Drive Towards Savings: How Buying an Electric Car can Unlock Tax Benefits

Thinking about buying an electric car? Beyond the obvious benefits, such as reduced emissions and lower fuel costs, there are a variety of tax benefits that you may be able to take advantage of. If you’re looking for ways to save money on your next vehicle purchase, it’s important to understand the tax incentives that are currently available. One of the most significant tax benefits for buying an electric car is the federal electric vehicle tax credit.

This credit can help reduce the overall cost of your vehicle, making it more affordable to purchase and own over time. However, it’s important to note that the tax credit may not be available forever, as the government continues to reassess and make changes to its policies. In addition to the federal electric vehicle tax credit, there are also a variety of state-level incentives that may be available to you.

These can include things like tax rebates, exemption from sales taxes, and even free access to charging stations. Depending on where you live, the total savings that you can get from these incentives can add up quickly. Overall, if you’re considering buying an electric car, it’s important to do your research and understand all of the potential tax benefits that may be available to you.

By taking advantage of these incentives, you can save money and make your purchase more affordable in the long run. So why not make the switch to an electric car today and start taking advantage of these cost-saving benefits?

Federal Tax Credit

If you’re considering buying an electric car, there’s good news – the federal government is offering a tax benefit to incentivize the purchase of these environmentally friendly vehicles. The tax credit varies based on the specific car you buy, but it can be up to several thousand dollars. Make sure to do your research beforehand and check if the electric car you’re interested in qualifies for the tax credit.

It’s important to note that the tax credit is only available for a limited time, so if you’re considering buying an electric car, now may be the perfect time to take advantage of this benefit. With this tax credit, not only can you save money on your purchase, but you can also feel good knowing that you’re supporting a cleaner future.

Up to $7,500 in tax credits available for qualifying electric vehicles

If you’re considering purchasing an electric vehicle, you may be eligible for a federal tax credit of up to $7,500. This tax credit is designed to incentivize the purchase of electric vehicles as they are seen as more environmentally-friendly and energy-efficient alternatives to traditional gasoline vehicles. The exact amount of the tax credit depends on the make and model of the vehicle you purchase, and it is important to note that once a manufacturer sells 200,000 qualifying vehicles, the tax credit begins to phase out.

However, there are still many options available that qualify for the full credit. Before making any purchase, it is important to research the eligible vehicles and consult with a tax professional to ensure you receive the maximum credit for your purchase. Taking advantage of this federal tax credit can provide a significant cost savings and make purchasing an electric vehicle more affordable for many consumers.

Based on battery capacity and manufacturer phase-out schedules

When it comes to federal tax credit for electric cars, it is important to consider the battery capacity and the manufacturer’s phase-out schedules. The federal tax credit is an incentive given to encourage people to buy electric cars. However, the amount of tax credit you can receive depends on the battery capacity of the vehicle.

If the battery capacity is 16 kWh or more, you can get up to $7,500 in tax credits. On the other hand, if it is less than 16 kWh, you can only receive up to $4,000. Furthermore, tax credit phases out once the manufacturer reaches a certain number of electric vehicles sold.

For example, Tesla has already reached the phase-out limit, so buying a new Tesla will not grant you any tax credit. However, other manufacturers such as Chevrolet and Nissan have not yet reached the limit, so you can still receive the full tax credit when buying their electric cars. Therefore, it is important to research and consider the battery capacity and manufacturer phase-out schedules when looking into purchasing an electric car to make the most out of the available tax credits.

State Incentives

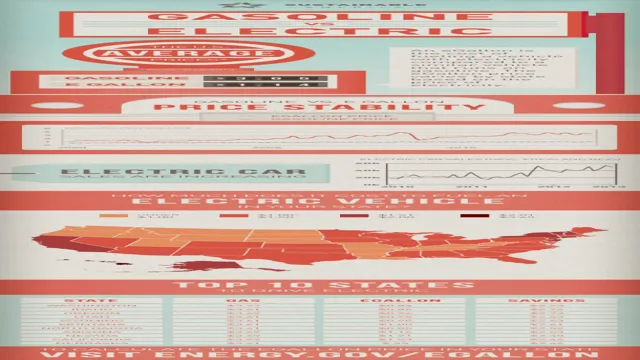

If you’re looking to buy an electric car, you may be interested in the tax benefit that comes with it. Many states offer tax incentives for purchasing electric vehicles as a way to encourage more people to make the switch to clean transportation. These incentives can take the form of tax credits or rebates that reduce the overall cost of the vehicle or even eliminate it entirely.

