Switch to Electric and Save Big with Our Benefit-in-Kind Calculator for Electric Cars in Ireland

Have you been pondering over purchasing an electric car and wondering about the benefits it might bring? Recently, the use of electric cars has exploded around the world due to their environmentally friendly features and low running costs. In Ireland, electric car ownership also offers attractive taxation benefits to users, but how do you calculate your Benefit-in-Kind (BIK) tax? Fear not, as Ireland’s Electric Car Benefit-in-Kind Calculator has got you covered! This tool is designed to make it easy for you to calculate your tax for your electric car, taking into account various factors such as the model, your income, and the number of business kilometers you cover. In this blog, we will walk you through the process of using the Electric Car Benefit-in-Kind Calculator in Ireland and help you understand how it works.

Let’s dive in and explore the world of electric car ownership in Ireland!

What is a Benefit-in-Kind (BIK)?

If you work in Ireland and have access to an electric car through your job, you may want to familiarize yourself with Benefit-in-Kind (BIK) calculations. Basically, BIK is a tax on any non-cash benefits you receive from your employer, and this is usually deducted from your salary. The good news, however, is that the BIK rates for electric cars are quite favorable in Ireland.

Moreover, there are BIK calculators that can help you determine the amount you need to pay for this tax. As an electric car driver, you can enjoy significant savings because of the low BIK rates. So, if you’re thinking of switching to an electric vehicle or already have one from work, find out more about the BIK rules and calculations in Ireland.

By doing so, you can save money and contribute to a cleaner environment!

Explanation of BIK and Why It Matters for Electric Cars

If you’re considering purchasing an electric car, it’s important to understand what Benefit-in-Kind (BIK) means and how it could impact your decision. Essentially, BIK is a tax that’s applied to the benefits you receive as an employee, such as a company car. When it comes to electric cars, BIK rates are usually lower than those of traditional petrol or diesel cars.

This is because they are seen as a more environmentally-friendly option. The lower the BIK rate, the less tax you’ll have to pay. So, if you’re in the market for a new car, it’s worth considering an electric option to take advantage of any potential tax savings.

Plus, you’ll also be doing your bit for the planet by reducing your carbon footprint.

Current BIK Rates for Electric Cars in Ireland

If you’re looking to purchase an electric car in Ireland, it’s important to understand what a Benefit-in-Kind (BIK) is and how it may affect your expenses. BIK is a tax that employers pay for benefits provided to their employees, including company cars. Electric cars have lower CO2 emissions and as such, have much lower BIK rates than traditional petrol or diesel cars.

Currently, the BIK rate for electric cars in Ireland is 7% for cars that have a price below €50,000 and 10% for cars priced above €50,000. This is a significant reduction from the BIK rate for traditional petrol or diesel cars, which can be as high as 30%. This means that electric cars can be a cost-effective option for company cars, as employers can save money on their tax liability while also contributing to a greener environment.

Using the Benefit-in-Kind Calculator for Electric Cars in Ireland

If you’re considering buying an electric car in Ireland, it’s important to understand the tax implications, specifically the benefit-in-kind (BIK). The BIK is a tax on the benefit an employee receives from their employer in the form of a company car and is calculated based on factors such as the value of the car and the employee’s income. However, if you opt for an electric car, the BIK rates are significantly lower than they are for petrol or diesel cars.

To determine how much you would be taxed, you can use the benefit-in-kind calculator Ireland electric car. By entering details such as the make and model of the car, its price, and your income, the calculator will provide an estimate of how much you would be taxed. This can be useful when comparing the cost of owning an electric car versus a petrol or diesel car.

So, if you’re thinking about making the switch to an electric car, be sure to take advantage of the benefit-in-kind calculator to make an informed decision.

Step-by-Step Guide on How to Use the Calculator

If you’re considering purchasing an electric car in Ireland, it’s essential to understand the financial implications of doing so. The Benefit-in-Kind Calculator is an excellent tool to help you calculate how much you’ll be taxed on the car’s value in the form of a company car benefit. The first step is to select the relevant model from the drop-down list.

Next, enter the car’s open market selling price, which can be found either on the manufacturer’s website, a dealer or the ATC Vehicle Excise Duty Rates website. The next step is to enter the car’s battery kilowatts per hour rating, and this information will give you the EV range that you can expect from the vehicle on a single charge. Finally, you’ll need to enter your marginal income tax rate (usually between 20% and 40%), and the calculator will show you the total amount of the Benefit-in-Kind you’ll be taxed for that year.

