Rev up your Savings: Explore the Tax Benefits of Buying an Electric Car in the UK

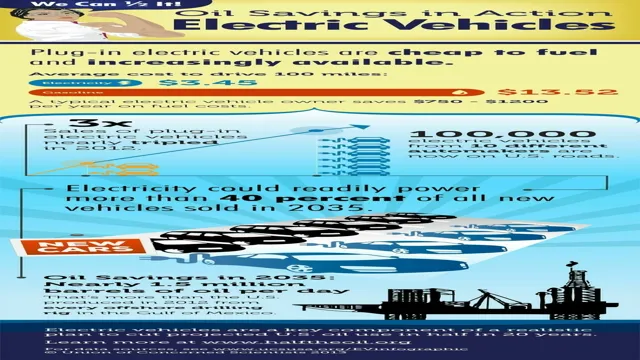

Electric cars are becoming an increasingly popular choice among car buyers in the UK. Beyond being eco-friendly, there are also many tax benefits that come along with owning one. Have you ever wondered what these benefits are and how they work? In this blog post, we’ll delve into the tax benefits of electric cars in the UK and explore why they’re a smart choice for both your wallet and the environment.

So, let’s plug in and take a closer look.

Overview of Tax Benefits

If you’re thinking about purchasing an electric car in the UK, you may be pleased to know that there are several tax benefits you can take advantage of. One significant benefit is that electric cars are exempt from the Vehicle Excise Duty, also known as road tax. This exemption can save you a considerable amount of money each year.

Additionally, electric cars are also eligible for lower company car tax rates, which can make them an attractive option for business owners. Lastly, the government offers a grant of up to £2,500 for eligible electric cars, which can help offset the initial cost of the vehicle. With these tax benefits, purchasing an electric car in the UK can be a smart financial decision while also contributing to a more sustainable future.

Exceptional first-year capital allowances

First-year capital allowances refer to tax deductions that businesses can claim on qualifying assets purchased and put to use in their first year of operation. This exceptional allowance provides a significant benefit for new businesses and encourages investment in assets that can help grow and improve their operations. Essentially, it means that businesses can claim a larger deduction on assets in the year they purchase them, rather than claiming depreciation over multiple years.

For instance, a business might be able to claim 100% of the cost of a qualifying asset in the first year instead of a percentage each year over the asset’s useful life. This can significantly reduce the tax burden of new businesses, helping them to reinvest saved funds back into their operations. However, it is important to note that not all assets qualify for first-year capital allowances, and these deductions are subject to specific tax regulations in different countries.

Therefore, businesses should speak to their accountants or tax advisors to determine their eligibility for and how to claim these deductions.

Exemption from vehicle excise duty

One of the benefits of owning an environmentally friendly vehicle is the exemption from vehicle excise duty, which is also known as car tax. This is a tax payable on most vehicles that use public roads in the UK and it is calculated based on factors such as the vehicle’s carbon dioxide emissions. However, low-emission vehicles are eligible for exemption from this tax, which means you can save a considerable amount of money in the long run.

The exemption applies to both electric and hybrid vehicles and is a great incentive for people to switch to eco-friendly transportation options. Not only will you be doing your part to reduce carbon emissions, but you’ll also be benefiting from tax savings.

Company Car Users

Are you a company car user? If so, you may be interested in the tax benefits of buying an electric car in the UK. With low emissions and improved fuel efficiency, electric cars can be a smart investment for both individuals and companies. For company car users, the tax benefits can be particularly enticing.

Not only do electric cars have lower company car tax rates than conventional vehicles, but they are also exempt from the new diesel supplement tax. In addition, electric cars are exempt from the London congestion charge and have reduced road taxes. Investing in an electric car not only benefits the environment but can also save you a considerable amount of money in taxes.

Lower Benefit-in-Kind (BIK) Rates

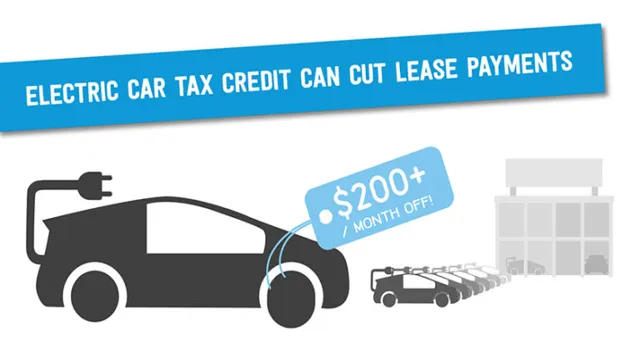

If you’re a company car user, you’re in luck! Lower Benefit-in-Kind (BIK) rates have been introduced to help reduce the tax bills for drivers. This is great news for those who rely on company cars for their work as it means they can save money in tax. The changes mean that the BIK rates for electric vehicles have been reduced, making them a more attractive option for businesses.

