Tax Benefits of Buying Electric Car in India: Save Big!

More and more people are choosing electric cars in India. Why? They are good for the environment and can save money. One big reason is the tax benefits. Buying an electric car can give you financial help. In this article, we will explore the tax benefits of buying an electric car in India. Let’s dive in!

What is an Electric Car?

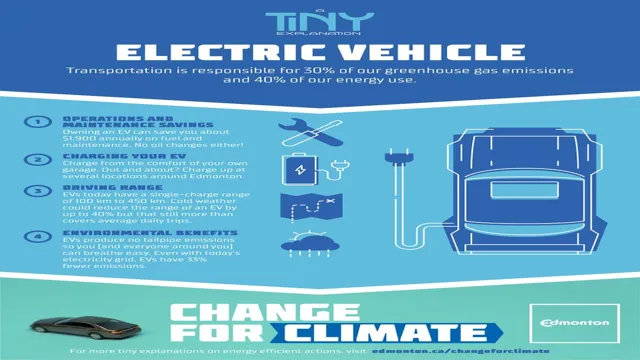

An electric car runs on electricity. It uses batteries instead of gasoline. This makes it cleaner for the air. Electric cars do not produce smoke like regular cars. They help reduce pollution.

Government Push for Electric Cars

The Indian government wants people to buy electric cars. They want to reduce pollution and save energy. To encourage this, the government has set up many plans. These plans give tax benefits and subsidies.

Tax Benefits for Electric Cars

When you buy an electric car, you can enjoy many tax benefits. Here are some of the main ones:

1. Income Tax Deduction

The Indian government offers an income tax deduction. If you buy an electric car, you can claim up to ₹1.5 lakh. This is part of Section 80EEB of the Income Tax Act. This deduction is for the interest on loans taken for electric cars. It helps reduce your taxable income.

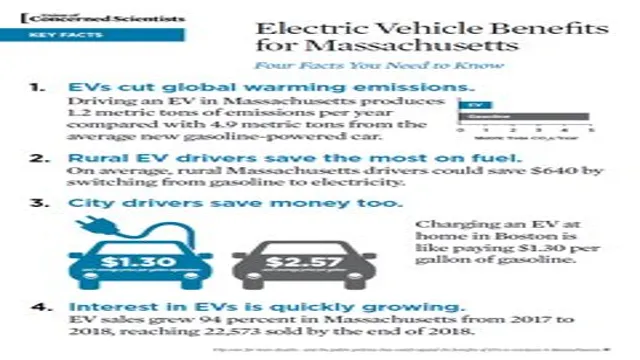

2. Gst Reduction

The Goods and Services Tax (GST) on electric cars is lower. The GST for electric vehicles is only 5%. For regular cars, it can be up to 28%. This means you pay less tax when you buy an electric car.

3. Registration Fee Waiver

Some states in India also waive the registration fee. This means you don’t have to pay for registering your electric car. This helps you save more money when you buy a new car.

4. State Subsidies

Many state governments provide additional subsidies. These subsidies can range from ₹10,000 to ₹1.5 lakh. Each state has its own rules. Check your state’s rules to find out how much you can save.

5. Lower Running Costs

Electric cars have lower running costs. They cost less to charge than to fill with petrol or diesel. Over time, this can mean big savings.

Why Choose an Electric Car?

Besides tax benefits, there are other reasons to choose an electric car:

- Environmentally Friendly: They do not pollute the air.

- Quiet: They are quieter than regular cars.

- Less Maintenance: They have fewer moving parts, so they need less maintenance.

- Easy to Charge: You can charge at home.

How to Apply for Tax Benefits?

Applying for tax benefits is easy. Here are the steps:

- Buy an Electric Car: Choose the car you want.

- Take a Loan: If needed, take a loan for the car.

- Keep Documents: Save all the bills and loan documents.

- File Your Taxes: When you file your income tax, mention the deduction.

Common Misconceptions About Electric Cars

Some people have doubts about electric cars. Let’s clear some common misconceptions:

1. Electric Cars Are Expensive

At first, electric cars may seem costly. However, the tax benefits and lower running costs save money in the long run.

2. They Have Short Ranges

Many electric cars now have longer ranges. Some can run for over 300 kilometers on a single charge.

3. Charging Takes Too Long

Charging times are improving. Many electric cars can charge in a few hours. Fast chargers can do it even quicker.

Challenges of Owning an Electric Car

While there are many benefits, there are some challenges too:

1. Charging Infrastructure

Charging stations are still not everywhere. However, they are growing in number.

2. Battery Replacement

Batteries may need replacement after some years. This can be costly, but improvements are being made.

3. Limited Models

There are fewer electric car models than regular cars. This is changing, with more options coming soon.

Frequently Asked Questions

What Are The Tax Benefits For Electric Cars In India?

Electric cars in India enjoy tax benefits like reduced GST rates and income tax deductions.

How Much Gst Do Electric Cars Attract In India?

Electric cars attract a lower GST rate of 5% compared to 28% for petrol and diesel cars.

Can I Claim Tax Deductions For Electric Car Loans?

Yes, you can claim a tax deduction of up to ₹1. 5 lakh on interest paid for electric car loans.

Is There A Subsidy For Electric Cars In India?

Yes, the Indian government offers subsidies under the FAME II scheme to promote electric vehicle adoption.

Conclusion

Buying an electric car in India comes with many tax benefits. These benefits can save you money. With the push for electric vehicles, the future looks bright. Electric cars are good for you and the environment. Consider making the switch today!

FAQs About Electric Cars in India

1. Can I Get A Loan For An Electric Car?

Yes, many banks offer loans for electric cars.

2. How Much Can I Save On Taxes?

You can save up to ₹1.5 lakh on interest deductions.

3. Are Electric Cars Good For The Environment?

Yes, they produce no emissions, helping reduce pollution.

4. How Long Does It Take To Charge An Electric Car?

Charging can take a few hours. Fast chargers are quicker.

5. Are There Any State-specific Benefits?

Yes, some states offer extra subsidies for electric cars.