Unlocking Huge Tax Benefits: Exploring the Advantages of Leasing an Electric Car in the UK

As the world becomes increasingly conscious of the impact of carbon emissions on the environment, the demand for electric cars has skyrocketed. In the UK, the government incentivizes the switch to electric cars by offering tax benefits for those who choose to lease them. These benefits have made leasing an electric car a financially-wise decision for many UK citizens.

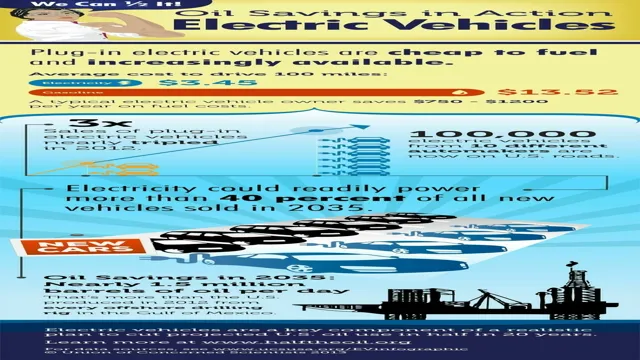

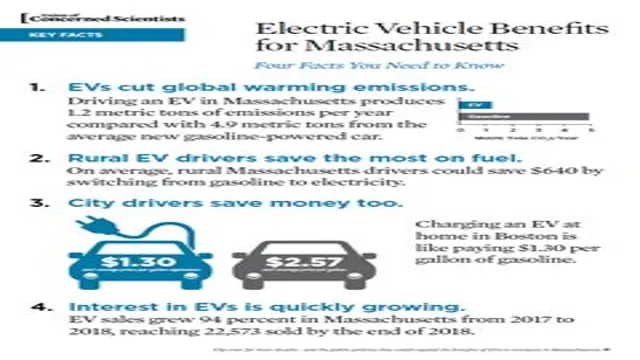

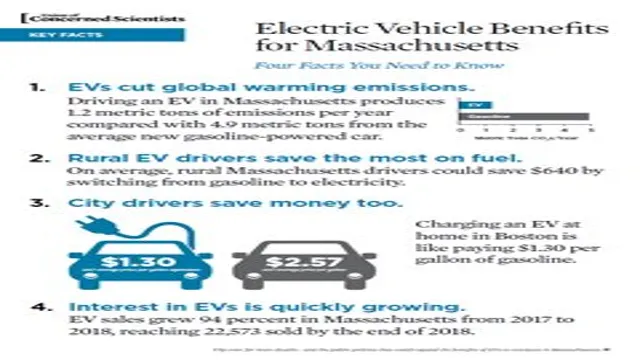

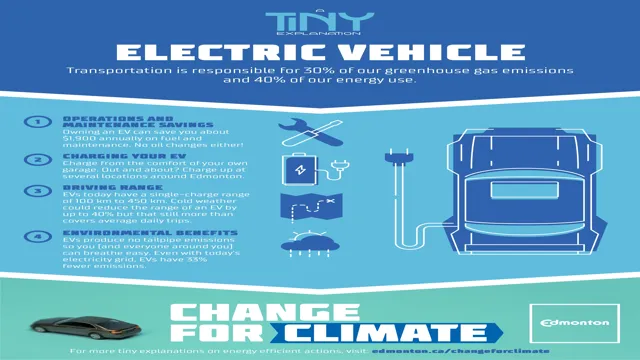

Not only are electric cars environmentally friendly, but they also offer significant savings in the long run. For instance, tax benefits on electric cars reduce the amount of money that lessees pay as compared to those who lease petrol or diesel cars. Additionally, the use of electric cars saves money on fuel, maintenance, and other running costs.

However, with the different tax codes and regulations surrounding the leasing of electric cars, it can be challenging to navigate the process. Nonetheless, understanding the tax benefits of leasing an electric car in the UK is a crucial step towards making informed decisions about your vehicle choice. From lower company car tax rates to reduced personal tax rates, the benefits of leasing electric cars in the UK continue to attract individuals, businesses, and organizations alike.

In this blog post, we explore the different tax benefits available for those leasing electric cars in the UK to help you make an informed decision that suits your needs and budget.

Overview of Tax Benefits

Electric car leasing in the UK provides several tax benefits for individuals and businesses alike. The first is a reduction in the vehicle’s Benefit-in-Kind (BIK) tax, which is lower for electric cars than their petrol or diesel counterparts. Additionally, companies can claim the full cost of the vehicle against their corporation tax bill, unlike purchasing a car outright, where only a portion can be claimed.