For example, in California, eligible buyers of electric cars can receive up to $2,500 in tax credits. Other states like Colorado, Maryland, and Michigan also have similar incentives in place. Besides tax incentives, some states offer additional benefits like access to HOV lanes or free charging stations.

Be sure to check with your state’s department of transportation to see what incentives are available to you if you’re considering buying an electric car. Not only will you be doing your part to reduce emissions and help the environment, but you may also save some money in the process.

Additional tax credits or rebates available from certain states

State Incentives If you’re looking for even more ways to save money on your taxes, be sure to check with your state. Some states offer additional tax credits or rebates for various things like energy-efficient home improvements, electric vehicles, and even child care expenses. For example, California offers a tax credit for low- to moderate-income households who rent their homes and pay more than 30% of their income on rent.

Pennsylvania offers a tax credit for film production companies that shoot within the state. And New York offers a tax credit for companies that invest in research and development. These incentives vary widely from state to state, so be sure to check with your local tax commission or a tax professional to see what you may be eligible for.

Taking advantage of these state incentives can help you save even more money on your taxes and keep more of your hard-earned money in your pocket.

Varies by state, some may offer additional perks such as carpool lane access

State incentives are a critical aspect of purchasing an electric vehicle (EV), and these incentives can vary widely by location. Some states, such as California, offer a slew of benefits that can make owning an EV more than worth the investment. In California, for example, EV owners can gain access to carpool lanes and save time during their daily commutes.

Additionally, some states offer incentives like tax rebates or reduced registration fees to offset the purchase price of an EV. It’s important to research the incentives available in your state to understand exactly what benefits you might qualify for. Not only can these incentives offset the initial cost of purchasing an EV, but they can also save you additional money over time by reducing your operating costs.

Regardless of where you live, it’s clear that investing in an electric vehicle can bring many benefits beyond just environmental sustainability.

Lower Operating Costs

Are you considering buying an electric car? You may be pleased to know that there is a tax benefit for purchasing one! The federal government currently offers a tax credit worth up to $7,500 for those who buy an electric car. The credit amount is based on the car’s battery capacity and begins to phase out once a manufacturer has sold over 200,000 eligible plug-in electric vehicles. In addition to this tax credit, driving an electric car can also lead to lower operating costs in the long run.

Electric vehicles typically require less maintenance and have lower fuel costs compared to traditional gasoline-powered cars. While the initial cost may be higher, the tax benefit and savings on operating costs can make buying an electric car a smart financial decision in the long term. So, why not consider an electric car for your next vehicle purchase and take advantage of these potential cost savings? It’s not only better for your wallet but also better for the environment!

Electric cars can save thousands of dollars in fuel costs compared to gasoline cars

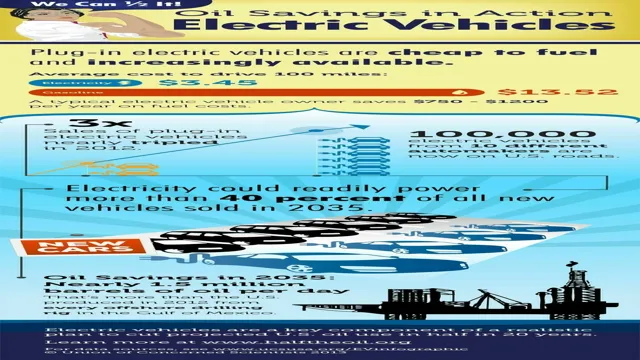

Electric cars have been growing in popularity in recent years, and one of the biggest reasons for this is their lower operating costs. Unlike gasoline cars, electric cars don’t require gasoline to run, which means that electric car owners can save thousands of dollars in fuel costs. Instead, electric cars are powered by electricity, which is generally much cheaper than gasoline.

