Electric Cars: Driving Towards Tax Efficiency with P11D Benefits

Electric cars are revolutionizing the way we drive and interact with our environment. Not only do they emit fewer harmful pollutants, but they also provide several financial benefits for companies and their employees. One such benefit is P11D, a tax system that calculates an employee’s taxable income based on the benefits they receive from their employer.

With the rise of electric cars, companies can provide their employees with green transportation options that offer numerous P11D benefits, making them a sound investment for both the environment and the company’s bottom line. So, let’s dive into the details of P11D benefits and how electric cars can be a game-changer for employee benefits and your company’s sustainability goals.

What Are Electric Cars?

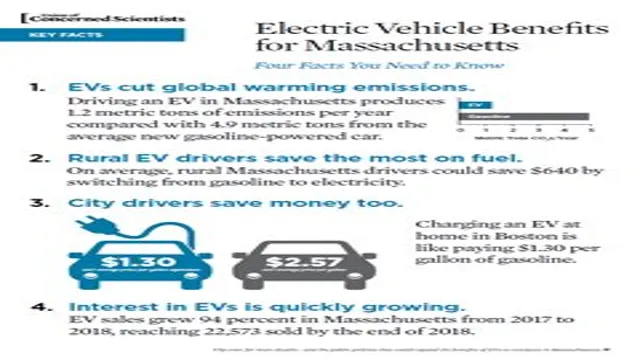

Electric cars are vehicles powered by electricity from batteries rather than gasoline or diesel fuel. They are becoming increasingly popular in many countries, including the UK, as drivers seek more eco-friendly, cost-effective, and convenient modes of transportation. In addition to reducing harmful air pollutants, electric cars offer significant financial advantages, such as lower running costs, road tax, and maintenance expenses.

The P11D benefit is also a crucial factor for companies and employees using electric cars. It is a tax calculation used in the UK to assess the value of an employee’s company car, which determines the amount of income tax and national insurance contributions payable by the employer and employee. As electric cars have lower CO2 emissions, the P11D benefit is lower than for conventional cars, making them a more attractive option for tax-savvy drivers.

Explanation on What Electric Cars Are

Electric cars, also known as electric vehicles (EVs), are automobiles powered by rechargeable batteries instead of traditional gasoline or diesel fuel. These batteries power an electric motor that drives the wheels. EVs come in a variety of forms, ranging from small city cars to larger SUVs, and are becoming increasingly popular due to their ability to significantly reduce emissions and their lower operating costs compared to gasoline-powered cars.

They are also generally seen as a step towards a more sustainable future and a way to reduce the world’s reliance on fossil fuels. With advancements in battery technology, the range and charging time of electric cars have improved, and they are now able to compete with traditional vehicles in terms of convenience and practicality. While they are not yet as widespread as traditional cars, electric vehicles are steadily gaining in popularity, and many countries are now offering incentives and subsidies to encourage their adoption.

P11D Benefit and Its Significance

If you’re considering switching to an electric car, it’s important to understand the P11D benefit and how it impacts your finances. The P11D benefit is a tax charge that applies to certain benefits provided by an employer, including company cars. For electric cars, the P11D benefit is currently much lower than for petrol or diesel cars, making them a more appealing option for company car drivers.

This is because electric cars are considered to be environmentally friendly and therefore attract lower tax rates. By choosing an electric car as your company car, you could save a significant amount of money on your tax bill. Additionally, electric cars are exempt from certain taxes, such as the London Congestion Charge, which can save you even more.

So not only are electric cars better for the environment, but they can also be better for your wallet in the long run.

Definition of P11D Benefit

P11D benefit P11D benefit refers to any non-salary perks or benefits provided to an employee by their employer. This could include things like company cars, health insurance, gym memberships, or even work-related expenses like travel or entertainment. While these benefits are certainly appreciated by employees, they also have tax implications.

Employers are required to report the value of these benefits on an annual P11D form, which the employee can then use to calculate their tax liability. It’s important for both employers and employees to understand the significance of P11D benefits, as failure to report them accurately could result in fines or even legal trouble. By keeping detailed records of all benefits provided and reporting them correctly, employers can help their employees stay compliant with tax laws and avoid any costly mistakes.

Calculating P11D Benefits for Electric Cars

Calculating P11D benefits for electric cars can be a bit confusing, but it’s important to get it right to ensure you’re not paying extra tax. First, you need to know the list price of the electric car, as this is used to calculate the benefit-in-kind (BIK) tax. If the list price is less than £40,000, the BIK rate is 1% for the 2021-2022 tax year.

However, if the list price is over £40,000, the BIK rate is 2%, but only applies to the portion of the list price over £40,000. So, for example, if the list price is £45,000, the BIK rate would be 2% on £5,000 (£100). Keep in mind that you’ll also need to factor in any optional extras that increase the list price, as well as the car’s CO2 emissions (if any), as this affects the amount of Class 1A National Insurance contributions you’ll need to pay.

Overall, calculating P11D benefits for electric cars can be a bit of work, but it’s worth it to ensure you’re not overpaying on your taxes.

Step-by-Step Guide on How to Calculate P11D Benefits

If you’re an employer who provides electric cars to your employees, it’s important to understand how to calculate P11D benefits. These benefits refer to any perks or expenses that are paid to employees on top of their regular salary, such as the use of a company vehicle. When it comes to electric cars, the P11D benefits are calculated differently than for other vehicles.

