Juicy Tax Breaks You Don’t Want to Miss: The Power of Owning an Electric Car!

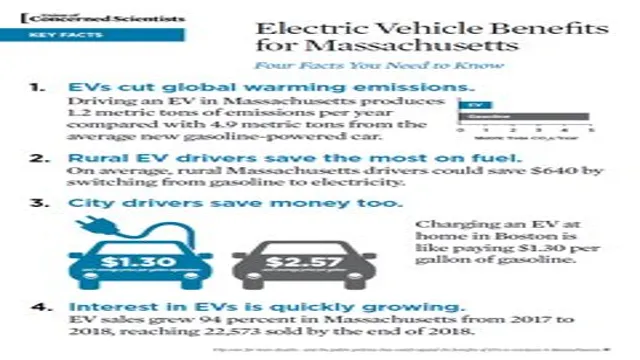

As electric cars become ever-more popular, people are starting to realize the numerous benefits of switching to an electric vehicle (EV). For those looking to make the switch, one of the most enticing advantages is the tax benefits for electric cars. These incentives can range from federal tax credits to state rebates, making electric cars not only environmentally conscious, but also financially savvy.

But what exactly are these tax benefits, and how can they help you save money? In this blog post, we’ll explore the different types of tax benefits available for electric cars and how they can benefit you when purchasing an EV.

Federal Tax Credit

If you own or are considering purchasing an electric car, you may be eligible for a federal tax credit that can significantly lower the cost. As part of the government’s effort to incentivize the use of electric vehicles, taxpayers can receive up to $7,500 in tax benefits for purchasing a qualifying electric car. The amount of the credit varies depending on the make and model of the vehicle, but it can be a significant financial incentive for those interested in sustainable transportation.

It’s important to note that not all electric cars are eligible for the tax credit, so be sure to do your research before purchasing. Additionally, the credit begins to phase out once a manufacturer has sold 200,000 eligible vehicles, so it’s best to take advantage of the opportunity while it lasts. Overall, the tax credit is a valuable benefit for those who want to save money and make a positive environmental impact with their transportation choices.

Up to $7,500 credit for eligible vehicles

Are you in the market for a new electric vehicle? You could be eligible for a Federal Tax Credit of up to $7,500! This credit is a great incentive for those interested in purchasing an environmentally friendly car. The amount of credit you receive depends on the make and model of the vehicle, as well as its battery capacity. To qualify, the vehicle must be brand new and purchased for personal use only.

It’s important to note that this credit can only be used to offset your federal tax liability. If the credit exceeds your tax liability for the year, it cannot be carried over to the following year. However, if you lease a qualifying electric vehicle, the tax credit may be passed on to you in the form of reduced monthly lease payments.

So, don’t miss out on this great opportunity to save some money while also helping the environment!

Phase-out period and limitations

The federal tax credit for electric cars is a great incentive for buyers looking to go green. However, it is important to note that there is a phase-out period and limitations to the credit. The phase-out period starts after the manufacturer sells 200,000 electric vehicles in the United States.

Once this happens, the credit starts to decrease and eventually disappears entirely. For example, Tesla and GM have already reached their limit and no longer qualify for the federal tax credit. Additionally, the credit has a cap of $7,500 and cannot exceed the total amount of taxes owed.

This means that if you owe less than $7,500 in taxes, you will not be able to receive the full credit. It is important to keep these limitations in mind when considering purchasing an electric vehicle and planning for tax season.

State Incentives

One of the biggest advantages of owning an electric car is the tax benefits that come with it. Many states offer tax incentives to individuals who purchase an electric vehicle, which can significantly reduce the cost of owning one. These incentives come in many different forms, from rebates and tax credits to other monetary incentives.

One such example is the Federal Electric Vehicle Tax Credit, which can provide up to $7,500 in tax credits for the purchase of a new electric car. Some states also offer additional incentives, such as reduced registration fees or access to carpool lanes for electric vehicle owners. It’s worth noting that each state’s incentives vary, so it’s important to research the specific benefits available in your area before making a purchase.

All in all, the tax benefits of going electric can add up to thousands of dollars in savings for the savvy car buyer.

