Switching to Electric Cars: Unlocking Federal Benefits and Savings You Never Knew Existed

As the world shifts towards clean energy, electric cars are becoming more popular than ever. Not only are they better for the environment, but they also offer a number of financial and practical benefits. If you’re considering purchasing an electric car, you may be wondering about the federal benefits that are available to you.

Luckily, there are a variety of incentives and programs that can help you save money and make the switch to electric. In this blog, we’ll explore some of the most notable federal benefits for electric cars and how you can take advantage of them. So, buckle up and let’s get started!

Tax Credits

If you’re considering switching to an electric car, you’ll be happy to know that there are a number of federal benefits available. One of the most significant is the federal tax credit, which can help you offset the higher initial cost of purchasing an electric vehicle. This credit is available for both new and used electric cars, and can range from $2,500 to $7,500 depending on the size of the vehicle’s battery pack.

Keep in mind, however, that this credit is not unlimited and will eventually expire once the manufacturer has sold a certain number of eligible vehicles. It’s also important to note that not all electric vehicles are eligible for the full credit amount, so make sure to do your research ahead of time. In addition to the federal tax credit, some states and municipalities also offer their own incentives for electric vehicle owners, such as rebates, tax credits, and access to HOV lanes.

So if you’re thinking about making the switch to electric, be sure to explore all of your options for potential savings.

Federal Tax Credit

If you’re a taxpayer in the US, you may qualify for a federal tax credit. Tax credits are a type of incentive given by the government to encourage taxpayers to take certain actions that benefit society. In the case of the federal tax credit, this incentive is to encourage taxpayers to invest in renewable energy sources, such as solar panels, wind turbines, and geothermal systems.

Members of the public can claim credits of up to 30% of the cost of clean energy projects installed in their homes or businesses. The tax credit model encourages individuals to invest in renewable energy by making it more accessible and affordable, ultimately helping put the US on a path toward a more sustainable future. So, if you’re looking to take the step toward clean energy, consider looking into the federal tax credit as you could save thousands of dollars in the long run.

State and Local Incentives

When it comes to business growth, tax credits can make a huge difference in helping your company succeed. State and local governments offer a variety of tax incentives to encourage economic development within their communities. Tax credits provide businesses with the opportunity to reduce their tax burden, allowing them to keep more revenue and allocate resources towards growth.

Some of the most common tax credits businesses can take advantage of include investment tax credits, research and development tax credits, and job creation tax credits. These credits can have a significant impact on your bottom line, reducing your overall tax liability and increasing your ability to invest in growing your business. Remember to check with your state and local government to see what tax incentives are available to you and take advantage of these opportunities to maximize your business’s potential for success.

Fuel Savings

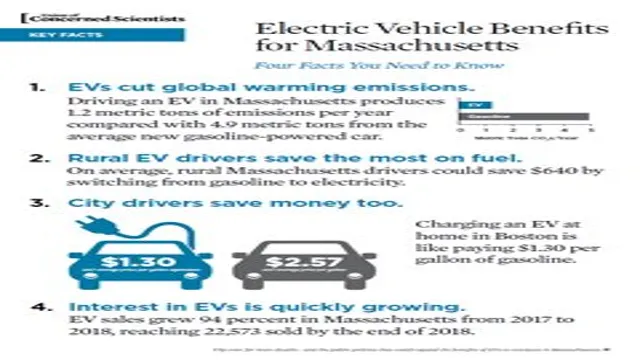

Electric cars are becoming increasingly popular due to their numerous benefits over traditional gasoline-powered vehicles. Besides being an eco-friendly alternative that helps reduce carbon emissions, electric cars can help you save on fuel costs significantly. Moreover, there are federal benefits available for those who switch to electric cars.

For instance, the federal government offers tax credits of up to $7,500 on the purchase of certain electric vehicles. Additionally, some states also offer rebates or other incentives to promote electric car use. By switching to an electric car, you not only get the advantage of fuel savings but also get to contribute to creating a cleaner, greener future for generations to come.

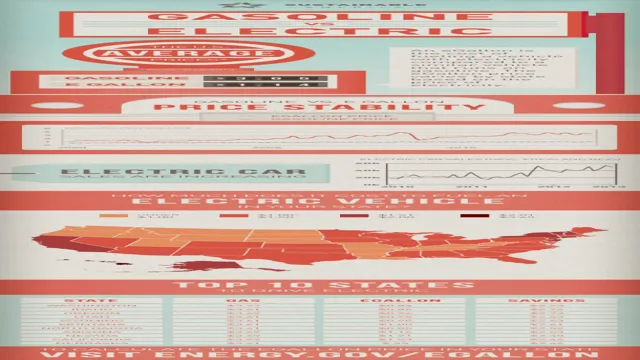

Electricity costs vs Gasoline

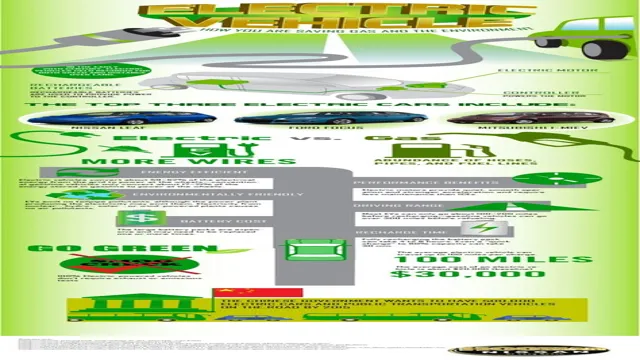

When it comes to fueling our vehicles, one factor that can have a significant impact on our budget is the cost of electricity vs gasoline. While electricity can be cheaper than gasoline in some areas, this isn’t always the case. It’s essential to consider the cost of electricity in your area and the efficiency of your vehicle.

