Rev up Your Savings: Unlocking the Tax Benefits of Electric Cars in India

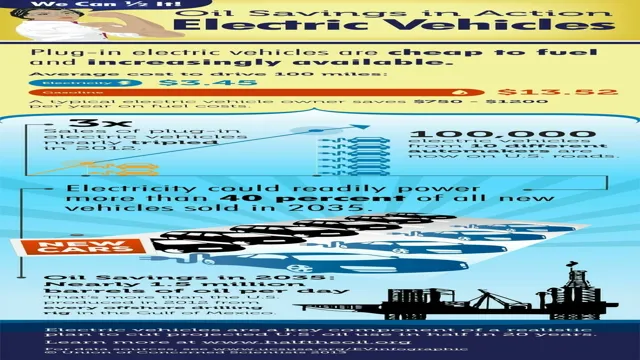

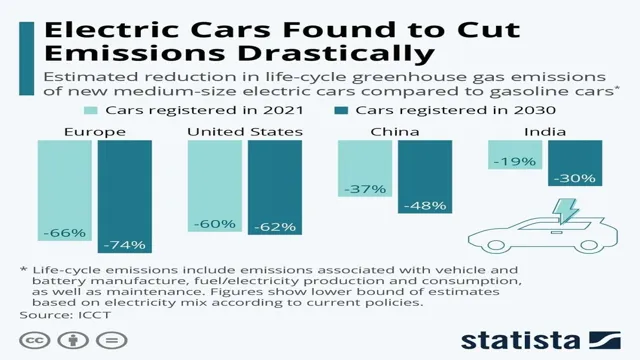

As the world progresses towards sustainable living, electric cars are gaining popularity as a sustainable means of transportation. Not only do they contribute towards reducing pollution, but they also come with several tax benefits for their owners. In India, the government encourages the adoption of electric vehicles and has introduced several incentives to promote their usage.

These incentives can range from tax waivers, subsidies, and grants to lower registration fees and exemptions from road tax. With the cost of fuel soaring high, electric cars offer a promising solution to reduce the expenses on transportation. But how exactly do these tax benefits work? Let’s dive into the details and explore the advantages of owning an electric car in India.

Overview of the Electric Car industry in India

The Indian government has been taking steps to promote the use of electric vehicles in the country, and one of the ways they are doing this is by providing tax benefits to those who buy electric cars. The Union Budget for 2021-22 extended the eligibility for claiming tax deduction on the interest paid on loans taken for purchase of electric vehicles till March 31, 202 These tax benefits are meant to incentivize people to switch to electric vehicles and reduce their carbon footprint.

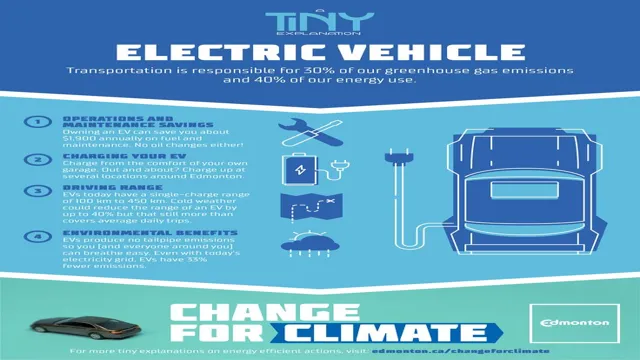

In addition to being environmentally friendly, electric cars also offer lower operating costs and require less maintenance compared to traditional gasoline-powered cars. The tax benefits on electric cars in India vary depending on the state, but they generally include exemptions or reductions on road tax, registration fees, and state taxes. With the growing demand for electric cars in India and the government’s efforts to promote their use, it is likely that we will see more tax benefits and incentives in the future.

Electric car penetration in India

Electric car penetration in India is still at a nascent stage, with only a few models available in the market. The Indian government has been actively promoting the adoption of electric vehicles as part of its efforts to reduce carbon emissions and dependence on imported fossil fuels. To incentivize the transition, the government has introduced several policies such as tax cuts, subsidies, and waivers on registration fees.

