The Shocking Truth About Taxable Benefits for Electric Cars: Are You Overpaying?

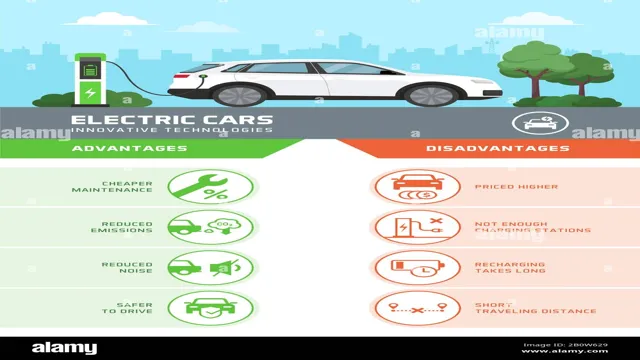

As electric cars continue to gain popularity, more and more people are considering making the switch to this eco-friendly and cost-efficient mode of transportation – and for good reason. Owning an electric car comes with a variety of benefits, including lower fuel costs and reduced carbon emissions. However, as with any type of vehicle ownership, there are taxable benefits to take into consideration.

In this blog post, we’ll delve into the ins and outs of navigating the taxable benefits of owning an electric car. From tax credits to reimbursements, we’ll cover everything you need to know to make the most of your electric vehicle ownership experience. So, let’s dive in and explore how you can maximize your savings while also reducing your carbon footprint!

Overview of Taxable Benefits

If you’ve recently purchased an electric car or are considering it, you may be curious about taxable benefits. In Canada, certain employer-provided benefits, such as a company car or parking spot, are taxable. However, if you’re using an electric car, you may be able to benefit from some tax exemptions and incentives.

The federal government offers a rebate of up to $5,000 for the purchase of an electric vehicle, and some provinces and territories have additional incentives. Additionally, electric cars may be exempt from certain taxes and fees, such as the federal excise tax and the Ontario Drive Clean fee. However, it’s important to remember that any taxable benefits will depend on your specific situation and the policies of your employer.

It’s always best to consult with a tax professional to understand your specific tax obligations when it comes to taxable benefits and your electric car.

Understanding the Taxable Benefit of an Electric Car

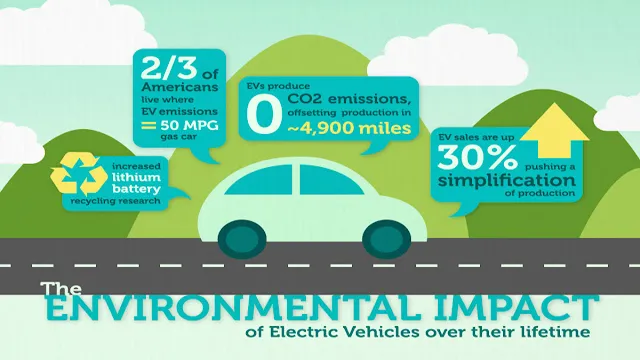

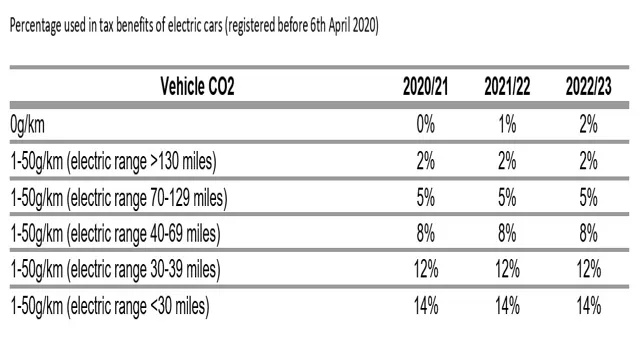

As electric cars become more popular, understanding their taxable benefits is essential. The taxable benefit is the value of the benefit an employee receives from their employer’s provision of an electric car. The taxable value is dependent on various factors, including the CO2 emissions produced by the vehicle and the cost of the car.

To simplify things, the government introduced a flat rate taxable benefit of £0 for electric cars in the tax year 2021-202 This means that employees who receive an electric company car will not pay any tax on the benefit in kind. However, it is important to note that this flat rate taxable benefit will end on April 5th, 202

From April 6th, 2022, new taxable benefit rates will apply, based on the car’s CO2 emissions and list price. Therefore, it’s crucial to check the updated taxable benefit rates to avoid any surprises.

