Revolutionary New Battery Technology Powers Up Electric Car Stocks

Electric vehicles (EVs) have gained a lot more attention lately because of the environmental impact of traditional fuel-powered cars. However, many people are still wary to switch to EVs due to concerns over battery life and range. Fortunately, advancements in technology have allowed for the creation of new battery tech that could revolutionize the EV industry.

Several companies are developing new battery technologies that promise to increase the lifespan and efficiency of EVs, which is great news for both the environment and investors. In this article, we will explore the recent developments in the EV battery sector and the potential impact on EV stocks. So, buckle up and get ready to learn about the latest and greatest in the world of EVs!

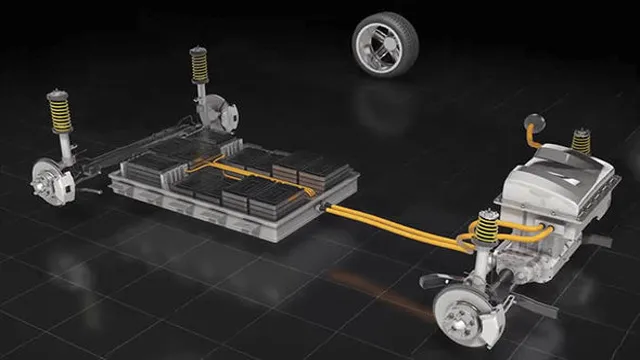

Current Battery Technology

As the demand for electric cars continues to grow, car manufacturers are constantly exploring newer battery technologies that can provide longer driving ranges and faster charging times. They are investing heavily in developing solid-state batteries, which have the potential to be more efficient and safer than traditional batteries. Solid-state batteries use a solid electrolyte instead of a liquid one, which reduces the likelihood of leaks and increases safety.

It also has the potential to increase the energy density, meaning that cars could travel further on a single charge. Companies like Toyota, Samsung, and QuantumScape are racing to commercialize this technology and bring it to the market. As newer battery technologies like solid-state batteries become more prevalent, the stock of companies involved in their manufacture and development is expected to rise, making it an exciting time to invest in the new battery technology for electric cars stock.

Lithium-ion

Lithium-ion batteries are currently the most popular type of battery technology, used in everything from smartphones to electric cars. One reason for their popularity is their high energy density, which allows them to hold more energy in a smaller and lighter package. This makes them ideal for portable devices and electric vehicles, where weight and size are important considerations.

Another advantage of lithium-ion batteries is their ability to hold a charge for longer periods of time, which means less frequent charging and longer lifespan. Despite these advantages, lithium-ion batteries are still not perfect, and there are concerns about their safety and environmental impact. They are known to be prone to overheating and fires, and their production and disposal can have negative environmental consequences.

Nevertheless, lithium-ion batteries remain the go-to choice for many applications due to their efficiency and convenience.

Nickel-metal hydride (NiMH)

One of the most common types of rechargeable batteries available on the market today is the nickel-metal hydride, or NiMH, battery. This type of battery is widely used in various applications, including toys, remote controls, flashlights, and even hybrid cars. NiMH batteries offer several advantages over other rechargeable batteries, such as nickel-cadmium (NiCad) batteries.

For example, they have a higher capacity, allowing them to hold more power and last longer. They are also less harmful to the environment than NiCad batteries, which contain toxic materials such as cadmium. However, one downside of NiMH batteries is that they can lose their charge more quickly than other types of batteries, which may limit their usefulness in certain situations.

Despite this, NiMH batteries remain a popular choice for many consumers due to their superior performance and eco-friendliness.

Promising New Technologies

Electric cars are gaining popularity as more people seek to reduce their carbon footprint, but one hurdle to their widespread use is finding a battery that is both long-lasting and affordable. However, there is promising new battery technology on the horizon that could address these concerns. Scientists are experimenting with a variety of approaches, such as solid-state batteries, and some companies are already investing in the research and development of these technologies.

As a result, investors are taking notice, with the new battery technology for electric cars stock showing signs of growth. This could create exciting opportunities for those interested in the energy sector, as well as those who want to support environmentally friendly transportation options.

Solid-state batteries

Solid-state batteries are a promising new technology that could revolutionize the way we power our everyday devices. These batteries use solid electrolytes rather than the liquid electrolytes found in traditional batteries. This results in several advantages, such as increased safety, longer lifespan, and higher energy density.

Unlike liquid electrolytes, solid electrolytes cannot leak or catch fire, making them a safer alternative for consumer electronics and electric vehicles. Additionally, solid-state batteries have the potential to store more energy in a smaller space, providing longer-lasting power for our devices and better range for electric vehicles. This technology is still in its early stages, but companies like Toyota and Samsung are investing heavily in its development.

With continued advancements, we may soon see solid-state batteries become the new standard in energy storage.

Lithium-sulfur (Li-S)

Lithium-sulfur (Li-S) batteries are a promising new technology that could revolutionize the way we power our devices. Unlike traditional lithium-ion batteries, which use graphite as the anode material, Li-S batteries use sulfur. This allows them to store more energy per unit of weight, which means that Li-S batteries could potentially offer much longer battery life for smartphones, laptops, and electric vehicles.

