Shocking Growth Potential: The Top Battery Companies for Electric Cars Stocks

Electric cars are the future of the automobile industry, and battery technology is what makes it all possible. But have you ever wondered which companies are behind the batteries that power these electric vehicles? With so many options in the market, it can be quite perplexing to know which companies are the best in the business. That’s where we come in.

In this blog post, we will dive into the world of battery companies for electric cars and explore the top players in the game. We’ll burst the myths and uncover the facts that will help you make an informed decision when choosing the best battery for your electric car. So, buckle up and get ready to explore the electrifying world of batteries and electric cars.

Top Stocks

Are you interested in investing in battery companies for electric cars? If so, there are several stocks to consider. One option is Tesla, which not only produces electric vehicles but also designs and manufactures battery systems. Another choice is Panasonic, which is a major supplier of lithium-ion batteries for Tesla’s vehicles.

Other companies to keep an eye on include Contemporary Amperex Technology Co Ltd (CATL), a Chinese battery manufacturer, and LG Chem Ltd, a South Korean company that supplies batteries to automakers like General Motors and Hyundai. It’s important to thoroughly research these companies before making any investment decisions, but with the growth of the electric vehicle industry, battery companies are likely to be a solid choice for long-term investments. So, keep a close eye on these top battery companies for electric cars stocks and watch your investments grow with the adoption of electric vehicles.

Tesla (TSLA)

Tesla (TSLA) Tesla is an American electric vehicle and clean energy company that was founded in 200 It is one of the top stocks to look out for when investing in the stock market. Tesla’s popularity has been soaring in recent years due to its innovative and sustainable products that cater to the current climate change crisis.

From electric cars to solar panels, Tesla has always been at the forefront of creating eco-friendly products that not only benefit the environment but also provide excellent performance. The company’s stock has had a bursty performance in the stock market, making it a popular choice of investment. However, with its high volatility and perplexing nature, investing in Tesla requires a thorough understanding of the company and its products.

Whether you’re a seasoned investor or just starting, Tesla is a company that deserves attention in your investment portfolio.

BYD Company Ltd (BYDDF)

If you’re looking to invest in top stocks, BYD Company Ltd (BYDDF) may be worth considering. BYD is a leading producer of rechargeable batteries, mobile handsets, and automobiles in China. The company’s electric vehicle segment is particularly promising, as it’s seen a significant increase in demand due to a global focus on sustainability.

Despite the COVID-19 pandemic’s impact on the economy, BYD’s stock price has seen steady growth in recent years. Additionally, the company has made strategic partnerships with major players in the automotive industry, such as Toyota, to develop new electric vehicles. Overall, BYD presents a solid investment opportunity for those interested in the growing electric vehicle market.

CATL (CATL)

CATL, also known as Contemporary Amperex Technology Co. Limited, is a Chinese company that specializes in the production of lithium-ion batteries for new energy vehicles. It is considered to be the largest manufacturer of batteries and battery cells in the world.

As the demand for electric vehicles continues to grow, the stock of CATL is one to watch. In recent years, CATL has been expanding its global presence by investing in overseas electric vehicle manufacturers. This move has paid off as its revenue has increased substantially in the last few years.

With a strong emphasis on innovation and technology, CATL’s future looks bright, and it remains a top stock to keep an eye on.

Industry Trends

Nowadays, more and more people are considering investing in battery companies for electric cars stocks. This trend is not surprising, considering that the demand for electric vehicles is growing exponentially. Battery companies are perceived as a key player in this industry, and investors are keen on taking a slice of the pie.

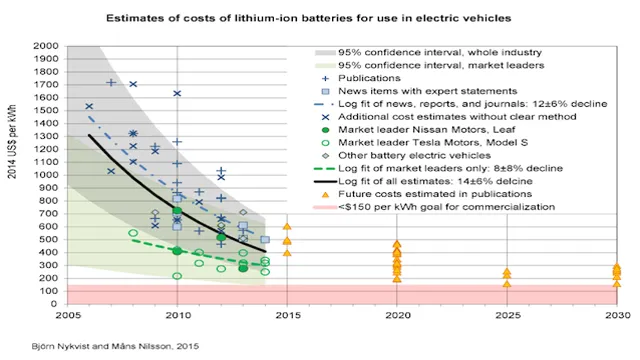

The electric car industry is estimated to grow by 21% in 2021, which will drive up the demand for batteries. One of the biggest advantages battery companies have is that their production costs are decreasing and their technology is improving, making it more financially viable to produce electric cars. Therefore, investing in battery companies for electric cars stocks is considered to be a wise move by many financial experts.

The key is to do your research and choose companies that have a solid track record of innovation, production efficiency, and financial stability. This is worth noting because a company can be innovative but not financially stable, which raises concerns about its long-term viability. All things considered, investing in battery companies for electric cars is definitely a trend worth paying attention to.

Growing Demand for Electric Vehicles

Electric vehicles are becoming increasingly popular due to the growing demand for environmentally sustainable transportation options. As a result, car manufacturers are investing heavily in developing higher quality, longer-range electric vehicle models. They are integrating new technologies that enable electric vehicles to be faster, more reliable, and more energy-efficient.