In fact, studies have shown that electric cars can cost up to 50% less to operate than gasoline cars. This is because the cost of electricity is much more stable than the cost of gasoline, which can fluctuate based on many factors. Additionally, electric cars require less maintenance than gasoline cars because they have fewer moving parts and don’t require oil changes.

Overall, electric cars offer a more cost-effective option for those looking to save money on transportation.

Maintenance costs are also typically lower for electric cars

Electric cars offer a ton of advantages compared to traditional fossil fuel-powered vehicles. One major perk is the lower operating costs that come with them. For one, electric cars typically require less maintenance than their gasoline counterparts.

Since electric cars don’t have a traditional engine, there is less to go wrong. Frequent oil changes, spark plug replacements, and other expensive engine-related repairs are not necessary. Furthermore, electric cars have fewer moving parts, which means there are fewer things that can break down.

Additionally, the brakes on electric cars tend to last longer because of the regenerative braking system that captures kinetic energy and converts it back into stored energy. All of these factors add up to reduced costs in terms of vehicle maintenance over the life of the car. And with the savings you make on maintenance costs, you can free up your budget to spend on other things like upgrades or even a vacation.

In summary, electric cars offer lower operating costs, including lower maintenance costs, providing a more cost-effective way to get around.

Environmental Benefits

Have you been considering purchasing an electric car, but hesitant due to the cost? Well, there is a tax benefit for buying electric cars that could make your decision easier. The federal government offers a tax credit of up to $7,500 for purchasing electric cars, which can significantly reduce the overall cost of the vehicle. Additionally, many states offer their own incentives, such as tax rebates or exemptions, to encourage the use of electric cars.

By switching to an electric car, you can also contribute to a cleaner environment. Electric cars emit fewer greenhouse gases and pollutants than their gas-powered counterparts, helping to improve air quality and mitigate climate change. Plus, by eliminating the need for gasoline, electric cars help to reduce our dependence on foreign oil, making us less reliant on potentially unstable regions for our energy needs.

The environmental benefits of electric cars combined with the tax incentives available make purchasing an electric car a smart choice for the planet and for your wallet.

Electric cars produce significantly lower greenhouse gas emissions compared to gasoline cars

Electric cars are becoming increasingly popular due to their numerous environmental benefits. One of the most significant advantages is that electric cars produce significantly lower greenhouse gas emissions compared to gasoline cars. Unlike conventional gasoline cars, electric vehicles run on electricity instead of fossil fuels, which means they emit zero carbon dioxide emissions from the tailpipe.

In addition, electric cars can significantly reduce carbon emissions when charged using renewable energy sources such as solar, wind, and hydropower. As a result, electric cars have the potential to significantly reduce greenhouse gas emissions and contribute to reducing the negative impact of climate change. Switching to electric cars is an excellent way for individuals and communities to reduce the overall impact of transportation on the environment, and it is a step towards a greener and more sustainable future.

By choosing an electric car, you can make a positive impact on the environment while enjoying the many benefits of electric vehicle ownership.

Conclusion

In conclusion, buying an electric car not only benefits the environment, but also the wallet. With tax benefits and potential savings on fuel and maintenance costs, owning an electric vehicle can provide a clever and witty way to reduce your carbon footprint while keeping some extra cash in your pocket. So why not make the smart choice and electrify your ride?”

FAQs

What is the tax benefit for buying an electric car?

The tax benefit for buying an electric car varies based on the country and region you live in. In some places, there may be tax credits or rebates available for electric car buyers. It is best to check with your local government or a tax consultant for specific details.

Are all electric cars eligible for tax benefits?

Not all electric cars are eligible for tax benefits. Some models may not meet the criteria set by the government to qualify for tax credits or rebates.

Is there a deadline for claiming a tax benefit for an electric car purchase?

Yes, there may be a deadline for claiming tax benefits for an electric car purchase. Again, this varies depending on the country and region you live in. It is essential to know the specific time frame in which you must claim the tax benefit.

What documents do I need to claim the tax benefit for buying an electric car?

The documents required to claim a tax benefit for buying an electric car will vary based on location, but generally, you may need to provide proof of purchase or lease, the vehicle’s make and model information, and any applicable tax forms. It is recommended to consult with a tax professional or government entity for a specific list of required documents.