Tax Benefit on Electric Cars: Unlock Savings Today!

Electric cars are becoming more popular. Many people are choosing them. They are good for the environment. They help reduce pollution. But did you know they can also save you money? This article will explain the tax benefits of electric cars. We will cover many important points. Read on to learn more.

What Are Electric Cars?

Electric cars run on electricity. They have batteries instead of gas engines. You can charge them at home or at charging stations. They do not produce exhaust fumes. This makes them better for the air we breathe.

Why Choose an Electric Car?

There are many reasons to choose an electric car:

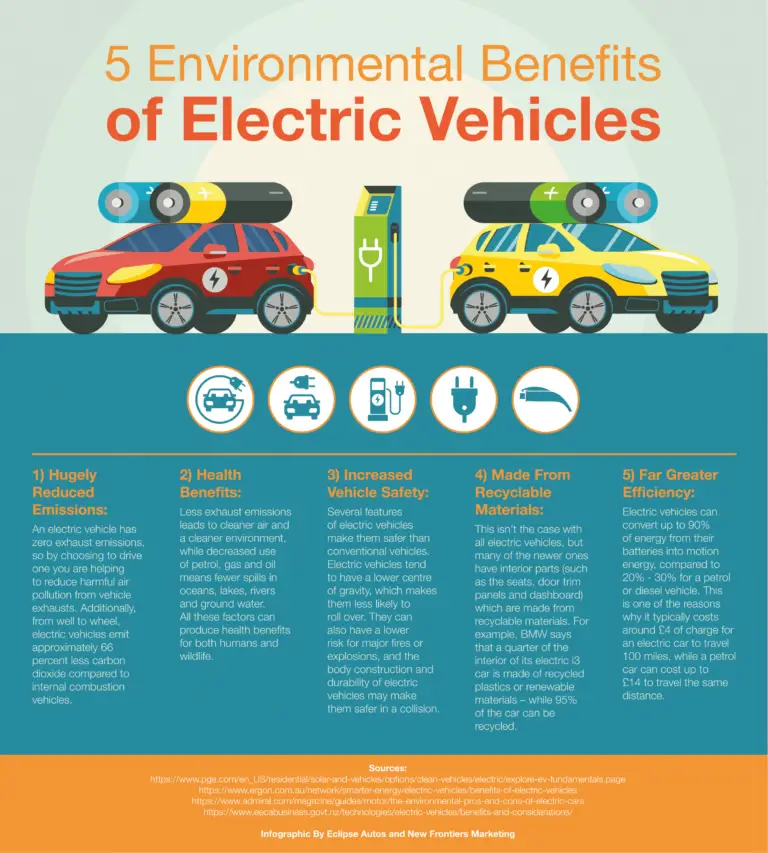

- They are eco-friendly.

- They can save you money on gas.

- They often have lower maintenance costs.

- They provide quiet and smooth rides.

