The Shocking Truth About Electric Car Battery IPO – A Game-Changing Opportunity for Investors

Attention all eco-conscious readers! Have you ever dreamt of investing in a promising electric car battery company that not only aligns with your values but provides lucrative returns? This blog post is going to excite you as a highly anticipated electric car battery company plans to go public via an Initial Public Offering (IPO) soon. As the world shifts towards cleaner energy options, electric cars and their batteries are gaining immense traction globally. In the current context of climate change and environmental degradation, electric cars have become the go-to mode of transport for many.

The transition from conventional vehicles to electric ones is inevitable, and investing in an electric car battery IPO could potentially offer financial and environmental rewards. Let’s dive deeper into the world of electric car battery, IPOs, and investing opportunities.

The Buzz Around Electric Car Batteries

The electric car industry has been the talk of the town and for good reasons. One major buzz currently is surrounding electric car battery IPOs. Electric car batteries are the lifeline of electric cars, and it seems everyone wants a piece of the pie.

As major car manufacturers are aligning themselves with electric cars, the demand for better batteries with longer life span has sky-rocketed. Companies like Tesla, Quantumscape, and Enevate with their cutting-edge battery technology have caught the attention of investors. They are getting ready to go public with electric car battery IPOs raising hopes of revolutionizing the industry.

With investors pouring in billions of dollars, the industry is set to expand, production will ramp up, and costs will come down. The electric car battery IPOs are expected to be a game-changer for the electric car industry. It will make batteries more accessible to car manufacturers and reduce electric cars’ production costs, making them more affordable for the mass market, and ultimately shifting the transportation paradigm.

Increasing Demand for Electric Cars and Batteries

The buzz around electric car batteries is growing stronger by the day, as more and more people make the switch to sustainable and eco-friendly transportation options. With concerns over the environment and climate change on the rise, electric vehicles and the batteries that power them are becoming increasingly popular. These batteries are designed to be more efficient and long-lasting than ever before, providing drivers with a reliable and cost-effective source of energy.

As the demand for electric cars continues to increase, so too does the demand for batteries. This has led to a surge in innovation and research in the field, with companies competing to create the most advanced and effective batteries possible. Whether you’re an eco-conscious driver or simply looking for a more economic choice in your transportation needs, electric car batteries are quickly becoming the way of the future.

Potential Benefits of Investing in Electric Car Battery IPOs

The buzz surrounding electric car batteries is reaching new heights, with many investors eyeing the potential benefits of investing in electric car battery IPOs. Electric cars use lithium-ion batteries, which can store more energy than traditional lead-acid batteries and are more eco-friendly. Investing in these types of companies can yield significant returns, as the demand for electric cars continues to rise.

Not only do electric car battery IPOs have the potential for high profit margins, but investing in these companies can also make a positive impact on the environment. As more people shift towards electric cars, the demand for these batteries is only going to increase, making electric car battery IPOs a smart investment choice for those interested in clean energy and financial gain. So, if you’re looking to invest in a forward-thinking industry while also making a positive impact on the planet, electric car battery IPOs may be the way to go.

Prominent Electric Car Battery IPOs

Electric car battery IPOs have been taking the market by storm, with several prominent names entering the field with significant IPO offerings. These include QuantumScape, which raised over $1 billion in its IPO, and Arrw. As electric vehicles grow in popularity and demand accelerates, the need for advanced battery technology becomes more pressing.

Investors have taken note, as electric car battery companies look poised for significant growth and success in the coming years. With innovative companies driving the development of next-generation batteries, investors have a chance to participate in the electric vehicle industry’s tremendous growth potential. As a result, electric car battery IPOs have become a focal point for many investors seeking exposure to this high-growth industry.

Tesla’s Battery Day and the Future of EV Batteries

Electric Car Battery IPOs Electric vehicle (EV) battery companies have been making headlines lately thanks to Tesla’s Battery Day event and the growing demand for electric cars. As a result, some of these companies are now going public through initial public offerings (IPOs), giving investors the opportunity to back these cutting-edge technologies. Some of the most prominent EV battery IPOs include QuantumScape, which raised over $1 billion, and Romeo Power, which raised $384 million.

These companies plan to use the funds to scale up their manufacturing processes and improve battery performance. Excitement around these IPOs reflects both the promise and demand for electric vehicles. While electric cars have improved significantly in recent years, many analysts believe that battery technology will be the key driver for the mass adoption of EVs.

As such, these IPOs could represent a significant opportunity for investors looking to capitalize on the growing EV market.

Rivian’s IPO and Their Advancements in Battery Technology

Rivian, IPO, battery technology. Rivian, the electric vehicle manufacturer, is one of the most talked-about companies in the industry today. After a successful IPO, the company is poised to make significant advancements in battery technology.

With their groundbreaking work on battery chemistry, Rivian has made it possible to store more energy in a smaller space, making their vehicles more efficient and environmentally friendly. What’s even more impressive is that Rivian’s batteries can be charged in just a matter of minutes, a major breakthrough for electric vehicles. This technology is a game-changer for the industry, and Rivian is one of the few companies leading the way in this area.

Their IPO is only further proof of their potential to revolutionize the electric vehicle market, and we can all look forward to seeing what they come up with next.

