What are the Tax Benefits of Buying an Electric Car: Unveiled Savings!

Buying an electric car can be smart. It helps the environment. Also, it can save you money. In this article, we will explore the tax benefits of buying an electric car. Let’s dive in!

1. Federal Tax Credit

One big benefit is the federal tax credit. When you buy a new electric car, you may qualify for this credit. The amount can be up to $7,500. This amount depends on the car’s battery size. The larger the battery, the bigger the credit.

This credit helps lower your tax bill. If you owe taxes, this credit reduces what you pay. For example, if you owe $5,000 in taxes, and you have a $7,500 credit, you can pay $0. You can even carry over the unused amount to the next year. But, this only works if you owe taxes.

2. State Tax Credits

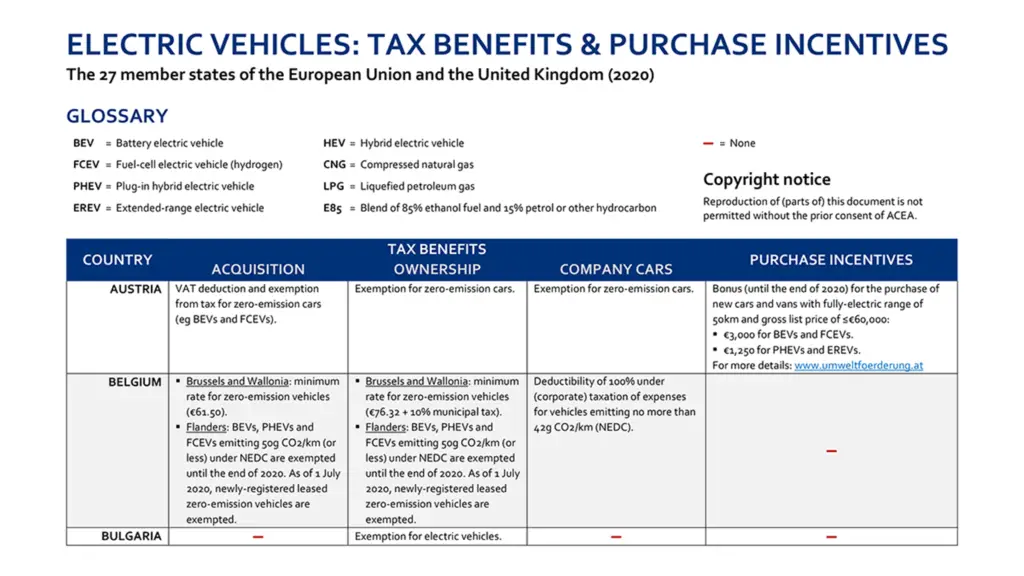

Many states also offer tax credits. These can be different amounts. Some states give $2,000 or more. Others may give rebates. You can check your state’s program. This can help you save even more money.

| State | Tax Credit Amount |

|---|---|

| California | $2,500 |

| New York | $2,000 |

| Texas | $2,500 |

| Florida | Varies |

3. Sales Tax Exemptions

Some states offer sales tax exemptions. This means you do not pay sales tax on electric cars. This can save you a lot of money when buying a car. The savings depend on the state. Make sure to check if your state offers this benefit.

4. Local Incentives

Local governments may also have incentives. Cities and counties can offer rebates or grants. These programs help encourage electric car use. Check with your local government for available programs.

5. Charging Station Grants

When you buy an electric car, you may need a charging station. Some states offer grants for installing these stations. This can help reduce costs. It makes it easier to charge your car at home.

6. Reduced Registration Fees

Some states offer lower registration fees for electric cars. This means you pay less each year to keep your car legal. Check your state’s rules to see if you can save here.

7. Additional Tax Benefits

There are other tax benefits too. Some employers offer electric car benefits. They may help pay for a car or charging. This can lower your overall costs.

Some businesses can also benefit. They may get tax deductions for using electric cars. This helps them save money on business expenses.

8. Environmental Benefits

Buying an electric car is good for the planet. It reduces pollution. Many governments offer tax benefits to encourage this. They want more people to drive electric cars. This helps combat climate change.

9. How to Claim These Benefits

Claiming these tax benefits is not hard. Here are steps to follow:

- Research the federal and state credits.

- Purchase an eligible electric car.

- Fill out the right tax forms.

- Consult a tax professional if needed.

10. Conclusion

Buying an electric car comes with many benefits. Tax credits and incentives can save you money. You can help the environment while saving. Always check local and state rules. This will help you understand your benefits.

Consider making the switch today. You can enjoy the benefits of electric cars. Plus, you contribute to a cleaner planet.

For more information, visit your local tax office or website. They can provide details on credits and programs.

Frequently Asked Questions

What Tax Credits Are Available For Electric Car Buyers?

Many countries offer tax credits to encourage electric car purchases. These credits can reduce your tax bill significantly.

How Much Can I Save On Taxes With An Electric Car?

Tax savings can vary. Some electric cars offer credits up to $7,500, depending on the model and location.

Do I Qualify For Electric Car Tax Incentives?

Qualification depends on your income, the car you buy, and local laws. Check your local tax regulations for details.

Can I Claim Tax Benefits For Used Electric Cars?

Yes, some regions allow tax credits for used electric cars. Always confirm the rules in your area.