Top Lithium-Ion Electric Car Battery Companies to Invest in for a Greener Future

Do you find yourself wondering about the best investments to make in today’s rapidly-evolving market? With the rise of electric cars, investing in lithium-ion battery companies has become a hot topic. Not only do these companies play a crucial role in the growing electric vehicle industry, but they also hold potential for long-term profitability. However, before diving into any investment, it’s important to understand the ins and outs of this burgeoning industry.

In this post, we’ll explore the current state of the electric vehicle market, the significance of lithium-ion batteries, and the top lithium-ion battery companies that are worth considering as investments. So, buckle up and get ready to discover the exciting world of electric car investing.

Market Overview

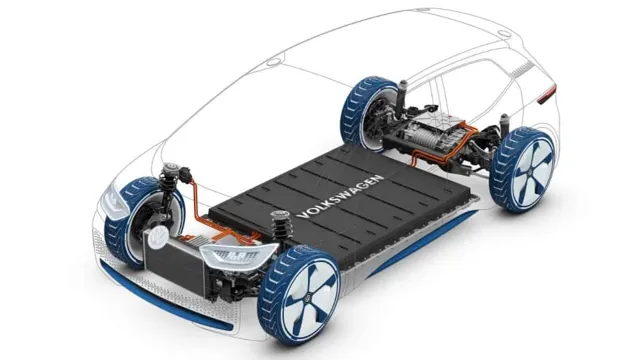

If you’re looking for investment opportunities in the electric car battery industry, it’s worth considering some of the top lithium-ion companies. Lithium-ion batteries are the most common type of battery used in electric vehicles due to their high energy density, reliability, and longevity. One of the leading companies in this space is Tesla, which not only produces electric cars but also manufactures its own batteries.

However, there are many other up-and-coming companies worth watching, such as LG Chem, CATL, and Panasonic. LG Chem is known for producing high-quality battery cells, while CATL is expanding rapidly and partnering with major automakers. Meanwhile, Panasonic has been producing batteries for Tesla for years and is expanding into other markets as well.

With the growing demand for electric vehicles, these lithium-ion companies are poised for significant growth in the coming years. Investing in companies like these could be a smart move for those looking to capitalize on the increasing shift towards electrification in the automotive industry.

Growing demand for electric cars and lithium-ion batteries

As the world shifts towards more sustainable and environmentally-friendly alternatives, the demand for electric cars and lithium-ion batteries has been on the rise. This trend is expected to continue as people become more conscious of their carbon footprint and the threat of climate change. The global electric vehicle market is projected to grow exponentially in the next few years, driven by various factors such as government initiatives, advancements in battery technology, and increasing consumer demand.

This growth will inevitably lead to a surge in demand for lithium-ion batteries, which are essential components of electric vehicles. The market for lithium-ion batteries is also expected to witness significant growth in the coming years, with various industries adopting this technology for their energy storage solutions. With all these developments, it’s safe to say that the future looks bright for electric cars and lithium-ion batteries.

Market size and projected growth

Market size and projected growth are important factors to consider when analyzing any industry, and the same goes for the world of business process outsourcing (BPO). According to recent market research reports, the global BPO market size was estimated at $230.49 billion in 2020 and is expected to grow at a compounded annual growth rate of

3% from 2021 to 202 This growth is mainly due to the increased demand for cost-effective and efficient business solutions across various industries. The BPO market can be categorized into various segments based on services rendered, industry vertical, and geography.

The major players in the market are mostly from North America, followed by Europe and the Asia Pacific. The healthcare, IT, and manufacturing industries are the largest consumers of BPO services. The market has been further boosted by the COVID-19 pandemic, with businesses seeking ways to cut costs and streamline their operations amidst a global economic crisis.

As such, the BPO market is expected to continue experiencing growth in the coming years, with more companies looking to outsource their non-core functions to specialist providers that can offer customized and scalable solutions.

Top Lithium-ion Battery Companies to Invest In

If you’re looking to invest in electric car battery companies, there are a handful of top lithium-ion battery manufacturers that are worth considering. One of the most well-known companies in this space is Tesla, which not only produces batteries for its own cars, but also provides them to other car manufacturers. Another popular option is Panasonic, which partners with Tesla to produce batteries for their electric vehicles.

LG Chem is another major player in the lithium-ion battery industry, producing batteries not only for electric cars, but also for home energy storage systems. Finally, Samsung SDI is a top contender in the market, supplying batteries to companies like BMW and Volkswagen for use in their electric vehicles. By investing in these top battery manufacturers, you can be sure that you’re putting your money into companies with a proven track record in the EV space.