If you own an electric car, you’re likely to save money on fuel costs over time, especially if you charge your vehicle during off-peak hours. On the other hand, if you have a traditional gasoline-powered car, it’s crucial to compare gas prices in your area and your vehicle’s fuel efficiency. Keep in mind that small changes in fuel efficiency can make a big difference over time.

By staying on top of fuel costs and making smart decisions about when and where you fill up, you can save money on fuel and keep your vehicle running efficiently.

Maintenance Savings

When it comes to saving money on maintenance costs for your vehicle, one of the best ways to cut down on expenses is to focus on fuel efficiency. By improving your car’s fuel efficiency, you can save money not only on gasoline but also on regular maintenance. When your car uses less fuel, engine components such as spark plugs and filters experience less wear and tear, which means they last longer and require less frequent replacement.

Additionally, by keeping up with regular oil changes and tire rotations, you can ensure that your car runs smoothly and efficiently, further reducing the need for costly repairs down the line. So, make sure you check your car’s tire pressure regularly, keep your engine well-maintained, and adopt fuel-efficient driving habits, such as avoiding idling, accelerating gradually, and driving at a steady pace. By doing so, you’ll not only save money but also help the environment by reducing your car’s carbon footprint.

Environmental Benefits

If you’re thinking about switching to an electric car, you may be pleasantly surprised to learn that there are actually several federal benefits available that can help make the transition easier on your wallet. One of the most significant benefits comes in the form of tax credits, which allow you to claim up to $7,500 in credits for purchasing certain electric vehicles. Additionally, some states and municipalities offer their own additional incentives, such as rebates or exemptions from certain fees and taxes.

But beyond the financial benefits, perhaps the biggest reason to switch to an electric car is the environmental impact. By choosing a car powered by electricity rather than gasoline, you can significantly reduce your carbon footprint and help protect the planet for future generations. So whether you’re looking to save money or do your part for the environment – or both! – there are plenty of reasons to consider making the switch to an electric car.

Reduced CO2 Emissions

Reduced CO2 emissions are just one of the many environmental benefits of making changes to our daily habits. By reducing the amount of CO2 that we put into the atmosphere, we can help to slow down the rate at which our planet is warming up. This can lead to a reduction in the number of natural disasters and other negative impacts on our environment.

Additionally, reducing CO2 emissions can also help to improve air quality and reduce pollution levels in our cities and towns. By making small changes such as walking or biking instead of driving, or by using renewable energy sources like solar or wind power, we can make a big impact on the environment. So, let’s all do our part to reduce CO2 emissions and make a difference for our planet!

Improved Air Quality

Improved air quality is one of the most significant environmental benefits that we can achieve through individual and collective efforts. This importance is due to the direct impact of air quality on human health and the natural ecosystem. With improved air quality, we can reduce respiratory diseases such as asthma and bronchitis, particularly in vulnerable individuals such as children and elderly people.

Furthermore, good air quality provides a healthy environment for animals and plant species to thrive and function properly. The main keyword of this blog is “improved air quality.” It is vital to note that improving air quality is not the responsibility of the government or large corporations alone.

We can contribute to this environmental benefit by making simple adjustments to our daily routine, such as using public transportation, conserving energy, and recycling. By collectively embracing such practices, we can significantly reduce air pollution and create a healthy environment for ourselves and future generations.

Conclusion

In conclusion, while there may not be an immediate avalanche of federal benefits for switching to electric cars, there are certainly perks to be found – from tax credits to HOV lane access, not to mention the overall benefit to the environment. However, if you’re still on the fence about making the switch, just remember: picking an electric car is basically the automotive version of having your cake and eating it too. So why not indulge in some guilt-free driving?”

FAQs

What types of federal benefits are available for switching to an electric car?

The federal government offers a tax credit of up to $7,500 for the purchase of a qualifying electric vehicle.

Are there any additional state or local benefits for owning an electric car?

Yes, some states and localities offer additional incentives such as rebates, tax credits, or reduced registration fees for owning an electric car.

How do I claim the federal tax credit for purchasing an electric car?

You can claim the tax credit on your federal tax return by filling out IRS Form 8936 and including it with your tax return.

Are there any income restrictions for claiming the federal tax credit for purchasing an electric car?

No, there are no income restrictions for claiming the federal tax credit, but the amount of the credit may be reduced for higher-income taxpayers.