Electric Car Tax Benefits in India: Unlock Savings!

Electric cars are becoming popular. Many people are choosing them. They are good for the environment. They help reduce air pollution. In India, there are many benefits for electric car owners. One of these benefits is tax savings. This article will discuss the tax benefits of electric cars in India.

What is an Electric Car?

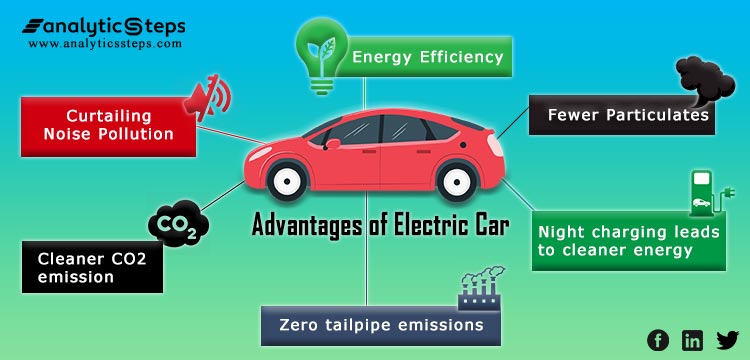

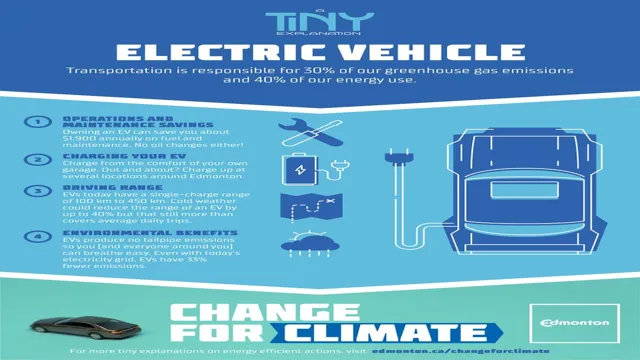

An electric car runs on electricity. It does not use petrol or diesel. Instead, it has a battery. This battery stores energy. When you drive, the car uses energy from the battery. Electric cars are quiet and clean. They do not produce harmful gases. This makes them better for our planet.

Why Choose Electric Cars?

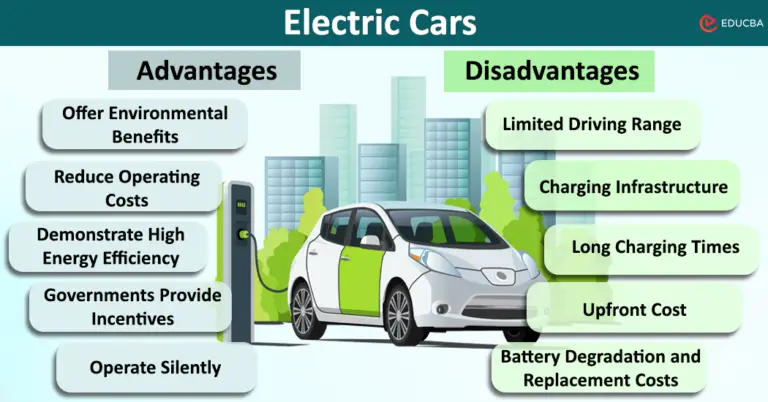

There are many reasons to choose electric cars:

- They are good for the environment.

- They save money on fuel.

- They have lower maintenance costs.

- They offer tax benefits.

Tax Benefits for Electric Car Owners

In India, the government supports electric cars. They want to reduce pollution. They also want to save energy. So, they offer tax benefits for electric car owners. Here are some of the main benefits:

1. Income Tax Deduction

The government gives a tax deduction for electric cars. If you buy an electric car, you can claim a deduction. The maximum deduction is ₹1.5 lakh. This is under Section 80EEB of the Income Tax Act. This means you pay less tax. It helps you save money.

2. Gst Reduction

The Goods and Services Tax (GST) for electric cars is lower. The government reduced GST to 5%. This is much lower than the 28% for regular cars. It means you pay less when you buy an electric car. This makes electric cars cheaper.

3. State-level Incentives

Many states offer extra benefits. Each state has its own rules. Some states give subsidies. This means they pay part of the cost for you. Other states offer tax rebates. These benefits can help you save more money.

4. Road Tax Exemption

Some states do not charge road tax for electric cars. Road tax can be a lot of money. If you do not have to pay it, you save. This is another way to save money when buying an electric car.

5. Registration Fee Waiver

In some states, you do not have to pay registration fees. Registration fees can add up. It can be expensive. If you buy an electric car, this fee may be waived. This is another financial benefit.

Additional Benefits of Electric Cars

Besides tax benefits, electric cars have other advantages:

- They are cheaper to run.

- They require less maintenance.

- They have less noise pollution.

- They can be charged at home.

Government Initiatives for Electric Cars

The Indian government has many programs. They want to support electric vehicles. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) is one such program. It aims to promote electric cars. It provides financial support to buyers and manufacturers.

How to Claim Tax Benefits?

Claiming tax benefits for electric cars is easy. Follow these steps:

- Purchase an electric car.

- Keep all documents related to the purchase.

- Fill out your income tax return form.

- Claim your deduction under Section 80EEB.

Things to Consider Before Buying an Electric Car

Before buying an electric car, think about these points:

- Check the availability of charging stations.

- Look for the range of the car on a single charge.

- Understand the total cost of ownership.

- Research the brand and model you want.

Challenges of Electric Cars

Even with many benefits, electric cars have some challenges:

- Charging infrastructure is still developing.

- Battery life can be a concern.

- Some models may be expensive.

Frequently Asked Questions

What Are Electric Car Tax Benefits In India?

Electric car tax benefits in India reduce the cost of buying electric vehicles. These benefits include exemptions and rebates on taxes.

How Much Tax Rebate Can I Get For Electric Cars?

You can get a tax rebate of up to ₹1. 5 lakh on loan interest for electric vehicles.

Are Electric Vehicles Exempt From Road Tax In India?

Yes, many states in India exempt electric vehicles from road tax. This makes them cheaper to own.

Do Electric Cars Have Lower Registration Fees?

Yes, electric cars often have lower registration fees compared to petrol or diesel vehicles.

Conclusion

Electric cars are a smart choice. They help the environment and save money. The Indian government offers many tax benefits. These benefits make electric cars more affordable. If you are thinking of buying one, consider all the advantages. You will not only help the planet but also enjoy savings.

FAQs

1. What Is The Maximum Deduction For Electric Cars?

The maximum deduction is ₹1.5 lakh under Section 80EEB.

2. Is Gst On Electric Cars Lower?

Yes, the GST is 5% for electric cars.

3. Do All States Offer The Same Benefits?

No, benefits may vary by state.

4. Can I Charge My Electric Car At Home?

Yes, you can charge it at home.

5. Are Electric Cars More Expensive?

Some models may be expensive, but savings add up.