This is a positive step towards driving the adoption of electric vehicles as they become more affordable. If you’re considering swapping your petrol or diesel car for an electric car, now might be the perfect time to do so. Not only will you be helping to reduce your carbon footprint, but you will also save money on your tax bill.

Exemption from fuel tax

For company car users, there is a valuable exemption available that can significantly reduce your fuel costs. This exemption is the fuel tax credit, which is designed to benefit businesses that operate vehicles for business purposes. Essentially, you can claim a credit or refund for the fuel taxes that you pay when you purchase fuel for your company car.

This can result in significant savings over time, particularly if you drive long distances for work or use multiple vehicles. It’s important to note that the fuel tax credit is not available for personal vehicles, so you’ll need to ensure that you keep accurate records of your fuel usage and expenses to claim this benefit. By taking advantage of this valuable exemption, you can reduce your company’s operating costs and potentially increase your profitability over time.

Discounted or free parking and charging

Company car users can take advantage of discounted or even free parking and charging options offered by many businesses and municipalities. This incentive not only saves drivers money but also promotes the use of electric vehicles, reducing the carbon footprint of the company. Some companies offer their employees discounted rates or free charging while parked at work, while others have partnerships with local charging stations to offer discounted or free charging to their employees.

Municipalities may also offer discounted or free parking and charging for electric vehicles in designated areas, encouraging more individuals to switch to electric cars. By taking advantage of these incentives, company car users can save money, reduce their carbon footprint, and encourage the adoption of electric vehicles.

Other Financial Incentives

One of the major financial incentives for buying an electric car in the UK is the tax benefits that come with it. For one, there is zero road tax on electric vehicles since they have zero emissions. Additionally, electric cars are exempt from the London Congestion Charge, which can save drivers up to £15 per day.

Moreover, the government has implemented a Plug-In Car Grant, offering up to £2,500 off the cost of a new EV (Electric Vehicle), as long as it meets the requirements set by the Office for Low Emission Vehicles. Lastly, electric vehicles have a lower Benefit-in-Kind tax rate, allowing employees who use EVs for business purposes to receive substantial tax deductions on their company car tax. All of these tax benefits of buying an electric car make it a wise investment, not just for the environment but for your wallet as well.

Grants for Electric Vehicle Purchase

If you’re considering purchasing an electric vehicle, it’s worth exploring the various financial incentives available to offset the higher upfront cost. In addition to grants, there are a range of other incentives offered by various entities, including tax credits, rebates, and special financing arrangements. For example, some states offer tax incentives for purchasing an electric vehicle, which can save you thousands of dollars in taxes.

Some utility companies may also offer rebates to customers who install home charging stations, making it more affordable to have a dedicated EV charging spot. Additionally, some automakers offer special financing deals or discounts to help encourage the adoption of electric vehicles. With so many options available, it’s worth taking the time to research each one and figure out which combination of incentives will work best for your unique situation.

Reduced charging rates at public charging stations

Reduced charging rates at public charging stations can be a great incentive for electric vehicle (EV) owners. Many cities and states offer these reduced rates as a way to encourage people to switch to EVs and reduce their carbon footprint. This means that you can charge your EV for less than the regular rate at public charging stations, which can save you a significant amount of money over time.

Additionally, some places may offer free charging for EV owners, as well as discounts on parking fees or tolls. These financial incentives make owning an EV more cost-effective and can make a big difference for those considering making the switch. So, if you’re an EV owner, be sure to research the available incentives in your area to take advantage of these cost-saving opportunities.

Conclusion

In conclusion, buying an electric car in the UK not only lowers your impact on the environment but also offers some fantastic tax benefits. From reduced road tax and exemption from congestion charges, to grants for installation of charging stations and a lower capital allowance, electric cars are a smart financial and environmental choice. So don’t be shocked by the initial cost, put some spark in your life and consider an electric car for your next vehicle purchase!”

FAQs

What tax benefits are available for buying an electric car in the UK?

There are several tax benefits for buying an electric car in the UK, including a government grant of up to £3,000 and exemption from paying Vehicle Excise Duty (VED).

Are electric cars eligible for other types of tax incentives in the UK?

Yes, electric cars are also eligible for the Plug-in Car Grant, which provides up to 35% off the cost of the car, up to a maximum of £2,500.

Do electric cars qualify for any other types of financial incentives in the UK?

Yes, electric car owners can also benefit from reduced rates of company car tax and exemption from paying London’s Congestion Charge.

How do the tax benefits of buying an electric car in the UK compare to those of a traditional gasoline car?

While there may be some tax breaks available for traditional gasoline cars, the tax benefits for electric cars in the UK are generally more significant and offer greater long-term savings.

![Going Green with Electric Cars: Unlocking the Environmental Benefits [Cited Studies]](https://electriccarwiki.com/wp-content/uploads/2023/10/electric-car-environmental-benefits-with-sitation.webp)