Charge into the Future: Invest in India’s Leading Electric Car Battery Companies’ Stock

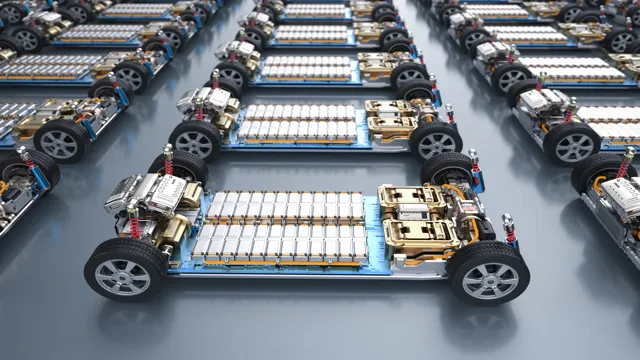

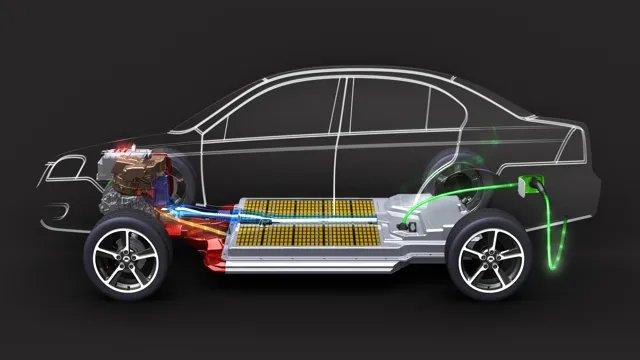

Electric cars have become increasingly popular over the years as people become more conscious about their impact on the environment. In India, there has been a surge in the number of electric car battery companies, each trying to come up with innovative solutions to meet the rising demand for electric vehicles. With the Indian government’s push towards clean energy, these companies are racing to produce sustainable and efficient batteries that can power electric cars.

This blog post will explore some of the top electric car battery companies in India and their efforts to create a sustainable future.

Top Performers

One of the leading electric car battery companies stock in India is Exide Industries Ltd. Exide’s battery manufacturing expertise makes it one of the top performers in the Indian market. The company has been around since 1947 and has continued to innovate with new products.

Recently, they have expanded into EV batteries, making them one of the key players in the space. Another noteworthy Indian electric car battery company is Amara Raja Batteries, which is a joint venture with Johnson Controls. Amara Raja is also renowned for producing batteries for various applications, including automotive, industrial, and renewable energy storage systems.

With the growth of the Indian electric car market, these companies are poised to make substantial gains in the coming years, making them attractive options for investors looking to invest in this growing sector.

Tata Chemicals

Tata Chemicals is without a doubt one of the top performers in the chemical industry. With their focus on sustainable practices and innovation, they have managed to rise above their competitors. Their commitment to reducing their carbon footprint through initiatives such as carbon capture and utilization has earned them accolades from various industry experts.

Additionally, they have also invested heavily in research and development to create new and improved products that meet the changing needs of their customers. One of their notable achievements is the development of plant-based proteins that offer a healthy and sustainable alternative to traditional meat. Overall, Tata Chemicals’ unwavering commitment to sustainability and innovation has allowed them to thrive in an ever-evolving industry, making them a clear leader in the field.

Exide Industries

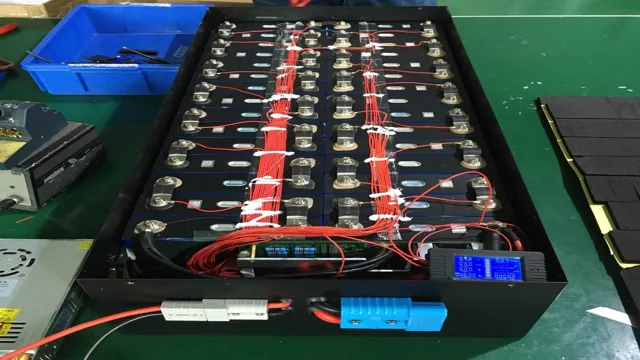

Exide Industries is one of the top performers in the automotive battery industry, with a reputation for quality and reliability that has made them a go-to choice for drivers around the world. They offer a wide range of batteries for cars, motorcycles, and commercial vehicles, with a focus on innovation and sustainability that has helped them stay ahead of the competition. One of the key factors that has contributed to their success is their commitment to research and development, which has enabled them to introduce new technologies that improve performance and efficiency while reducing environmental impact.

