Benefit in Kind on Electric Company Cars: Smart Savings!

Electric cars are becoming very popular. Many companies offer electric cars to their employees. This is good for the environment. It also has benefits for the companies and the workers. One important benefit is called “Benefit in Kind.” Let’s explore what this means.

What is Benefit in Kind?

Benefit in Kind (BIK) is a tax that workers pay. This tax is for any perks they get from their job. Perks can be cars, phones, or housing. When a company gives you a car, you may have to pay BIK tax. The tax amount depends on the car’s value and emissions.

Why Choose Electric Cars?

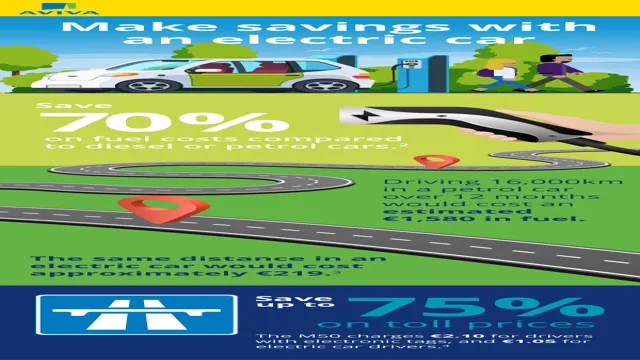

Electric cars have many benefits. First, they are better for the environment. They produce no carbon emissions. This helps reduce air pollution. Second, electric cars can save money on fuel. Charging an electric car is usually cheaper than buying petrol or diesel.

Lower Bik Rates For Electric Cars

One big reason to choose electric cars is the lower BIK rates. The government wants more people to drive electric cars. So, they offer lower taxes on them. In the UK, for example, the BIK rate for electric cars is very low. In 2023, it is just 2%. This means less tax to pay for employees.

| Car Type | BIK Rate |

|---|---|

| Petrol/Diesel Cars | Higher than 2% |

| Electric Cars | 2% |

How Does BIK Work for Electric Cars?

To understand BIK, we need to know how it is calculated. The BIK tax is based on two things:

- The car’s value

- The car’s emissions

Electric cars have zero emissions. This means they get the lowest BIK rate. The higher the car’s value, the more tax you pay. But since electric cars have low rates, the tax stays low.