Electric car leasing also qualifies for the government’s Plug-in Car Grant, which reduces the purchase price of eligible vehicles. Finally, all-electric vehicles are exempt from UK road tax and the London Congestion Charge. All of these tax incentives make electric car leasing a financially viable and environmentally friendly option for individuals and businesses alike.

Zero Emission Vehicle (ZEV) Incentive

If you’re considering purchasing a zero-emission vehicle (ZEV), there are plenty of tax benefits to take advantage of. ZEVs qualify for a federal tax credit of up to $7,500, which can significantly lower the cost of owning a ZEV. Additionally, many states offer their own incentives for ZEV owners, such as rebate programs and tax credits for charging stations.

Some states even waive sales tax for ZEV purchases. These incentives are designed to encourage more people to purchase green vehicles and to help the environment by reducing greenhouse gas emissions. By taking advantage of these tax benefits, you not only save money but also contribute to a more sustainable future for everyone.

So, why not consider buying a ZEV today and enjoy the tax benefits that come with it?

Enhanced Capital Allowance (ECA)

If you’re a business owner, you may be able to benefit from the Enhanced Capital Allowance (ECA) scheme, which grants tax benefits for investing in energy-efficient equipment. The scheme allows you to claim back a percentage of the cost of eligible equipment in the form of a first-year capital allowance. This includes items such as energy-efficient lighting, heating and ventilation systems, and some non-road vehicles.

By investing in ECA-approved equipment, you can reduce your tax bill, as well as lower your energy consumption and costs in the long term. Additionally, the ECA scheme aims to reduce carbon emissions, so you can feel good about making your business more environmentally friendly while also saving money.

Plug-in Car Grant

The Plug-in Car Grant is a tax benefit provided by the UK government to encourage the adoption of low-emission vehicles. The grant allows buyers to save up to £2,500 on eligible new electric cars and up to £500 on eligible new electric motorbikes. This can make a significant difference in the overall cost of the vehicle and make electric cars more affordable for many people.

In addition, electric vehicles are exempt from paying certain taxes, such as Vehicle Excise Duty and the London Congestion Charge. Furthermore, they typically cost less to maintain and can help reduce your carbon footprint. With the Plug-in Car Grant, there has never been a better time to consider purchasing an electric car or motorbike.

Not only will you save money, but you’ll also be doing your part to help the environment.

Tax Benefits for Business Leasing

If you’re a business owner in the UK, you may be wondering about the tax benefits of leasing an electric car. In short, there are plenty of potential savings to be had! For starters, electric vehicles are exempt from the London Congestion Charge, which can save you up to £15 per day. In addition, there are currently tax incentives in place that allow businesses to write off a significant portion of the cost of an electric car as a capital allowance.

This means you can reduce your company’s taxable profits and potentially save a considerable amount of money on your annual tax bill. Plus, leasing an electric car also allows you to benefit from lower fuel and maintenance costs, as well as reduced carbon emissions. It’s worth noting that the specific tax benefits available to your business will depend on a variety of factors, such as the type of vehicle you choose, your business structure, and your tax bracket.

That being said, if you’re looking to reduce your tax liability while also doing your part for the environment, leasing an electric car could be a smart move for your business.

Capital Allowances

Capital allowances are a tax benefit available to businesses that lease equipment. When a business leases equipment, such as vehicles, machinery, or IT equipment, they are entitled to claim capital allowances on the lease payments. This tax relief can be claimed in the form of a reduction in the business’s taxable profit, offering a potential saving on their tax bill.

For smaller businesses, in particular, leasing equipment can be an attractive option as it reduces the upfront costs of purchasing and allows them to claim valuable tax relief. This can, in turn, improve cash flow and help the business to grow. Overall, capital allowances represent a valuable tax benefit for businesses, and those looking to lease equipment should consider the potential tax savings when making their decision.

Lower Benefit-In-Kind Taxes

When it comes to business leasing, there are certainly some tax benefits to take advantage of that can help lower your overall expenses. One of the most significant of these benefits is lower Benefit-In-Kind (BIK) taxes. These taxes are based on the value of the leased vehicle and can be quite high for more expensive models.

However, by leasing a car or van through a business agreement, you may be able to lower your BIK taxes and therefore reduce your overall tax bill. This is because you are not the owner of the vehicle, but rather leasing it from someone else. As a result, the taxable value of the vehicle is lower, and you are taxed less.