Their batteries are known for their durability and long lifespan, making them a smart choice for anyone looking for a high-quality battery that will last for years to come. Whether you’re a commuter, a trucker, or a motorcyclist, Exide Industries has the perfect battery for your vehicle.

Amara Raja Batteries

Amara Raja Batteries has been consistently ranked among the top performers in the battery industry. With a wide range of products, including automotive, industrial, and consumer batteries, Amara Raja has been able to cater to diverse markets and meet the demand for high-quality and reliable batteries. What sets Amara Raja apart is their commitment to innovation and sustainability.

Their advanced technology and eco-friendly solutions not only benefit their customers but also demonstrate their dedication to environmental responsibility. The brand’s focus on customer satisfaction and safety is evident in their rigorous quality control measures and strict adherence to industry standards. It’s no wonder that Amara Raja Batteries is a trusted and respected name in the battery market, and their continued success is a testament to their dedication to excellence.

Current Stock Trends

There’s a lot of buzz these days about electric cars and the battery companies that power them. In India, the demand for electric vehicles is on the rise, and so are the stocks of the companies producing the batteries for them. Some of the most prominent electric car battery companies in India are Exide Industries, Amara Raja Batteries, and Tata Chemicals.

All three of these companies have seen their stock prices rise in recent years, thanks in part to the increasing popularity of electric vehicles and the government’s push towards cleaner energy. But like any stock market investment, there are no guarantees, and it’s important to do your research and understand the risks before jumping in. However, if you believe in the future of electric cars and the role India will play in their growth, investing in one of these battery companies may be a smart move for your portfolio.

Recent Market Activity

In recent market activity, we’ve seen a lot of different trends emerge in the stock market. One trend that seems to be prevailing currently is the growth of technology stocks. Companies like Apple, Facebook, and Amazon continue to hit all-time highs, while other sectors like energy and banking have struggled.

This trend is largely fueled by the increasing dominance of technology and the internet in our daily lives. Many investors are betting that this trend will continue to grow as more and more people turn to online businesses and digital services. However, there are also concerns about the high valuations of these companies and the potential for a market correction.

It’s important to stay up to date with the latest trends and do your research before making any investment decisions.

Analysis of Stock Performance

As we keep an eye on the current stock trends, we can see that certain industries are thriving while others are struggling. Tech stocks, for example, have been performing well amidst the pandemic due to remote work and increasing reliance on digital platforms. On the other hand, sectors such as energy have seen a decline in stock prices due to reduced demand for oil and gas.

It’s important to always stay up-to-date on the latest news and market trends in order to make informed investment decisions. While stock performance can fluctuate, taking a long-term approach and diversifying your portfolio can help mitigate risks. As the saying goes, don’t put all your eggs in one basket.

By spreading out your investments, you can remain relatively stable during volatile market conditions and potentially see greater returns in the long run.

Comparison to Global Electric Car Battery Market

With the world shifting towards sustainable and renewable energy sources, the demand for electric vehicles is on the rise. This has led to an increasing demand for electric car batteries, making it a lucrative market for manufacturers and investors alike. In comparison to the global electric car battery market, the stock trends of electric car battery manufacturer XL Fleet Corp.

have shown significant growth. While the global electric car battery market is expected to reach a valuation of $994 billion by 2027, XL Fleet Corp.

has already displayed promising results with their innovative electrification solutions for fleet vehicles. With a focus on efficiency and sustainability, their products have caught the attention of major players in the fleet and transportation industries. This has led to impressive stock gains and makes XL Fleet Corp.

a promising contender in the race for dominance in the electric car battery market.

