Tax Benefits of an Electric Car: Maximize Your Savings!

Many people are choosing electric cars. They are good for the environment. They also help save money. One big way to save money is through taxes. In this article, we will learn about the tax benefits of electric cars. Let’s explore how these benefits work.

What is an Electric Car?

An electric car runs on electricity. It does not use gasoline. This means it does not produce harmful gases. Electric cars are becoming very popular. People like them for many reasons. They are quiet, clean, and often cheaper to run.

Tax Credits for Electric Cars

One of the best benefits is the tax credit. A tax credit reduces the amount of tax you pay. In the United States, you can get a federal tax credit. This credit can be up to $7,500. The amount depends on the car’s battery size. The bigger the battery, the bigger the credit.

Who Can Get This Credit?

Anyone who buys a new electric car can apply. You must buy the car for yourself, not for someone else. The car must be new and not used. Used electric cars do not qualify for this credit.

How To Claim The Tax Credit

To claim the tax credit, you need to file your taxes. You will fill out IRS Form 8834. This form is for qualified electric vehicles. Make sure to keep your receipt. You need it for proof.

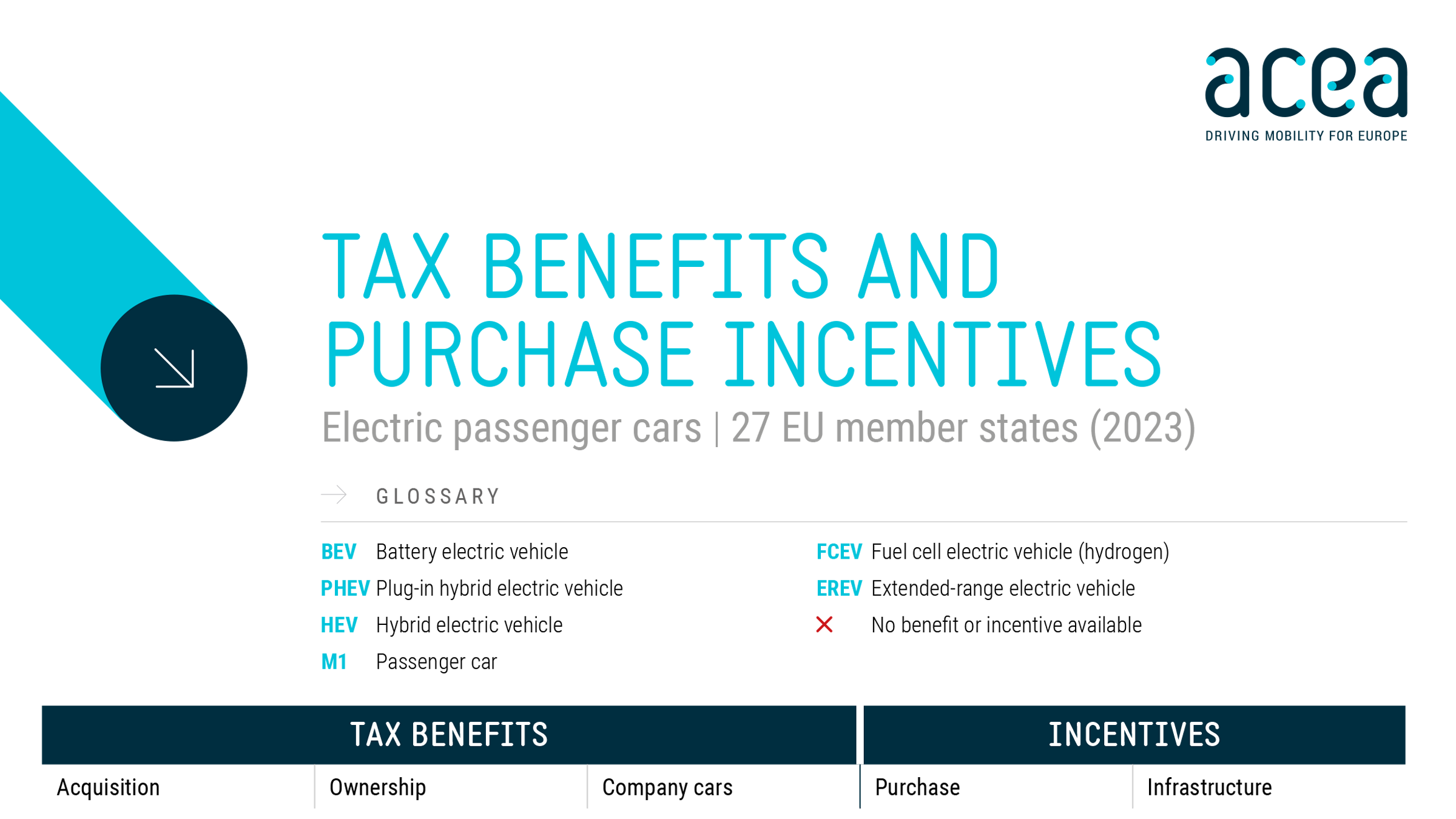

State Tax Benefits

Many states also offer tax benefits. Each state has different rules. Some states give tax credits too. Others may offer rebates. A rebate is money back after you buy the car.

Examples Of State Benefits

Let’s look at a few states:

- California: Offers a rebate of up to $2,000.

- New York: Offers a credit up to $2,000.

- Florida: Has no sales tax on electric cars.

These benefits can save you a lot of money. Always check your state’s rules. They can change often.

Tax Deductions for Electric Cars

Besides credits, there are deductions. A tax deduction lowers your taxable income. This means you pay less tax. If you use your electric car for business, you can deduct expenses.

How To Deduct Expenses

You can deduct costs like:

- Electricity used to charge the car.

- Insurance costs.

- Maintenance costs.

- Registration fees.

Keep good records of these expenses. You will need them when filing taxes.

Charging Station Tax Benefits

If you install a charging station at home, you may get a tax credit. This credit can be up to 30% of the cost. The maximum amount can be $1,000 for residential stations. This helps with the cost of charging your car at home.

Commercial Charging Stations

Businesses can also benefit. They can get tax credits for installing charging stations. This helps make electric cars more accessible. It also supports the environment.

