Exploring the Financial Perks: Uncovering the Tax Benefits of Owning an Electric Car

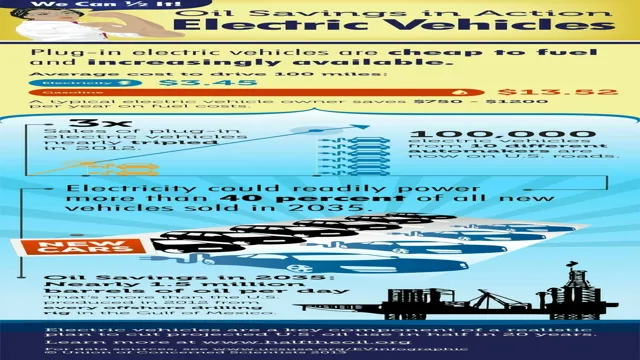

Thinking about making the switch to an electric car? Besides all the environmental benefits, there are also some great tax benefits to consider. Not only will you be saving money on gas, but owning an electric car can also help you save on taxes. With governments around the world trying to reduce carbon emissions, they are offering incentives to people who make the switch.

In this blog post, we will explore how electric cars can help reduce your tax bill and encourage you to make the change to a greener way of driving.

Cost Savings

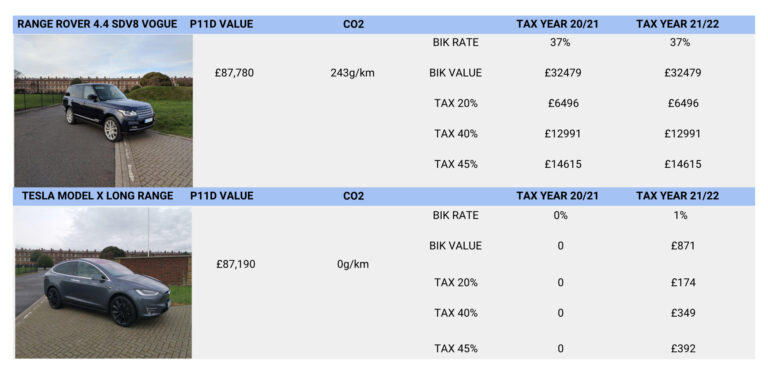

If you’re considering purchasing an electric car, one of the benefits is tax savings. The federal government offers up to a $7,500 tax credit for electric vehicle purchases, depending on the battery’s size and the vehicle’s overall performance. Some states also offer their incentives, including tax credits, rebates, and exemptions from certain fees.

Additionally, electric cars are typically less expensive to maintain than their gas-powered counterparts. They require fewer repairs because they have fewer moving parts and no oil changes. Charging an electric car also costs significantly less than fueling up a gas tank.

Overall, owning an electric car can save you money in both the short and long run. Plus, lowering your carbon footprint is an added bonus.

Federal Tax Credit

If you’re considering switching to solar power, you’ll be happy to know that there’s a federal tax credit you can take advantage of. The federal solar investment tax credit allows you to subtract up to 22% of the cost of your solar system from your federal taxes. This can save you thousands of dollars and make solar power much more affordable.

The tax credit is set to decrease in the coming years, so if you’re thinking of making the switch, it’s best to do it sooner rather than later to maximize your savings. And the best part is, this credit is available to both homeowners and businesses. So not only can you make a positive impact on the environment, but you can also save money while doing so.

State and Local Incentives

State and local incentives are a great way to save costs for businesses. These incentives come in many different forms, including tax credits, grants, and low-interest loans. They are designed to stimulate economic growth and development in a given area, often by encouraging companies to move there or expand their operations.

For businesses, taking advantage of these incentives can mean significant savings on things like equipment purchases, construction costs, and payroll expenses. In addition, many state and local governments offer programs to help businesses reduce energy consumption and promote sustainability, which can lead to further savings. Overall, if you’re a business owner or considering starting a business, it’s worth exploring the potential incentives available in your area to help you save on costs and grow your operations.

Environmental Impact

If you’re considering buying an electric car, you might be curious about the tax benefits of going green. One significant tax benefit of buying an electric car is the federal tax credit. This credit can range from $2,500 to $7,500 depending on the model, and it’s designed to encourage people to opt for more environmentally-friendly transportation.

Some states also offer additional tax credits or rebates for electric car purchases. Additionally, electric cars are eligible for other tax benefits, such as the ability to deduct the cost of charging at a public charging station. However, it’s essential to keep in mind that tax laws can change and that credit amounts may vary depending on several factors.

It’s best to contact a tax professional or consult the IRS website for up-to-date information on the tax benefits of buying an electric car. Overall, choosing an electric car can have numerous benefits, from saving money on fuel costs to reducing your carbon footprint.

Reduced Emissions

Reduced emissions have been a pressing issue for years, as the impact on the environment becomes more and more apparent. The release of greenhouse gases, such as carbon dioxide, methane, and nitrous oxide, contribute significantly to global warming and climate change. As a result, individuals and companies have been encouraged to take steps towards reducing their emissions to limit their impact on the environment.

One way businesses can reduce their emissions is by implementing sustainable practices in their operations, such as using renewable energy sources and eco-friendly products. Additionally, individuals can make conscious choices to reduce their emissions, such as carpooling or using public transportation instead of driving alone. By taking small steps towards reducing our emissions, we can all contribute to a healthier and more sustainable future for our planet.

Global Carbon Footprint

Global Carbon Footprint Our actions have direct consequences on the environment, and our carbon footprint is one of the biggest contributors to climate change. The amount of greenhouse gases released into the atmosphere through our daily activities, like driving cars and producing electricity, contribute to the global carbon footprint. The increasing demand for energy, population growth, and industrialization are major contributing factors, resulting in a growing carbon footprint worldwide.