Future Outlook

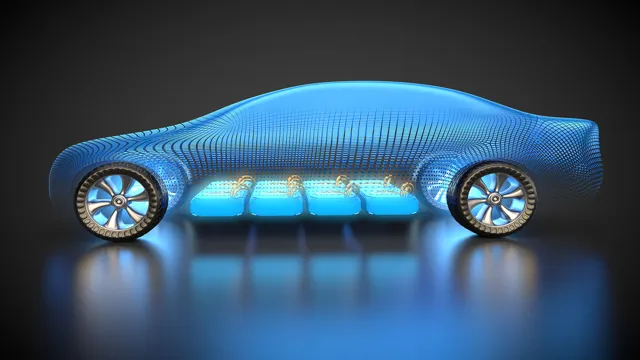

If we talk about electric car battery companies stock in India, the future outlook is promising. The government’s push for electric vehicles has led to an increase in demand for batteries, which, in turn, has propelled the growth of the battery industry in India. Currently, there are a few top players in the Indian electric vehicle battery market, including Exide Industries, Tata Chemicals, and Amara Raja Batteries.

Additionally, foreign players are also looking to enter the Indian market, which will further increase competition and push innovation. With the increasing investment in charging infrastructure and government subsidies, it is expected that the demand for electric vehicles will continue to grow, presenting ample growth opportunities for electric car battery companies in India. Therefore, investing in electric car battery companies’ stock can be a promising bet for investors who believe in the rapid growth of the electric vehicle industry.

Expected Growth of Electric Car Market in India

The electric car market in India is expected to see significant growth in the coming years. With the Indian government’s push towards electrification and the rising demand for environmentally friendly vehicles, many automakers are expanding their offerings to include electric cars. According to industry experts, the electric vehicle market in India is predicted to reach

34 million units by 202 This is mainly due to the adoption of electric two and three-wheelers, which are becoming increasingly popular in the country as a mode of transportation. Additionally, the introduction of new policies and incentives aimed at promoting electric vehicle adoption is likely to drive growth in the market even further.

Overall, the future outlook for the electric car market in India looks promising, and the country seems poised to become a key player in the global transition to electric mobility.

Potential Impact on Battery Company Stocks

The potential impact of the electric vehicle (EV) revolution on battery company stocks is undoubtedly significant. With the global push for clean energy, rising concerns about climate change, and increased government initiatives to reduce greenhouse gas emissions, the demand for EVs and their batteries is expected to skyrocket in the coming years. This shift towards sustainable transportation is already having a positive impact on the battery industry.

Battery companies are investing heavily in R&D and scaling production to meet the growing demand for EV batteries, which is expected to boost their stock prices. However, the competition in the battery industry is fierce, and only the companies that can keep up with the latest technological advancements will succeed in the long run. Therefore, investors need to keep a close eye on the battery companies’ R&D pipeline and technology roadmap to make informed investment decisions.

Overall, the future outlook for battery companies looks bright, and they are expected to keep growing steadily as the EV market expands.

Conclusion

In conclusion, investing in electric car battery companies in India is a charge in the right direction. The market is charged up with potential and the demand for sustainable energy solutions is only growing. It’s time to spark some interest in electric car batteries and switch on to a greener future for India.

As you charge ahead with your investment choices, always remember to stay current with trends and battery technologies, and never let your portfolio run out of juice.”

FAQs

What are some popular electric car battery companies in India?

Some popular electric car battery companies in India are Tata Chemicals, Amara Raja Batteries, and Exide Industries.

What is the current market trend for electric car battery companies in India?

The current market trend for electric car battery companies in India is positive, with an increasing demand for electric vehicles and government incentives for the adoption of electric vehicles.

How have electric car battery companies stock performed in India in the last year?

The performance of electric car battery companies stock in India in the last year has been mixed, with some companies experiencing significant growth while others have faced challenges due to market competition.

What are some challenges faced by electric car battery companies in India?

Some challenges faced by electric car battery companies in India include high production costs, lack of infrastructure for charging stations, and limited consumer awareness and acceptance of electric vehicles.