Charging Up Your Portfolio: Top Battery Makers for Electric Cars Stocks to Watch

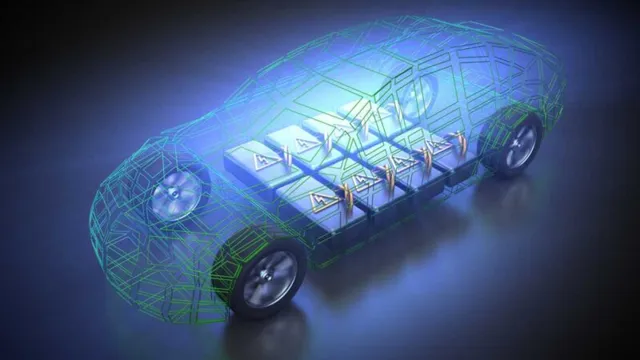

Electric vehicles (EVs) are rapidly gaining popularity as countries around the world push towards sustainability. But while discussions on EVs often focus on advanced technologies such as battery packs and charging infrastructures, there is another player in the mix that is often overlooked – the battery makers. Battery technology represents a significant revenue stream for companies that produce batteries for electric cars stocks such as Tesla, General Motors, and BYD (Build Your Dreams).

In fact, battery producers are considered a vital component of the EV industry’s supply chain. As such, it’s worth examining their role in the sector and the potential for battery makers’ stocks to perform well in the future.

Overview

Battery makers for electric cars stocks are an essential part of the ever-growing electric car industry. In recent years, the demand for electric vehicles has increased, and it has led to the rise of battery makers’ stocks. One such company is Tesla, which not only produces electric cars but also manufactures batteries.

In addition to Tesla, there are other battery makers such as LG Chem, Panasonic, and CATL, which are expected to grow as the demand for electric vehicles continues to rise. Furthermore, the development of new and more efficient batteries, such as solid-state batteries, could provide a significant boost to battery makers’ stocks. As the world moves towards clean energy sources, battery makers for electric cars stocks are poised to be a critical player in the transition to sustainable transportation.

Current state of electric car battery market

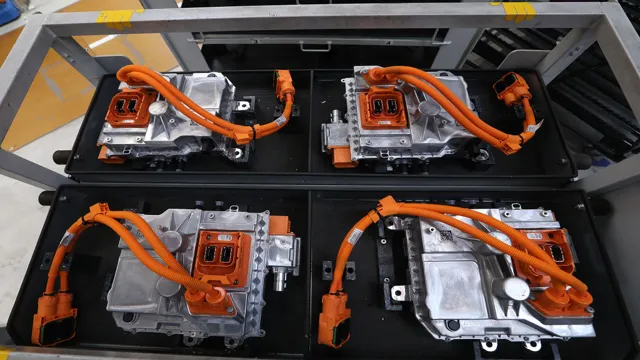

The electric car battery market has been steadily growing in recent years due to a heightened concern for the environment and the advancement of technology. Lithium-ion batteries are currently the most commonly used type of battery in electric cars due to their high energy density and reliability. However, there are constant innovations being made to improve their performance and lower costs.

One of the major challenges facing the industry is ensuring enough supply of raw materials for the production of batteries, such as lithium and cobalt. This has led to the exploration of alternative materials and even the possibility of recycling existing batteries. As the demand for electric cars continues to rise, it is expected that the battery market will become even more competitive and innovative.

It is an exciting time for the industry, and we can expect to see even more advancements in the near future.

Factors influencing battery makers stock prices

Battery makers’ stock prices are influenced by a variety of factors, including the demand for electric vehicles, fluctuations in the cost of raw materials, and the innovation of new battery technologies. With the increased focus on renewable energy and global efforts to reduce carbon emissions, there has been a surge in demand for electric vehicles, leading to a direct increase in demand for batteries. As a result, companies with a strong presence in the electric vehicle battery market experience higher stock prices.

Additionally, fluctuations in the cost of raw materials such as lithium, cobalt, and nickel can have significant impacts on battery costs and, in turn, stock prices. Finally, advancements in battery technology can greatly impact stock prices. Companies that innovate and create more efficient and cost-effective battery solutions are more likely to see an increase in stock prices.

As such, it is important for battery makers to stay on top of these trends and develop strategies that allow them to navigate these factors to maintain consistent growth and profitability.

Top Battery Makers in the Market

If you’re looking to invest in the electric car market, battery makers are a crucial element to consider. The top battery makers for electric cars stocks are Panasonic, LG Chem, CATL, and BYD. Panasonic is the leading battery supplier for Tesla, producing the innovative lithium-ion batteries that power the sleek electric cars.

LG Chem, a South Korean company, is also a major supplier for large automakers like GM and Ford. CATL, a Chinese company, has rapidly grown to become one of the world’s largest battery makers, with partnerships with Volkswagen, BMW, and other major automakers. BYD, also a Chinese company, primarily produces batteries for its own electric cars, but has recently expanded to supply batteries to other automakers.

Investing in these battery makers can provide a solid opportunity for growth and profit in the electric car market.

Tesla (TSLA)

As the world moves towards a more sustainable future, the demand for electric vehicles (EVs) has skyrocketed, and with it, the need for high-quality batteries. This has led to intense competition among battery manufacturers, with companies such as LG Chem, Panasonic, and CATL emerging as some of the top players in the market. However, leading the pack is Tesla, with its revolutionary battery technology and innovative manufacturing processes.

Tesla’s batteries are not only highly efficient, but they are also lighter and more durable than their competitors, making them the preferred choice for many EV manufacturers worldwide. Additionally, Tesla’s vertical integration strategy, which involves manufacturing batteries in-house, has helped the company stay ahead of the curve in terms of cost and quality. All in all, when it comes to the top battery makers in the market, Tesla is undoubtedly a force to be reckoned with.

