Join us on this informative journey and discover the best options to invest in for a bright economic future.

Introduction

Investing in electric car batteries is becoming increasingly popular. To find the best stock for electric car batteries, it is important to consider the companies that manufacture the batteries as well as those that produce the cars. One of the biggest players in the electric car market is Tesla, and therefore, investing in their stock could potentially yield significant returns.

Tesla not only produces electric cars, but also manufactures their own batteries, giving investors a direct connection to the electric car battery market. Additionally, companies such as LG Chem and Panasonic, which supply batteries to electric car manufacturers, could also be strong investment options. These companies have a long history of producing quality batteries and could see a surge in demand as more car manufacturers switch to electric.

In summary, when looking to invest in the best stock for electric car batteries, companies like Tesla, LG Chem, and Panasonic all have promising potential.

Why Invest in Electric Car Battery Stocks?

Investing in electric car battery stocks can be a lucrative opportunity for investors looking to capitalize on the growing demand for electric vehicles (EVs). With advancements in technology and increasing government support for renewable energy, the EV market is expected to expand rapidly in the coming years. This makes electric car battery stocks an attractive investment option for those who wish to benefit from this trend.

EV manufacturers such as Tesla and General Motors are already investing heavily in battery technology to improve range, charging times, and battery life. As a result, investors can expect to see growth in companies that produce and supply these batteries. If you are looking to invest in a sustainable future, then electric car battery stocks may be worth considering.

Market Size and Growth

Market Size and Growth is an essential aspect of any business or industry. It refers to the total revenue generated by a specific market and its potential to expand in the future. Understanding market size and growth is crucial for companies looking to expand their business operations, launch a new product or service, or enter a new market.

The size and growth rate of a market can provide valuable insights into the demand for specific goods or services, the competitive landscape, and the overall health of the industry. As a business owner, it is essential to conduct market research to understand the size and growth potential of the target market, including the purchasing behavior of customers, industry trends, and the competitive landscape. Keyword: Market Size and Growth.

Top Electric Car Battery Stock Picks

If you’re looking for the best stock for electric car batteries, there are a few companies to consider. One of the top picks is Tesla, whose battery technology powers not only their own electric vehicles but also those of other automakers. Another promising company is LG Chem, which produces batteries for several major automakers, including General Motors and Ford.

Panasonic Corporation, which supplies batteries to Tesla, also has a strong foothold in the electric vehicle market. Investing in any of these companies could be a smart move as the demand for electric vehicles continues to grow. Just be sure to do your research and weigh the risks and potential rewards before making any investment decisions.

Tesla, Inc. (TSLA)

Tesla, Top Electric Car Battery Stock Picks Looking for the top electric car battery stock picks? Look no further than Tesla, Inc. (TSLA). With a market cap of over $700 billion, this leading electric vehicle and clean energy company is at the forefront of the industry.

Tesla’s mission is to accelerate the world’s transition to sustainable energy, and the company’s electric vehicles and batteries are key components of that effort. Tesla’s innovative battery technology allows for longer driving ranges and faster charging times, which makes their electric cars more practical and appealing to consumers. In addition, Tesla’s stationary battery storage solutions enable homes and businesses to store clean energy, reducing reliance on fossil fuels.

With a commitment to sustainability and a strong track record of success, Tesla is a top pick for investors looking to make a difference in the world and the environment while also seeing strong financial returns.

Albemarle Corporation (ALB)

Albemarle Corporation (ALB) is a leading player in the electric car battery market. It provides lithium for batteries used in electric vehicles, as well as other applications. Albemarle’s stock is a top pick for investors seeking exposure to the growing electric car market, as demand for lithium-ion batteries is expected to increase rapidly.

With the global shift towards cleaner energy sources, the future looks bright for Albemarle. Its diverse portfolio of lithium assets puts it in a strong position to benefit from the expansion of the electric car industry. If you’re looking to invest in a stock that is well-positioned to benefit from the electric car revolution, Albemarle Corporation should be at the top of your list.

Lithium Americas Corp. (LAC)

Lithium Americas Corp. Are you looking for top electric car battery stock picks? Look no further than Lithium Americas Corp. (LAC).

With the demand for electric vehicles on the rise, the need for lithium-ion batteries is also increasing. LAC is a lithium mining and processing company that produces lithium for use in electric vehicle batteries. LAC operates two lithium mining projects, one in the United States and one in Argentina, which makes it a unique company in the industry.

The United States project, located in Nevada, is known as Thacker Pass and is one of the largest lithium deposits in the world. The Argentina project, located in Jujuy, is a joint venture with a local company that produces high-quality lithium products. In addition, LAC has partnerships with battery and electric vehicle manufacturers, such as Tesla, to ensure the continued demand for its lithium products.

Investing in LAC is a smart move for those looking to capitalize on the growing electric vehicle industry.

BYD Company Ltd. (BYDDF)

Looking for top electric car battery stock picks? BYD Company Ltd. (BYDDF) could be worth considering. This Chinese automaker and rechargeable battery manufacturer offers a wide range of electric and hybrid vehicles, making it a one-stop-shop for clean energy enthusiasts.

Furthermore, the company has made some recent strides in expanding its reach into Europe and other markets. Investors should keep an eye on BYDDF’s progress in these areas, as it could lead to even greater growth opportunities. With a strong commitment to sustainability and an impressive portfolio of electric vehicle offerings, BYD is one of the top electric car battery stocks to watch.

