Maximizing Tax Savings: Electrify Your Fleet with Electric Company Cars in the UK

If you’re considering getting an electric company car in the UK, you might be wondering about the tax benefits. The good news is that there are several tax incentives for green vehicles in the UK, ranging from lower CO2 emissions rates to reduced company car tax rates. In this blog, we’ll explore the various tax benefits of electric company cars and how you can take advantage of them.

So, if you’re looking to save some money while also reducing your carbon footprint, keep reading!

Introduction

If you’re considering purchasing an electric company car in the UK, there are many tax benefits available for you to take advantage of. Firstly, company cars that have zero emissions attract lower rates of company car tax, and in some cases are exempt completely. This means you could save money on your monthly tax bill, making an electric company car a financially viable option.

Additionally, electric cars are exempt from paying the London Congestion Charge, which can save you a lot of money if you drive in the city frequently. There are also other benefits, such as being able to claim back the cost of charging your car at home through your company expenses. All of these benefits make an electric company car a great option for both you and your business.

Explaining electric company car tax benefits in the UK

Electric company car tax benefits in the UK are an attractive incentive for businesses that want to reduce their carbon footprint and costs. Essentially, company car tax benefits are tax breaks given to UK businesses that choose to invest in electric vehicles as part of their fleet. This includes plug-in hybrids, fully electric vehicles, and hydrogen fuel cell vehicles.

The tax benefits apply to the business as well as employees who use the electric company cars for personal use. The key advantage of this scheme is reduced taxation on both company cars and the associated fuel costs, which makes EVs a more cost-effective option for companies. Additionally, electric vehicles are exempt from congestion charges in some cities, giving a further boost for businesses looking to save money and reduce their environmental impact.

Why electric cars are great for tax benefits in the UK

Electric cars have been gaining popularity across the globe due to their various benefits, including their positive impact on the environment, low maintenance costs, and low running costs. But what most people in the UK are unaware of are the tax benefits associated with owning an electric car. The government is making it attractive for people to move towards electric vehicles by introducing tax incentives, making electric cars a wise investment.

In this article, we will discuss why electric cars are great for tax benefits in the UK.

Tax Benefits

Looking to buy an electric company car? You’re in luck! The UK government offers a range of tax incentives and benefits to encourage individuals and businesses to go green. As an electric car owner, you may be eligible for a 100% first-year allowance, which means you can deduct the full cost of your vehicle from your taxable profits, up to a maximum threshold. In addition, electric company cars benefit from lower CO2 emissions, which means they’re subject to lower fuel duty rates and pre-tax benefit-in-kind (BIK) rates.

This means you’ll pay lower road tax and company car tax, which can save you thousands of pounds every year. Overall, electric company cars offer a range of tax benefits that make them a smart investment for businesses and individuals alike. So why not consider upgrading your company fleet today and enjoy the many benefits of electric vehicle ownership?

Company car tax benefits for electric vehicles

Electric vehicles have become increasingly popular in recent years due to their many benefits, including tax benefits. If you’re considering purchasing an electric vehicle as a company car, you’ll be happy to know that you could save quite a bit of money on taxes. One of the main tax benefits of electric vehicles is the lack of emissions, which makes them much more environmentally friendly than traditional gas-powered vehicles.

In addition, electric vehicles also offer lower fuel costs, reduced maintenance costs, and a range of other tax incentives, such as lower road tax rates and lower Benefit-in-Kind (BIK) rates for company cars. This means that you could potentially save thousands of pounds in taxes each year by switching to an electric company car. So, not only will you be doing your part for the environment, but you’ll also be saving money in the process.

Savings on fuel and road tax

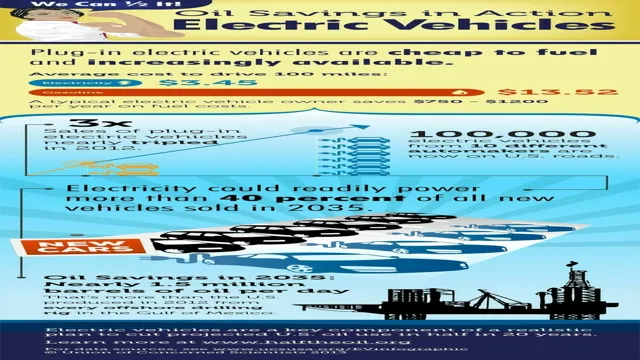

Saving money on fuel and road tax is one of the most significant benefits of owning an electric car. Traditional cars run on gasoline, which can be a significant expense for drivers. In contrast, electric vehicles are powered by rechargeable batteries, and the cost of electricity is much cheaper than gasoline.

