Unleashing the Hidden Benefits of Electric Car Loans: How to Maximize Your Tax Savings!

Are you considering purchasing an electric vehicle but worried about the financial burden? Don’t worry, there are tax benefits available to help maximize your savings. Electric car loan tax benefits are a great way to offset the cost of your new car while also supporting the environment. In this blog, we’ll explore the tax benefits available for electric car purchasers, including federal tax credits and state incentives.

We’ll also offer tips on how to qualify for these benefits and how to calculate their value. So sit back, relax, and let’s dive into the world of electric car loan tax benefits.

Why Electric Cars Are a Smart Investment

If you’re considering purchasing an electric car, there are several reasons why it’s a smart investment. One of the key benefits is the tax incentives available for electric car loans. The federal government provides tax credits of up to $7,500 for those who purchase an electric car.

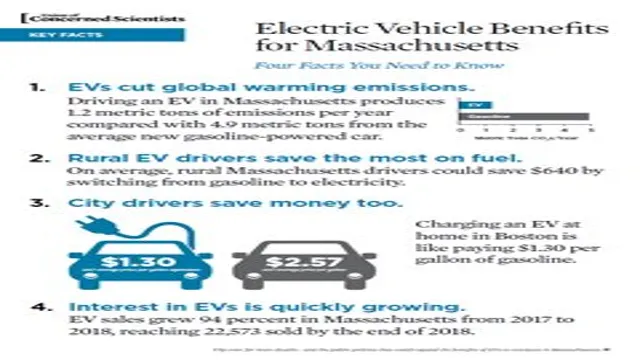

Some states also offer additional incentives, such as rebates and tax deductions. These tax benefits can significantly reduce the cost of purchasing an electric car and make it a more affordable option. Additionally, electric cars have lower maintenance costs and fuel expenses, making them a more cost-effective choice in the long run.

Investing in an electric car not only benefits your wallet but also helps reduce your environmental impact. So why not take advantage of the tax benefits and make the switch to electric?

Reduced Fuel Costs and Maintenance Expenses

Electric cars are becoming increasingly popular, and for good reason. One of the main benefits of owning an electric car is the reduced fuel costs and maintenance expenses. Electric cars do not require gasoline to operate, which means you won’t have to constantly fill up at the gas pump.

Additionally, because electric cars have fewer moving parts than traditional gas-powered vehicles, they require less maintenance. This can save you a significant amount of money on maintenance expenses over the lifetime of the car. Investing in an electric car is a smart financial decision that not only benefits your wallet but also the environment.

So, if you’re looking to save money on fuel and maintenance costs, while also reducing your carbon footprint, an electric car is the way to go.

Potential Rebates and Incentives

When it comes to investing in a car, choosing an electric vehicle can actually be a smart move. Not only are they better for the environment and can save you on gas costs, but electric cars also come with potential rebates and incentives. Many states and cities offer tax credits or rebates for purchasing an electric car, which can significantly reduce the overall cost.

Additionally, some utility companies offer special rates or discounts for electric car owners. When you add up all of the potential savings over time, investing in an electric car can be a wise financial decision. Plus, you’ll have the satisfaction of knowing that you’re doing your part to reduce emissions and protect our planet.

So, next time you’re in the market for a new car, don’t overlook the benefits of going electric.

Lower Carbon Emissions

Electric cars have gained popularity in recent years due to their ability to significantly reduce carbon emissions. This is due to the fact that electric cars do not rely on fossil fuels, which emit harmful pollutants into the atmosphere. By switching to an electric car, you can significantly decrease your carbon footprint.

Additionally, electric cars are also cost-effective in the long run as they require less maintenance and have lower fuel costs. Investing in an electric car is a smart decision for both the environment and your wallet. So, why not join the thousands who have already made the switch and invest in an electric car today?

Maximizing Tax Benefits for Electric Car Loans

When it comes to purchasing an electric car, there are plenty of incentives to consider. Not only are these vehicles better for the environment, but they can also save you money in the long run. One such benefit includes the electric car loan tax credit.

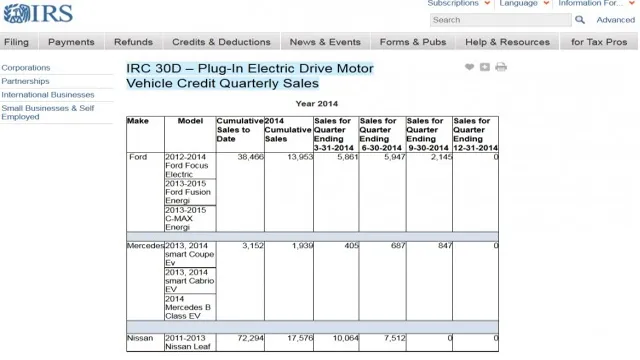

By taking out a loan to purchase an electric car, you may qualify for a tax credit that can help offset the cost. The amount of credit you can receive will depend on the specific make and model of the electric car you purchase, as well as the terms of your loan. However, it’s important to note that not all electric cars are eligible for this tax credit, so it’s worth doing your research beforehand.

Additionally, it’s important to carefully consider the terms of your loan and make sure that you can afford the monthly payments and any associated fees in order to maximize the tax benefits. By doing so, you can enjoy the many advantages of owning an electric car while also taking advantage of any tax benefits available to you.

Deducting Interest on Electric Car Loans

If you’ve recently purchased an electric car, you may be wondering about the tax benefits available for electric car loans. One of the biggest benefits is the ability to deduct the interest paid on your loan from your taxes. This can significantly lower your tax bill and help you save money in the long run.