Of course, there are still some rules and regulations to follow, and the details will depend on your specific leasing agreement and the type of vehicle you choose. But if you are looking for ways to save money on your business expenses, exploring the tax benefits of business leasing is definitely worth considering.

VAT Benefits

As a business owner, you may be wondering how you can save money on expenses. One option to consider is leasing equipment rather than buying it outright. Not only does leasing provide you with access to the latest technology without hefty upfront costs, but it can also offer significant tax benefits.

VAT, for example, is only applied to the portion of the payment that covers the equipment’s depreciation over the lease term. This means that you can reclaim a portion of the VAT you paid on the lease payments. As a result, your business can save money and improve cash flow.

Moreover, leasing is a viable way to offset your tax bill. By making lease payments, you can lower your taxable profit, meaning you pay less in corporation tax. In conclusion, while leasing equipment may not always be the best option for a business, the tax advantages can make it worthwhile in certain circumstances.

Don’t hesitate to speak with your accountant or financial advisor to determine if leasing makes sense for your business.

Tax Benefits for Personal Leasing

If you’re considering leasing an electric car in the UK, you may be happy to learn about the tax benefits that are available to you. One of the major benefits of leasing an electric car is that you can claim a 100% first-year allowance on the cost of the car. This means that you can deduct the cost of the car from your taxable income in the year that you purchase it, which can result in significant tax savings.

Additionally, electric cars are exempt from vehicle excise duty (VED) and the London Congestion Charge, which can save you even more money. Plus, if you lease an electric car for business purposes, you can claim the cost of the lease as a tax-deductible expense. All of these tax benefits make leasing an electric car a smart financial decision for many people.

Lower Vehicle Excise Duty (VED)

If you’re considering personal leasing, one of the advantages is the tax benefits you may be eligible for, such as a lower Vehicle Excise Duty (VED). VED is a tax you pay based on your vehicle’s CO2 emissions. Personal leasing can be a smart move because many car manufacturers offer low CO2-emitting models that can qualify for a lower VED rate than other vehicles.

By selecting a low-emission vehicle through your personal lease, you will be contributing to a sustainable future and could save money on your taxes. For instance, if you choose an electric car with zero tailpipe emissions, you can pay zero VED. By applying for personal leasing and investing in a low-emission vehicle, you can make an impact and save money.

Lower Fuel Costs

One of the most significant benefits of personal leasing is the tax benefits that it offers. Personal leasing allows you to claim a tax deduction on your lease payments, as it is considered an operating expense. This means that you can reduce your taxable income and lower your tax bill.

Additionally, personal leasing also allows you to reduce your fuel costs, as you can choose a more fuel-efficient car and benefit from improved miles per gallon. With the rise in fuel prices, this can result in significant savings over the course of your lease. Overall, taking advantage of the tax benefits of personal leasing can help you reduce your monthly expenses and save money in the long run.

So if you’re looking to save money on your car expenses, personal leasing might be the right choice for you.

Conclusion

Leasing an electric car in the UK not only saves you money on fuel and maintenance costs, but also offers an array of tax benefits. By taking advantage of these benefits, you’ll not only reduce your carbon footprint, but also your tax bill. So, if you want to save money and do your part for the environment, leasing an electric car may be the way to go.

After all, there’s nothing more electrifying than making a sound financial decision while also helping the planet in the process!”

FAQs

What are the tax benefits of leasing an electric car in the UK?

There are several tax benefits for individuals or companies who lease electric cars in the UK, such as exemption from paying vehicle tax, lower rates for the Benefit-in-Kind (BIK) tax, and 100% first-year allowances for eligible electric vehicles.

How much can I save on vehicle tax if I lease an electric car in the UK?

If you lease an electric car in the UK, you can save up to £320 per year on vehicle tax, as electric cars are exempt from paying this tax.

What is the Benefit-in-Kind (BIK) tax rate for electric cars in the UK?

The BIK tax rate for electric cars in the UK is 1% for the tax year 2021-2022, with plans to increase this to 2% for the following years, which means you can save a significant amount of money on company car tax if you choose to lease an electric car.

What is a first-year allowance for electric cars in the UK?

A first-year allowance is a tax relief that allows businesses to deduct the full cost of an electric car from their pre-tax profits in the year of purchase, which could result in significant tax savings if you choose to lease an eligible electric car in the UK.