Unlock Savings: Federal Benefits for Electric Car Switch

Many people are thinking about electric cars. They want to know if there are benefits from the government. This article will explain the federal benefits for switching to electric cars. We will cover tax credits, rebates, and more. Let’s dive in.

What is an Electric Car?

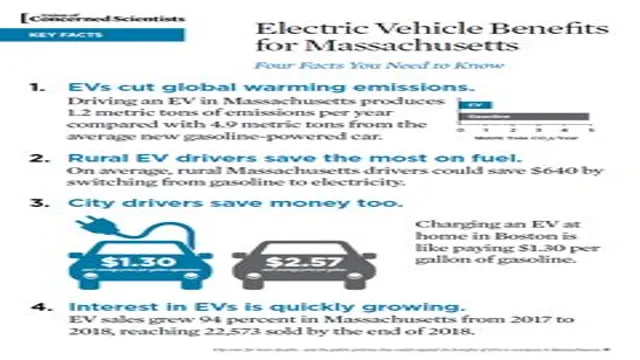

Electric cars run on electricity. They use batteries instead of gasoline. This means they do not make pollution like regular cars. People are interested in them for many reasons. They save money and help the environment.

Why Switch to Electric Cars?

- Save money on fuel.

- Help the environment.

- Get tax benefits from the government.

- Enjoy a quiet driving experience.

- Use fewer resources.

Federal Tax Credit for Electric Cars

One of the biggest benefits is the federal tax credit. This credit helps people pay less in taxes. The credit can be up to $7,500. But not everyone can get the full amount. It depends on the car you buy.

Here is how it works:

- You buy a new electric car.

- The car must be on the list of eligible vehicles.

- You file your taxes for the year.

- You claim the credit on your tax return.

It is important to keep in mind. The credit is not cash. It reduces the amount you owe on your taxes. If you do not owe taxes, you may not get the full credit.

Eligibility for the Tax Credit

Not every electric car qualifies for the tax credit. The car must meet certain conditions. Here are some key points:

- The car must be new, not used.

- The vehicle must have a battery with at least 4 kWh.

- The manufacturer must not have sold over 200,000 electric cars.

Some popular electric car brands include:

- Tesla

- Chevrolet

- Nissan

- Ford

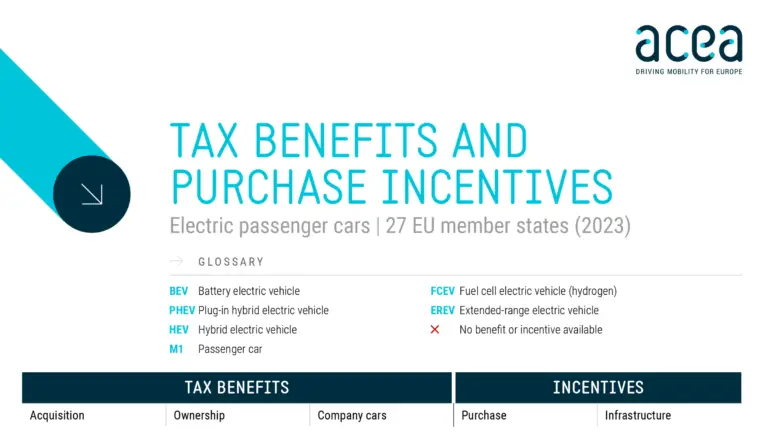

State Incentives for Electric Cars

In addition to federal benefits, many states offer incentives. These can include tax credits, rebates, and more. Each state has different rules. Check the rules in your state to see what benefits you can get.

Some states offer:

- Cash rebates for buying an electric car.

- Reduced registration fees.

- Access to carpool lanes.

- Free charging stations.

Charging Infrastructure Benefits

Another benefit is the growing number of charging stations. Many places offer free charging. This makes it easier to own an electric car. You can charge your car at home too. This saves money and time.

Federal Grants and Funding

The federal government also offers grants. These help with the cost of electric car programs. They support businesses that install charging stations. This makes it easier for everyone to use electric cars.

How to Claim Federal Benefits

Claiming benefits can be easy. Here are steps to follow:

- Buy an eligible electric vehicle.

- Keep all your receipts and documents.

- Fill out IRS Form 8834 for the tax credit.

- Submit your tax return.

It is also good to consult a tax professional. They can help you understand the process better.

The Future of Electric Cars

The future looks bright for electric cars. Many people are switching to them. This helps reduce air pollution. It also helps fight climate change.

Governments want to promote electric cars. They are creating more incentives. This makes it easier for everyone to drive electric.

Frequently Asked Questions

What Federal Benefits Are Available For Electric Cars?

You can access tax credits, rebates, and grants for electric vehicles. These benefits help reduce overall costs.

How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500. The amount depends on the vehicle’s battery capacity.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Check the IRS list to see eligible models.

Are There State Benefits For Electric Cars?

Yes, many states offer their own incentives. These can include tax credits, rebates, and access to HOV lanes.

Conclusion

Switching to electric cars has many benefits. Federal tax credits can save you money. There are also state incentives and rebates. You can enjoy lower fuel costs and a cleaner environment.

Consider switching to an electric car. Research the options available. Look into the federal benefits. It may be a good decision for you and the planet.

Frequently Asked Questions

1. How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500.

2. Do Used Electric Cars Qualify For The Tax Credit?

No, the tax credit is only for new electric cars.

3. How Do I Know If My Car Qualifies For The Tax Credit?

You can check the IRS website for eligible vehicles.

4. Can I Get State Benefits In Addition To Federal Benefits?

Yes, many states offer their own incentives.

5. What Should I Do If I Have More Questions?

Consult a tax professional or visit government websites.