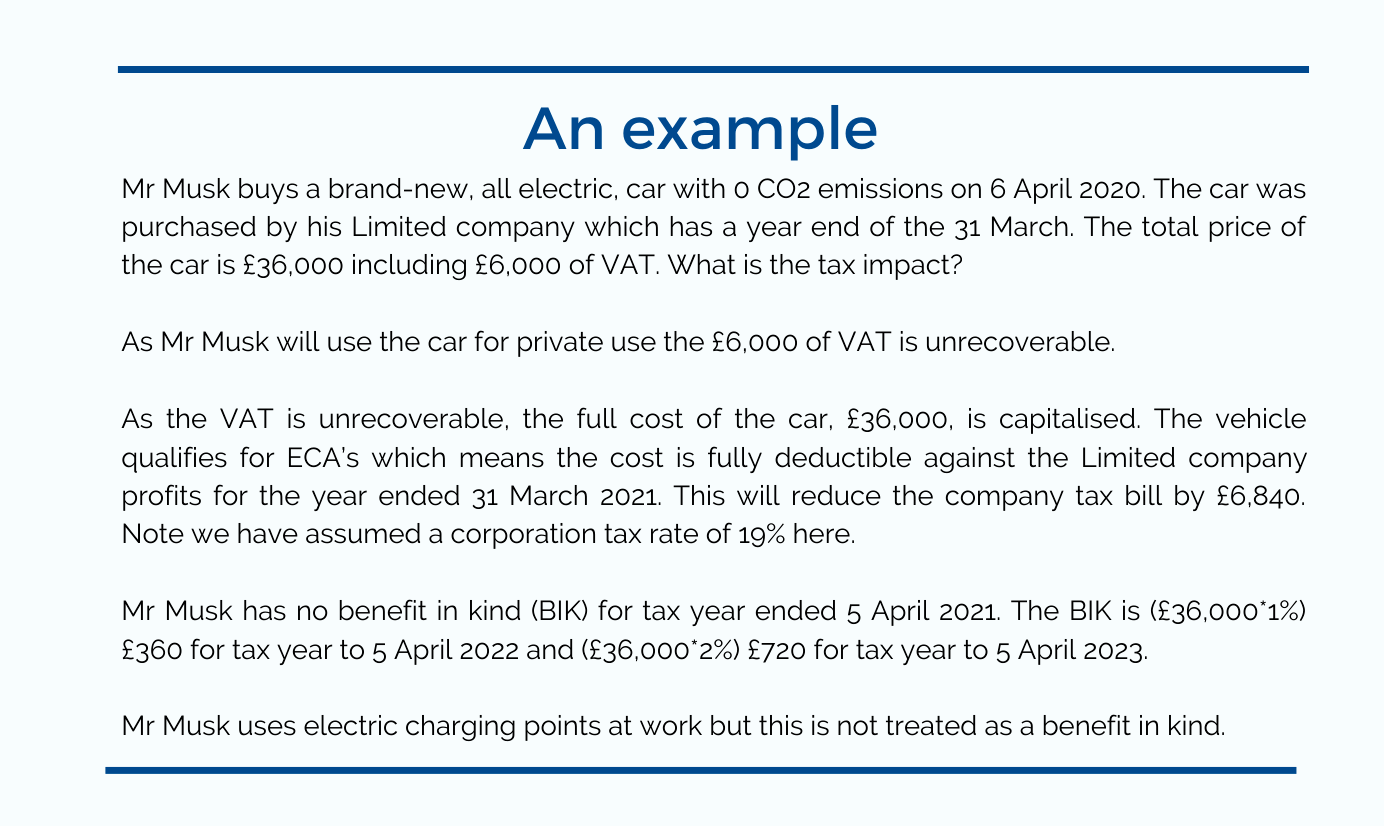

Examples of BIK for Electric Cars

Let’s look at some examples. Suppose a company gives an employee an electric car worth £30,000. The BIK rate is 2%.

To find the BIK tax, we do the following:

- Calculate 2% of £30,000.

- This equals £600.

Now, if the employee pays 20% tax on this amount:

- 20% of £600 is £120.

So, the employee pays only £120 in BIK tax for the year. This is much lower than for petrol or diesel cars.

Benefits for Employees

There are many benefits for employees with electric company cars. Here are some:

- Lower tax payments

- Cheaper running costs

- Less impact on the environment

- Access to charging points

Employees can save money. They also help the planet. This makes it a good choice for everyone.

Benefits for Companies

Companies also gain from offering electric cars. Here are some benefits:

- Tax savings for the company

- Attracting new talent

- Improving company image

- Meeting environmental goals

Companies can save money on taxes. They also look good in the eyes of the public. This helps them attract new workers.

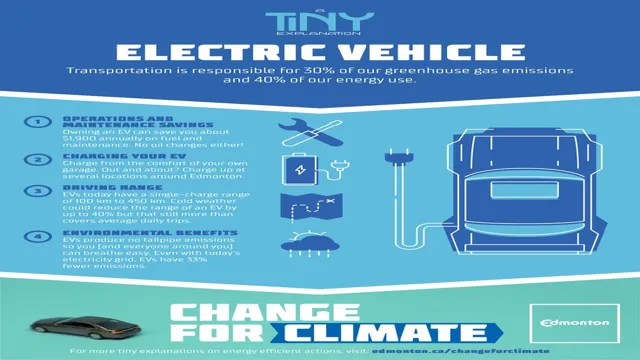

Charging Electric Cars

Charging electric cars is easy. Many companies install charging points. Employees can charge cars at work. They can also charge at home. It is simple and convenient.

Types Of Chargers

There are different types of chargers:

- Home chargers

- Workplace chargers

- Public charging stations

Home chargers are convenient for daily use. Workplace chargers allow charging during work hours. Public charging stations are useful when traveling.

Choosing the Right Electric Car

Choosing the right electric car can be challenging. There are many options available. Here are some popular models:

- Tesla Model 3

- Nissan Leaf

- BMW i3

- Hyundai Kona Electric

Each car has its own features. Employees should consider their needs. They need to think about range, comfort, and price.

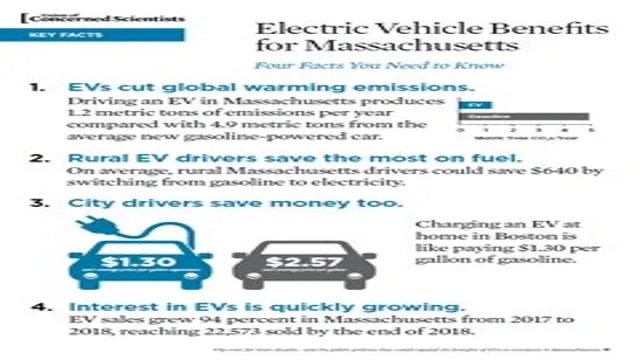

Environmental Impact

Driving electric cars helps the environment. They do not emit harmful gases. This helps reduce global warming. Every electric car makes a difference.

By choosing electric cars, companies show they care. They contribute to a cleaner planet. This is important for future generations.

Frequently Asked Questions

What Is Benefit In Kind For Electric Company Cars?

Benefit in Kind (BiK) is a tax on company cars. It applies to employees who receive vehicles from their employer.

How Is Benefit In Kind Calculated For Electric Cars?

BiK for electric cars is based on their list price and CO2 emissions. Lower emissions mean lower tax rates.

What Are The Current Bik Rates For Electric Vehicles?

As of 2023, the BiK rate for electric vehicles is 2%. This rate is beneficial for employees.

Do Electric Company Cars Reduce Tax Bills?

Yes, electric cars have lower BiK rates. This reduces the overall tax bill for employees.

Conclusion

In conclusion, Benefit in Kind on electric company cars offers many advantages. Employees pay lower taxes. They save money on fuel. Companies benefit too by saving on taxes and improving their image.

Electric cars are a smart choice. They help the environment and save money. More companies and employees should consider electric cars.

With the right information, everyone can make better choices. The future is bright for electric cars.