Drive into Savings: Exploring the Tax Benefits of Owning an Electric Car

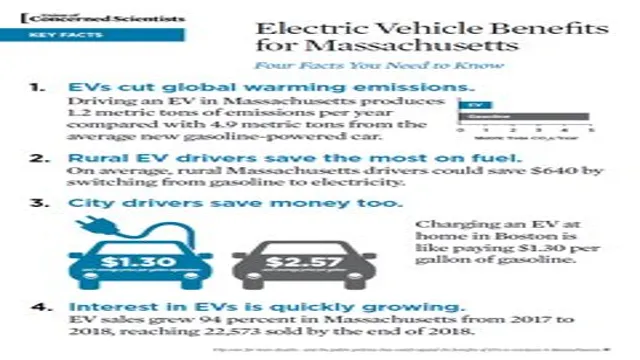

Electric cars have gained increased popularity among drivers who are environmentally-conscious and seeking to save on fuel costs. Additionally, electric cars come with the added benefit of tax incentives from governments worldwide. Tax benefits of electric cars vary depending on the country, state or province, and even local governments.

Therefore, it is essential to be aware of the tax benefits and incentives that apply in your area. In this blog, we will explore the tax benefits of electric cars, how they vary across different nations and provide tips on how to take advantage of these incentives. So if you’re considering purchasing an electric vehicle, keep reading to learn how you can save some money while doing your bit for the environment.

Federal Tax Credit

If you are in the market for a new car and considering an electric vehicle (EV), you may be wondering if there are tax benefits to buying one. The good news is, there is a federal tax credit available to eligible EV buyers. This tax credit can potentially save you thousands of dollars on your income tax return.

However, it’s important to note that the credit amount and eligibility requirements vary depending on the make and model of the EV. For example, Tesla and General Motors no longer qualify for the tax credit due to exceeding the sales threshold, while other EV manufacturers still do. Additionally, the tax credit begins to phase out once a manufacturer reaches a certain sales volume, so it’s important to check the IRS website to confirm eligibility before making a purchase.

Overall, purchasing an EV with the federal tax credit can provide a great opportunity to save money and make a positive environmental impact.

Up to $7,500 in tax credits for a new electric car.

If you’re in the market for a new electric car, you might be pleased to know that you could qualify for a federal tax credit of up to $7,500. This generous credit was introduced in an effort to incentivize Americans to purchase more environmentally-friendly vehicles. Of course, not every electric car is eligible for the full credit; the amount you can claim depends on the make and model of the vehicle you choose.

However, with many electric cars currently on the market priced below $30,000, the tax credit could make a significant dent in the overall cost. It’s also worth noting that the credit is only available to those who purchase a brand new electric car, rather than a used one. If you’re considering making the switch to electric, it’s definitely worth doing your research to see which models are eligible for the tax credit and what other incentives may be available to help you make the leap.

Credit begins to phase out after manufacturer sells 200,000 eligible vehicles.

The Federal Tax Credit on electric vehicles is a fantastic incentive for consumers to make the switch to electric cars. With the credit, EV buyers can receive a significant discount on their federal taxes, potentially saving them thousands of dollars. However, it’s important to note that this credit doesn’t last forever.

After a manufacturer sells 200,000 eligible vehicles, the credit begins to phase out. This means that the credit amount will decrease over time until it eventually disappears altogether. So, if you’re considering buying an EV and want to take advantage of the Federal Tax Credit, it’s essential to act fast before the credit starts to phase out.

However, it’s worth noting that not all EV manufacturers have hit the 200,000 cap yet, so it’s worth researching and finding out which companies still offer the full rebate. Overall, while the credit’s eventual phase-out may be disappointing for some, it’s still an excellent incentive for consumers to transition to more sustainable and environmentally-friendly transportation options.

State and Local Incentives

A major perk of buying an electric car that often goes overlooked is the potential tax benefits. State and local governments frequently offer incentives to encourage drivers to switch from gas-powered vehicles to electric ones. These incentives can come in many forms, including tax credits, rebates, and even exemptions from certain fees and taxes.

For example, in California, electric vehicle owners can receive a rebate of up to $2,000, and they are also eligible for carpool lane access, reducing commute times. New York offers a rebate of up to $2,000 as well, along with a sales tax exemption and a reduced registration fee. It’s worth looking into incentives available in your state or city, as they can make the transition to an electric car more affordable and financially worthwhile in the long run.

Over 40 states and numerous local governments offer electric vehicle incentives.

If you’ve been considering purchasing an electric vehicle, there may be more incentives available than you realize. Over 40 states and numerous local governments offer electric vehicle incentives, making it easier and more affordable to switch to a cleaner mode of transportation. These incentives can come in the form of tax credits, rebates, and even free parking or charging stations.

Depending on where you live and the specific vehicle you choose, you could save thousands of dollars on your purchase. Not only will you be helping the environment, but you’ll also benefit from lower maintenance costs and cheaper fuel expenses. It’s worth doing your research and exploring the incentives available in your area to see how you could make the switch to an electric vehicle more economical.

