Powering the Future: Exploring the Rise of Battery Stocks for Electric Cars

Electric cars are one of the most popular and rapidly growing forms of transportation, with more and more people opting for sustainable alternatives to gasoline-powered vehicles. One of the key components that make electric cars possible is the battery – and with growing demand for electric cars, there is also a growing demand for the batteries that power them. This has led to a surge in interest in electric car battery stocks, as investors look for ways to capitalize on the booming industry.

But which specific stocks are worth investing in, and what factors should investors consider when choosing which companies to invest in? In this blog, we’ll take a look at some of the top electric car battery stocks, as well as the factors that influence their performance in the market.

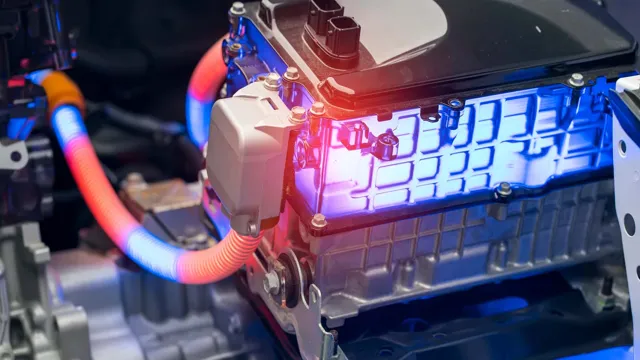

Current State of Electric Car Batteries

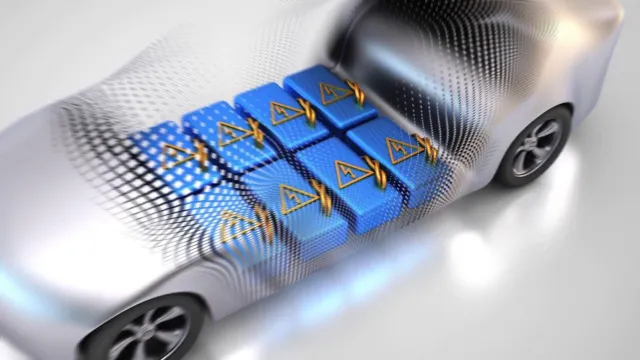

Battery for electric car stocks have been an increasingly relevant topic in today’s world. As society becomes more aware of the effects of climate change and seeks out ways to lessen its impact on the environment, electric cars are gaining popularity due to their eco-friendliness. Electric vehicles rely entirely on battery power to run, so the durability, longevity, and reliability of car batteries are crucial aspects to consider.

Fortunately, advancements in technology have brought forth significant breakthroughs in the performance of electric car batteries, with more sustainable, affordable, and long-lasting options now readily available. As a result, investors are consistently tracking the developments in the electric car market to determine which battery companies are producing the most efficient and effective technology for electric cars. This is evident in the rising stock of some battery manufacturers, reflecting their success in working towards more sustainable solutions for the electric car industry.

Growing Demand for Electric Cars

As the demand for electric cars continues to grow, the current state of electric car batteries is a topic of great interest. With more and more people interested in lowering their carbon footprint and reducing their reliance on fossil fuels, the efficiency and longevity of electric car batteries are important considerations. Fortunately, advancements in battery technology have made vast improvements over the years.

Today’s electric car batteries can last longer and hold more power than ever before. These advancements have made electric cars a more practical and viable option for many people. It’s no wonder the keyword “electric car batteries” is becoming increasingly popular in search engines.

With the continued push towards a more sustainable future, the demand for electric cars and their batteries will only continue to rise.

Importance of Reliable Car Batteries

As electric cars become more prevalent on the roads, the importance of reliable car batteries cannot be overstated. Currently, the state of electric car batteries is one of rapid innovation and advancement. The latest batteries offer higher energy density, longer ranges, and faster charging times than their predecessors.

However, there’s still a long way to go in terms of addressing the concerns of drivers who fear being stranded due to dead batteries. This is where the importance of reliable car batteries comes in. A reliable battery ensures that the car can operate at optimal levels, while also providing peace of mind to drivers.

It’s important to invest in a quality battery from a reputable manufacturer to avoid the frustration and inconvenience of a dead battery. With emerging technologies and a growing market, the future looks bright for electric car batteries, but for now, a reliable battery remains essential for drivers.

