Electric Car Lease Tax Benefits: Maximize Your Savings!

Electric cars are becoming popular. Many people want to know about tax benefits. Leasing an electric car can save you money. This article will explain how. We will cover what electric car leases are. We will also talk about the tax benefits. Let’s get started.

What is an Electric Car Lease?

A lease is like renting a car. You do not own it. You pay to use it for a certain time. Leases usually last for two to four years. At the end, you return the car. Some people like leasing. It allows them to drive a new car often.

Why Choose an Electric Car?

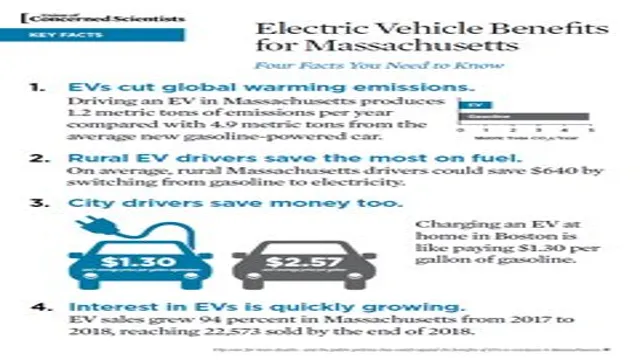

Electric cars are good for the environment. They produce no emissions. This means they do not pollute the air. Electric cars are also cheaper to run. You save money on gas and maintenance.

Tax Benefits of Leasing Electric Cars

Leasing an electric car can give you tax benefits. These benefits can help you save money. Here are the main benefits:

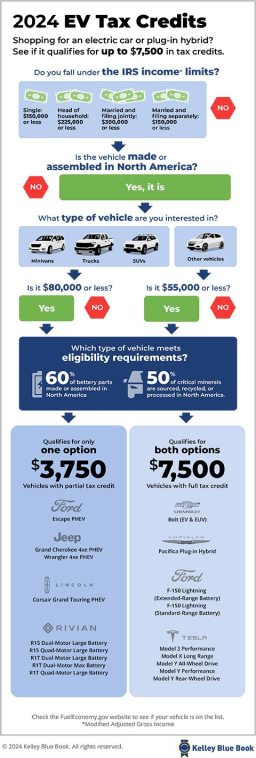

1. Federal Tax Credit

The U.S. government offers a federal tax credit. This credit can be up to $7,500. You can claim this credit when you lease. It helps lower your tax bill. Not all cars qualify. Check if your car is eligible.

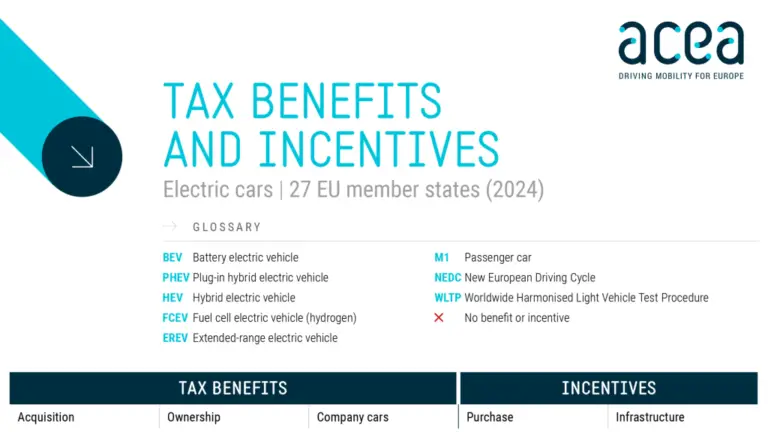

2. State Tax Incentives

Many states have their own tax benefits. These benefits vary by state. Some states offer additional credits. Others have rebates for electric cars. Check your state’s rules. You may save even more money.

3. Sales Tax Exemption

Some states do not charge sales tax on electric cars. This means you pay less when leasing. This can save you a lot of money.

4. Lower Registration Fees

Many states offer lower fees for electric cars. This can also save you money. Check with your local DMV for details.

Understanding the Federal Tax Credit

The federal tax credit is important. It helps more people buy electric cars. The amount you can get is $2,500 to $7,500. The amount depends on the car’s battery size. The bigger the battery, the bigger the credit. But, you cannot get the credit if you do not owe taxes. It helps to reduce your tax bill.

How to Claim the Tax Benefits

Claiming these benefits is easy. Here are the steps:

- Get the lease agreement.

- Check if the car qualifies for the federal credit.

- Fill out IRS Form 8834.

- Attach the form to your tax return.

- Submit your tax return.

It is wise to get help from a tax professional. They can help you understand the process.

Additional Benefits of Leasing Electric Cars

Leasing electric cars has more benefits. Here are some:

- Lower monthly payments compared to buying.

- Warranty coverage often lasts the entire lease.

- You can drive a new car every few years.

- No worries about selling the car later.

Considerations Before Leasing

Leasing is not for everyone. Here are some things to think about:

- Leases have mileage limits. You may pay extra if you go over.

- You must keep the car in good condition.

- At the end of the lease, you have no ownership.

Think about your driving habits. Make sure leasing is right for you.

Frequently Asked Questions

What Are Electric Car Lease Tax Benefits?

Electric car lease tax benefits are deductions or credits for leasing an electric vehicle. They can reduce your taxable income.

How Do Tax Credits For Electric Car Leases Work?

Tax credits lower your tax bill. You can claim them when you file your taxes for leasing an electric vehicle.

Can I Get A Tax Deduction For Leasing An Electric Car?

Yes, you can get a tax deduction for leasing an electric car. This depends on your local tax laws.

What Are The Eligibility Requirements For Tax Benefits?

Eligibility varies by location and vehicle type. Check local laws for specific requirements.

Conclusion

Leasing an electric car can save you money. Tax benefits can help lower costs. The federal tax credit and state incentives are valuable. Consider all aspects before leasing. Make sure it fits your needs. Electric cars are good for the planet. They also offer many benefits for drivers.

.jpg)

FAQs

1. Can I Lease An Electric Car Without A Down Payment?

Some leases require no down payment. Ask your dealer for options.

2. What Happens If I Exceed The Mileage Limit?

You will have to pay extra fees. These fees can add up quickly.

3. How Does The Federal Tax Credit Work For Leased Cars?

The dealer usually applies the credit. This lowers your lease payments.

4. Are Electric Cars More Expensive To Lease?

Leasing costs depend on the car. Electric cars can be more affordable.

5. Can I Lease A Used Electric Car?

Yes, but tax benefits may not apply. Check your state’s rules.

In summary, leasing an electric car offers many benefits. The tax credits and incentives can help you save. Make sure to research your options. Always check the eligibility of the car you choose. Enjoy driving your electric car while saving money!