To calculate the benefit, you’ll need to know the list price of the vehicle, any accessories or options that were added, and the CO2 emissions. It’s important to note that with electric cars, the CO2 emissions are typically zero, which means the benefit is also zero. This makes electric cars an attractive option for employers who want to provide their employees with a company vehicle without incurring extra costs.

Additionally, electric cars also come with other cost-saving benefits such as reduced fuel costs and lower maintenance costs. So if you’re considering providing electric cars to your employees, it’s important to understand the ins and outs of calculating P11D benefits to make sure you’re offering the best perks possible.

Real-life Example of Calculating P11D Benefit for Electric Cars

Calculating P11D benefits for electric cars can be a bit confusing, but let me break it down for you. The P11D benefit is the amount you must pay tax on for having access to a company car outside of work hours. For electric cars, this benefit is calculated differently than for traditional fuel cars.

To determine the P11D benefit for electric cars, you need to know the list price of the car, the amount of any optional extras, and the battery’s capacity in kWh. For example, if the list price of your electric car is £40,000 and the battery capacity is 60 kWh, then the taxable P11D benefit will be £8,000 for the 2021/22 tax year. It’s important to note that this amount will change depending on any optional extras you add to the car.

So if you added a panoramic sunroof for £1,000, then your taxable P11D benefit would increase to £9,000. Don’t worry about doing the calculations yourself though, as your employer or HR department will determine this benefit and inform you of any tax you need to pay.

Tax Implications of Electric Cars and P11D Benefits

If you’re considering purchasing an electric car, it’s important to understand the potential tax implications and P11D benefits that come with it. One of the biggest advantages of electric vehicles is the government grants and incentives available, such as the Plug-in Car Grant and the Electric Vehicle Homecharge Scheme, which can reduce the overall cost of the vehicle. In addition, electric cars can be more tax-efficient than traditional gasoline cars, as they are exempt from Vehicle Excise Duty (VED) and can reduce company car tax.

This makes electric cars a great choice for businesses, as the P11D benefit in kind tax rate is much lower than traditional cars. Overall, investing in an electric car can bring significant tax savings and benefits, making it a smart choice for both personal and business use.

Potential Tax Savings with Electric Cars

Electric cars not only help the environment but they can also provide potential tax savings for businesses. If a company chooses to invest in electric cars for their fleet, they may be eligible for a range of government tax incentives. One of the most significant tax savings available is through a grant called the Plug-In Car Grant.

This grant provides up to £3,000 off the cost of a new electric car. Additionally, businesses can claim 100% first-year allowances for the purchase of electric cars, which means that the full cost of the vehicle can be deducted from the company’s taxable profits. Electric cars can also provide a P11D benefit for employees who use them for personal use.

This benefit is calculated based on the list price of the vehicle and its CO2 emissions. By choosing an electric car with a lower list price and CO2 emissions, an employee can have a lower taxable benefit, resulting in a reduced tax bill. Overall, investing in electric cars can provide a range of tax benefits for businesses while also promoting sustainability.

Reducing Carbon Footprint and Its Tax Benefits

Reducing your carbon footprint can have several benefits, including reducing your environmental impact and even tax benefits. One way to reduce your carbon footprint is by switching to an electric car. Electric cars produce zero emissions and have tax benefits that can help you save money while also helping the environment.

In terms of tax implications, electric cars are currently exempt from company car tax, saving companies a significant amount of money. Additionally, individuals who purchase electric cars can receive a government grant of up to £3,500 to offset the cost of purchasing the vehicle. Furthermore, electric cars have numerous P11D benefits that can lead to tax savings, including lower fuel costs, lower maintenance costs, and a reduced national insurance contribution.

As our society becomes more environmentally conscious, making the switch to an electric car can have a positive impact on both the environment and your wallet.

Conclusion and Final Thoughts

In conclusion, electric cars are not only good for the environment, but they can also be a smart financial choice for employees. Their low emissions and high fuel efficiency can lead to a lower P11D benefit, meaning less taxable income and more money in your pocket. Plus, who doesn’t love seeing their colleagues enviously eyeing up their sleek and silent electric ride in the office car park? So, swap your gas guzzler for an electric car and watch your bank account and street cred soar!”

FAQs

What is P11D benefit on electric cars?

P11D benefit is the amount an employee pays for the private use of a company car, including fuel and insurance, which is added to their salary for tax purposes. Electric cars have a lower P11D benefit than petrol or diesel cars, which can result in lower tax liabilities for employees.

How is P11D benefit on electric cars calculated?

P11D benefit on electric cars is calculated by multiplying the list price of the vehicle by the appropriate percentage determined by its CO2 emissions and battery range. The resulting amount is the employee’s taxable benefit, which is subject to income tax and National Insurance contributions.

Are there any exemptions for electric cars on P11D benefit?

Yes, there are exemptions for zero-emission electric cars on P11D benefit. These vehicles are currently exempt from paying any benefit in kind tax, making them a popular choice for companies and employees alike.

Can an employee claim back P11D benefit for electric cars?

No, an employee cannot claim back P11D benefit for electric cars. This benefit is the responsibility of the employer and is included in the employee’s gross income for tax purposes. However, employees can claim back any fuel costs incurred while driving for work purposes.