10 Electric Car Battery Stocks to Power Up Your Portfolio

Are you curious about the latest investing trends in battery electric car stocks? With the ongoing concerns over climate change, electric cars have quickly become a major player in the automotive industry, and investing opportunities are on the rise. As countries set ambitious targets for electric vehicle adoption, investors are taking note and looking for ways to diversify their portfolio by investing in EV stocks. From industry giants to up-and-coming startups, there’s no shortage of options for those interested in this exciting market.

In this post, we’ll explore the latest trends and best stocks to consider for your portfolio. So, let’s dive in and discover how you can be a part of the electric car revolution.

Overview of Electric Vehicle Market Growth

Battery electric car stocks have experienced a significant increase in demand in recent years as the shift toward sustainable transportation gains momentum. The global electric vehicle market is projected to reach a valuation of $8081 billion by 2027, with a compound annual growth rate of 2

6%. This growth is driven by advancements in battery technology, government incentives, and consumer desire for environmentally friendly vehicles. Investors have taken notice of this trend, as evidenced by the surge in battery electric car stocks.

Companies like Tesla, NIO, and BYD have seen their stock prices skyrocket as they lead the charge in the electric vehicle market. As more automakers enter this market, it will be interesting to see how the competition drives innovation and shapes the future of transportation.

Sales and Production Data for EV Stocks

Electric Vehicle Market The electric vehicle market has been experiencing impressive growth in recent years, with sales and production data supporting this trend. Despite initial reluctance from some consumers to switch to EVs due to concerns about range anxiety and high prices, sales have steadily increased, and companies such as Tesla, Nio, and Li Auto have emerged as major players in the market. In 2020, EV sales reached a record high of almost 3 million units worldwide, representing a 43% increase compared to the previous year.

Likewise, the production of EVs rose significantly, with major automakers such as Volkswagen and General Motors investing heavily in this technology. One notable example is the Volkswagen Group, which plans to produce 22 million electric vehicles by 202 As more countries pledge to phase out gasoline-powered vehicles and demand for sustainable transportation grows, the electric vehicle market is set to experience even greater growth in the years to come.

Comparing Battery-Electric Cars vs Traditional Gasoline Engine Cars

The electric vehicle market has seen tremendous growth over the last few years, with an increasing number of people opting for battery-electric cars over traditional gasoline engine cars. The main reason for this trend is the increasing awareness about the environment and the need to reduce carbon emissions. Battery-electric cars are pollution-free and have lower carbon footprints compared to gasoline engine cars.

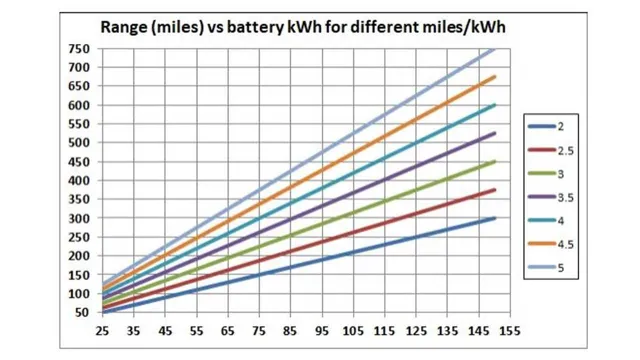

Additionally, electric vehicles offer several other advantages, such as lower maintenance costs, quiet and smooth rides, and instant torque. Despite the several benefits of electric cars, there are still some challenges such as limited range, lack of charging infrastructure, and high upfront costs. However, as technology continues to improve and more investment is made in charging infrastructure, electric vehicles will become increasingly accessible and affordable to consumers.

Overall, the electric vehicle market is expected to grow exponentially in the coming years, with more and more manufacturers entering the market and more consumers adopting this eco-friendly mode of transportation.

Top Battery Electric Car Stocks to Watch

If you’re looking to invest in the growing popularity of battery electric vehicles (BEVs), there are a few car stocks to keep an eye on. One of the biggest players in the industry is Tesla (TSLA), which is known for their innovative technology and luxury electric vehicles. Other popular BEV stocks include General Motors (GM), which recently announced their ambitious plan to become carbon neutral by 2040, and Ford (F), who plans to invest more than $11 billion in electric vehicles by 202

Another promising company to watch is Chinese automaker Nio (NIO), who is focused on designing sustainable and high-performance electric vehicles for the global market. As the demand for sustainable and eco-friendly modes of transportation continues to rise, these battery electric car stocks are poised for growth in the coming years.

Tesla (TSLA): Current Market Dominance and Future Plans

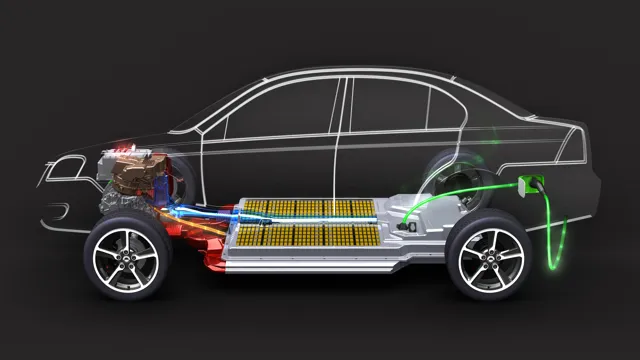

As electric vehicles continue to gain popularity, Tesla (TSLA) is emerging as the clear market leader, dominating the EV space in terms of sales and innovation. Tesla has been at the forefront of EV development, introducing a range of new models that have helped to make EVs more mainstream. What sets Tesla apart from other car manufacturers is its focus on battery technology.

