Drive in Style and Save with CA State’s Electric Car Benefits

If you’re considering buying an electric car in California, you’re in luck! The Golden State offers a range of benefits and incentives designed to encourage the adoption of electric vehicles (EVs) and reduce greenhouse gas emissions. In fact, California currently has the highest number of EVs on the road in the United States. But what exactly are these benefits, and how can you take advantage of them? In this blog post, we’ll explore the CA state benefit for electric cars and explain why going electric might be the right choice for you.

Incentives and Rebates

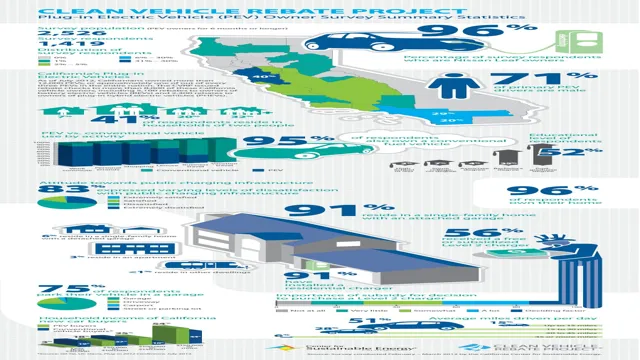

If you’re considering purchasing an electric car in California, then you’re in luck – there are several incentives and rebates that you may qualify for. One of the most significant benefits for electric vehicle owners in California is the Clean Vehicle Rebate Project (CVRP), which offers up to $7,000 in rebates for eligible vehicles. Additionally, California residents who purchase or lease an electric car may also qualify for a federal tax credit of up to $7,500.

However, it’s important to note that each individual rebate or incentive has its own set of eligibility criteria and requirements, so it’s essential to do your research to determine which ones you may qualify for. Overall, the state of California has made great efforts to incentivize the adoption of electric vehicles, and the benefits of driving an EV extend far beyond just appealing rebates and incentives – they’re good for the planet, too.

Up to $7,000 in Rebates from the California Clean Vehicle Rebate Project

Are you considering making the switch to a clean vehicle but hesitant about the cost? The California Clean Vehicle Rebate Project is here to help! They are offering rebates up to $7,000 for eligible electric, plug-in hybrid, and fuel cell vehicles. This incentive program aims to reduce transportation-related emissions and encourage more individuals to choose cleaner and greener transportation options. The amount of the rebate varies depending on the type of vehicle you choose and your income level.

For example, low-income individuals may be eligible for a higher rebate amount. By taking advantage of this incentive, not only will you be saving money on your vehicle purchase, but you will also be contributing to a cleaner environment. So, why not consider making the switch to a clean vehicle and take advantage of the rebates offered by the California Clean Vehicle Rebate Project?

HOV Lane Access for Single-Occupancy Vehicles

HOV lane access for single-occupancy vehicles can be a hassle, but there are incentives and rebates to make it more appealing. In some states, drivers can apply for a permit that gives them access to the HOV lane, even if they are driving alone. This can save a ton of time during rush hour traffic, and make the commute a lot less stressful.

Additionally, some car manufacturers offer incentives for drivers who purchase electric or hybrid vehicles, which often includes HOV lane access. It’s important to research the specific requirements for HOV lane access in your state, as well as any available rebates or incentives for purchasing an eligible vehicle. While it may require a little bit of legwork to apply, it’s definitely worth it if you can enjoy a less congested commute.

Tax Credits

Are you interested in purchasing an electric car but worried about the cost? Good news! California offers a state benefit for electric cars that can help you save money on your purchase. This benefit comes in the form of tax credits, which can range from $2,500 to $7,000, depending on the make and model of your vehicle. Not only will this help offset the higher initial cost of an electric car, but it will also contribute to a cleaner environment by reducing emissions.

With the rising popularity of electric vehicles, there’s never been a better time to make the switch and take advantage of this amazing opportunity. So why not make the switch today and enjoy the many benefits of owning an eco-friendly car while also putting some extra cash in your pocket?

Up to $2,500 in Tax Credits from the Clean Vehicle Assistance Program

When it comes to owning a clean vehicle, there are plenty of benefits beyond just doing your part for the environment. The Clean Vehicle Assistance Program provides tax credits up to $2,500 for eligible individuals who want to purchase a clean vehicle. This program aims to make it easier for lower-income individuals and households to make the switch to more sustainable transportation options, such as electric or hybrid vehicles.

