Benefit in Kind Electric Cars 2020/21: Maximize Savings!

Electric cars are becoming more popular. Many people want to drive them. They are good for the environment. In the UK, there is a special tax for people who use company cars. This tax is called Benefit in Kind (BIK). In 2020 and 2021, the rules for BIK changed. This article will explain these changes and their benefits.

What is Benefit in Kind (BIK)?

Benefit in Kind is a tax. It applies to company cars. When you get a company car, you pay tax on it. The amount of tax depends on the car’s value and its CO2 emissions. The more CO2 a car emits, the more tax you pay. Electric cars produce very little CO2. This means lower tax for drivers.

Why Choose Electric Cars?

There are many reasons to choose electric cars. Here are some key benefits:

- Environmentally Friendly: Electric cars help reduce pollution.

- Lower Running Costs: They cost less to charge than to fuel.

- Quiet Operation: Electric cars are quieter than petrol cars.

- Less Maintenance: They have fewer moving parts, which means less repair.

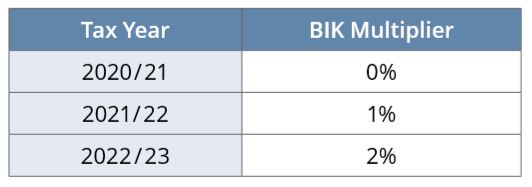

BIK Rates for Electric Cars in 2020/21

The BIK rates for electric cars are very low. In 2020/21, the tax rate for electric cars was just 0%. This means if you drive an electric car from your company, you do not pay any tax. This is a big benefit.

Comparison of BIK Rates

| Car Type | CO2 Emissions | BIK Rate |

|---|---|---|

| Petrol Car | Over 160 g/km | 37% |

| Diesel Car | Over 160 g/km | 37% |

| Hybrid Car | Less than 50 g/km | 13% |

| Electric Car | 0 g/km | 0% |

How to Calculate Your BIK Tax

Calculating your BIK tax is simple. Follow these steps:

- Find the value of the car.

- Check the BIK rate for your car type.

- Multiply the car’s value by the BIK rate.

- Multiply the result by your income tax rate.

Example Calculation

Let’s say you have an electric car worth £30,000. The BIK rate is 0%. Here is how to calculate:

- Car value: £30,000

- BIK rate: 0%

- Taxable benefit: £30,000 x 0% = £0

- Your tax: £0 x income tax rate = £0

So, you pay no tax for this electric car.

Advantages of BIK for Electric Cars

Choosing an electric car has many advantages:

- No BIK Tax: You do not pay tax for electric cars.

- Save Money: You save money every month.

- Incentives from the Government: There may be grants available.

- Better for the Planet: You help reduce pollution.

Other Considerations

While electric cars have many benefits, consider the following:

- Charging Stations: Make sure you have access to charging points.

- Range: Check how far the car can go on a full charge.

- Initial Costs: Electric cars can cost more to buy.

Frequently Asked Questions

What Is Benefit In Kind For Electric Cars?

Benefit in Kind (BIK) is a tax on company car benefits. It applies to employees using electric cars for work.

How Is Bik Calculated For Electric Cars?

BIK is calculated based on the car’s value and its emissions. Electric cars usually have lower BIK rates.

What Are The Bik Rates For Electric Cars In 2020/21?

For 2020/21, electric cars had a BIK rate of 0%. This means no tax for drivers.

Why Choose An Electric Car For Bik Benefits?

Electric cars offer lower BIK rates. This saves money on taxes. Plus, they are eco-friendly.

Conclusion

In summary, Benefit in Kind for electric cars in 2020/21 is very low. The rate is 0%. This means no extra tax for drivers. Electric cars are a great choice for many reasons. They are good for the environment, save money, and have low running costs. If you are thinking about a company car, consider an electric car. You will enjoy many benefits and help the planet.

Call to Action

Are you ready to choose an electric car? Talk to your company today. Explore your options. Start saving money and help the environment. Electric cars are the future. Make the smart choice now.