Maximize Your Savings: A Comprehensive Guide to Electric Car Tax Benefits in the UK

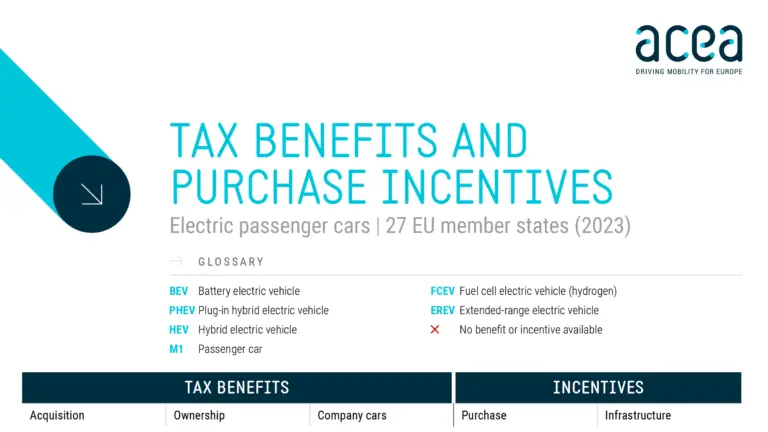

Electric cars have become increasingly popular in the UK and for good reason. They are not only significantly better for the environment, but also bring with them a range of tax benefits. As the popularity of electric cars continues to grow, so do the tax incentives offered by the government.

With so many incentives currently available, it can be difficult to understand which benefits apply to you and your electric vehicle. In this blog post, we’ll take a closer look at the electric car tax benefits in the UK, helping you to understand the incentives available and how you may be able to benefit from them. Whether you’re considering purchasing an electric car or already own one, this post will provide you with all the information you need to know about electric vehicle tax benefits in the UK.

Overview

Electric cars have become more and more popular in the UK, and for good reason. Aside from the obvious benefits of being environmentally friendly, electric cars also come with a range of tax benefits. Firstly, owners of electric cars pay less Vehicle Excise Duty (or road tax) than those driving non-electric cars.

This is because electric cars produce zero emissions, which lowers the environmental impact. Additionally, electric car owners are also exempt from paying the London Congestion Charge, which means that using these cars to navigate the busy streets of London can save drivers a substantial amount of money. Lastly, electric car owners can also benefit from the government’s Plug-in Car Grant, which provides up to £2,500 towards the cost of a new electric car, making them more affordable for those interested in purchasing one.

All of these tax benefits combined make investing in an electric car a smart financial decision for UK drivers.

Explanation of electric car tax benefits in the UK

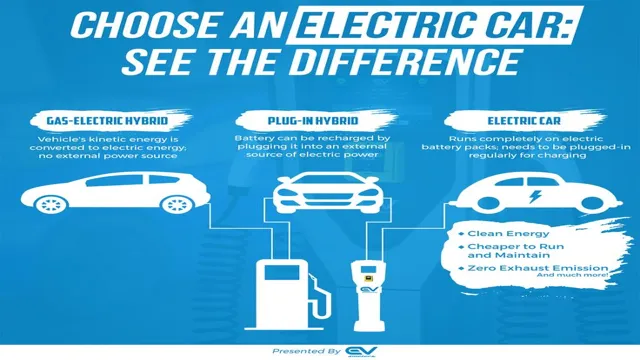

Electric car tax benefits in the UK Electric cars are becoming increasingly popular due to their environmental benefits and the incentives that come with owning one. One of the most significant advantages of owning an electric car in the UK is the tax benefits. These benefits include exemption from vehicle tax, lower company car tax rates, and a 100% first-year allowance for businesses that purchase electric cars.

Owners of fully electric vehicles are also exempt from paying the congestion charge in London and other cities that have implemented similar schemes. Furthermore, electric cars are eligible for government grants, which can help reduce the purchase price. The government also offers grants for charging equipment installation, making it easier and more convenient for owners to charge their vehicles at home.