This calculation can be done for up to five years, which means you can see the long-term financial impact of purchasing an electric vehicle in Ireland. So, why not try it out today and get an idea of the potential savings you could enjoy by switching to an electric car!

Factors Used in the Calculation of BIK for Electric Cars in Ireland

If you’re considering purchasing an electric car in Ireland, one important factor to take into account is the Benefit-in-Kind (BIK) calculation. In simple terms, this is the amount of tax you will pay on the benefit of having the car provided to you by your employer. The BIK for electric cars is significantly lower than for petrol or diesel cars, as an incentive to encourage people to switch to electric vehicles.

To calculate the BIK for your specific electric car model, you can use the official BIK calculator provided by Revenue.ie. To use the calculator, you’ll need to input a variety of factors, such as the make and model of your car, its CO2 emissions, and its list price.

The result will be a percentage of the car’s value that will be added to your taxable income. By using this calculator, you can get an accurate estimate of the BIK tax you’ll be expected to pay and factor it into your decision-making process when choosing an electric car. So, if you’re thinking about making the switch to electric, remember to take the BIK calculation into account and use the online calculator to get a clear idea of what you’ll be paying in tax.

Examples of BIK Calculations for Popular Electric Car Models in Ireland

When it comes to calculating the Benefit-in-Kind (BIK) for electric cars in Ireland, there are a few things to keep in mind. Using the BIK calculator can be helpful in determining the amount of tax you may need to pay on your electric vehicle. For example, popular electric car models such as the Nissan Leaf, Hyundai Kona Electric, and Tesla Model S all have different BIK rates.

The Nissan Leaf has a BIK rate of 7%, whereas the Hyundai Kona Electric has a BIK rate of 8%, and the Tesla Model S has a BIK rate of 7%. It’s worth noting that the BIK rate is based on the original list price of the vehicle, and any grants or incentives received for purchasing an electric car do not affect the BIK calculation. By using the BIK calculator, you can get a better idea of how much you’ll need to pay in taxes each year and plan accordingly.

Benefits of Owning an Electric Car in Ireland

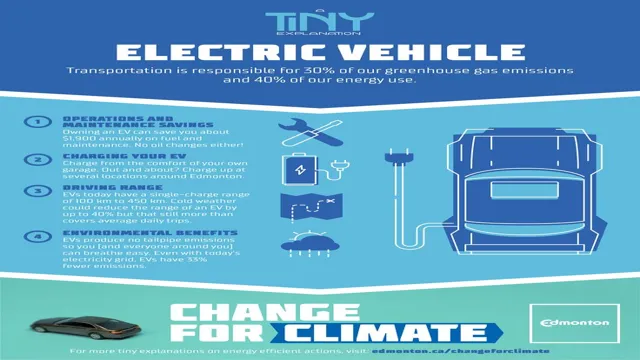

If you’re considering purchasing an electric car in Ireland, there are numerous benefits to take into account. For one, owning an electric car can help you save on fuel and maintenance expenses in the long run. Additionally, electric cars produce lower emissions, making them an eco-friendly option.

One of the most significant advantages, though, is the tax benefits you can receive. With the benefit-in-kind calculator Ireland electric car owners can use, you can calculate the tax relief you can get when purchasing and running your vehicle. This means that you can save a considerable amount on tax payments and deductions each year.

Moreover, purchasing an electric car means you will have access to charging points throughout the country, making long journeys much more manageable. With these benefits and more, owning an electric car in Ireland is not only more financially feasible, but it’s also a step towards a greener future.