Calculating the Taxable Benefit of an Electric Car

Electric Car Taxable Benefits If you’re a company car driver, it’s essential to know how much tax you’ll be paying on your electric car. The taxable benefit is the value given to the employee for their benefit in kind of using the car. The benefit is taxed on the employee’s income tax, and the tax liability is calculated by multiplying the benefit by the income tax rate.

In the case of electric cars, there is a 0% benefit-in-kind rate in the UK, meaning that you won’t pay any tax on your electric car. Nevertheless, if your employer allowed you to use a company charging point that isn’t considered home charging, this benefit will be subject to taxation. Those who charge their electric cars at home through their employee’s power supply will get a tax exemption, provided the electricity provided is solely for the charging of the car.

Maximizing Taxable Benefits

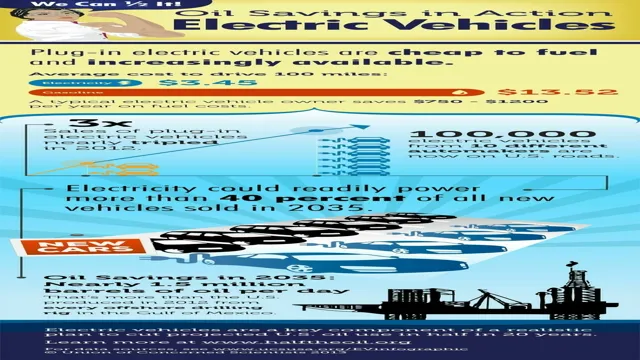

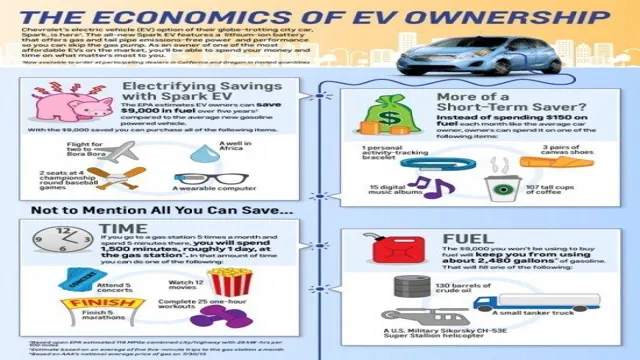

If you’re thinking of purchasing an electric car, there are several tax benefits that could help reduce the overall cost of ownership and maximize your taxable benefits. One of the key benefits is the federal tax credit provided to buyers of electric vehicles. Depending on the make and model of your electric car, you could get a tax credit of up to $7,500.

Additionally, some states offer their own tax credits or incentives for electric car purchases. You should also consider the potential tax savings that come with using an electric car for business purposes. By using an electric car for business travel, you could be eligible for various tax deductions, including fuel and maintenance costs.

To maximize your taxable benefits, consult with a tax professional to make sure you’re taking advantage of all available credits and incentives for electric car ownership. Overall, owning an electric car comes with several tax benefits that can significantly reduce the cost of ownership while also contributing to a cleaner, greener future.

Tax Credits and Deductions for Electric Car Owners

If you’re thinking of purchasing an electric car, it’s worth knowing that there are tax credits and deductions available that can help make your investment more affordable. Two main federal incentives that you may qualify for are the federal electric vehicle tax credit and the qualified electric vehicle (EV) charging station credit. The former provides a tax credit of up to $7,500 for qualified plug-in electric vehicles, while the latter allows for a 30% credit for the installation of a charging unit, up to $1,000.

It’s important to note that these credits are only available to those who purchase a new electric vehicle that qualifies for the credit. It’s also important to research the specific tax laws in your state, as some states offer additional incentives such as rebates or exemptions from certain taxes. Overall, taking advantage of these incentives can make a significant impact on your bottom line.

However, it’s crucial to keep track of all relevant documentation and deadlines to ensure you’re maximizing your taxable benefits. Additionally, it’s worth speaking with a tax professional to ensure you’re fully utilizing all available credits and deductions. By investing in an electric car and taking advantage of these incentives, you’ll not only be making a sustainable choice but also a smart financial one.