Tesla’s battery technology is considered to be among the best in the industry, with the company constantly looking for ways to improve battery performance and reduce costs. Tesla’s future plans include the Tesla Semi, which is set to revolutionize the trucking industry, and the Cybertruck, a futuristic electric pickup truck. Other top battery electric car stocks to watch include NIO (NIO), which is poised to become a major player in the Chinese EV market, and Rivian, a startup that has received significant investment from companies such as Amazon and Ford.

Despite increased competition, Tesla’s market dominance and innovation make it a solid investment for the future of the EV industry.

NIO (NIO): Strong Chinese Market Presence and Growth Potential

As the world moves towards a more sustainable future, the demand for battery electric cars is skyrocketing. In the world of electric vehicles, NIO is a company that stands out with its strong presence in the Chinese market and has immense growth potential. With its focus on electric SUVs, NIO offers a unique offering, which is highly sought after in China, given the country’s preference for SUVs.

Beyond China, the company has also established a foothold in Europe and is expanding its presence globally. Other battery electric car stocks that investors should consider include Tesla, known for its cutting-edge technology and innovation, and General Motors, which is set to release a fleet of electric vehicles in the coming years. With the increasing demand for electric vehicles, these are exciting times for the industry, and it’s a great time to invest in battery electric car stocks.

Li Auto (LI): Innovative Battery-Swapping Technology and Expansion Plans

Li Auto is a promising player in the battery electric car market due to its innovative battery-swapping technology and expansion plans. This Chinese automaker is focused on creating a seamless user experience for its customers with its unique battery-swapping technology, which allows for a quick and easy battery replacement in just a few minutes. Furthermore, Li Auto has ambitious plans to expand its product line and global presence, aiming to launch at least two new models per year and expand its overseas product offerings in the coming years.

With its strong commitment to innovation and expansion, Li Auto is definitely one of the top battery electric car stocks to keep an eye on.

Future Predictions for Battery-Electric Car Stocks

Battery-electric car stocks are set to experience a significant surge in the coming years as more and more people embrace electric vehicles as a more sustainable and cost-effective means of transportation. One of the main reasons for this optimistic outlook is the increasing demand for renewable energy sources, which is expected to fuel the growth of battery technology. Leading car manufacturers such as Tesla, Nissan, and General Motors are already investing heavily in battery-electric cars, and their portfolios are expected to expand in the near future.

Additionally, governments around the world are implementing strict regulations and incentives to encourage the adoption of electric vehicles, which will further drive the demand for battery-electric cars. Overall, this presents a favorable outlook for investors who want to invest in the growth of battery-electric car stocks. The market is expected to be highly volatile, but it offers an excellent opportunity for those who are willing to assume the risk.

So, if you’re interested in buying battery-electric car stocks, now is the time to start researching and investing in this exciting industry.

Analyst Forecasts for EV Market Growth and Stock Performance

The battery-electric car market is growing rapidly and analysts predict it will continue to do so in the coming years. The increasing demand for eco-friendly solutions and the decline in battery prices are some of the key drivers behind this growth. As a result, investors are looking to jump on this bandwagon and invest in battery-electric car stocks.

Analysts predict that companies like Tesla, NIO, and Lucid Motors will see significant growth in the near future. However, with any investment, there are risks involved. It’s important to conduct thorough research and understand the market dynamics before investing.

Many factors can influence the performance of stocks, such as government regulations, market conditions, and technological advancements. Therefore, it’s crucial to keep an eye on the trends and be aware of any changes that could impact the EV market as a whole. Ultimately, investing in battery-electric car stocks requires a long-term outlook and patience as the market continues to evolve and grow.

Potential Impact of Government Policies and Environmental Regulations

Battery-electric car stocks are expected to be impacted by government policies and environmental regulations in the future. With a growing focus on reducing carbon emissions, many governments around the world are incentivizing the use of electric vehicles through tax credits and other beneficial policies. As a result, demand for battery-electric cars is on the rise, which is great news for stockholders in this industry.

In addition, environmental regulations are also driving the trend towards electric vehicles, as they produce significantly less pollution than traditional gasoline-powered cars. This is particularly important as some major cities around the world are experiencing severe air pollution problems, and electric vehicles can help to alleviate this problem. With the potential for even more government policies and regulations in the future, the future looks bright for those investing in battery-electric car stocks.

Conclusion: The Future of Battery Electric Car Stocks

In conclusion, investing in battery electric car stocks is a wise choice for both the environmentally-conscious and financially-savvy. As our world becomes more environmentally-aware, the demand for electric vehicles is only going to increase, providing ample opportunities for investors to reap rewards. And as battery technology continues to improve, we can expect the performance and range of electric cars to become even more impressive.

So why not charge up your investment portfolio with some battery electric car stocks? They’re sure to keep you going the distance in both ethics and profits.”

FAQs

What are battery electric car stocks?

Battery electric car stocks refer to publicly traded companies that manufacture or sell electric vehicles powered by batteries.

How do I invest in battery electric car stocks?

To invest in battery electric car stocks, you can buy shares of publicly traded companies that manufacture or sell electric vehicles powered by batteries through an online brokerage account or a financial advisor.

What are some examples of battery electric car stocks?

Some examples of battery electric car stocks include Tesla, NIO, BYD, BMW, and Volkswagen.

What are the advantages of investing in battery electric car stocks?

Investing in battery electric car stocks can provide potential growth and returns as the demand for electric vehicles continues to rise due to environmental concerns and government regulations supporting the adoption of clean energy.