Benefit in Kind Electric Cars Calculator: Maximize Savings!

Are you curious about Benefit in Kind (BiK) tax? Do you want to learn how it affects electric cars? If yes, you are in the right place. This article explains what BiK is. It also explains how to use a BiK calculator for electric cars.

What is Benefit in Kind (BiK)?

Benefit in Kind (BiK) refers to extra benefits from your job. These benefits are not cash. They can include a car, health insurance, or other perks. If you receive these benefits, you may need to pay tax.

For company cars, BiK tax depends on the car’s value. It also depends on its CO2 emissions. Lower emissions mean lower tax. Electric cars are very popular. They have zero emissions. This means they usually have lower BiK rates.

Why Use a BiK Calculator for Electric Cars?

A BiK calculator helps you understand your tax. It shows how much you will pay for your electric car. Using this calculator can save you money. It helps you compare costs between different cars.

Benefits Of Using A Bik Calculator

- Easy to use.

- Shows clear results.

- Helps in decision-making.

- Compares different electric cars.

- Gives you a better idea of costs.

How Does the BiK Calculator Work?

Using a BiK calculator is simple. You will need to enter some information. Here are the common steps:

- Enter the car’s list price.

- Input the CO2 emissions.

- Provide your tax rate.

- Click to calculate.

Understanding The Inputs

1. Car’s List Price

This is the price of the car before any discounts. It includes the cost of the car and any extras.

2. CO2 Emissions

CO2 emissions show how much carbon dioxide the car emits. Electric cars have zero emissions. This is important for lower BiK rates.

3. Your Tax Rate

Your tax rate depends on your income. Higher earners pay more tax. The calculator uses this rate to find your BiK tax.

Example of Using a BiK Calculator

Let’s say you want to buy an electric car. The car costs £30,000. It has zero CO2 emissions. You are in the 20% tax band. Here is how the calculator works:

| Input | Value |

|---|---|

| Car’s List Price | £30,000 |

| CO2 Emissions | 0 g/km |

| Your Tax Rate | 20% |

After you enter these values, the calculator shows your BiK tax. For this example, the BiK rate for electric cars may be low. This means you will pay less tax.

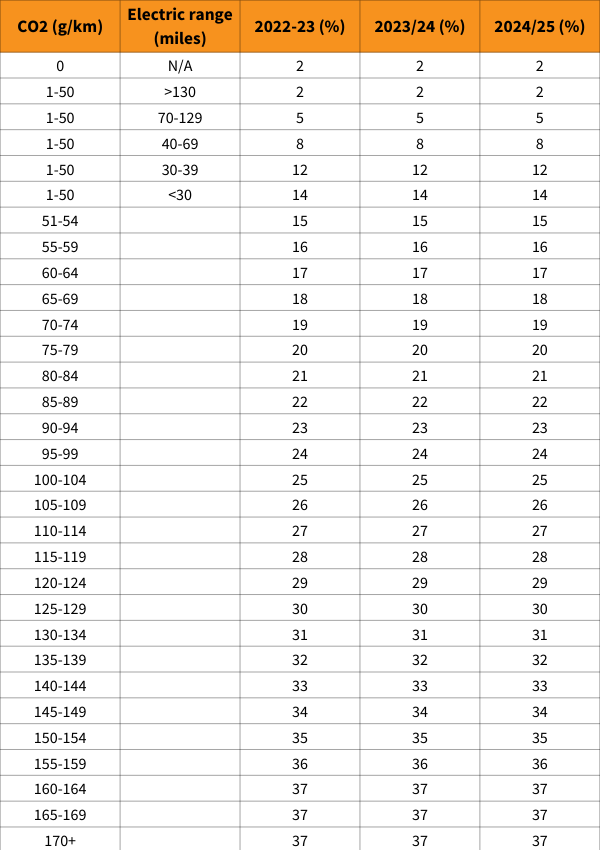

Current BiK Rates for Electric Cars

BiK rates change every year. As of 2023, electric cars have a low rate. Here is a simple breakdown:

| Tax Year | BiK Rate for Electric Cars |

|---|---|

| 2022-2023 | 2% |

| 2023-2024 | 3% |

| 2024-2025 | 4% |

As you can see, the BiK rate is low for electric cars. This means you save money on taxes.

Other Factors to Consider

When buying an electric car, think about other costs. These include:

- Insurance costs.

- Maintenance costs.

- Charging costs.

- Resale value.

Insurance Costs

Electric cars can cost more to insure. This is because they are new technology. However, some companies offer discounts for electric cars.

Maintenance Costs

Electric cars usually need less maintenance. They have fewer moving parts than petrol cars. This can save you money over time.

Charging Costs

Charging an electric car is cheaper than buying petrol. You can charge at home or use public charging stations. Check local rates for charging costs.

Resale Value

Electric cars may have a good resale value. As more people buy them, the demand increases. This is a good point to consider for the future.

Frequently Asked Questions

What Is A Benefit In Kind Electric Cars Calculator?

A Benefit in Kind Electric Cars Calculator helps you estimate tax costs for electric vehicles provided by employers.

Why Should I Use A Benefit In Kind Calculator?

Using a calculator helps you understand potential tax savings on electric cars. It’s a simple way to plan your finances.

How Do I Calculate Benefit In Kind For Electric Cars?

Enter the car’s value, CO2 emissions, and your tax rate in the calculator. It will show your taxable benefit.

What Are The Tax Benefits Of Electric Cars?

Electric cars often have lower tax rates and exemptions, which can save you money compared to traditional vehicles.

Conclusion

Using a Benefit in Kind Electric Cars Calculator is helpful. It helps you understand the tax you need to pay. Electric cars have low CO2 emissions. This means lower BiK rates and savings.

Before buying an electric car, compare different options. Look at all costs involved. This can help you make the best choice.

In summary, a BiK calculator can guide you. It helps you see the benefits of electric cars. Remember to consider insurance, maintenance, and charging costs. By doing this, you will make a smart decision.

Frequently Asked Questions (FAQs)

1. What Is The Bik Rate For Electric Cars?

The BiK rate for electric cars is low. For 2023-2024, it is 3%.

2. How Do I Calculate My Bik Tax?

Use a BiK calculator. Enter the car price, emissions, and tax rate.

3. Are Electric Cars Cheaper To Run?

Yes, electric cars are cheaper to run. Charging costs are lower than petrol.

4. Do Electric Cars Have Higher Insurance Costs?

Yes, electric cars can have higher insurance costs. Check for discounts.

5. What Should I Consider Before Buying An Electric Car?

Consider insurance, maintenance, charging costs, and resale value.