Electrify your savings: Discover the tax benefits of owning an electric car in India

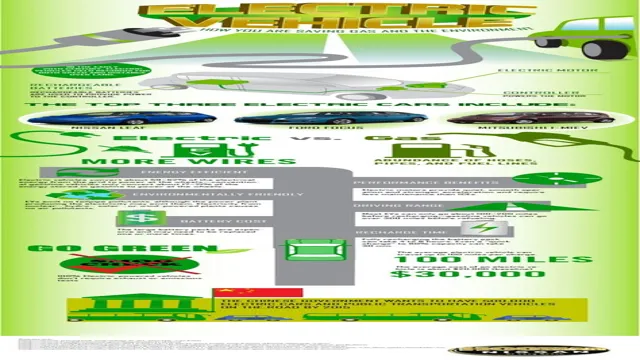

Electric cars have become increasingly popular in recent years due to their sustainability and environmental contribution. In India, the growing interest in electric vehicles has been supported by a range of tax benefits that make owning them more affordable and accessible. These incentives are designed to encourage individuals and organizations to switch to sustainable transportation and reduce carbon emissions.

In this blog, we will explore the electric car tax benefits in India and how they can help consumers make an informed decision when purchasing a car. From tax exemptions to government subsidies, we will delve into the details of each tax benefit and highlight its significance in promoting clean energy and a green India. So, let’s dive into the world of electric car tax benefits in India and see how they are changing the future of transportation.

Overview of Electric Car Tax Benefits

Electric car tax benefits in India are becoming increasingly attractive for car buyers and enthusiasts. In a bid to promote the adoption of electric vehicles in the country, the Indian government has introduced several tax benefits for electric car owners. These include exemption from road tax, reduced GST rates, and lower registration fees.

Additionally, the government has also provided a significant reduction in income tax for individuals who purchase electric cars. Moreover, many states in India are providing additional incentives, such as free parking and toll waivers, to encourage electric car adoption. These tax benefits not only benefit the environment but also make owning an electric car more economical.

With the increasing awareness of the harmful effects of petrol and diesel cars on the environment, electric cars are quickly becoming a popular choice for car buyers in India.

Incentives for Purchasing Electric Cars

Electric car tax benefits are incentives provided by the federal government and some state governments to motivate people to purchase electric cars. These tax benefits can come in the form of tax credits, tax deductions, or rebates, depending on where you live and what type of electric car you buy. For example, if you purchase a new electric car in the United States, you may be eligible for a federal tax credit of up to $7,500.

Some states also offer additional tax credits or rebates, which vary in amount depending on the state you live in. Taking advantage of these tax benefits could significantly reduce the overall cost of owning an electric car, making it a more affordable and attractive option for car buyers. However, it’s important to note that these tax benefits may expire or change over time, so it’s important to stay up-to-date on the latest information and act fast to take advantage of them.

Income Tax Benefits for Electric Car Owners

Electric car owners can benefit from several income tax benefits, making it more economically viable to own an electric car. Electric car owners can claim up to $7,500 federal tax credit in the year of purchase, which varies according to the model and the battery capacity of the vehicle. Additionally, many states offer additional incentives for electric car owners such as rebates, reduced registration fees, and low-cost charging schemes.

Tax incentives can also significantly lower the cost of electric car ownership in the long term. Apart from these tax benefits, owning an electric car has several other financial advantages, including lower fuel, maintenance, and repair costs. These benefits, combined with their eco-friendliness, make electric cars a smart choice for anyone looking for a sustainable, cost-effective way to commute.

State-Specific Tax Benefits

Electric car tax benefits in India are available on a state-specific basis. In some states, incentives are provided to encourage the use of electric vehicles, including tax rebates, subsidies, and exemptions. For example, the Delhi government provides a 100% exemption on road tax for electric vehicles, while the Maharashtra government offers a 15% subsidy on the purchase of electric vehicles.

Additionally, some states offer perks such as free parking in government-owned parking lots and charging stations for electric vehicles. These state-specific benefits can greatly reduce the cost of owning and driving an electric car in India, making them a more viable and attractive option for environmentally conscious individuals. It is important to research the specific incentives available in your state before making a decision to purchase an electric vehicle.

Maharashtra Electric Vehicle Policy 2021

The Maharashtra Electric Vehicle Policy 2021 is a significant step towards creating a sustainable transportation system in the state. One of the key benefits of the policy is the state-specific tax benefits that offer great opportunities for EV buyers and manufacturers. The policy exempts electric vehicles (EVs) from road tax for up to 10 years, which is a significant relief for buyers considering the high initial cost of EVs.

Additionally, the policy offers a waiver on registration fees for the first 7,000 private EVs registered in the state. This move not only makes EVs more affordable but also encourages the adoption of EVs among consumers. On the manufacturing side, the policy offers discounts on electricity tariffs for EV manufacturers, making EV production more cost-effective and competitive.

Overall, the Maharashtra Electric Vehicle Policy 2021 is a positive step towards reducing carbon emissions and promoting sustainable transportation in the state.

Delhi Electric Vehicle Policy 2020

The Delhi Electric Vehicle Policy 2020 has introduced state-specific tax benefits to encourage people to shift towards electric vehicles (EVs). These tax benefits include waiving road tax and registration fees for electric vehicles, providing subsidies for purchasing EVs, and offering incentives for setting up charging infrastructure. The policy aims to reduce air pollution and promote sustainable transportation by increasing the number of electric vehicles on Delhi’s roads.