In summary, electric car tax benefits in the UK are substantial and can help make owning an electric car a cost-effective and environmentally-friendly option. From reduced vehicle tax to government grants, the UK government is committed to incentivizing the shift towards electric vehicles. With more manufacturers producing electric cars, it is only a matter of time before they become the norm on UK roads.

How much you can save on taxes by driving an electric car

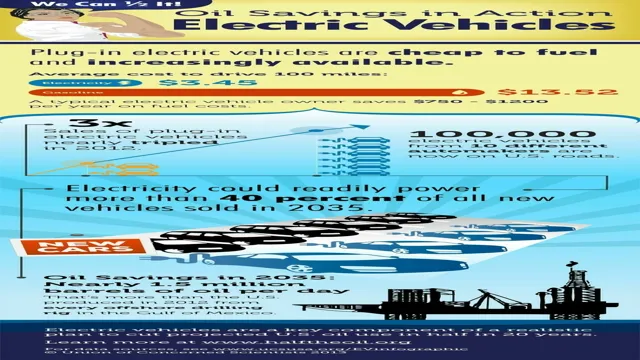

Electric car, taxes, savings If you’re considering buying an electric car, then you’re in for some pleasant surprises. Not only will you be driving a vehicle that is friendlier to the environment, but you could also save a significant amount on taxes. This is because most electric cars qualify for tax credits, rebates, and other incentives offered by both federal and state governments.

The amount you can save will depend on various factors such as the make and model of the electric car you choose, your tax bracket, and the state you live in. However, on average, you could save anywhere from $2,500 to $7,500 in federal tax credits alone. Some states also offer additional incentives such as exemption from sales tax, reduced registration fees, and special HOV lane access.

So, not only will you be doing something good for the environment, but you could also save some serious money on taxes by opting for an electric car.

Company Car Tax Benefits

Electric cars offer significant tax benefits to businesses in the UK through the company car tax system. With the government’s push towards reducing carbon emissions, electric cars are an attractive option for business owners looking to save on tax while reducing their environmental impact. Electric cars are exempt from the standard vehicle tax, and for company car drivers, they benefit from lower tax rates compared to petrol or diesel vehicles, with the lowest rate being zero if the vehicle has zero emissions.

Additionally, businesses can benefit from a 100% first-year allowance on the purchase of electric cars, providing tax relief on the cost of investment. With the increasing popularity of electric vehicles, it’s crucial for businesses to consider the tax benefits of switching to electric cars to save money and contribute to a greener future.

Detailed explanation of company car tax benefits for electric cars

Electric cars have become a popular choice for company cars, mainly due to the significant tax benefits associated with them. With the government’s efforts to reduce carbon emissions, electric cars come with lower tax liabilities as compared to conventional vehicles. For example, for fully electric cars, there is a 0% tax rate in the tax year 2020/21 and 1% in the tax year 2021/22, compared to petrol or diesel vehicles which come with a rate of 20%.

Also, electric cars qualify for 100% first-year allowances, which means companies can deduct the cost of purchasing an electric car from their annual profits, fully reducing their tax liabilities. Moreover, electric cars come with lower fuel and maintenance costs, saving companies money in the long run. By opting for electric cars, companies not only contribute to reducing carbon emissions, but they also enjoy significant tax benefits that can positively impact their bottom line.

Example of tax savings for a company with a fleet of electric cars

If your company operates a fleet of electric cars, you could be eligible for significant tax savings. One major benefit is the 0% rate for company car tax for electric cars that produce zero emissions. This means that your employees who are using electric cars for personal use will not have to pay any tax on their company cars.

In addition, electric cars also qualify for 100% first-year capital allowance, meaning you can claim the full cost of the car as a tax deduction in the first year of purchase. This can result in significant tax savings for your business. However, it’s important to keep in mind that these benefits are subject to change as tax laws and regulations constantly evolve.

To maximize these tax benefits, consider consulting with a professional tax advisor who can guide you through the process and ensure that you’re taking advantage of all the available tax breaks. Overall, making the switch to an electric fleet can be a smart financial move for your company, not only in terms of cost savings but also in terms of reducing your carbon footprint.