Tesla

Tesla, Lithium-ion Battery Companies, Invest Tesla is one of the top lithium-ion battery companies that investors have their eyes on. The company has made great strides in the battery technology industry and has helped revolutionize the electric vehicle market. Tesla’s innovative battery technology is a key part of their success, and this has led to many people investing in the company.

With Tesla’s recent announcement that they will be building a new gigafactory in Texas, the demand for their lithium-ion batteries is expected to rise even higher. As a result, investing in Tesla is seen as a promising opportunity for many investors who believe in the future growth potential of the company. On top of this, Tesla has also established partnerships with other lithium-ion battery companies, further adding to its market dominance.

Overall, Tesla is certainly a company to watch as it continues to drive forward the lithium-ion battery industry and transform the way we think about sustainable transportation.

LG Chem

When it comes to investing in the lithium-ion battery industry, LG Chem is a top contender. This South Korean company is one of the largest producers of lithium-ion batteries in the world and boasts an impressive portfolio of products. They manufacture batteries for an array of applications, including electric vehicles, laptops, smartphones, and energy storage systems.

What sets LG Chem apart is their commitment to sustainability. They have made significant strides in reducing their carbon footprint and investing in renewable energy sources. In addition to their impressive technology and eco-friendly practices, LG Chem has also established partnerships with companies such as Amazon and General Motors to supply batteries for their electric vehicles.

All of these factors combined make LG Chem a company worth considering for investors interested in the growing lithium-ion battery market.

Panasonic

Panasonic When it comes to investing in the lithium-ion battery market, Panasonic is a company that should not be overlooked. With over 40 years of experience in the battery industry, alongside a strong reputation for their electronics and energy solutions, Panasonic is a leader in the market. They produce a wide range of batteries used in many applications, from small electronic devices to electric vehicles and even energy storage systems.

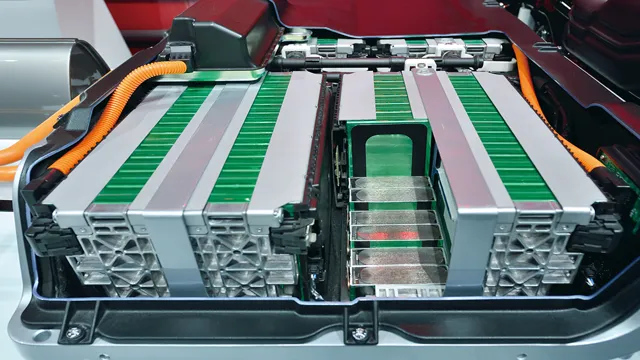

Their focus on researching and developing newer and better batteries has resulted in the production of highly efficient, dependable and long-lasting products. One of their most notable advancements in the battery industry is the Lithium Ion Battery. This environmentally friendly battery has high energy density, which results in longer lasting and faster charging devices.

Beyond lithium-ion batteries, Panasonic is also looking into producing solid-state batteries, which are known for having even higher energy density and increased safety. This innovative company is a great option for potential investors who are looking for a company with a proven track record and an eye on the future.

Emerging Lithium-ion Battery Companies to Watch

Are you looking to invest in the emerging electric car battery market? If so, there are several lithium-ion companies worth keeping an eye on. One of the most promising is Quantumscape, which has recently announced plans to merge with a special-purpose acquisition company (SPAC) and go public. This Silicon Valley-based company has developed a solid-state lithium-ion battery that promises to revolutionize the electric car industry.

Other notable companies to watch include Solid Power, which is backed by Ford and BMW, and StoreDot, which claims its lithium-ion batteries can be fully charged in just five minutes. With the demand for electric vehicles on the rise, investing in these innovative lithium-ion battery companies could be a smart move for those looking to get in on the ground floor of this burgeoning industry.

QuantumScape

QuantumScape is one of the most exciting emerging companies in the lithium-ion battery industry. They specialize in solid-state batteries, which are more durable, safer, and have a higher energy density than traditional lithium-ion batteries. This makes them ideal for use in electric vehicles, where efficiency and performance are crucial.

QuantumScape has already received significant investment from companies like Volkswagen and Bill Gates, indicating the high expectations for the company’s technology. Their solid-state batteries also have the potential to revolutionize other industries, such as aerospace and renewable energy. QuantumScape is definitely a company to keep an eye on as they continue to develop and improve their cutting-edge technology.