Additionally, sulfur is cheap and abundant, which could make Li-S batteries more cost-effective than current lithium-ion technologies. However, there are still some challenges to overcome, such as the tendency of sulfur to dissolve in the electrolyte, which can lead to the formation of polysulfides and reduce the battery’s overall efficiency. Despite these challenges, researchers are continuing to work on improving Li-S battery technology and exploring its potential applications in the future.

Graphene-based batteries

Graphene-based batteries are a promising new technology that could revolutionize the way we power our devices. Graphene, a material made up of a single layer of carbon atoms, has incredible conductivity and strength, which makes it an excellent candidate for high-performance batteries. These batteries have the potential to be much lighter and more compact than traditional lithium-ion batteries while also offering faster charging times and longer lifetimes.

Imagine being able to charge your phone in just a few minutes and not have to worry about replacing the battery for years! While graphene-based batteries are still in the early stages of development, they hold tremendous promise for the future of technology. As research continues, we may soon see these batteries powering everything from smartphones to electric cars.

Implications for Stock Market

Investors looking to take advantage of the growth of electric vehicles should keep an eye on the new battery technology being developed. With battery technology improving rapidly, electric cars are becoming more and more popular, leading to increased demand for companies who produce them. One company on the forefront of this innovation is Tesla, who recently announced plans to significantly increase production of their new battery technology called the 4680.

This could have a major impact on the stock market, as Tesla’s success could signal a shift towards renewable energy and away from traditional combustion engines. Additionally, other companies in the electric vehicle space, such as NIO or General Motors, could see their stock prices rise as well as they incorporate new battery technology into their own vehicles. Keep an eye on news related to the development and implementation of new battery technology for electric cars – it could be the key to finding the next hot stock.

Increased Demand for EVs

The world is moving towards a greener future, and as more people become aware of the need to reduce their carbon footprint, there has been an increased demand for electric vehicles (EVs). This has big implications for the stock market, with many investors now turning to companies that are involved in the production of EVs. Companies like Tesla have seen a surge in their stock prices, and even traditional car manufacturers like General Motors and Ford are stepping up their electric vehicle game.

Investors are increasingly looking for companies that are committed to sustainability and reducing emissions, and those that are able to innovate in the production of EVs are likely to see significant growth in their stock prices. In addition, companies that are involved in the development of EV infrastructure, such as charging stations and battery technology, are also expected to see growth in the coming years. As the demand for EVs continues to grow, we can expect to see a shift in the market, with traditional fossil fuel-based industries being phased out in favor of cleaner, more sustainable options.

While the transition may be bumpy at times, the long-term outlook for the stock market and the planet is looking positive. It’s an exciting time for investors who are looking to make a positive impact and grow their portfolio at the same time.

New Investment Opportunities

With the constant evolution and technological advancements in the modern world, new investment opportunities have emerged, providing investors with multiple ways to diversify their portfolio. But what does this mean for the stock market? As more investors start investing in alternative markets, such as cryptocurrencies or real estate investment trusts (REITs), it could potentially shift the overall demand and supply within the stock market. This shift could create new opportunities and challenges for investors, requiring a different approach to trading and investing.

Nevertheless, with these new opportunities, investors can potentially earn large returns with higher risk levels, giving them the chance to increase their overall wealth. However, it is essential to remember the importance of diversification in any investment portfolio, as putting all of one’s eggs in one basket is never a wise decision. As with any investment, conducting thorough research and seeking advice from professionals is essential to making informed decisions for long-term profitability.

Conclusion

In the world of electric cars, battery technology is the lifeblood that keeps us moving forward. And with new advancements in battery tech, the future is looking brighter than ever before. Imagine driving for days without needing to recharge, or zooming past gas stations with a smug grin on your face.

That’s the promise of the new battery technology for electric cars stock. As investors, it’s time to rev up those engines and get ready for the ride of our lives. The road ahead may be long, but with these new batteries powering us forward, we’re sure to come out on top.

“

FAQs

What is the latest new battery technology for electric cars on the stock market?

The latest new battery technology for electric cars on the stock market is lithium iron phosphate (LiFePO4) batteries, which are gaining popularity due to their high safety, longer lifespan, and lower cost compared to other battery types.

Are there any promising startups in the new battery technology industry for electric cars?

Yes, there are several promising startups in the new battery technology industry for electric cars, including QuantumScape, Solid Power, and SES Inc. These companies are working to develop solid-state batteries that offer higher energy density, faster charging, and longer lifespan than traditional lithium-ion batteries.

How is the new battery technology affecting the stock prices of companies in the electric car industry?

The new battery technology is having a significant impact on the stock prices of companies in the electric car industry, particularly those that are investing heavily in research and development of new battery technologies. Companies that are perceived to be leaders in this area, such as Tesla and Panasonic, have seen their stock prices rise in recent years.

What challenges does the new battery technology face in terms of mass adoption for electric cars?

The new battery technology faces several challenges in terms of mass adoption for electric cars, including high manufacturing costs, limited availability of critical raw materials, and concerns about safety and reliability. Additionally, the infrastructure for charging and servicing these new batteries is still being developed, which may slow down adoption in the short term.