The more we rely on fossil fuels, the larger our carbon footprint becomes, which in turn accelerates climate change. We have to be more mindful of our carbon footprint and take actions to reduce it, as individuals and as a society. This can be done by limiting the use of fossil fuels, increasing the use of renewable energy, improving energy efficiency, and changing our lifestyle choices.

Ultimately, the responsibility of lessening our carbon footprint falls on all of us, not just businesses and governments. Let’s take action now to ensure a sustainable future for generations to come.

Accessibility to EV Charging Stations

As the demand for electric vehicles (EVs) grows in popularity, one of the critical issues that must be addressed is accessibility to EV charging stations. The lack of charging infrastructure is often cited as one of the biggest barriers to EV adoption. However, it’s not just about providing more charging stations, but also ensuring equitable access to them.

The environmental impact of transportation emissions is a significant concern for our planet, and EVs offer a promising way to reduce these emissions. But for EVs to become a viable option for everyone, regardless of their income or location, access to charging stations must be expanded and made available in areas that have historically been overlooked. The use of public and private partnerships can help to facilitate the expansion of charging infrastructure in underdeveloped regions and promote accessibility for all.

By making it easier for more people to charge their EVs, we can all contribute to reducing our collective carbon footprint.

Future Outlook

If you’re considering purchasing an electric car, you may be wondering what kind of tax benefits you can expect. The good news is that there are several tax incentives currently available to those who buy electric cars. One of the most significant tax benefits is the federal tax credit, which can range from $2,500 to $7,500 depending on the battery size of the car.

Many states, including California, Colorado, Georgia, and Virginia, also offer their own tax incentives for electric car buyers. Additionally, electric car owners can save money on fuel costs since charging an electric car is much cheaper than filling up a traditional gas-powered vehicle. With these tax benefits and cost savings, buying an electric car can be a smart financial decision in addition to being environmentally friendly.

Potential for more Tax Incentives

Looking towards the future, there is a potential for more tax incentives to be offered to individuals and businesses alike. This could be particularly beneficial for those operating within certain industries or those looking to make significant investments in their companies. Governments around the world are becoming increasingly aware of the importance of incentivizing businesses to operate in their countries, and tax breaks are often a key component of this strategy.

With the global economy continuing to recover from the impacts of the pandemic, it is likely that we will see a greater emphasis on tax incentives in the coming years. For companies and individuals that are able to take advantage of these incentives, the benefits could be significant, allowing them to save money and invest more in their businesses or personal lives. However, it is important to keep in mind that tax incentives are often subject to strict guidelines and eligibility criteria, so it’s important to carefully review the details before making any decisions.

Overall, the growing interest in tax incentives is a positive sign for the economy and businesses as a whole, suggesting that governments are keen to support growth and encourage investment.

Shift Towards Renewable Energy

As we look towards the future of renewable energy, there are a few key trends to keep in mind. First and foremost, the shift towards renewable energy is undeniable. As fossil fuels become increasingly expensive and environmentally damaging, more and more countries are investing in solar, wind, and hydro power.

This shift is being driven by both government policies and market forces, and it shows no signs of slowing down. In fact, many experts predict that we are on the cusp of a major renewable energy boom. As technology improves and costs continue to fall, renewable energy is becoming more and more competitive with traditional sources of energy.

This means that in the coming years, we can expect to see a major shift towards renewable energy, as both governments and private companies invest in wind and solar farms, hydropower plants, and other forms of clean energy. Of course, there are still many challenges to be overcome if we are to fully transition to renewable energy. One major challenge is the intermittency of renewable energy sources.

Since solar and wind power rely on the weather, they can be unreliable sources of energy if they are not backed up by storage technology. However, there are already promising developments in this area, and many experts believe that energy storage will be the key to unlocking the full potential of renewable energy. All in all, the future looks bright for renewable energy.

With governments and corporations investing heavily in wind, solar, and hydro power, and with new technologies making these energy sources even more reliable and cost-effective, we can expect to see a major transition towards a clean energy future in the coming years. It’s an exciting time to be part of the renewable energy industry, and there is no doubt that the shift towards clean energy will have a positive impact on both our environment and our economy.

Conclusion

In conclusion, the tax benefit of buying an electric car goes beyond simply saving money on gas. It also allows you to take advantage of various federal and state tax credits aimed at encouraging eco-friendly transportation choices. Plus, who wouldn’t want to drive a car that not only saves the planet but also saves their wallet? So, join the electric car revolution and let’s power towards a greener future, one tax credit at a time!”

FAQs

What is the maximum tax credit available for buying an electric car?

The maximum federal tax credit available for buying an electric car is $7,500. However, the actual credit amount can vary depending on the model and manufacturer.

Do state governments also offer tax incentives for buying an electric car?

Yes, several states offer additional tax incentives for buying an electric car. For example, California offers a rebate of up to $2,500 for electric and hydrogen fuel cell cars.

Is there a limit on the number of electric cars that are eligible for tax incentives?

Yes, there is a limit on the number of electric cars that are eligible for tax incentives. Once a manufacturer reaches a certain threshold of selling electric cars, the tax credit amount for that manufacturer’s cars begins to phase out.

Are there any other benefits to buying an electric car besides tax incentives?

Yes, there are several other benefits to buying an electric car. They produce fewer emissions, have lower maintenance costs, and can be more fuel efficient than traditional gas-powered cars. Additionally, some states offer perks such as HOV lane access or free public charging.