Local Incentives

Some cities offer local incentives. These can include free parking. You may also find discounts on tolls. Some areas even offer special lanes for electric cars. This makes driving easier and cheaper.

How To Find Local Benefits

To find local benefits, check with your city’s website. You can also call local government offices. They can give you the latest information.

Environmental Benefits

Driving an electric car helps the environment. Fewer gas cars mean less pollution. This helps keep our air clean. Many tax benefits support this goal. This is good for everyone.

Government Support

The government wants people to drive electric cars. They encourage this with tax benefits. This helps reduce greenhouse gases. It also helps fight climate change.

Resale Value

Electric cars can have a good resale value. Many buyers want electric cars. This means you can sell it for a good price later. The tax benefits can make the car cheaper now. This can help when you decide to sell it.

Frequently Asked Questions

What Are Tax Credits For Electric Cars?

Tax credits reduce the amount of tax you owe. Electric cars may qualify for these credits.

How Much Is The Tax Credit For Electric Vehicles?

The tax credit can be up to $7,500, depending on the car’s battery size.

Can I Get A Tax Deduction For Electric Car Expenses?

You cannot deduct electric car expenses, but you may claim credits instead.

Do All Electric Cars Qualify For Tax Benefits?

Not all electric cars qualify. Check the specific model for eligibility.

Conclusion

Tax benefits of electric cars can save you money. You can get federal tax credits, state benefits, and deductions. Many local incentives also exist. Electric cars help the environment and save money. They are a smart choice for many people.

Before buying, check all the benefits. These can vary by location. Always read the latest information on taxes. This way, you can make a good choice. Driving an electric car is good for you and our planet.

FAQs

1. What Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500.

2. Can I Get A Tax Credit For A Used Electric Car?

No, the credit is only for new electric cars.

3. How Do I Claim The Tax Credit?

You fill out IRS Form 8834 when filing taxes.

4. Do All States Offer Tax Benefits For Electric Cars?

No, benefits vary by state. Check your state’s rules.

5. Are There Local Incentives For Electric Cars?

Yes, many cities offer local benefits like free parking.

6. Can I Deduct Expenses For Using My Electric Car For Work?

Yes, you can deduct work-related expenses.

7. What Is A Rebate?

A rebate is money given back after a purchase.

8. What Are Charging Station Tax Benefits?

You can get a credit for installing charging stations.