Benefit in Kind Electric Cars HMRC: Tax-Savvy Perks

Electric cars are becoming more popular. Many people want to drive them. They are good for the environment. In the UK, there are special rules for these cars. This is called “Benefit in Kind” or BIK. This article will explain what BIK is. We will also look at how it works with electric cars. Let’s dive in!

What is Benefit in Kind (BIK)?

Benefit in Kind is a tax. It applies to employees who get perks from their jobs. These perks can include cars. When companies provide cars to workers, it counts as a benefit. Employees pay tax on the value of this benefit.

BIK aims to tax the extra perks you get from your job. If you have an electric car, the rules may be different. This can mean less tax for you!

Why Choose Electric Cars?

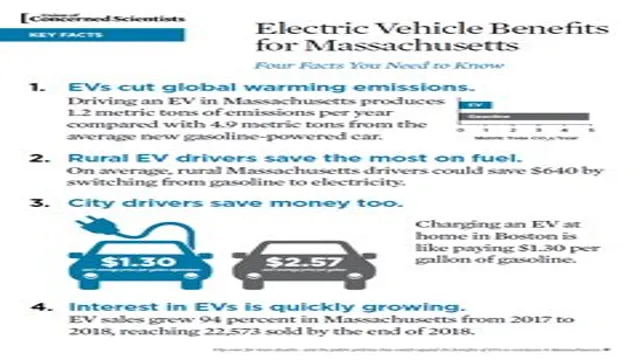

Electric cars offer many benefits. They are good for the planet. They produce less pollution. This helps keep the air clean. Many people also like them because they are quiet. They do not make a lot of noise.

In addition, electric cars often cost less to run. You can charge them at home. You can also find charging stations in many places. This makes them easy to use. They are also cheaper to maintain than petrol or diesel cars.

How Does BIK Work for Electric Cars?

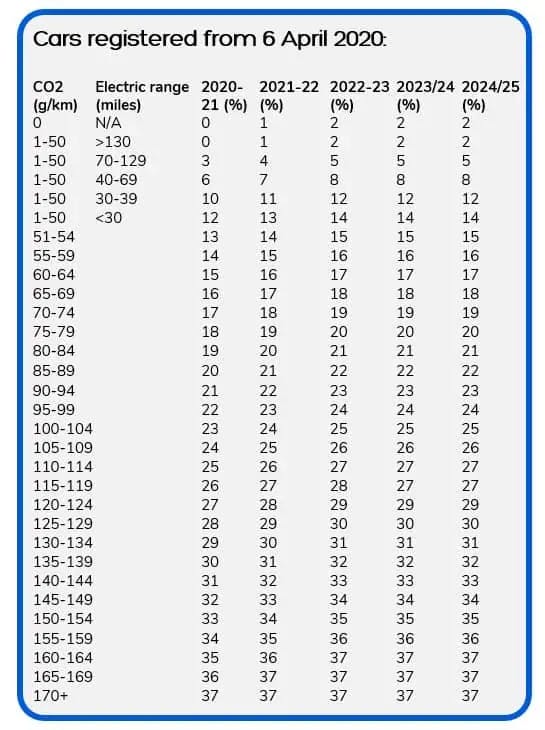

The BIK tax for electric cars is lower than for petrol or diesel cars. This means you pay less tax. The amount you pay depends on the car’s value and its CO2 emissions.

Electric cars usually have zero CO2 emissions. This can make them very attractive. For the tax year 2023 to 2024, the BIK rate for electric cars is very low. It is set at 2%. This is much lower than petrol or diesel cars.

How is BIK Calculated?

To understand how BIK is calculated, you need to know a few things:

- Car’s list price: This is the price when it is new.

- CO2 emissions: This is how much CO2 the car produces.

- BIK rate: This is the percentage you pay tax on.

To calculate BIK, follow these steps:

- Find the car’s list price.

- Check the BIK rate for electric cars (currently 2%).

- Multiply the list price by the BIK rate.

- Calculate the tax based on your income tax rate.

Let’s look at an example. Suppose the electric car costs £30,000.

1. The BIK rate is 2%.

2. Multiply £30,000 by 2% (0.02):

£30,000 x 0.02 = £600.

3. If your income tax rate is 20%, you will pay:

£600 x 20% = £120.

This means you pay £120 in BIK tax for the year.

Benefits of BIK for Electric Cars

There are many benefits to driving an electric car under BIK rules:

- Lower Tax Bills: You pay less tax than for petrol or diesel cars.

- Encourages Eco-Friendly Choices: The government wants to reduce pollution.

- Future Savings: Electric cars may have better resale values.

- Less Maintenance: Electric cars often need less repair work.

Employer Benefits

Employers can also benefit from providing electric cars:

- Attract Talent: Offering electric cars can attract new employees.

- Green Image: Companies can improve their image by being eco-friendly.

- Tax Benefits: Employers can save on National Insurance contributions.

Challenges with Electric Cars

Even with the benefits, there are challenges:

- Initial Cost: Electric cars can be expensive to buy.

- Charging Infrastructure: Not all areas have enough charging stations.

- Range Anxiety: Some people worry about the car’s driving range.

Frequently Asked Questions

What Are Benefit In Kind (bik) Rates For Electric Cars?

BiK rates for electric cars are tax rates you pay on the value of your vehicle. These rates apply to company cars.

How Do Electric Cars Affect My Tax Bill?

Electric cars usually have lower BiK rates. This can lead to lower tax bills compared to traditional cars.

What Is The Current Bik Rate For Electric Cars?

The BiK rate for electric cars depends on the car’s CO2 emissions. For the latest rates, check the HMRC website.

Can I Claim Expenses For Charging My Electric Car?

Yes, you can claim expenses for charging your electric car used for work. Keep your receipts for records.

Conclusion

In summary, Benefit in Kind for electric cars is a great deal. The lower tax rates make them more attractive. They help the environment and can save money.

Employers and employees can both gain from electric cars. It is a smart choice for the future. As more people switch to electric, we can all breathe cleaner air.

If you are thinking about an electric car, consider the BIK benefits. It may help you save money in the long run. Always check the latest rules and rates. This way, you will have the most current information.

Remember, driving an electric car is not just good for you. It is also good for the planet.