Various incentives depending on state

State incentives are beneficial programs designed to promote economic growth in specific regions by providing tax breaks, grants, low-interest loans and other benefits to businesses that choose to operate within their borders. Each state has its own unique set of incentives aimed at driving job creation, promoting green initiatives, and cultivating specific industries. For example, some states offer incentives for businesses that invest in renewable energy, while others focus on attracting film production companies.

These incentives can significantly reduce the cost of doing business, making it easier for companies to grow, hire workers, and expand their operations. If you’re looking to start or relocate a business, be sure to research the state incentives available in your area to take advantage of the benefits they offer.

Examples: California, Colorado, New York

State incentives are a great way to encourage businesses to invest in renewable energy and reduce their carbon footprint. These incentives come in different forms, such as tax credits, grants, and rebates. California, for example, offers a variety of incentives for clean energy development, such as the Self-Generation Incentive Program, which provides rebates for qualifying distributed energy resources like solar panels, battery storage, and wind turbines.

Colorado has a similar incentive through the Renewable Energy Standard that requires utilities to generate a certain percentage of their power from renewable sources, which helps increase demand and incentivizes investment in renewable energy. New York also provides a range of incentives, including tax credits, bond financing, and grants for renewable energy projects. These incentives not only help businesses save money but also contribute to creating a cleaner, more sustainable future.

By embracing renewable energy and taking advantage of state incentives, businesses can reduce their carbon footprint and make a positive impact on the environment.

Business Tax Benefits

As electric cars become more prevalent, there are several tax benefits that can come with owning one. One of the primary benefits is the federal tax credit of up to $7,500 that electric car owners can claim. This credit is based on the size of the battery in your car and begins to phase out after a certain number of vehicles are sold.

In addition to the federal credit, there may also be state-level credits or incentives available to you. For example, California offers up to $2,500 in rebates for electric car purchases. It’s important to note that these benefits can be subject to change, so keeping up-to-date with the latest tax laws and incentives is essential.

Overall, electric cars present a smart financial decision for those looking to save money on gas and take advantage of tax benefits.

Deductions for electric car purchases and leases

When it comes to purchasing or leasing electric cars for your business, there are various tax benefits to take advantage of. One of the major benefits is the federal tax credit. If you purchase an electric car, you may qualify for a credit of up to $7,500.

However, it’s important to note that this credit may decrease or even disappear once a car manufacturer sells a certain number of electric cars. Additionally, many states offer their own tax credits or rebates for electric car purchases, which can further reduce the total cost. Overall, investing in electric cars for your business not only benefits the environment but can also provide significant tax savings.

Write-offs for charging stations and infrastructure

If you’re a business owner considering installing electric vehicle charging stations or infrastructure, you’ll be glad to know that there are several potential tax benefits. These write-offs can make it more affordable for your company to adopt EV charging technology and contribute to the growing trend of sustainable transportation. Some of the tax incentives available include deductions for the purchase and installation of charging stations, as well as credits for qualifying alternative fuel vehicles.

Additionally, you may be able to depreciate the cost of the equipment over several years, which can help spread out the financial impact of the purchase. Overall, these tax benefits can make it easier for your business to invest in charging infrastructure while also reducing your carbon footprint. So, if you’re looking to enhance your company’s eco-friendly initiatives, electric vehicle charging stations can be a smart choice that provides multiple benefits for both your business and the environment.

Conclusion: Switch to Electric Cars for Tax Benefits

In conclusion, choosing an electric car not only helps to protect the environment by reducing harmful emissions, but it also comes with a number of tax incentives and benefits. From federal tax credits to state rebates and exemptions, going electric can provide some relief for your wallet while keeping our planet healthy. So, why not make the switch and enjoy the ride without having to worry about breaking the bank or the planet?”

FAQs

What tax benefits are available for electric car owners?

Electric car owners may be eligible for federal tax credits up to $7,500 and state tax incentives, such as rebates or exemptions from certain taxes.

In which states are the most significant tax benefits available for electric car owners?

California, Colorado, Connecticut, and New York are among the states with the best tax incentives for electric car owners.

Is there a limit on how many times an electric car owner can claim tax benefits?

An electric car owner can only claim federal tax credits for electric cars for the first 200,000 plug-in electric vehicles sold in the United States by each manufacturer.

Can business owners also benefit from tax credits for electric cars?

Yes, businesses that purchase electric cars can claim a federal tax credit of up to $7,500 per vehicle, and some states offer additional tax benefits for businesses.