Benefit in Kind Company Car Electric: Eco-Smart Perks

Many people want to know about electric cars. They ask, “What is a company car?” or “What is Benefit in Kind?” This article will explain everything you need to know. We will talk about electric cars, company cars, and the benefits they offer. Let’s dive in!

What is a Company Car?

A company car is a car given by an employer. This car is for work use. However, employees can use it for personal reasons too. Company cars can be petrol, diesel, or electric. Many companies offer cars to attract good workers.

What is Benefit in Kind?

Benefit in Kind (BIK) is a tax. It is paid on benefits received from work. If you have a company car, you pay tax on it. This is because it is not just for work. It is also for personal use.

Why Choose an Electric Company Car?

Electric cars are becoming popular. There are many reasons to choose electric cars. Here are some benefits:

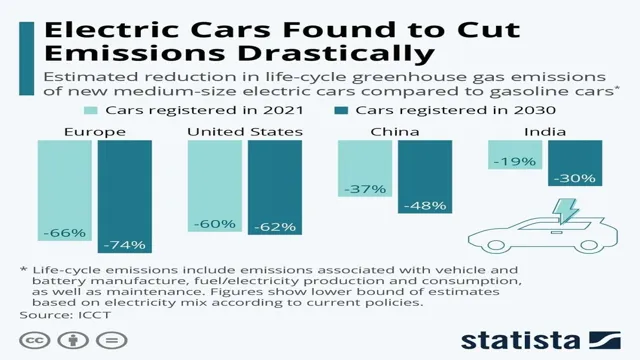

- Environmentally Friendly: Electric cars produce less pollution.

- Lower Fuel Costs: Electricity is cheaper than petrol or diesel.

- Government Incentives: Many governments support electric cars.

- Less Maintenance: Electric cars need less servicing.

- Quiet and Smooth Ride: Electric cars are quiet and easy to drive.

