Tax Benefits of Buying an Electric Car: Maximize Savings!

Electric cars are popular today. Many people want to buy them. They are good for the environment. But did you know they can save you money too? Buying an electric car can give you tax benefits. This article will explain those benefits.

What is an Electric Car?

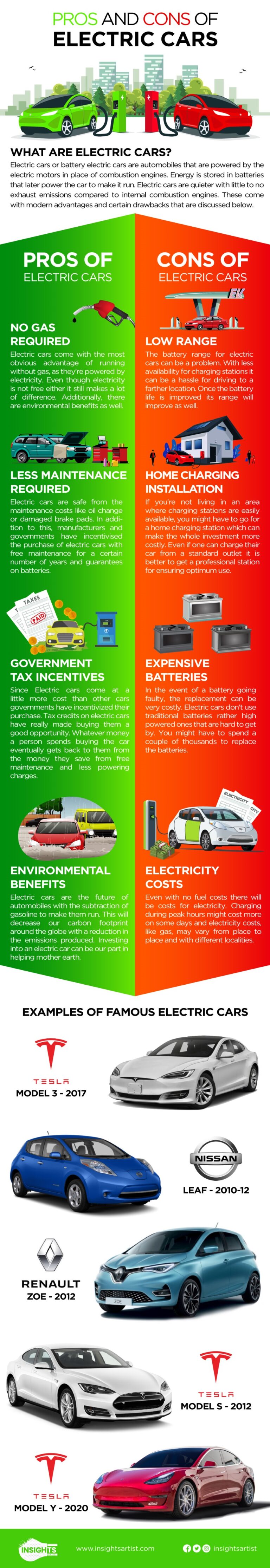

An electric car runs on electricity. It does not use gasoline. These cars are quiet and clean. They help reduce pollution. You can charge them at home or at charging stations. Many people like electric cars for their low cost to drive.

Tax Credits for Electric Cars

One of the biggest tax benefits is the tax credit. In many countries, you can get money back when you buy an electric car. This is called a tax credit. It reduces your tax bill. It can be a big amount, depending on the car.

How Much Can You Save?

The tax credit can be up to $7,500 in the United States. The exact amount can change. It often depends on the size of the battery in your car. Larger batteries mean more savings. Always check the current rules.

