All You Need to Know About Tax Benefits While Purchasing a Hybrid Electric Car

If you are looking to reduce your carbon footprint and save money on taxes, owning a hybrid car is an excellent option. Hybrid cars provide several tax benefits that can save you hundreds or even thousands of dollars every year. The increasing concern for climate change and carbon emissions have made hybrids popular among car buyers.

They are not only environmentally friendly but also economically viable in the long run. In this blog, we will explore various tax benefits of owning a hybrid car, helping you make an informed decision while buying your next vehicle. So, if you are interested in saving money on taxes and contributing towards the green cause, keep reading!

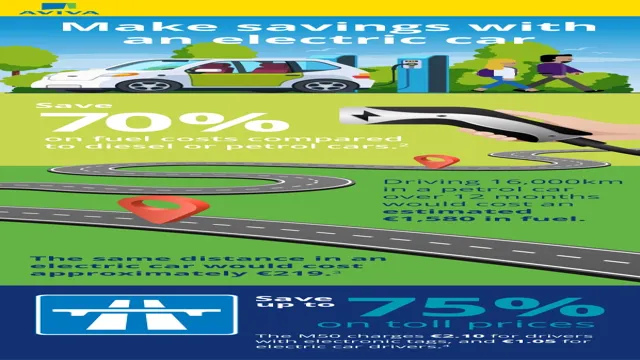

Lower Fuel Costs

If you are thinking about buying a hybrid electric car, you may be wondering if there are any tax benefits available. The answer is yes, there are! You may be able to take advantage of federal tax credits, which can help lower the overall cost of your car. These credits vary depending on the make and model of your hybrid, so it’s important to do your research before making a purchase.

Additionally, hybrid cars are known for their lower fuel costs, which means you’ll be saving money at the pump over the life of the vehicle. While tax credits may not completely offset the higher upfront cost of a hybrid, they can certainly make the investment more attractive. So, if you’re eco-conscious and looking to save money on fuel costs in the long run, a hybrid electric car can be a great choice.

Fuel Efficient

When it comes to owning a car, one of the most significant ongoing expenses is fuel costs. Not only can these costs add up quickly, but they can also be unpredictable, leaving you scrambling to adjust your budget accordingly. However, by choosing a fuel-efficient vehicle, you can lower these costs and enjoy more predictable expenses.

Fuel-efficient vehicles utilize technology that allows them to get more miles per gallon, meaning you’ll spend less on gas over time. Plus, by decreasing your carbon footprint, you’ll be doing your part to reduce your impact on the environment. So if you’re looking to save money on fuel costs and make a positive change, consider investing in a fuel-efficient car.

Good for Environment

Lower Fuel Costs One of the biggest advantages of electric vehicles is their lower fuel costs. As opposed to traditional gas-guzzlers, electric cars rely on electricity as their primary fuel source. This means that their owners can save a substantial amount of money on fuel costs, as electricity is far cheaper than gasoline.

In fact, according to a recent study, the average EV owner can save up to $1,000 a year on fuel costs alone. What’s more, as electricity prices continue to fall, this savings is only set to increase. While the initial cost of purchasing an EV may be slightly higher than that of a traditional vehicle, the long-term savings of reduced fuel costs mean that it is an investment well worth making.

Not only does this benefit the individual owner, but it also has a positive impact on the environment, as reduced fuel consumption means fewer emissions and a cleaner planet.

Tax Credits

If you’re considering purchasing an electric hybrid car, you may be wondering if there are any tax benefits to doing so. Fortunately, the answer is yes! The federal government currently offers a tax credit for qualifying electric vehicles, which includes most hybrid models. The amount of the credit varies depending on several factors, including the type of car and its battery size.

However, some states also offer additional incentives, such as rebates or tax exemptions. These benefits can make purchasing an electric hybrid car more affordable in the long run, as they can help offset the initial cost. Plus, there are the added benefits of lower fuel and maintenance costs and reduced emissions.

So not only is buying a hybrid electric car good for the environment, it can also be good for your wallet.

Federal Tax Credit

The Federal Tax Credit is a government program that provides tax incentives for eligible taxpayers in order to encourage certain behaviors or activities that benefit the economy or society. Tax credits can be claimed by individuals or businesses that have incurred expenses in specific categories, such as education, energy efficiency, or charitable donations. These credits can be deducted directly from the taxpayer’s federal tax liability, reducing the amount of tax owed, or even resulting in a refund if the credit exceeds the tax liability.

For example, the Residential Energy Efficient Property Credit can save homeowners up to 30% of the cost of installing renewable energy systems like solar panels or geothermal heat pumps. It’s important to note that tax credits often have specific eligibility requirements and expiration dates, so it’s important to seek professional advice or consult the IRS website for up-to-date information. Overall, the Federal Tax Credit program is a valuable tool for taxpayers looking to reduce their tax burden while also supporting important initiatives.