In addition to saving money on fuel costs, electric car owners also enjoy tax benefits. Governments around the world offer tax incentives to promote the use of electric vehicles. For instance, in the US, electric car owners can receive up to $7,500 in tax credits.

Furthermore, electric cars are exempt from road tax in many countries. Road tax is a yearly fee that drivers must pay in order to use their cars on public roads. With an electric car, you can avoid this expense altogether, making it an even more affordable option.

By choosing an electric car, you not only help save the planet, but you can also save a significant amount of money in the process.

Capital allowances and tax exemptions for electric vehicles

When it comes to driving electric vehicles, there are definitely some significant tax benefits to keep in mind. For starters, there are often capital allowances that can help you reduce the amount of tax you’ll need to pay on the vehicle. Additionally, electric vehicles may also be eligible for tax exemptions, which can cut down on your overall tax bill even more.

These benefits are designed to encourage more people to use electric vehicles, which are generally better for the environment and can help reduce greenhouse gas emissions. So if you’re thinking about buying an electric vehicle, it’s definitely worth considering the tax advantages that come along with it. Not only will you be doing your part to help protect the planet, but you’ll also be able to save some money on your taxes in the process.

How to claim

If you’re lucky enough to be driving an electric company car in the UK, did you know that you could be benefiting from tax breaks? These benefits are designed to incentivize companies to switch to environmentally friendly vehicles. To claim the tax relief, you’ll need to gather a few pieces of information, including the make and model of the vehicle, and the list price. This information is usually included in the manufacturer’s documentation, or in the leasing contract if you’re using a leased vehicle.

You’ll then need to provide this information to your tax advisor or accountant, who can help you to claim the relief through the Annual Investment Allowance or Writing Down Allowance. Another option is to claim the benefit through your self-assessment tax return. By doing so, you can reduce your corporation tax bill, or your personal tax bill if you’re self-employed.

Claiming these tax breaks is a great way to encourage the use of environmentally friendly vehicles and to save on tax bills.

Overview of claiming electric company car tax benefits in the UK

If you’re using an electric company car in the UK, you may be eligible for tax benefits. The process of claiming these benefits is relatively straightforward but does require a few steps. Firstly, you’ll need to calculate your company car tax liability based on the car’s CO2 emissions and value.

Once you have this figure, you can deduct any applicable tax reliefs such as those for low-emission vehicles. It’s essential to keep accurate records of your car’s business and private use to ensure you’re only claiming for eligible expenses. You can also claim for charging costs if you pay for charging your car at home or work.

Overall, the process of claiming electric company car tax benefits may seem overwhelming, but it can save you a significant amount of money while also reducing your carbon footprint!

Step-by-step guide to claiming tax benefits for your electric company car

If you own or lease an electric company car, you may be eligible for tax benefits that can save you money. The first step to claiming these benefits is to ensure that your car meets the criteria for an electric vehicle. If your car meets the requirements, you can claim a tax credit on your federal tax return.

This credit can be up to $7,500, depending on the model and battery capacity of your car. Additionally, some states offer additional tax incentives for electric cars, so check with your state’s tax department to see if you are eligible. To claim the credit, you must complete IRS Form 8936 and attach it to your tax return.

Be sure to keep detailed records of your purchase or lease agreement and any other relevant documents, as the IRS may request them as proof of your eligibility. With a little bit of paperwork, you can potentially save thousands of dollars on your electric company car.

Conclusion

In conclusion, the electric car tax benefits in the UK are not just a smart move for the environment, but also for your wallet. Not only do you get a cleaner and quieter ride, but you also enjoy a lower cost of ownership, reduced fuel expenses, and various tax perks. So whether you’re looking to make a positive impact on the planet, or simply want to save some cash, an electric company car is the way to go.

After all, who needs a gas guzzler when you can have a sleek and savvy electric car?”

FAQs

What are the benefits of electric company cars for UK businesses?

Electric company cars can benefit UK businesses in various ways, including lower tax rates, exemption from certain taxes, reduced fuel costs, and improved environmental credentials.

How much tax do UK businesses have to pay on electric company cars?

UK businesses can enjoy lower tax rates on electric company cars due to their lower emissions, which are calculated based on the car’s CO2 emissions and list price. The exact rate depends on the car’s emissions and fuel type.

What kind of tax exemptions are available for electric company cars in the UK?

Electric company cars are exempt from some taxes in the UK, including the London Congestion Charge and Vehicle Excise Duty (VED). They are also eligible for 100% First Year Allowances (FYA) for businesses, which allows them to offset the entire cost of the car against their taxable profits.

How can electric company cars help UK businesses reduce their carbon footprint?

Electric company cars produce zero emissions while driving, which can help businesses reduce their carbon footprint and meet sustainability targets. They can also be charged using clean energy from renewable sources, further reducing their environmental impact.