Are There Tax Benefits to Getting an Electric Car? Unveiled!

Electric cars are becoming popular. More people choose them. They are good for the environment. But, many people ask, “Are there tax benefits to getting an electric car?” Let’s explore this topic together.

What is an Electric Car?

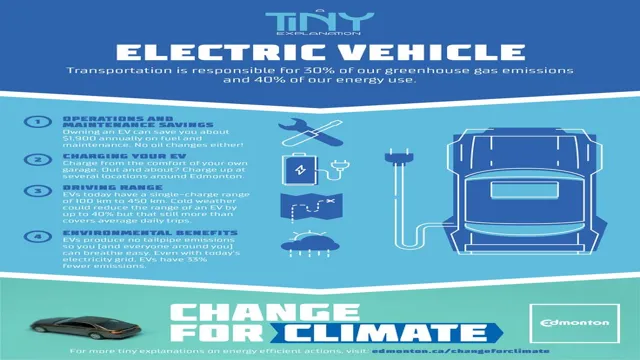

First, what is an electric car? An electric car runs on electricity. It uses batteries. These batteries can be charged at home or at charging stations. Electric cars do not use gas. This is why they are good for our air.

Why Choose an Electric Car?

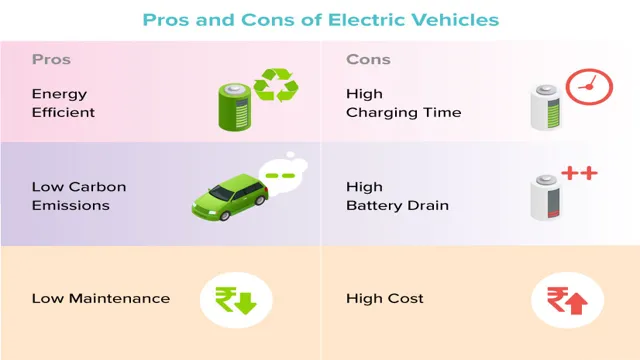

Many people choose electric cars for a few reasons:

- They save money on gas.

- They are better for the environment.

- They can have lower maintenance costs.

- They can be fun to drive.

Tax Benefits Explained

Now, let’s talk about tax benefits. Tax benefits can help you save money. The government wants people to use electric cars. They give incentives to encourage this. Here are some common tax benefits for electric car owners:

1. Federal Tax Credit

The federal government offers a tax credit. This credit can be up to $7,500. The amount depends on the car’s battery size. You can claim this credit when you file your taxes. But, not all electric cars qualify. Check if your car is eligible.

2. State Tax Credits

Many states offer their own tax credits. These can be different in each state. Some states give cash rebates. Others may have tax credits. Check with your state’s tax office. They can tell you what you can get.

3. Sales Tax Exemptions

Some states do not charge sales tax. This can save you money when you buy a car. If your state has this rule, it is a great benefit. Make sure to ask about this when buying your car.

4. Reduced Registration Fees

In some places, electric cars have lower registration fees. This means you pay less to register your car each year. Check with your local DMV. They can explain if this applies to your car.

5. Hov Lane Access

Some areas allow electric cars in HOV lanes. HOV lanes are for cars with more than one person. This can save time during rush hour. Check your local rules for details.

How to Claim Tax Benefits

Now, how do you claim these benefits? It is not very hard. Here are the steps:

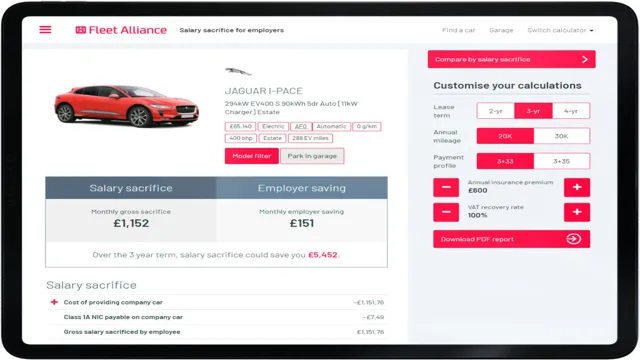

- Buy or lease an eligible electric car.

- Keep all your receipts and documents.

- When tax season comes, fill out the correct forms.

- Submit your forms with your tax return.

It is important to do this right. Incorrect forms can delay your benefits.

Things to Consider

Before you get an electric car, think about these points:

- Check if your car qualifies for tax benefits.

- Know your state’s rules on incentives.

- Consider the total cost of owning an electric car.

- Look into charging options near your home.

Future of Electric Cars and Tax Benefits

Electric cars are growing in popularity. Many people see the benefits. Governments want to help more people buy them. They may add new tax benefits in the future.

As more electric cars come to the market, rules may change. Stay informed about these changes. Follow news about electric cars and taxes.

Frequently Asked Questions

What Are The Tax Benefits Of Electric Cars?

Electric cars often qualify for federal and state tax credits. These can lower your overall tax bill.

How Much Can I Save On Taxes With An Electric Car?

The federal tax credit can be up to $7,500. State credits may add more savings.

Do Electric Cars Have Lower Registration Fees?

Yes, some states offer lower registration fees for electric vehicles. Check local laws for details.

Can I Get A Tax Credit For Used Electric Cars?

Yes, some tax credits apply to used electric vehicles. Check eligibility requirements in your state.

Conclusion

In conclusion, there are tax benefits to getting an electric car. Federal and state governments offer incentives. These can save you money when buying a car. Before you decide, check the rules. Make sure you know all the benefits. Electric cars are not only good for the environment. They can also be good for your wallet.

Think about your needs and options. Electric cars can be a smart choice. They help reduce pollution. They can save you money in the long run. If you have more questions, ask a tax professional. They can guide you to make the best choice.