Lucid Motors’ Merger with Churchill Capital Corp IV and Their Battery Innovations

The electric vehicle market has been growing rapidly in recent years. Lucid Motors, a company focused on producing high-end luxury electric cars, has been in the spotlight recently due to its merger with Churchill Capital Corp IV. One of Lucid’s biggest strengths is their battery technology, which is why they have been able to achieve impressive driving range numbers with their vehicles.

In fact, the Lucid Air, their flagship sedan, has a range of over 500 miles on a single charge. Lucid’s battery technology is seen as one of the most advanced in the industry, with innovations such as using silicon in the anodes of their batteries. This can increase the overall energy density of the battery, allowing for longer ranges and better performance.

With their upcoming IPO, Lucid is set to continue leading the way in battery innovations in the electric vehicle market.

Factors to Consider When Investing in Electric Car Battery IPOs

If you’re considering investing in electric car battery IPOs, there are a few important factors to keep in mind. First and foremost, you’ll want to look at the overall demand for electric vehicles and the batteries that power them. As more and more consumers switch to electric cars, the demand for high-quality, long-lasting batteries will only continue to grow.

Additionally, you’ll want to pay attention to the specific company issuing the IPO. Do they have a solid track record of success in the industry? Have they made any major breakthroughs or innovations in battery technology? It’s also worth considering the long-term outlook for the company and the industry as a whole. Are there any potential disruptors or competitors on the horizon? Finally, it’s important to keep an eye on the broader economic and political landscape.

Government subsidies and regulations can have a big impact on the growth of the electric car industry, for better or for worse. Overall, investing in electric car battery IPOs can be a smart move for the savvy investor, but it’s important to do your research and keep a close eye on the market trends.

Market Trends and Forecast for EV and Battery Demand

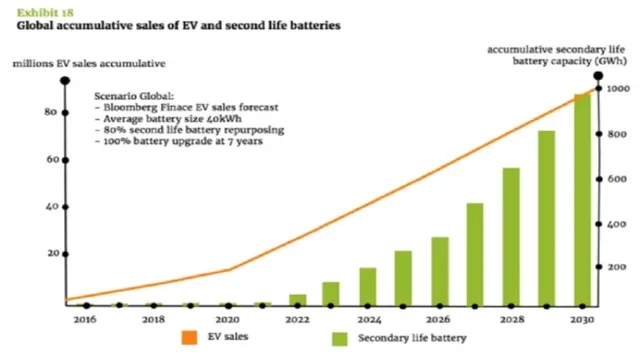

Electric Car Battery IPOs Investing in electric car battery IPOs can be both lucrative and risky. It is important to understand the current market trends and forecasts for EV and battery demand before making any investment decisions. Factors to consider include the growth potential of the EV market, the performance and reliability of the batteries, and the competition among battery manufacturers.

It is also important to evaluate the financial stability, management team, and overall company strategy of the battery manufacturer in question. Investing in electric car battery IPOs can be a strategic move for investors who believe in the potential of the EV market and want to capitalize on the growing demand for electric vehicles. However, it is crucial to do thorough research and due diligence before investing to mitigate the risk involved in these types of investments.

The Company’s Financial Health and Technological Advancements

Investing in electric car battery IPOs can be a great opportunity for those looking to support sustainable energy and make a return on their investment. However, it’s important to consider the financial health of the company issuing the IPO. Look for companies with a solid track record of profitability and a strong balance sheet.

Additionally, take note of any technological advancements the company has made in their battery development. A company that is continuously improving their technology and staying at the forefront of the industry is likely to have a higher chance of success in the long run. Overall, it’s crucial to do thorough research before investing in any IPOs, electric car battery-related or not, to ensure that it aligns with your investment goals and risk tolerance.

Final Thoughts and Potential for Growth in the Industry

The electric car battery industry has the potential for significant growth in the coming years and with the possible IPO of one of the leading manufacturers, excitement is building. As the world looks towards renewable energy solutions, electric cars are becoming more popular and the demand for high-quality batteries to power these vehicles is growing. The IPO of a battery manufacturer would open up investment opportunities for those looking to be a part of the growing industry.

With advancements in technology, electric car batteries are becoming more efficient and affordable, making them accessible to a wider market. As the industry continues to evolve, it is clear that electric car batteries will play a crucial role in the transition towards a cleaner, sustainable future.

Conclusion

In conclusion, the electric car battery IPO is a fascinating development in the world of sustainable transportation. Not only does it offer an innovative solution to the problem of fossil fuels, but it also represents a significant investment opportunity for those looking to support environmental progress while making a profit. So, let’s charge ahead with this electrifying trend and power up our world with sustainable energy solutions.

After all, who needs petrol when you can have watts?”.

FAQs

What is an electric car battery?

An electric car battery stores energy to power an electric motor in an electric car.

How long does the battery of an electric car last?

The lifespan of an electric car battery can vary depending on the make and model, but typically lasts around 8-10 years or 100,000 miles.

What is an IPO?

An IPO (Initial Public Offering) is the first time a company sells shares of its stock to the public in order to raise capital and grow their business.

Are there any upcoming IPOs in the electric car battery industry?

Yes, there are several upcoming IPOs in the electric car battery industry, including QuantumScape, which is developing solid-state batteries for electric vehicles.