Tax Benefits for Electric Cars in India: Maximize Savings!

Electric cars are becoming popular in India. Many people want to drive them. There are good reasons for this. One of these reasons is tax benefits. Let’s learn about these benefits. This article explains everything you need to know.

What are Electric Cars?

Electric cars run on electricity. They do not use petrol or diesel. This makes them better for the environment. They produce less pollution. Many people like them for this reason.

Why Choose Electric Cars?

Choosing an electric car has many benefits. Here are a few:

- Environmentally friendly

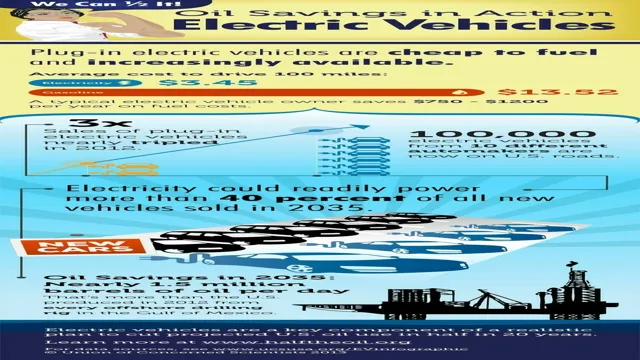

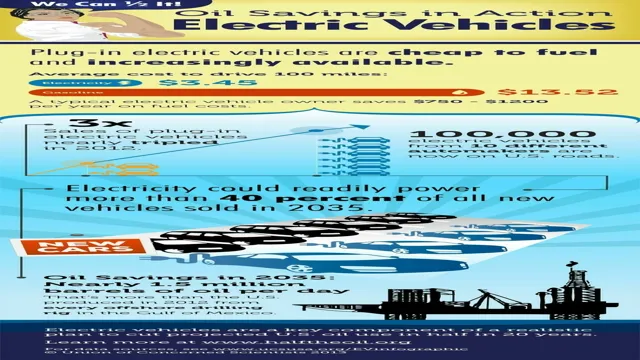

- Lower fuel costs

- Less maintenance

- Quiet operation

Government Support for Electric Cars

The Indian government wants more people to buy electric cars. They have set up programs to help. These programs give tax benefits. These benefits make buying electric cars cheaper.

Types of Tax Benefits Available

There are different types of tax benefits for electric cars. Let’s look at them.

1. Income Tax Benefits

When you buy an electric car, you may get an income tax deduction. You can get a deduction of up to ₹1.5 lakh. This is under Section 80EEB of the Income Tax Act.

2. Gst Benefits

The Goods and Services Tax (GST) on electric cars is lower. The GST rate is 5%. This is lower than petrol and diesel cars. This helps in saving money when buying a car.

3. State-level Incentives

Many states in India give extra benefits. They may provide cash rebates. Some states also offer road tax exemptions. This means you do not pay tax for using the road.

How to Claim These Benefits

It is easy to claim these benefits. Here are the steps:

- Buy an electric car.

- Keep all purchase receipts.

- File your income tax return.

- Claim the deductions under Section 80EEB.

Additional Benefits of Electric Cars

Beyond tax benefits, electric cars offer more advantages:

- Lower running costs

- Less maintenance needed

- Many charging stations are available

- Some cities offer free parking

Challenges of Electric Cars

While there are many benefits, there are also challenges. Here are some:

- Higher upfront cost

- Limited range on a single charge

- Charging stations may not be enough

Future of Electric Cars in India

The future looks bright for electric cars. The government is promoting their use. Many companies are making more electric cars. This will increase options for buyers.

Frequently Asked Questions

What Are Tax Benefits For Electric Cars In India?

Tax benefits for electric cars in India include exemptions on road tax and registration fees, along with deductions under the Income Tax Act.

How Much Tax Deduction Can I Get For Electric Cars?

You can claim a deduction of up to ₹1. 5 lakh on interest paid for loans taken to buy electric vehicles.

Is Gst Lower For Electric Cars In India?

Yes, the Goods and Services Tax (GST) for electric vehicles is set at 5%, which is lower than for regular vehicles.

Are There Any State-specific Benefits For Electric Cars?

Yes, several states in India offer additional incentives, such as subsidies and tax rebates for electric vehicle buyers.

Conclusion

Electric cars are a good choice for many people. They are good for the environment. The tax benefits make them cheaper. If you are thinking about buying a car, consider an electric one. You will save money and help the planet.

FAQs

1. Are There Tax Benefits For Electric Bikes In India?

Yes, electric bikes also have tax benefits. They can enjoy similar GST rates and income tax deductions.

2. How Can I Find Charging Stations For My Electric Car?

You can use apps or websites. They show locations of charging stations nearby.

3. Do I Need To Pay Road Tax For Electric Cars?

Many states offer exemptions. Check your state rules for details.

4. Can Businesses Also Get Tax Benefits For Electric Vehicles?

Yes, businesses can also claim benefits. They can deduct expenses related to electric vehicles.

5. Is It Worth Buying An Electric Car Now?

Yes, with tax benefits and low running costs, it is worth it.

Final Thoughts

Electric cars are a great option. They offer many benefits and help the environment. With tax benefits, they are more affordable. Consider all the options and make a smart choice.