Not only can you save money on gas and maintenance costs, but you can also take advantage of these tax credits to reduce your overall financial burden. It’s a win-win situation for both you and the environment. So why not consider making the switch to a clean vehicle and take advantage of these tax credits today?

Additional Tax Credits Available from Federal Government

Tax credits, federal government If you are looking for ways to lessen your tax burden, you may be interested in exploring various tax credits offered beyond the typical ones. The federal government provides additional tax credits that can help to reduce your overall tax liability. For instance, the Renewable Energy Tax Credit, also known as the Investment Tax Credit, allows people who install solar panels or other renewable energy sources to earn up to 30% of their installation costs back as a tax credit.

Another possible tax credit is the Earned Income Tax Credit, which benefits low-to-moderate-income working individuals and couples with children. The credit’s amount is determined by the recipient’s earned income and the number of children they have. Eligible taxpayers can also receive a credit of up to $2,000 per dependent through the Child Tax Credit.

By taking advantage of such credits, not only can you pay less in taxes, but it also promotes energy efficiency and support to the less-fortunate working individuals and families.

Charging Infrastructure

When it comes to encouraging Californians to make the switch to electric cars, the state is doing its part by offering a range of benefits and incentives. One such benefit is the availability of charging infrastructure throughout the state. While charging an electric car at home is certainly convenient, being able to top up your battery while out and about is vital for longer trips.

Luckily, California has invested heavily in charging infrastructure, boasting over 25,000 public charging stations across the state. This means that no matter where you go, you’re never too far from a place to charge your car. And with incentives like free charging at certain stations and reduced rates during off-peak hours, making the switch to electric has never been easier or more accessible.

So why wait? Start enjoying the benefits of owning an electric car today and take advantage of all the state has to offer.

CA State Rebate Programs for Charging Station Installation

If you’re thinking about getting an electric vehicle, one of the biggest concerns is making sure you have a place to charge it. But did you know that California has a variety of rebate programs available to help you install charging stations? Whether you’re a homeowner, a business owner, or even a multi-unit dwelling manager, there’s likely a program that suits your needs. The rebates can cover up to 75% of the installation cost and can be used for both Level 2 and DC Fast Charging stations.

That means you can have a fast and convenient way to charge your car without breaking the bank. Plus, having a charging station can increase the value of your property and attract more customers if you’re a business owner. Don’t let concerns about charging hold you back from making the switch to an electric vehicle – take advantage of these rebate programs and start driving with confidence today.

Free or Reduced-Fee Charging for Electric Car Owners

Electric Car Charging Infrastructure Electric car owners can benefit from free or reduced-fee charging at certain charging stations. This incentive is a great way to encourage more people to switch to electric vehicles. Charging stations are a crucial component of the electric car ecosystem, and their availability helps ease the anxiety of running out of power while on the road.

By providing free or reduced-fee charging, more charging stations can be installed, and people can have access to a variety of different charging options. This proves to be especially useful for long-distance travel. In fact, a lot of people choose electric cars for their environmental benefits and efficiency.

With reduced-fee charging infrastructure available, EV owners can have more options to charge their vehicle and contribute to a greener environment. Additionally, local governments can encourage the use of electric cars by partnering with local businesses and offering discounted charging rates to EV owners.

Conclusion

In conclusion, it’s no longer shocking to hear that California is leading the charge towards a greener future with its generous state benefits for electric cars. These perks not only save you money, but also make you feel like you’re helping make a difference in the fight against climate change. So, if you’re in the market for a new car, why not shock your friends and neighbors by going electric and taking advantage of all the benefits California has to offer?”

FAQs

What is the California state benefit for electric cars?

The California state benefit for electric cars includes a rebate of up to $2,000 for eligible vehicles.

How do I qualify for the California state benefit for electric cars?

To qualify for the California state benefit for electric cars, you must purchase or lease a new eligible vehicle and meet certain income and residency requirements.

Can I receive the California state benefit for electric cars if I purchase a used electric vehicle?

No, the California state benefit for electric cars only applies to the purchase or lease of a new eligible vehicle.

Are there any other incentives available for electric vehicle owners in California?

Yes, California offers additional incentives for electric vehicle owners, including access to carpool lanes, free or discounted charging at public charging stations, and an exemption from certain emissions testing requirements.