State Tax Credits

Tax credits are a type of incentive offered by state governments to encourage certain behaviors or activities that benefit the state and its residents. These credits can take many forms, from credits for alternative energy production to child care expenses. They work by reducing the amount of taxes owed by a taxpayer and can even lead to a refund in some cases.

One benefit of tax credits is that they are generally available to a wide range of taxpayers, including individuals, businesses, and charities. However, the eligibility requirements for many credits can be complex, and the amount of credits available may be limited, so it’s important to do your research and work with a qualified tax professional to ensure you receive all the credits you’re entitled to. Overall, tax credits can play a significant role in reducing your tax burden and incentivizing desired behavior, so it’s worth exploring what credits may be available to you.

Additional Incentives

Tax Credits In addition to the cost savings and environmental benefits of switching to solar energy, homeowners and businesses can also take advantage of tax credits to further offset the initial investment. The federal government offers a solar Investment Tax Credit (ITC), which allows homeowners and businesses to deduct up to 26% of the total cost of installing solar panels from their federal taxes. This credit is set to decrease in the coming years, so now is a great time to take advantage of the full 26% credit before it drops.

Additionally, some states offer their own tax incentives for switching to solar energy, further adding to the potential savings. It’s important to research and understand all the available tax credits and incentives for your specific location and situation, as they can make a significant impact on the overall cost of going solar. By taking advantage of these incentives, not only will you be contributing to a sustainable future, but you’ll also be saving money in the long run.

Tax Deductions

If you’re considering buying a hybrid electric car, you may be wondering if there are any tax benefits to doing so. The answer is yes, there are! The federal government currently offers a tax credit for buyers of eligible plug-in hybrid electric vehicles, which can range from a few thousand dollars up to $7,500 depending on the make and model of the vehicle. Additionally, some states offer their own tax credits or rebates for hybrid or electric car purchases, so it’s worth researching what incentives are available in your area.

Not only can buying a hybrid electric car save you money on fuel costs in the long run, but it can also provide a financial benefit up front through tax deductions. Encouraging the use of fuel efficient and environmentally-friendly vehicles is a priority for many governments, and taking advantage of these tax benefits is a great way to support this movement while also saving money as a car owner.

Deductible Expenses

Tax deductions are a great way to reduce your tax burden. By claiming deductible expenses on your tax return, you can lower your taxable income, which in turn lowers your tax liability. Deductible expenses can include a variety of things such as medical expenses, charitable donations, business expenses, and many others.

However, it’s important to note that not all expenses are deductible, and the rules and regulations surrounding deductions can be tricky. That’s why it’s important to speak with a tax professional to ensure that you’re claiming all of the deductions you’re entitled to. Think of deductible expenses as a tool to help you keep more of your hard-earned money.

When you take advantage of tax deductions, you’re essentially telling the government, “I earned this money, and I’m using it for purposes that benefit me and my community.” So, be sure to keep good records of all of your deductible expenses, and consult with a tax professional to make the most of your tax deductions.

Depreciation Deduction

When it comes to taxes, every deduction counts and depreciation is one that shouldn’t be overlooked. Depreciation is a tax deduction that allows businesses to deduct the cost of an asset over its useful life. For example, if you purchase a new vehicle for your business, you can deduct a portion of the cost each year for the life of the vehicle.

This deduction can help reduce your taxable income and ultimately save you money on your tax bill. It’s important to note that not all assets qualify for depreciation and the depreciation methods can vary. It’s best to consult with a tax professional to ensure you are taking advantage of all available depreciation deductions.

Don’t miss out on this valuable deduction that could potentially save you thousands on your taxes each year.

Conclusion

In conclusion, yes, buying a hybrid electric car can indeed provide tax benefits. Not only can you save money on gas and reduce your carbon footprint, but the government also rewards you with potential tax credits and deductions. So, not only can you feel good about doing your part for the environment, but your wallet may thank you come tax time.

It’s a win-win situation that’s both clever and witty!”

FAQs

What are the tax benefits of buying a hybrid electric car?

There are several tax benefits to purchasing a hybrid electric car, including federal tax credits and potential state incentives. These benefits can help offset the higher purchase price of the vehicle.

How much is the federal tax credit for buying a hybrid electric car?

The federal tax credit for purchasing a new hybrid electric car ranges from $2,500 to $7,500, depending on the make and model of the vehicle. The credit amount is gradually phased out once a certain number of qualifying vehicles are sold by the manufacturer.

Are state tax incentives available for buying a hybrid electric car?

Yes, many states offer additional tax incentives for purchasing a hybrid electric car. These incentives can include tax credits, exemptions from sales tax, and discounts on vehicle registration fees.

Are there any restrictions on qualifying for tax benefits when buying a hybrid electric car?

Yes, there are several restrictions that apply to qualifying for tax benefits when purchasing a hybrid electric car. These can include income limits, vehicle purchase date requirements, and restrictions on the type and size of the vehicle. It is important to consult with a tax professional to determine your eligibility for these benefits.