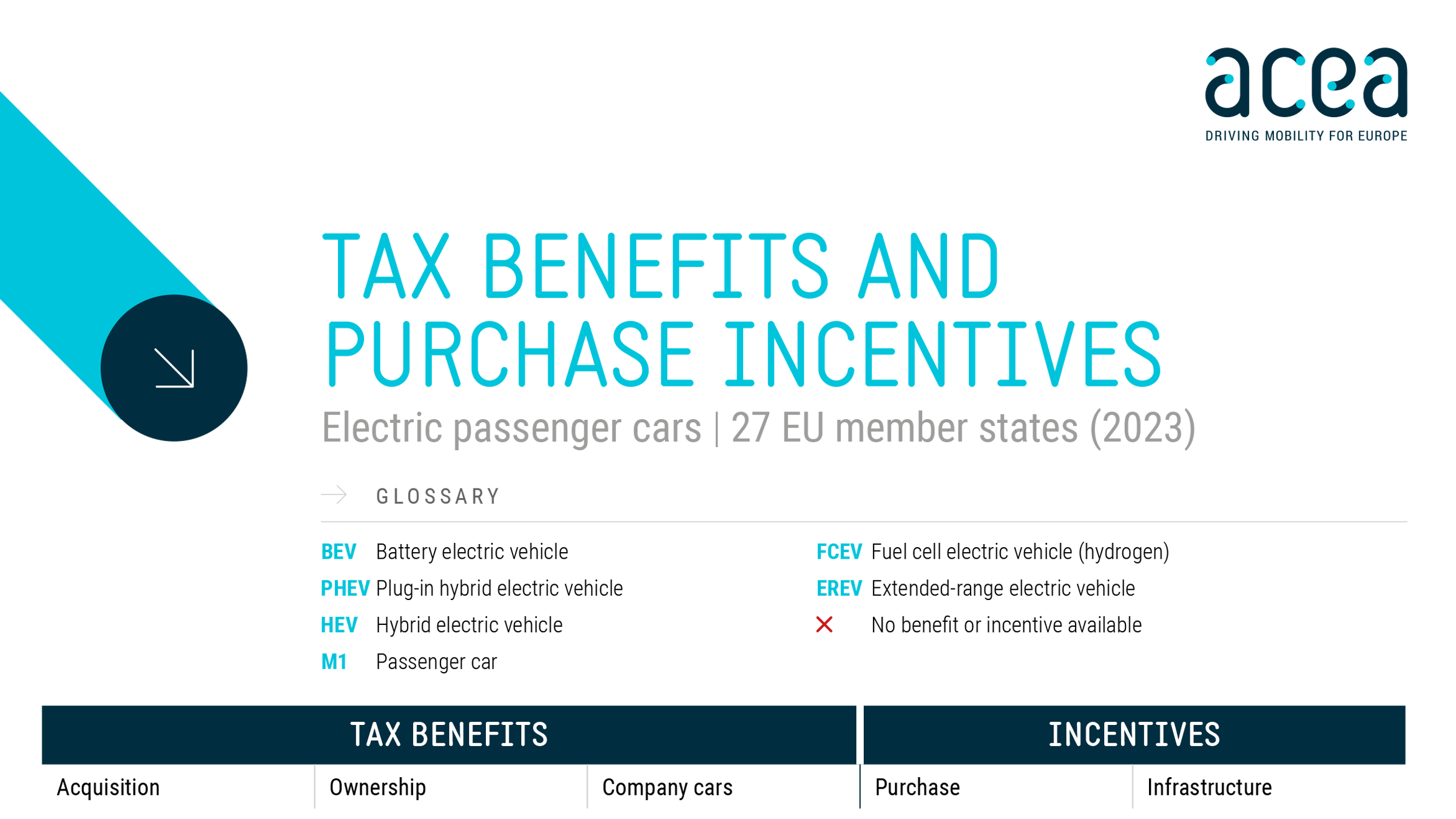

State and Local Incentives

Many states also offer tax benefits. These can be in the form of rebates or credits. Each state has different rules. Some states offer more money back than others. It is important to check what your state offers.

Examples Of State Benefits

- California offers up to $2,500.

- New York gives up to $2,000.

- Colorado offers a $5,000 tax credit.

Sales Tax Exemptions

Some states do not charge sales tax on electric cars. This can save you a lot of money. If your state offers this, you can save even more. Always ask your dealer about this benefit.

Reduced Registration Fees

In some areas, electric cars have lower registration fees. This means you pay less money every year to keep your car legal. This can add up to big savings over time.

Charging Station Incentives

Installing a charging station at home can cost money. But some states help with this cost. They offer rebates for buying and installing home chargers. This can save you money on your electric bill too.

Business Tax Benefits

If you use an electric car for business, you can save more. Businesses can often deduct the cost of the car from their taxes. This includes any charging stations used for business purposes.

Important Points For Businesses

- Keep all receipts for tax deductions.

- Consult a tax professional for advice.

- Check local business incentives.

Environmental Benefits

Buying an electric car helps the environment. Many governments want to reduce pollution. They encourage people to buy electric cars. This is good for our planet and for future generations. Saving the earth is a bonus!

How to Claim Tax Benefits

To get these tax benefits, you need to follow steps. First, buy your electric car. Next, save all your documents. This includes the purchase agreement and any rebates. Finally, fill out the tax forms needed for your tax return.

Documents You Need

- Purchase agreement.

- Proof of payment.

- Any state rebate letters.

Things to Consider

Not all electric cars qualify for tax benefits. Always check if your car is eligible. Some tax benefits may change. It is important to stay updated on new laws.

Future of Electric Cars

Electric cars are becoming more popular. More people want to save money and help the environment. Governments may continue to offer more tax benefits. This encourages more people to buy electric cars.

Frequently Asked Questions

What Are Tax Credits For Electric Car Purchases?

Tax credits are amounts you can deduct from your tax bill when buying an electric car.

How Much Is The Electric Car Tax Credit?

The federal tax credit can be up to $7,500, depending on the car model.

Can I Get State Tax Benefits For Electric Cars?

Yes, many states offer additional tax credits or rebates for electric vehicle buyers.

Do I Qualify For Electric Car Tax Deductions?

Eligibility depends on the car’s battery capacity and your tax situation.

Conclusion

Buying an electric car has many benefits. You can save money on taxes. Many states offer additional incentives. Lower registration fees and charging station rebates also help. Always check local laws for the best benefits. Electric cars help the planet and your wallet!

Frequently Asked Questions

1. What Is A Tax Credit?

A tax credit reduces the amount of tax you pay.

2. How Much Can I Save With A Tax Credit?

You can save up to $7,500 on your federal taxes.

3. Do All Electric Cars Qualify For Tax Benefits?

No, not all electric cars qualify. Check eligibility before buying.

4. Can I Get Money Back For Charging Stations?

Yes, some states offer rebates for home charging stations.

5. Should I Consult A Tax Professional?

Yes, a tax professional can help you find all available benefits.