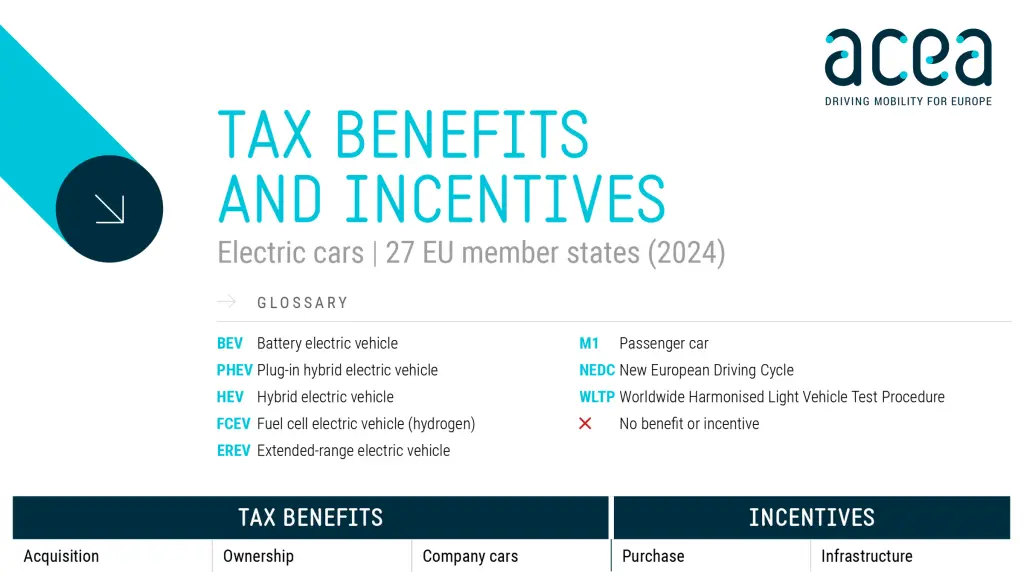

Tax Benefits for Electric Cars

One of the best reasons to buy an electric car is the tax benefits. Many countries and states offer tax credits. These credits can lower the amount of tax you pay. Let’s look at some of these tax benefits in detail.

Federal Tax Credit

In the United States, there is a federal tax credit. This credit is for people who buy electric cars. The credit can be up to $7,500. The amount can depend on the size of the battery. The bigger the battery, the bigger the credit. This tax credit can help reduce the cost of the car.

State Tax Credits

Many states also offer tax credits. These vary by state. Some states offer a credit as high as $5,000. Others may give rebates instead of credits. It is important to check your state’s rules. You can often find this information on the state government website.

Local Incentives

Some cities give local incentives. These may include rebates, free parking, or access to carpool lanes. Local incentives can help save even more money. You should check your city’s rules. Many cities have programs for electric car owners.

How to Claim Tax Benefits

Claiming these benefits is simple. You will need to follow a few steps:

- Buy an electric car.

- Keep the purchase receipt.

- Fill out IRS Form 8834. This form is for the federal tax credit.

- Check your state’s requirements.

- File your taxes.

Make sure to keep all your documents. This includes your car registration and proof of purchase. You may need these for tax time.

How Tax Benefits Affect Your Budget

Understanding tax benefits can help your budget. If you buy an electric car, you can save money. Here’s how:

- Lower upfront cost due to tax credits.

- Savings on fuel costs.

- Lower maintenance costs compared to gas cars.

These savings can add up over time. You can use this money for other things. It may even help you buy a better car. Or, you can save for a vacation!

Environmental Benefits

Electric cars are good for the environment. They help lower greenhouse gas emissions. This is important for our planet. Less pollution means cleaner air. Cleaner air means better health for everyone.

Common Misconceptions

Many people have questions about electric cars. Here are some common misconceptions:

- Electric cars are too expensive: With tax credits, they can be affordable.

- Charging takes too long: Many chargers work quickly, and you can charge at home.

- They do not have enough range: Many electric cars can go over 200 miles on a single charge.

These myths can stop people from buying electric cars. But the facts show they are a great choice.

Future of Electric Cars

The future looks bright for electric cars. More people are choosing them every year. Governments are supporting electric cars more. This means more tax benefits could come. New models are being made every day. They are becoming more affordable and better.

As technology improves, electric cars will become even better. They will have longer ranges and faster charging times. This will make them more appealing to everyone.

Frequently Asked Questions

What Are Tax Benefits For Electric Cars?

Tax benefits for electric cars include credits and deductions that lower your tax bill.

How Much Is The Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500, depending on the vehicle.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify; check if your car meets eligibility rules.

Can I Claim The Electric Car Tax Credit Every Year?

You can claim it only once per vehicle, in the year you buy it.

Conclusion

Tax benefits for electric cars are important. They help make electric cars more affordable. They also help the environment. If you are thinking about buying a car, consider an electric one. Check the federal and state tax benefits. Look into local incentives too. You might save more money than you think.

Electric cars are not just good for you. They are good for our planet. Making a switch to electric can be a smart decision. It can help you save money and help the Earth.

So, do your research. Explore your options. Electric cars are a great choice for many reasons. The tax benefits are just one of them. Choose wisely and enjoy your ride!