The state government is also planning to collaborate with the central government to create a network of charging stations across the city. With this policy, citizens can save money while also contributing to a cleaner and greener environment. If you’re considering switching to an electric vehicle, there’s no better time than now to take advantage of the benefits offered by the Delhi Electric Vehicle Policy 2020.

Karnataka Electric Vehicle and Energy Storage Policy 2017

The Karnataka Electric Vehicle and Energy Storage Policy 2017 is providing state-specific tax benefits to promote the adoption of electric vehicles. This policy is a significant step towards reducing the carbon footprint and lowering air pollution levels in the state. The state government is offering incentives such as subsidies and exemptions on registration fees, road tax, and state GST on electric vehicles.

Moreover, EV manufacturing units will receive incentives on land, power, and capital subsidies, which provide a perfect opportunity for private companies and investors to set up their manufacturing units in the state. The Karnataka government is also providing tax benefits to companies setting up charging stations, which encourages private players to invest in public charging infrastructure. These policies are not only going to help the environment but will also encourage the citizens of the state to adopt sustainable modes of transportation, which will benefit their pockets as well in the long run.

The incentives and tax breaks offered by the government will bring down the total cost of ownership of electric vehicles and will help overcome the initial expense barrier for those who were hesitant about switching to EVs.

Future of Electric Car Tax Benefits in India

As the world shifts towards a cleaner, greener future, electric cars are becoming increasingly popular. In India, the government has introduced various tax benefits to incentivize the switch to electric vehicles. These benefits include lower GST rates, reduced registration fees, and income tax exemptions for electric car owners.

However, with the country facing economic challenges and a high fiscal deficit, there is uncertainty about the future of these tax benefits. While the government has reiterated its commitment to promoting electric vehicles, it remains to be seen whether the tax incentives will continue in the long run. Nevertheless, the benefits are certainly encouraging and have already resulted in a surge in electric car sales in the country.

As technology evolves and prices become more competitive, we can expect to see more electric cars on Indian roads in the future.

National Electric Mobility Mission Plan 2020

The National Electric Mobility Mission Plan 2020 in India is aimed towards reducing carbon emissions by promoting the use of electric vehicles. As a part of this mission, the government provides various tax benefits and incentives to encourage people to switch to electric cars. These benefits include reduced GST rates, no road tax, and income tax deductions on the interest paid on loans for electric vehicles.

This not only helps in reducing pollution but also provides a cost-effective solution for the consumers. With more and more carmakers launching electric cars in India, the future of electric car tax benefits looks bright. The government is likely to come up with more policies and incentives to promote the use of electric vehicles as a primary mode of transportation in the country.

Electrification of Public Transport in India

Electric Car Tax Benefits With the increasing focus on sustainable transportation, the Indian government has introduced tax benefits for electric cars to encourage their usage. According to the latest tax incentives, electric cars will be exempted from paying road tax, registration fees, and will be eligible for a 5% reduction in GST. Moreover, charging infrastructure for electric vehicles will also be installed at various locations across the country.

These incentives will not only help in reducing environmental pollution but also lower the operating costs for the users. However, it’s important to note that although electric vehicles are more expensive than conventional cars, the tax benefits will help make them more affordable in the long run. The future of electric car tax benefits looks promising in India, and it’s expected to create a significant impact on the adoption rate of eco-friendly transportation.

Conclusion

In conclusion, electric car tax benefits in India are like a double shot of espresso in your morning coffee. They provide a jolt of energy to the environment and your wallet, all while helping to reduce the nation’s carbon footprint. The incentives and policy reforms in India are a clear indication of the growing importance of sustainable transportation, and electric cars are the perfect embodiment of this movement.

So why wait to join the electric car revolution? Go green, save green, and enjoy all the tax benefits that come with it!”

FAQs

What are the tax benefits of buying an electric car in India?

The government of India offers a variety of tax benefits to those who purchase electric cars. These include exemptions on road tax and registration fees, as well as reduced GST rates.

Are there any subsidies available for purchasing electric cars in India?

Yes, the government of India offers subsidies on the purchase of electric cars through the FAME (Faster Adoption and Manufacturing of Electric Vehicles) program. These subsidies can range from Rs. 10,000 to Rs. 1.5 lakh depending on the type of electric vehicle and its battery capacity.

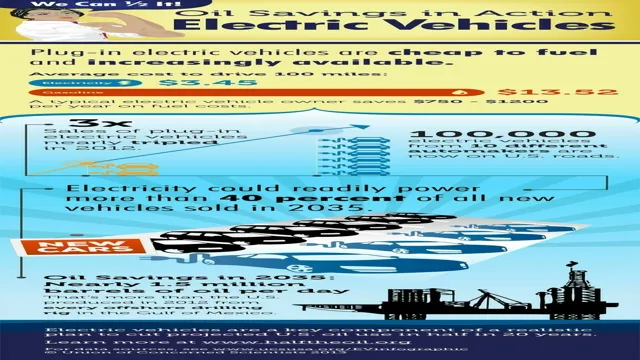

How do electric cars compare to petrol or diesel cars in terms of running costs?

Electric cars are significantly cheaper to run than petrol or diesel cars, due to lower electricity costs and reduced maintenance costs. They also have zero emissions, making them better for the environment.

What is the expected lifespan of an electric car battery in India?

The lifespan of an electric car battery depends on various factors such as usage, maintenance, and charging habits. However, most electric car batteries in India come with a warranty of up to 8 years or 1,00,000 km, whichever comes first.