BYD Company (BYDDF)

When it comes to battery makers in the market, BYD Company (BYDDF) is definitely one of the top players. This Chinese company has established itself as a leading manufacturer of batteries for electric vehicles. Their success can be attributed to their extensive research and development in battery technology, which has resulted in high-quality batteries that provide exceptional performance and durability.

Another factor that sets BYD apart is their commitment to sustainability and environmental responsibility. They have implemented strict measures to reduce the environmental impact of their manufacturing processes and have even built solar-powered factories to reduce their dependence on non-renewable energy sources. With their focus on innovation and sustainability, BYD is definitely a company to watch out for in the battery market.

LG Chem (LGCLF)

LG Chem, battery makers, market. LG Chem, also known as LGCLF, is one of the top players in the battery market. Their products are renowned for their high-quality, long-lasting performance, and reliability.

The company specializes in manufacturing lithium-ion batteries that are widely used in electric cars, smartphones, laptops, and other electronic devices. LG Chem has been in the battery industry for over two decades, and their expertise and technological advancements have helped them stay ahead of the game. With an increasing demand for sustainable and eco-friendly energy sources, LG Chem has become a popular choice for customers who are looking for reliable and efficient batteries.

Their focus on research and development has led to the creation of superior products that outperform most others in the market. LG Chem’s commitment to innovation and excellence has made them one of the top battery makers in the world.

Panasonic (PCRFY)

When it comes to the top battery makers in the market, one that stands out is Panasonic (PCRFY). This Japanese company has been making batteries for over 80 years, and has become a leader in the industry with its innovative and reliable products. Their batteries are used in a wide range of devices, from small handheld devices to large electric vehicles, and are known for their high energy density and long lifespan.

In addition to traditional lithium-ion batteries, Panasonic is also working on developing new technologies such as solid-state batteries, which could potentially offer even greater energy density and safety. With their commitment to sustainability and cutting-edge research, it’s no surprise that Panasonic is seen as one of the top players in the battery market. So if you’re looking for a reliable and innovative battery for your device, you can’t go wrong with Panasonic.

Battery Makers on the Rise

Battery makers for electric cars stocks are on the rise as the demand for electric vehicles soars. With more countries setting aggressive decarbonization targets, the electric vehicle market is expected to grow rapidly in the coming years. Battery technology plays a critical role in the growth of this market, and companies that manufacture batteries for electric vehicles are set to benefit.

As a result, we are seeing an increase in investment in battery makers for electric cars. These investments are driven by the belief that the companies that can deliver the most advanced, cost-effective, and reliable battery technology will be the winners in this space. Investors are turning their attention to battery makers like Tesla, Panasonic, LG Chem, and CATL, all of which are showing signs of growth and innovation.

With so much potential for growth, battery makers for electric cars could be the next big thing in the world of investing.

QuantumScape (QS)

QuantumScape (QS) Lately, battery makers are becoming a hot investment due to the increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Among these battery makers, one company stands out – QuantumScape (QS). What sets them apart is their development of solid-state batteries, which are safer, more energy-dense, and have faster charging times than traditional lithium-ion batteries.

This breakthrough technology has attracted investments from the likes of Volkswagen, which believes that solid-state batteries could be the future of EVs. However, this technology is still in the early stages of development, with many technical challenges that need to be overcome. Nonetheless, QuantumScape’s potential to revolutionize the energy storage industry has led to substantial investor interest and a surge in their stock price.

It remains to be seen whether they can overcome the technical challenges and deliver on their promise, but one thing is certain – the future of energy storage is looking brighter with innovative companies like QuantumScape leading the way.

EnerSys (ENS)

EnerSys (ENS) Have you noticed the surge in demand for electric cars? With this growth, the need for high-quality batteries has increased too, resulting in an uptick for battery makers such as EnerSys (ENS). This global leader in stored energy solutions is making waves in the industry as more and more companies shift to sustainable energy practices. Not only is EnerSys providing solutions for electric cars, but they are also catering to various other sectors, including aerospace, marine, and telecommunications.

Their state-of-the-art technology and innovative advancements make them a game-changer in the industry. It’s exciting to see companies like EnerSys actively taking steps towards a greener future, and it’s no wonder their growth trajectory is on the rise.

Conclusion

As electric cars become more prevalent on our roads, the demand for batteries will continue to rise. This presents a golden opportunity for battery makers to not only meet the needs of the automotive industry but also to make a significant profit. However, investors must be cautious when considering investing in battery makers for electric cars as the competition in the industry is fierce, and not all companies are poised for success.

So, if you’re looking to make a sound investment in this space, remember to do your research, keep an eye on emerging trends and don’t be afraid to take a calculated risk. Happy investing!”

FAQs

Who are the top battery makers for electric cars in the stock market?

The top battery makers for electric cars in the stock market include Tesla, Panasonic, LG Chem, CATL, and BYD.

Can you recommend some publicly traded stocks of battery makers for electric cars?

Yes, some publicly traded stocks of battery makers for electric cars include Tesla (TSLA), Panasonic Corporation (PCRFF), LG Chem (LGCLF), Contemporary Amperex Technology Co., Limited (CATL) (CATL), and BYD Company Limited (BYDDF).

How has the stock performance of battery makers for electric cars been in recent years?

The stock performance of battery makers for electric cars has been quite impressive in recent years, with some companies like Tesla and CATL experiencing significant growth. However, the industry is also quite volatile, and investors should carefully consider the risks involved.

What are the key factors affecting the stock prices of battery makers for electric cars?

The key factors affecting the stock prices of battery makers for electric cars include demand for electric vehicles, technological advancements, government regulations and policies, competition, and the overall health of the global economy. Investors should consider all these factors before making any investment decisions.