Using Employee Discounts for Electric Cars to Your Advantage

Electric Car Employee Discounts If your employer offers employee discounts for electric cars, you could be in luck! Not only can purchasing an electric car help you save on gas bills, but it can also reduce your carbon footprint. However, there’s also an excellent chance that these employee discounts on electric cars come with taxable benefits. If you’re trying to make the most of this perk, it’s necessary to understand these tax requirements.

For instance, if your employer provides a discount on an electric car first available to high-ranking executives, then the tax benefits may differ. Taxable fringe benefits include discounts for assets such as electric vehicles. So before you buy your electric car, work with your HR or tax specialist to figure out the tax implications of these discounts.

Negotiating Electric Car Perks with Employers

As electric cars continue to grow in popularity, many employers are offering incentives to employees who own one. These perks include free charging stations, preferred parking spots, and even financial incentives. However, it’s important to maximize these benefits by ensuring they are being taxed correctly.

By working with your employer to structure these perks as taxable benefits, you can avoid any surprises come tax season. It’s important to negotiate with your employer to find a solution that works best for both parties. By taking advantage of these electric car perks, you can save money and lessen your environmental impact.

Just remember to consult with a tax professional to ensure you’re getting the most out of your benefits.

Avoiding Taxable Benefits

If you’re considering purchasing an electric car, it’s important to be aware of any taxable benefits that could affect your bottom line. While there are certainly incentives available for electric cars, such as tax credits and rebates, there are also potential drawbacks to be aware of. For example, certain employer-provided benefits related to electric cars could be considered taxable income, meaning you would need to pay taxes on those benefits come tax time.

To avoid this, it’s important to carefully review any potential offers or benefits related to your electric car purchase, and possibly consult with a tax professional to ensure you understand the full implications of these benefits. By being aware and proactive, you can ensure your electric car purchase remains financially advantageous.

Opting Out of Taxable Electric Car Benefits

As electric cars become more popular, many businesses are providing their employees with electric company cars to reduce their carbon footprint and support sustainability efforts. However, it’s important to be aware of the taxable benefits that come with these vehicles. If an employee has access to an electric company car for personal use, they may be subject to a taxable benefit, which is based on the value of the car and the number of days it was available for personal use.

To avoid these taxable benefits, employees can opt out of using the electric car for personal use or pay for the value of the benefit. It’s important to understand the tax implications of electric company cars and make informed decisions to avoid any unexpected tax bills.

Managing Your Electric Car Use to Reduce Taxable Benefit Risk

Electric Car Use, Taxable Benefits If you drive an electric car, it’s important to manage your usage to reduce any potential taxable benefit risks. One way to do this is by ensuring you only charge your car at home or at a public charging point, rather than using your workplace’s facilities. If you do need to charge your car at work, make sure you keep accurate records of the exact amount of electricity you use, and declare it to your employer to avoid any confusion.

Additionally, avoid using your company car for personal journeys, as this can also lead to taxable benefits. By managing your electric car usage carefully, you can enjoy all the benefits of electric driving without any unwanted tax implications.

Conclusion: Weighing the Pros and Cons of Taxable Electric Car Benefits

In conclusion, driving an electric car as a taxable benefit may seem like a shocking idea at first, but it’s actually a smart move. Not only does it promote environmental sustainability, but it also saves money on fuel and reduces carbon emissions. The benefits of electric cars are electrifying, so it’s time to plug in and ride into the future of transportation!”

FAQs

What is a taxable benefit for an electric car?

A taxable benefit for an electric car is the amount an employee would have to pay in taxes for the personal use of the company-provided electric car.

How is the taxable benefit for an electric car calculated?

The taxable benefit for an electric car is calculated by multiplying the value of the car by a set percentage determined by the Canadian Revenue Agency (CRA).

Are there any exemptions to the taxable benefit for an electric car?

Yes, there are exemptions to the taxable benefit for an electric car. If the electric car is used for work-related purposes only, then the employee may not have to pay taxes on the personal use of the car.

Can an employee opt-out of the taxable benefit for an electric car?

Yes, an employee can opt-out of the taxable benefit for an electric car. They will need to keep detailed records of their car usage and provide proof that the car was used for work-related purposes only.