Personal Tax Benefits

If you’re thinking of purchasing an electric car in the UK, there are several tax benefits that you could take advantage of. One of the most significant benefits is the exemption from paying vehicle tax, which can save you hundreds of pounds per year. Additionally, electric cars are eligible for reduced rates of company car tax, making them an attractive choice for business owners.

Homeowners who install a charging point for their electric cars can also claim a grant of up to £350 through the Electric Vehicle Homecharge Scheme, which covers up to 75% of the installation costs. These tax benefits, along with the environmental benefits of driving an electric car, make it a smart investment for those who are passionate about reducing their carbon footprint and saving money in the long run. So, are you ready to make the switch to an electric car and take advantage of these tax benefits?

Explanation of personal tax benefits for electric cars

As more and more people are becoming conscious of their impact on the environment, electric cars are gaining popularity. Apart from being eco-friendly, electric cars also provide personal tax benefits. One such benefit is the federal tax credit, which can range from $2,500 to $7,500, depending on the car’s battery size.

This credit reduces the overall tax liability of an individual. Additionally, some states offer their own tax credits for buying an electric car. For example, Colorado offers a tax credit equal to 4% of the vehicle’s purchase price, up to $2,500.

These tax benefits can make the purchase and ownership of an electric car more affordable and financially feasible for an individual. Moreover, electric cars also save money in the long run by reducing fuel and maintenance costs. So, not only do electric cars benefit the environment, but they also help individuals save money on taxes and daily expenses.

How to claim your electric car tax benefits

If you’ve recently purchased an electric car, you may be wondering what kind of tax benefits you’re entitled to. The good news is that there are several personal tax benefits available for electric car owners. One of the most significant benefits is the federal electric vehicle tax credit, which can be worth up to $7,500, depending on your car’s battery size and other factors.

Additionally, if you live in a state with its program, you may be eligible for additional tax credits, rebates, or incentives. It’s essential to keep track of all your purchases and expenses related to your electric car and consult with a tax professional to make sure you’re claiming all the benefits you’re entitled to. With these tax benefits, owning an electric car can be a smart financial decision that saves you money in the long run.

Conclusion

In conclusion, it’s clear that electric cars in the UK offer a multitude of tax benefits. From lower road tax rates to exemption from congestion charges, it’s a no-brainer for environmentally conscious individuals and those looking to save on commuting costs. Plus, with the rise of renewable energy sources, owning an electric car can also contribute to a greener future for us all.

So, if you’re thinking of purchasing a new vehicle, consider going electric and reap the tax benefits while also doing your part for the planet. After all, who needs a gas-guzzling car when you can have a sleek and sustainable electric one?”

Summarize the benefits of driving an electric car in the UK

Driving an electric car in the UK comes with many benefits, including personal tax benefits. The UK government has recognized the impact of electric vehicles on the environment and has implemented numerous policies to incentivize their use. One of these policies is a tax exemption for electric vehicles.

Personal tax benefits for electric cars in the UK include no vehicle tax, which can save you hundreds of pounds a year. Also, if you’re a business owner, you can claim up to 100% of the cost of an electric vehicle against your tax bill. In addition to these personal tax benefits, electric cars in the UK also have lower running costs, reduced emissions, and potential access to clean air zones.

Overall, driving an electric car in the UK is not only a conscious decision for the environment but also a smart financial investment.

FAQs

What are the tax benefits of owning an electric car in the UK?

There are several tax benefits of owning an electric car in the UK, including exemption from road tax, reduced company car tax rates, and eligibility for government grants.

Are there any additional incentives for purchasing an electric car in the UK?

Yes, the UK government offers a plug-in car grant of up to £3,000 for eligible electric cars.

Can I claim tax relief on the purchase of an electric car for my business?

Yes, businesses can claim 100% first-year capital allowance on the purchase of new electric vehicles.

What is the future of electric cars in the UK in terms of tax benefits?

The UK government has set a target for all new cars to be zero-emissions by 2030, with the aim of incentivizing drivers to switch to electric cars and further increasing tax benefits in the future.