Solid Power

Solid Power Solid-state lithium-ion batteries are becoming an increasingly attractive alternative to traditional lithium-ion batteries because of their improved safety, higher energy density, and longer lifespan. Solid Power is one of the companies leading the charge in solid-state lithium-ion batteries, and they recently closed a $130 million funding round to expand production and accelerate development. They have partnered with BMW and Ford to develop solid-state batteries for electric vehicles, and they claim that their batteries can achieve 50% higher energy density than traditional lithium-ion batteries.

As the demand for electric vehicles continues to grow, companies like Solid Power are poised to play an integral role in powering the future of transportation.

Factors to Consider Before Investing

If you’re thinking about investing in electric car battery lithium ion companies, there are a few key factors to consider. First, it’s crucial to do your research and make sure you’re choosing a company with a strong track record of innovation and success in the market. Additionally, you’ll want to look at the overall state of the electric car industry and assess whether it’s poised for growth in the coming years.

Finally, it’s important to weigh the potential risks and rewards of any investment, and consider diversifying your portfolio to minimize risk. Overall, there’s no denying that the electric car market is a promising one, and investing in the right companies could lead to significant gains over time. Just be sure to approach your investment with caution and do your due diligence before making any big moves.

Financial performance and stability

When considering investing in a company, it is important to research its financial performance and stability. This includes examining factors such as revenue growth, profit margins, debt levels, and cash flow. A company with consistently strong financials is more likely to provide a stable return on investment.

It is also crucial to look at the broader economic picture, as external factors can affect a company’s performance. A company operating in a stable and growing industry, for example, may be a better long-term investment than one in a declining sector. Ultimately, investing involves a level of risk, and thorough research is key to making informed decisions.

By evaluating a company’s financials and considering external factors, investors can make more educated choices and minimize their risk exposure.

Technological advancements and innovation

When it comes to investing, there are a lot of factors to consider. One important consideration is the impact of technological advancements and innovation on your investment portfolio. As technology continues to change and disrupt industries, it’s important to stay up-to-date on the latest trends and developments.

This means doing your research and staying informed about emerging technologies that could impact the businesses you’re investing in. It’s also important to consider the risks associated with investing in technology, like the potential for rapid obsolescence or the possibility of security breaches. Overall, while technology can be a powerful driver of economic growth and innovation, it’s important to approach investments in this sector with caution and a thoughtful strategy.

Environmental and social responsibility

When it comes to investing, there are numerous factors to consider, and two key ones involve environmental and social responsibility. First and foremost, investors should look into a company’s environmental practices and policies. Are they striving towards sustainability and minimizing their carbon footprint? Do they have a history of ethical and responsible environmental practices? Secondly, social responsibility should also be taken into account.

This involves assessing how a company treats its employees, suppliers, and the communities in which they operate. Are they committed to fair labor practices and ensuring the well-being of their workers? Are they engaged in the wider community and giving back in meaningful ways? By taking these factors into account, investors can ensure that their money is supporting companies that are committed to making a positive impact on both the planet and society as a whole. So when it comes time to invest, don’t forget to consider environmental and social responsibility – your wallet and the world will thank you.

Conclusion and Recap

In conclusion, investing in electric car battery lithium ion companies is definitely a smart move for any investor looking for a sustainable and profitable future. As the world shifts towards renewable energy and reduced carbon emissions, the demand for electric vehicles and their batteries will only continue to grow. By investing in the right companies which have a strong track record of innovation, reliability, and a commitment to sustainability, you can help bring about a brighter and cleaner future while also earning strong returns on your investment.

So don’t wait, charge up your investment portfolio with electric car battery lithium ion companies today!”

FAQs

What are some companies that specialize in electric car batteries?

Some companies that specialize in electric car batteries include Tesla, Panasonic, LG Chem, and Samsung SDI.

Why are lithium-ion batteries popular for electric cars?

Lithium-ion batteries are popular for electric cars because they have a high energy density, are lightweight, and have a relatively long lifespan compared to other types of batteries.

What factors should investors consider before investing in a company specializing in electric car batteries?

Investors should consider factors such as the company’s financial stability, their current market share, any potential competition, and the overall growth potential of the electric car market.

How has the demand for electric car batteries affected the overall lithium-ion market?

The demand for electric car batteries has greatly impacted the lithium-ion market, with the market expected to grow significantly in the coming years due to the increased demand for electric vehicles.