Factors to Consider When Investing in Electric Car Battery Stocks

If you’re looking to invest in electric car battery stocks, there are a few factors to consider before making your decision. Firstly, it’s important to analyze the market trends and demand for electric vehicles, as this will impact the need for batteries and ultimately the success of battery companies. Additionally, it’s crucial to investigate the technology and research behind the batteries, as breakthroughs can lead to a competitive advantage in the market.

It’s also wise to consider the financial stability and track record of the company you’re interested in, as well as any potential partnerships or collaborations they may have. Ultimately, the best stock for electric car batteries will depend on your personal investment goals and risk tolerance, so it’s important to do your research and consult with a professional before making any decisions.

Battery Technology Innovation

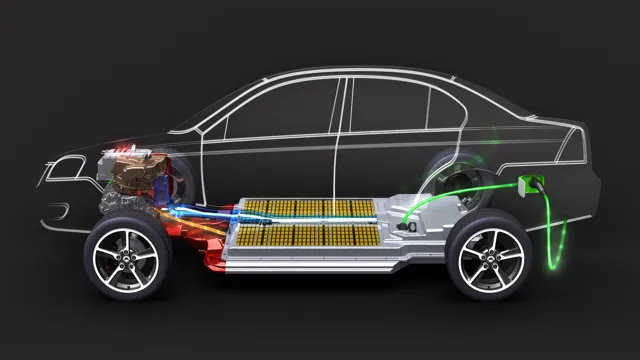

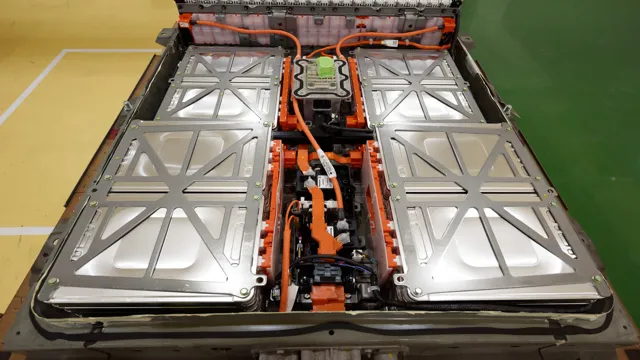

When it comes to investing in electric car battery stocks, there are several factors to consider. One important factor is the technology used in the batteries. Lithium-ion batteries are currently the most popular choice for electric vehicles, but there are other emerging technologies that could potentially disrupt the market.

It’s also important to consider the battery’s energy density and charging time, as these factors can greatly impact the EV’s performance and usability. Another factor to consider is the battery’s cost and durability, as these will determine the overall cost of owning an electric vehicle. When investing in electric car battery stocks, it’s crucial to keep an eye on the latest advancements in battery technology and the companies that are leading the way in innovation.

Government Regulations and Policies

Government regulations and policies play a significant role in electric car battery stock investments. Investors must consider regulatory limits on CO2 emissions, manufacturing standards, and tax incentives supporting the electric car industry. In addition, international regulations on trade and tariffs may impact the supply chain and production costs of electric car batteries.

For example, the US-China trade war could threaten the supply of essential raw materials used in electric car battery production. Therefore, investors need to stay informed on government policies and their impact on the electric car industry to make informed investment decisions. Investing in electric car battery stocks offers an opportunity for growth and aligning investments with environmental goals.

However, investors need to exercise caution due to the volatile nature of the market. Overall, investors must consider government regulations and policies when deciding whether to invest in electric car battery stocks.

Global Demand for Electric Vehicles

As the global demand for electric vehicles continues to soar, investing in electric car battery stocks can be a smart move for investors who are considering long-term gains. There are several factors to consider when choosing the right stocks. One major factor is the company’s research and development capabilities to stay competitive in the constantly evolving industry.

Another is the ability to scale their production capacities based on future demand. Additionally, it is crucial to consider the company’s sustainability practices in the manufacture and disposal of their batteries. Finally, the emergence of new technologies like solid-state batteries should also be taken into account.

With these factors in mind, investors can make informed decisions and benefit from the potential growth of the electric vehicle industry.

Conclusion

In conclusion, the best stock for electric car batteries is like the perfect electric car: it’s not a one-size-fits-all solution. Each company has unique strengths and weaknesses, and ultimately, it comes down to investing in the potential of their technology and execution. So do your research, watch the market trends, and choose wisely.

But just like a powerful electric car, whichever stock you choose, it’s bound to be a thrill ride.”

FAQs

What are the top companies producing electric car batteries?

Some of the top companies producing electric car batteries include Tesla, Panasonic, LG Chem, CATL, and BYD.

What type of batteries are used in electric cars?

Lithium-ion batteries are commonly used in electric cars due to their high energy density and efficiency.

How long do electric car batteries last?

The lifespan of electric car batteries varies, but most manufacturers offer warranties for 8 years or 100,000 miles.

What is the range of an electric car on a single charge?

The range of an electric car on a single charge depends on factors such as battery size, vehicle weight, and driving habits, but most electric cars have a range of 100-300 miles.

How does the lifespan of an electric car battery compare to a traditional car battery?

Electric car batteries typically have a longer lifespan than traditional car batteries, lasting an average of 8-10 years compared to 3-5 years for a traditional car battery.