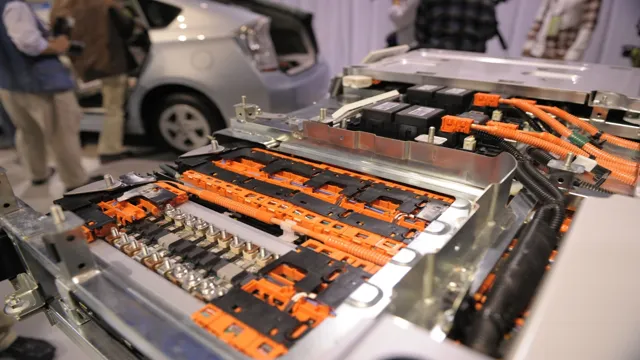

Top Battery Manufacturers with Stocks

Battery for electric car stocks have been gaining traction in the market, as the demand for electric vehicles continues to rise. Some of the top battery manufacturers offering stocks in this sector include Panasonic, Tesla, LG Chem, CATL, and BYD. Panasonic, for instance, is a leading supplier of automotive lithium-ion batteries and partners with Tesla to produce batteries for their electric vehicles.

Similarly, LG Chem supplies batteries to automakers like GM, Ford, and Hyundai, while CATL and BYD dominate the Chinese market. Investing in battery stocks can be a smart move, as electric vehicles are expected to become more mainstream in the coming years, meaning these companies are poised for long-term growth. However, it’s important to note that the battery industry is highly competitive, with new players emerging all the time, so investors should carefully consider their options before making any significant investments.

Tesla (TSLA)

Tesla (TSLA) Tesla is one of the top battery manufacturers in the world and a leader in the electric vehicle (EV) industry. The company produces its own batteries and integrates them into its vehicles, such as the Model S and Model X. However, Tesla isn’t the only battery manufacturer worth investing in.

Other top battery manufacturers with stocks on the market include Panasonic, BYD, LG Chem, and Samsung SDI. While these companies may not have the brand recognition that Tesla does, they are all leaders in the battery industry and are involved in various aspects of battery production. Investors who are interested in the renewable energy sector and electric vehicles should consider researching these companies and their stocks to diversify their portfolios.

LG Chem (LGCLF)

Looking for top battery manufacturers with stocks to invest in? Look no further than LG Chem (LGCLF). This South Korean company produces a variety of products, including lithium-ion batteries for electric vehicles, energy storage systems, and electronic devices. One of the company’s main advantages is its expertise in battery cathode chemistry, which has allowed it to produce high-quality batteries with longer lifetimes and higher energy densities than many competitors.

LG Chem is also committed to sustainability, with a goal of increasing the percentage of recycled materials used in its products and reducing greenhouse gas emissions. Additionally, the company has been expanding its production facilities and partnerships with other companies, which bodes well for its future prospects. Whether you’re interested in sustainable investing or simply want to invest in a company with a strong track record, LG Chem is a solid choice.

BYD Co. Ltd. (BYDDF)

Looking for top battery manufacturers with stocks? BYD Co. Ltd. (BYDDF) is a brand that should definitely make it to your list.

BYD is a Chinese multinational company that specializes in the production of electric vehicles and batteries. With an expanding production capacity, the company aims to become one of the top five EV manufacturers by 202 Basing its growth on the development of innovative technological solutions, BYD has a diverse portfolio of products, including battery cells, modules, and packs.

One of the key areas where BYD excels is in the development of lithium-ion iron phosphate batteries. These batteries are highly efficient, safe, and affordable. Moreover, they have a longer lifespan compared to traditional lead-acid batteries, which makes them ideal for applications in electric vehicles, energy storage systems, and other industries.

Given the company’s track record of success, it’s not surprising that BYD’s stock has performed well over the years. In fact, the company’s stock has risen by over 100% in the past year alone. Investing in BYD stock is a great way to capitalize on the growth of the EV industry and the demand for high-quality batteries.

In conclusion, with its innovative products and high-performance batteries, BYD is a brand that deserves recognition as one of the top battery manufacturers with stocks. The company’s commitment to excellence and its focus on sustainability make it a great investment choice for those who want to be part of the transition to a cleaner, more efficient future.

Lithium-Ion Batteries vs. Solid-State Batteries

When it comes to the future of batteries for electric cars, there are two main contenders – lithium-ion batteries and solid-state batteries. Lithium-ion batteries have been the go-to option for electric cars for years and have proven to be reliable and efficient. However, solid-state batteries are starting to gain traction as the next big thing in battery technology.