Environmental Benefits of Driving an Electric Car in Ireland

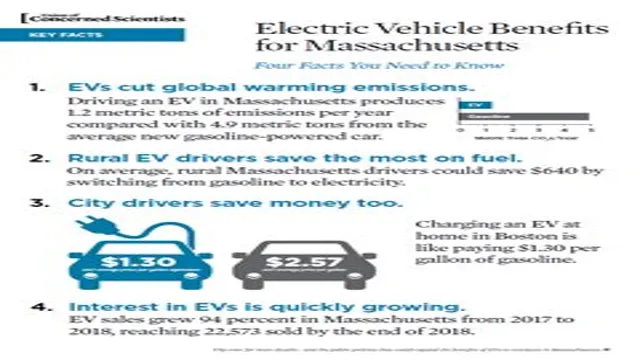

If you’re considering making the switch to an electric car in Ireland, it’s worth noting the environmental benefits that come with this decision. Firstly, electric cars emit significantly less carbon dioxide than traditional gas-guzzlers, which is great news for the planet. This is because electricity is generally cleaner than fossil fuels – particularly in Ireland, where we’re blessed with a high proportion of wind and hydroelectric power.

Additionally, electric cars don’t release harmful pollutants into the air, which can improve overall air quality and benefit human health. Not only that, but they’re quieter and produce less noise pollution than their traditional counterparts. In terms of waste, electric cars generate far less waste byproducts during their use, and their batteries can be recycled at the end of their lifespan.

All of these factors make owning an electric car in Ireland a more environmentally-friendly choice, with benefits that extend beyond your own driving experience.

Cost Savings of Driving an Electric Car in Ireland Compared to Gasoline Cars

If you are thinking about buying an electric car in Ireland, there are a number of benefits that might convince you to make the switch. Not only are electric cars better for the environment, but they can also save you significant amounts of money in the long run. According to recent studies, the cost savings of driving an electric car compared to a gasoline car in Ireland can be substantial.

In fact, over the lifetime of a vehicle, the cost savings can easily be in the thousands of euro range. This is due to the fact that electric cars are significantly more energy-efficient, meaning that they require less fuel to travel the same distance as a gasoline car. Additionally, the cost of electricity is generally lower than the cost of gasoline, meaning that the cost per mile of an electric car is significantly lower.

Overall, if you are looking for a sustainable and cost-effective mode of transportation, an electric car might be the perfect choice for you in Ireland.

Closing Thoughts and Additional Resources

If you’re considering purchasing an electric car in Ireland and want to know the potential benefits in kind, a benefit-in-kind calculator is a great tool to utilize. This calculator can give you an estimate of the additional tax and NI contributions you might owe if you choose an electric car. However, it’s important to keep in mind that the calculator can only give you an estimate, and it’s always best to consult with a financial advisor to get a better understanding of tax liabilities.

Additionally, further resources such as the Sustainable Energy Authority of Ireland and the Irish Electric Vehicle Owners Association can provide useful information on incentives, charging infrastructure, and other aspects of owning an electric car in Ireland. By utilizing available resources and properly planning, owning an electric car in Ireland can be a viable and eco-friendly option.

Conclusion

In conclusion, using a benefit-in-kind calculator for electric cars in Ireland is not just a smart move for our wallets, but also for the environment. As we shift towards a more sustainable future, electric cars are becoming an increasingly popular option for those looking to reduce their carbon footprint. By taking advantage of the many benefits that come with owning an electric car, from tax incentives to lower fuel costs and more, we can help drive positive change and lead the way towards a brighter, cleaner future.

So if you’re considering switching to an electric car, be sure to do your research and use a benefit-in-kind calculator to make the most of the many advantages that come with this exciting innovation. Your wallet – and the planet – will thank you!”

FAQs

What is a benefit-in-kind calculator in Ireland?

A benefit-in-kind (BIK) calculator in Ireland is a tool used to calculate the taxable value of a benefit given to an employee by their employer, such as a company car or health insurance.

How does an electric car affect benefit-in-kind calculations in Ireland?

Electric cars are incentivized in Ireland through lower BIK rates. The BIK rate is currently 0% for electric vehicles with a market value under €50,000, and 7% for those over €50,000. This means electric car owners in Ireland pay less tax on this benefit compared to traditional combustion engine cars.

Can a benefit-in-kind calculator in Ireland take into account personal usage of a work vehicle?

Yes, some benefit-in-kind calculators have the ability to factor in personal usage of a work vehicle, such as commuting and personal errands. This can affect the taxable value of the benefit and therefore the amount of tax the employee will have to pay.

Are there any other benefits that are subject to BIK taxation in Ireland besides company cars?

Yes, other benefits that may be subject to BIK taxation in Ireland include health insurance, gym memberships, company loans, and housing allowances. It is important for both employers and employees to understand the tax implications of these benefits.