Industry experts predict that by 2025, electric vehicle sales will make up twenty-five percent of total global vehicle sales. This significant trend is driven by the need for a more sustainable lifestyle and a reduction in carbon emissions that contribute to climate change. Governments are also providing incentives to car owners to switch to electric vehicles.

This creates a multiplier effect on the ever-growing trend toward electric vehicles. The future of electric cars may witness the emergence of highly advanced and efficient technologies that would drive this promising market to new heights. Therefore, as consumers become more environmentally and cost-conscious, the demand for electric vehicles continues to grow, revolutionizing the automotive industry.

Shift Towards Renewable Energy Sources

Renewable energy sources are becoming more and more popular as the world shifts towards sustainable energy. Many industries are adopting this trend and are investing in renewable sources such as solar and wind power. The benefits of renewable energy include reducing carbon emissions, lowering electricity costs, and minimizing the dependence on non-renewable resources.

With the advancements in technology, renewable energy sources are becoming more efficient and cost-effective, making them a viable and attractive option for businesses. As a result, the renewable energy industry is rapidly growing, and many large corporations are joining in on the movement. It’s time for us to embrace this shift and start incorporating renewable energy into our daily lives.

By doing so, we can ensure a greener and more sustainable future for generations to come.

Advancements in Battery Technology

The advancements in battery technology have revolutionized numerous industries in recent years. With an increased demand for sustainable energy, companies have been investing heavily in developing more efficient and powerful batteries. One industry that has seen significant progress is the electric vehicle market, where the size and weight of batteries play a crucial role in design and performance.

Lithium-ion batteries have been the go-to technology for electric vehicles, but newer technologies such as solid-state batteries offer higher energy density, longer lifespan, and faster charging times. However, solid-state batteries are still in the developmental phase and require further research before they can be widely implemented. Despite this, the industry is rapidly evolving, and we can expect even more advancements in battery technology in the near future.

Investment Outlook

As the world continues to shift towards electric vehicles, battery companies for electric cars stocks are becoming popular investment targets. With governments around the world pledging to reduce carbon emissions, automakers are under increasing pressure to produce electric vehicles powered by efficient and reliable batteries. This is good news for battery companies, as demand for their products is expected to skyrocket in the coming years.

However, investors must be careful to choose the right battery companies to invest in, as the market is crowded with different players. Look for companies that have a proven track record of producing high-quality, reliable batteries that are able to power electric vehicles for long distances. Additionally, keep an eye out for companies that are investing in innovative new technologies that could give them an edge in the market, such as solid-state batteries.

While there are no guarantees in investing, investing in battery companies for electric cars stocks could prove to be a profitable move in the long run.

Potential for Long-term Growth

When it comes to the investment outlook for long-term growth, there are many factors to consider. One key consideration is the potential for growth in various industries and markets. For example, emerging technologies like artificial intelligence, renewable energy, and biotech offer significant growth potential for investors.

Additionally, there are numerous other sectors, such as real estate, healthcare, and retail, that may also present promising investment opportunities. Another important factor to consider is global economic trends and geopolitical risks, which can impact investment performance over time. Ultimately, investors need to carefully weigh all of these factors, along with their own personal goals and risk tolerance, to develop a sound long-term investment strategy.

With the right approach, investors can position themselves for success and capitalize on the potential for long-term growth in a dynamic and ever-changing market.

Risks and Challenges to Consider

When considering investment opportunities, it’s important to analyze the risks and challenges associated with each option. One major factor to consider is the investment outlook, or the projected performance of the investment over time. While some investments may have a positive outlook, others may not perform as well.

Additionally, it’s important to consider any external factors that may influence the performance of the investment, such as changes in the market, political climate, or economic conditions. Investors should also evaluate their own risk tolerance and financial goals before making any investment decisions. While investing can be a great way to grow one’s money, it’s important to do so with caution and careful consideration of all relevant factors.

Conclusion

In conclusion, investing in battery companies for electric cars stocks is like investing in the fuel of the future. Just as gas powered cars rely on fossil fuels, electric cars rely on batteries to keep them moving. As the demand for electric vehicles increases, so too will the demand for high quality and efficient batteries.

Battery companies that invest in research and development to create the most advanced and durable batteries will be the ones to watch. So, if you want to be part of the electric revolution and have a charged up portfolio, consider investing in battery companies for electric cars stocks.”

FAQs

What are some top battery companies for electric cars in the stock market?

Some of the top battery companies for electric cars in the stock market include Tesla (TSLA), Panasonic Corporation (PCRFY), LG Chem Ltd. (LGCLF), BYD Company Limited (BYDDY), and Contemporary Amperex Technology Co., Ltd. (CATL).

Which battery company has the highest market capitalization in the electric car stock industry?

As of 2021, Tesla has the highest market capitalization in the electric car stock industry due to its successful integration of battery technology with electric cars.

What is the current growth rate of the battery companies for electric cars stocks industry?

The growth rate of battery companies for electric cars stocks industry is projected to be around 20% annually due to the increasing demand for electric cars.

How does the performance of battery companies for electric cars stocks compare with traditional car manufacturers?

Battery companies for electric cars stocks tend to experience higher growth rates and valuations due to the increasing demand for electric cars whereas traditional car manufacturers have a more stable growth rate.