So, what’s the difference between the two? Lithium-ion batteries are made up of a liquid electrolyte, while solid-state batteries use a solid electrolyte. This means that solid-state batteries have the potential to be safer, more efficient, and have a higher energy density. While solid-state batteries are promising, they are still in the developmental stage and are not yet widely available for use in electric cars.

Despite this, many battery for electric car stocks have invested in solid-state battery technology, believing that it will be the future of the industry. It’s still too early to tell which technology will come out on top, but it’s clear that the competition between lithium-ion batteries and solid-state batteries is heating up.

Pros and Cons of Lithium-Ion Batteries

Lithium-ion batteries are undoubtedly the most common type of rechargeable batteries in use today. They have a high energy density, which means they can store a lot of energy in a relatively small package. However, they also have their drawbacks.

One of their biggest disadvantages is that they can be quite volatile and prone to overheating and fire, as we have witnessed in some cases. This has led to a growing interest in solid-state batteries, which do not rely on a liquid electrolyte and are more stable. Solid-state batteries can support even higher energy densities than lithium-ion batteries and have the potential to be smaller, safer, and longer-lasting.

But, as with any new technology, there are still some challenges that need to be overcome before solid-state batteries can become a commercially viable option. They are currently more expensive and harder to manufacture than lithium-ion batteries, and their performance can be affected by temperature changes. Nevertheless, with continued research and development, solid-state batteries hold great promise for powering the next generation of electronic devices and electric vehicles.

Potential Advantages of Solid-State Batteries

Lithium-ion batteries have been the standard power source for electronic devices for decades. However, solid-state batteries are emerging as a promising alternative due to their potential advantages in terms of safety, energy density, and performance. Unlike traditional lithium-ion batteries, solid-state batteries use a solid electrolyte instead of a liquid or gel electrolyte, which eliminates the risk of leakage and fire.

Moreover, solid-state batteries can achieve higher energy density, meaning they can store more energy in a smaller volume and weight. This feature is particularly attractive for electric vehicles because it allows them to travel further on a single charge. Solid-state batteries also have a faster charging rate, allowing them to recharge in just minutes instead of hours.

Overall, solid-state batteries show great promise in improving the efficiency and safety of energy storage systems, which could have a significant impact on various industries, including automotive, aerospace, and consumer electronics.

Predictions for the Future of Electric Car Batteries

The electric car industry has been growing rapidly, with battery technology playing a crucial role in their success. Battery technology is essential as it determines the car’s range, performance, and cost-effectiveness. As the demand for electric cars rises, so does the demand for better and more efficient batteries.

This increased demand is, in turn, driving the growth of battery for electric car stocks. There is already an upward trend in EV stocks as investors are optimistic about the future of the electric car industry. The increased interest in electric cars means that battery research and development is undergoing continuous innovation and advancements, ensuring that consumers have access to more efficient and powerful batteries.

Lithium-ion batteries are currently the most used in electric cars because they have the best energy density and a well-established manufacturing infrastructure. However, other technologies such as solid-state batteries and lithium-sulfur batteries are emerging as the next-generation electric car batteries. The future of electric car batteries is promising, with advancements expected to increase EV range, performance, and lifespan.

As a result, investors in battery for electric car stocks can expect to reap significant returns in the future.

Conclusion

As the world shifts towards more sustainable modes of transportation, the demand for electric cars is on the rise. Fueled by this trend, battery for electric car stocks have become a hot commodity among investors. These stocks represent not just a financial opportunity, but a chance to contribute to a cleaner, greener future.

And who knows, with advancements in battery technology, we may soon see electric cars that can travel for centuries on a single charge. Until then, let’s charge forward towards a brighter tomorrow!”

FAQs

What are the top battery stocks for electric cars?

Some of the top battery stocks for electric cars include Tesla, Panasonic, LG Chem, and CATL.

How has the demand for electric car batteries affected the stock market?

The increasing demand for electric car batteries has led to significant growth in the electric car and battery industries, resulting in a surge in related stock prices.

Are there any new battery technologies that may impact electric car stocks?

Yes, there are several new battery technologies, including solid-state batteries and lithium-sulfur batteries, that could potentially impact electric car stocks in the future.

What factors can influence the performance of battery stocks for electric cars?

The performance of battery stocks for electric cars can be influenced by a range of factors, including global electric car adoption rates, government policies and incentives, new battery technology breakthroughs, and overall economic conditions.