Examples include tax exemptions, rebates, and HOV lane access.

If you’re looking to buy an electric vehicle, there has never been a better time to do it. In addition to federal incentives, there are a host of state and local incentives that can make owning an EV even more affordable. For example, some states offer tax exemptions or rebates for purchasing an electric vehicle.

Additionally, some cities and states offer preferential parking, allowing EV owners to park closer to their destination or in designated charging spots. HOV lane access is another common perk, allowing EV owners to skip traffic and save time on their commute. These incentives vary by location, so it’s worth researching what’s available in your area.

By taking advantage of these state and local incentives, you can save money while reducing your carbon footprint.

Savings on Gasoline

Many people have started considering the purchase of electric cars due to the significant savings it offers on gasoline. Unlike traditional gasoline cars, electric cars are powered by electricity, which is much cheaper than gasoline. You might even be eligible for some tax benefits if you decide to buy an electric car, which is even more tempting.

Owning an electric car not only reduces your carbon footprint but also minimizes your dependence on fossil fuels. Moreover, maintenance costs for electric cars are generally much lower than traditional cars as they have fewer moving parts. When you consider all these factors, buying an electric car can be a good investment in the long run.

So, the short answer is, yes, there are tax benefits to buying an electric car, which together with the savings on gasoline and other factors could make it a wise investment.

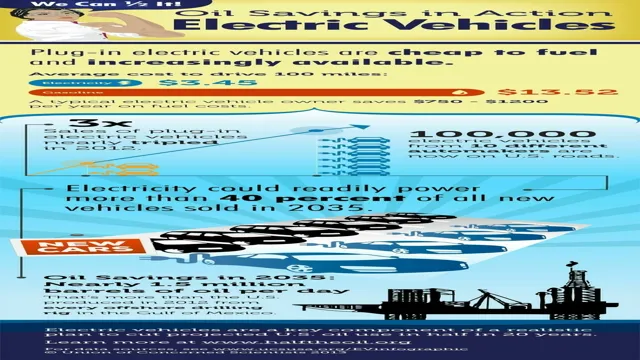

Not technically a tax benefit, but electric vehicles can save drivers thousands on gasoline costs over the life of the vehicle.

Saving money on gasoline is one of the many benefits of owning an electric vehicle. While not technically a tax benefit, the money saved on gas costs can add up to thousands over the life of the vehicle. This is because electric vehicles run purely on electricity, meaning they do not require gasoline to function.

Instead, they recharge using a charging station or a regular household outlet. The cost of electricity is generally lower than gasoline, making it a smart financial choice. Additionally, electric vehicles tend to be more energy-efficient, meaning they use less energy to travel the same distance as a gasoline-powered vehicle.

This means that the savings on gasoline costs are even higher. So, while electric vehicles may have a slightly higher upfront cost, the potential savings on gas costs make them a sound investment in the long run.

Less expensive to maintain and repair than traditional gas vehicles.

As electric vehicles become more popular, more people are realizing the benefits of owning one. One of the biggest advantages is the savings on gasoline. Electric vehicles can travel up to 100 miles on a single charge, reducing the need to refuel.

This alone can save owners hundreds, if not thousands, of dollars a year. In addition, electric vehicles are less expensive to maintain and repair than traditional gas vehicles. Without traditional gas engines, there are fewer moving parts, meaning less wear and tear.

This translates to lower maintenance costs and fewer repairs over time. And with electric vehicles becoming more common, repair shops are becoming better equipped and more knowledgeable about servicing electric vehicles, making repairs more affordable and less time-consuming than they were just a few years ago. Overall, owning an electric vehicle can be a smart financial decision, not only for the planet but for your wallet as well.

Conclusion

In conclusion, while buying an electric car may not be a guaranteed way to save money on taxes, there are certainly some benefits to be had. From federal tax credits and state incentives to lower overall maintenance costs, the appeal of an electric vehicle is undeniable. Plus, let’s not forget the added benefit of reducing your carbon footprint and helping to create a cleaner, more sustainable future.

So, while you may not be able to drive off into the sunset with a giant bag of tax deductions, you can certainly enjoy the peace of mind that comes with doing your part to protect the planet and save a little cash along the way.”

FAQs

What are the tax benefits of buying an electric car?

There are several tax benefits to buying an electric car, including a federal tax credit up to $7,500, state incentives, and lower sales tax in some states.

How much is the federal tax credit for buying an electric car?

The federal tax credit for buying an electric car is up to $7,500.

Are there state incentives for buying an electric car?

Yes, many states offer incentives such as rebates, tax credits, or free charging to drivers who buy electric cars.

Does buying an electric car lower your overall tax liability?

It can, as the federal tax credit and state incentives can reduce the amount of taxes you owe. Additionally, some states offer lower tax rates for electric vehicles.