However, the upfront costs of electric vehicles remain high compared to petrol and diesel cars, which has been a major deterrent for prospective buyers. Additionally, there is also insufficient charging infrastructure in the country, which limits the range and usability of electric cars. Despite these challenges, there is potential for the electric car industry to grow rapidly in India.

With increasing awareness of environmental issues and advances in technology, the electric car market is expected to mature and become more accessible to a wider audience. As more automakers enter the market and charging infrastructure improves, we can expect to see electric car sales rise, making them more mainstream.

Scope of electric cars in India

Electric Cars in India India has made great strides in the electric car industry in recent years. The government has launched several initiatives to promote the use of electric vehicles and made significant investments in building charging infrastructure. The market for electric cars is still relatively small, but it has been growing steadily.

There are several players in the industry, including Tesla, Mahindra, Tata, and Hyundai. These companies have launched electric vehicles in India, and their sales have been increasing. The main obstacle to the growth of the electric car industry in India is the lack of charging infrastructure and the high cost of electric vehicles.

The government is trying to address these issues by setting up charging stations and providing financial incentives to buyers of electric vehicles. The future of electric cars in India looks promising, and it is just a matter of time before they become the norm rather than the exception.

Income Tax Benefit on Electric Cars in India

If you’re considering buying an electric car in India, you might be happy to know that there are income tax benefits available to you. The government is offering a deduction of up to INR 5 lakh on the interest paid on loans taken to buy an electric vehicle.

This means that if you take a loan to buy an electric car, you can deduct up to INR 5 lakh from your taxable income. Additionally, electric vehicles are eligible for a lower GST rate of 5%, compared to the standard 28% for petrol or diesel cars.

With these tax benefits and reduced rates, electric cars can be a financially savvy choice for environmentally-conscious individuals. Not only will you be contributing to a greener planet, but you’ll also be benefiting from significant tax savings.

Details of income tax benefit

Electric cars are becoming increasingly popular in India, and for good reason. In addition to being environmentally friendly, electric cars can offer an income tax benefit to owners. The Indian government provides an income tax benefit of up to Rs

5 lakh to individuals who purchase an electric car. This benefit can be claimed under Section 80EEB of the Income Tax Act, and is available for the purchasing of both new and used electric vehicles. In order to claim this benefit, individuals must provide proof of purchase and the vehicle must be registered in their name.

It is important to note that this benefit is only available until the year 2022, so individuals interested in purchasing an electric car should act quickly to take advantage of this opportunity. By investing in an electric vehicle, individuals can not only reduce their carbon footprint, but also enjoy financial benefits in the form of income tax savings.

Maximum deduction limit

Electric cars are rapidly gaining popularity in India, not only for their environmental benefits but also for the income tax benefits they offer. The government offers a maximum deduction limit of Rs 5 lakh on the interest paid on a loan taken to purchase an electric vehicle.

This deduction can be availed over and above the standard deduction of Rs 50,000, which means that an individual can claim a total of Rs 2 lakh as tax deduction. Additionally, companies that opt to buy electric vehicles for their employees can also claim a deduction on the interest paid on the loan. This move is aimed at promoting the use of eco-friendly vehicles and reducing the country’s dependence on non-renewable sources of energy.

With the rising cost of fuel, opting for an electric car can not only save money but also provide substantial tax benefits. It is also important to note that this deduction is valid only for electric cars purchased on or before March 31, 202 Therefore, it is an excellent opportunity for individuals and companies to invest in electric vehicles and take advantage of the tax benefits offered by the government.

Eligibility criteria for tax benefit

Electric vehicles are a great way to reduce carbon emissions and make a positive impact on the environment. What’s even more exciting is that electric car owners in India are eligible for a tax benefit under Section 80EEB of the Income Tax Act. This scheme provides a tax deduction of up to Rs.

5 lakhs on the interest paid on the loan taken to purchase an electric vehicle. The eligibility requirements for this tax benefit are straightforward.

Firstly, the car must be purchased on or after April 1, 201 Secondly, the maximum loan that can be availed for the purchase of the electric vehicle is Rs. 25 lakhs, and it must be taken from a financial institution registered with the Reserve Bank of India (RBI).