To maximize your tax benefits, it’s important to keep careful records of your loan payments and make sure you qualify for the deduction. This deduction can only be claimed if you use your electric car for personal use and not for business purposes. Additionally, the loan must be secured by the vehicle itself and have a fixed term.

If you meet these requirements, you may be able to deduct up to $7,500 in interest on your electric car loan. So not only can you enjoy the many benefits of driving an electric car, but you can also save money on your taxes. It’s a win-win!

Claiming the Electric Car Tax Credit

Electric Car Tax Credit Claiming the electric car tax credit is an excellent way to save some money while enjoying an eco-friendly ride. The federal government offers a tax credit of up to $7,500 to those who buy an electric car, depending on their federal income tax liability. In addition to this, some states offer additional tax incentives and rebates.

To claim the electric car tax credit, you must qualify by owning an EV, and your income must be enough to be taxed by the federal government. You will need to fill out Form 8936 to claim the credit. Suppose you are buying an electric vehicle for business purposes, in that case, the car tax credit applies to fleet and commercial vehicles as well.

By taking advantage of this tax credit, you will be helping to reduce air pollution and save money on fuel costs, all while maximizing the tax benefits for your electric car loan.

Writing off Charging Station Costs

Electric car loans If you’re considering purchasing an electric car, it’s important to understand the potential tax benefits that come with it. One way to maximize these benefits is by writing off the costs of installing a charging station in your home. As electric cars continue to gain popularity, many homeowners are opting to install charging stations for their convenience.

The good news? The cost of installing a charging station, including its wiring and installation costs, can be written off as a tax credit for up to 30% of the total cost. That’s a significant amount of savings for something that will ultimately benefit you in the long term. Additionally, if you’ve taken out a loan for your electric car, you may also be eligible for tax credits.

Be sure to consult with a tax professional to ensure you’re taking advantage of all available tax benefits.

Navigating State-Specific Tax Benefits

Are you considering buying an electric car? If so, you may be eligible for state-specific tax benefits that can help offset the cost. One such benefit is the electric car loan tax benefit, which is available in certain states. This benefit can save you money on your car loan by reducing the amount of interest you’ll need to pay.

To navigate state-specific tax benefits, it’s important to do your research. Check with your state’s department of revenue to see what kinds of incentives are available for electric car buyers. You may also want to consult with a tax professional to ensure that you’re taking advantage of all the tax breaks available to you.

With a little bit of research and planning, you can save money on your electric car purchase and enjoy all the benefits of driving a clean, green vehicle.

Exploring Available State Incentives

When it comes to starting a business, every state offers different incentives and tax benefits. It’s important to explore what’s available in your state, as it could potentially save you a lot of money in the long run. Some common state-specific tax benefits include tax credits for hiring new employees, research and development credits, and property tax exemptions for certain types of equipment.

Additionally, some states offer special programs for small businesses, such as low-interest loans and grants. Taking advantage of these incentives can be a great way to reduce your tax burden and help your business grow. It’s worth taking the time to do your research and find out what options are available to you.

By doing so, you could be setting your business up for success while also potentially saving yourself a lot of money.

Understanding State-Specific Tax Credits

State-specific tax credits can be a confusing topic to navigate, but understanding them can lead to significant financial benefits. Each state has its own specific tax code, offering unique opportunities for taxpayers to claim tax credits and deductions. These credits can vary from state to state and can be based on a range of criteria, including industry, income level, and location.

For example, some states offer tax benefits for investing in renewable energy, while others provide credits for childcare expenses. It’s essential to research and understand your state’s tax code to take advantage of these benefits fully. By doing so, taxpayers can ensure they are maximizing their tax savings and potentially saving thousands of dollars each year.

So, if you haven’t explored your state’s tax credit options, now is the time to do so.

Final Thoughts and Action Steps

Investing in an electric car is a smart decision that will not only benefit the environment but will also give you access to tax benefits. With an electric car loan, you can enjoy a tax credit of up to $7,500, which will go a long way in reducing your tax bill. However, it’s essential to consult with a tax expert to understand the full extent of this benefit and how you can leverage it to your advantage.

Apart from the financial benefits, electric cars are also cost-effective to maintain, and you will enjoy significant savings on gas and maintenance costs. Suppose you’re thinking about investing in an electric car. In that case, you can take advantage of the tax benefit, save money, and contribute to a cleaner and sustainable environment by reducing your carbon footprint.

Conclusion

In conclusion, the electric car loan tax benefit is a shockingly smart and environmentally conscious way to invest in your future. By going green, not only will you save on your taxes, but you’ll also be making a statement about your commitment to sustainability. So why not give your finances a jolt of energy and join the electric vehicle movement today?”

FAQs

What is the electric car loan tax benefit?

The electric car loan tax benefit is a tax exemption or reduction provided by the government to individuals who availed of a loan to purchase an electric car.

Is the electric car loan tax benefit available for used electric cars too?

Yes, the electric car loan tax benefit is applicable to both new and used electric cars.

Can I claim the electric car loan tax benefit if I take a personal loan to purchase an electric car?

No, the electric car loan tax benefit is only applicable to loans taken specifically for purchasing an electric car.

How much tax benefit can I get on an electric car loan?

The tax benefit amount on an electric car loan varies between different countries and states. It is best to check with your local tax authority to know the exact amount.