Finally, the borrower must be an individual tax-paying citizen and should not own any other car. In summary, the income tax benefit on electric cars in India aims to encourage the adoption of electric mobility. By incentivizing citizens to purchase electric cars and providing a tax deduction on the interest paid on the loan, the government is supporting the shift towards a cleaner and greener future.

So if you’re thinking of buying an electric car, now is the best time to reap the tax benefits while contributing to a sustainable future.

Other Tax Benefits on Electric Cars in India

If you’re in India and considering purchasing an electric car, you may be eligible for various tax benefits. In addition to the federal government’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, some state governments offer additional tax incentives for electric car buyers. For example, Delhi and Maharashtra offer a waiver of road tax for electric cars, and Maharashtra also offers a state GST exemption.

Aside from taxes, electric car owners may also enjoy reduced maintenance costs and lower fuel costs compared to traditional petrol or diesel cars. With India pushing for more electric vehicles on the roads, these tax benefits are expected to continue and encourage more people to switch to electric cars. So, if you’re thinking of buying an electric car, take some time to research the various tax incentives available to you.

Goods and Services Tax (GST) reduction

Electric cars in India are not only environmentally friendly but also come with various tax benefits that encourage their adoption. Apart from the Goods and Services Tax (GST) reduction, there are several other tax benefits available for electric car buyers in India. For instance, electric vehicles are exempt from road tax and registration fees in many Indian states.

Additionally, the central government offers income tax benefits of up to Rs. 5 lakh for electric car buyers, which can significantly reduce the overall cost of ownership.

With these tax benefits, electric cars are becoming increasingly attractive to Indian consumers who are looking for an affordable and sustainable mode of transportation. By shifting to electric cars, we can reduce the carbon footprint and contribute towards a cleaner and greener planet.

Registration fee and Road tax exemption

Electric Cars in India Electric cars offer several tax benefits in India, making them a cost-effective and eco-friendly option. Apart from exemption from registration fees and road tax, there are other tax benefits available as well, including lower GST rates. Additionally, electric cars are eligible for a higher rate of depreciation, which can help reduce the overall tax liability for the owner.

With the government pushing for sustainable and green transportation, electric cars are becoming increasingly popular in India. Manufacturers are also offering incentives, such as lower interest rates on loans and extended warranties, to encourage more people to switch to electric cars. Overall, these tax benefits and incentives make electric cars a viable option for those looking for a more sustainable and economical mode of transportation in India.

Conclusion

In conclusion, the tax benefit on electric cars in India may seem like a mere financial incentive, but it actually holds a much deeper purpose. By encouraging the adoption of electric vehicles, the government is not only promoting sustainable transportation but also reducing our carbon footprint. It’s a win-win situation where you get to save money on taxes while contributing to a greener tomorrow.

So, if you want to go green and save some green, an electric car might just be the way to go!”

FAQs

What is the current tax benefit available for electric cars in India?

As per the current tax laws, electric cars are exempted from paying road tax and registration fees in most states of India. Additionally, there is an income tax benefit of up to Rs. 1.5 lakh for purchasing an electric car under Section 80EEB of the Income Tax Act.

Are there any conditions for availing the tax benefit on electric cars in India?

Yes, to avail the tax benefit on electric cars in India, the following conditions are applicable:

– The car must be bought on or after 1st April 2019.

– The loan, if any, taken for the car must be sanctioned on or before 31st March 2023.

– The car must be used for personal purposes only and not for commercial purposes.

Is the tax benefit applicable for hybrid cars as well?

No, the tax benefit on electric cars is not applicable for hybrid cars. Hybrid cars are still liable to pay road tax and registration fees like any other petrol or diesel car.

Can a person claim tax benefit on the purchase of multiple electric cars?

Yes, a person can claim tax benefit on the purchase of multiple electric cars. However, the maximum limit of Rs. 1.5 lakh remains the same for all the cars combined. Also, the cars must be used for personal purposes only and not for commercial purposes.