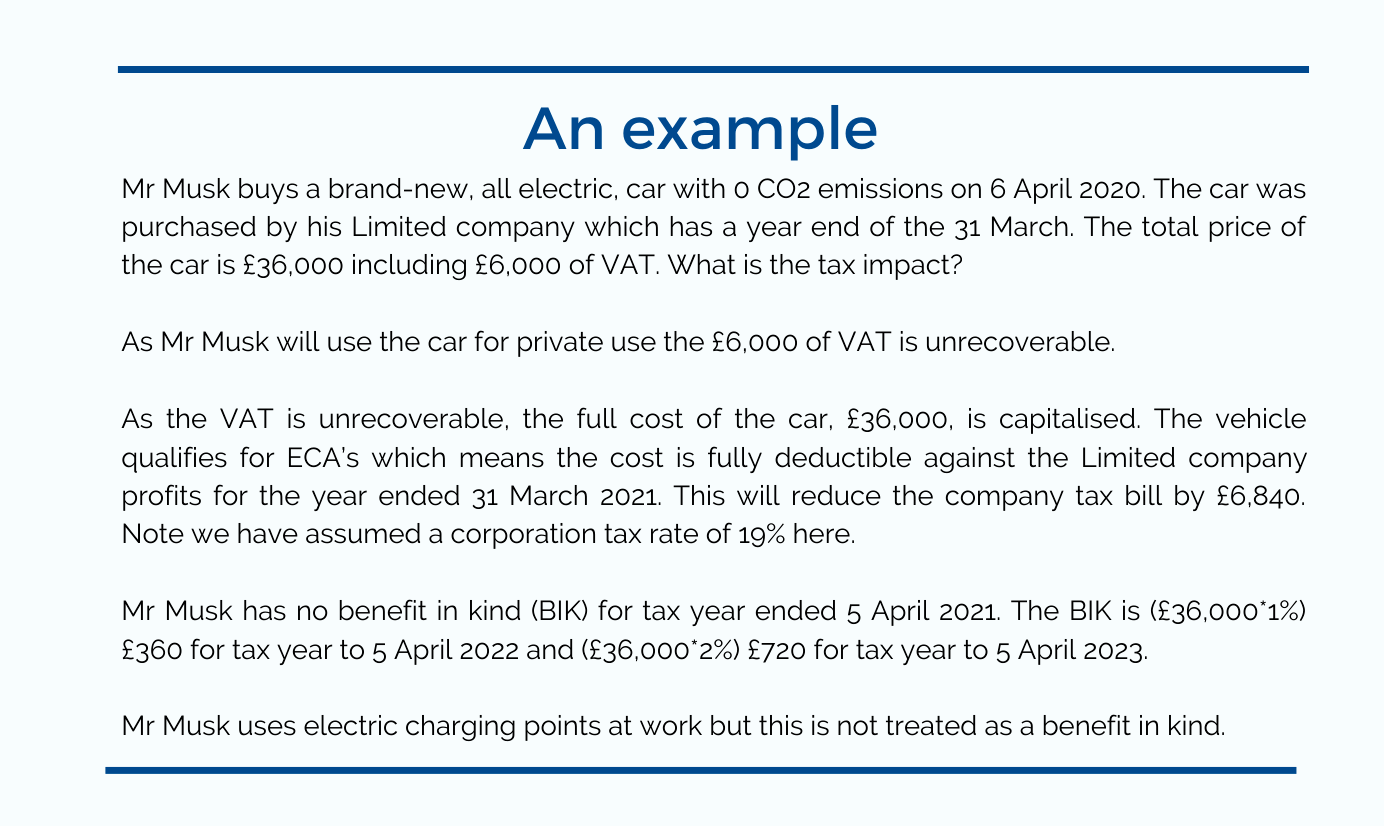

Tax Benefits of Electric Company Cars

One big benefit of electric company cars is tax savings. The BIK rate for electric cars is lower than for petrol or diesel cars. This means you pay less tax. Let’s look at some numbers.

| Type of Car | 2023 BIK Rate |

|---|---|

| Electric Car | 2% |

| Petrol/Diesel Car | 22% to 37% |

As you can see, electric cars are cheaper to tax. This makes them a smart choice for employees.

How to Calculate Your BIK Tax

Calculating BIK tax is simple. Here are the steps:

- Find the car’s value. This is the price when new.

- Multiply the value by the BIK rate. Use the rate for electric cars.

- Multiply the result by your tax rate. This is based on your income.

Let’s say your electric car is worth £30,000. The BIK rate is 2%. If your tax rate is 20%, here’s how it works:

- £30,000 x 2% = £600

- £600 x 20% = £120

You would pay £120 in tax for the year. That is much lower than for petrol cars.

Other Benefits of Electric Cars

Electric cars also have other advantages. Here are a few more:

- Charging at Home: You can charge your car at home. This is easy and convenient.

- Free Parking: Some places allow free parking for electric cars.

- Access to Bus Lanes: In some cities, electric cars can use bus lanes.

Possible Downsides of Electric Cars

While there are many benefits, there are some downsides. Here are a few:

- Charging Time: It takes time to charge electric cars.

- Range Anxiety: Some people worry about how far they can drive.

- Initial Cost: Electric cars can cost more upfront.

Frequently Asked Questions

What Is A Benefit In Kind (bik) For Company Cars?

A Benefit in Kind (BiK) is a tax applied to employees using company cars. It reflects the car’s value and emissions.

How Does Bik Apply To Electric Cars?

For electric cars, the BiK tax rate is lower. This means less tax for employees using electric company cars.

What Are The Tax Benefits Of Electric Company Cars?

Electric company cars often have lower BiK rates. They can lead to significant tax savings for employees.

Can I Choose Any Electric Car For Company Use?

Most companies allow you to choose from a specific list of electric cars. Check your company policy for details.

Conclusion

In summary, electric company cars offer many benefits. They are cheaper to tax and better for the environment. Choosing an electric car can save money in the long run. It is important to think about all the factors.

When you consider a company car, think about the type of car. Electric cars are a smart choice. They are good for you and the planet. Make sure to talk to your employer about options. You may find that an electric company car is right for you.

FAQs about Electric Company Cars

1. Can I Choose Any Electric Car?

Most companies have a list of approved cars. You can choose from this list.

2. How Do I Charge The Car?

You can charge it at home or use public chargers. Many places have charging stations.

3. What If I Need To Travel A Long Distance?

Plan your route and charging stops. Electric cars can go far with good planning.

4. Are There Any Hidden Costs?

Check for insurance and maintenance costs. These can vary by car.

5. What If My Company Does Not Offer Electric Cars?

Talk to your employer. They may consider adding electric options.

Now you know about Benefit in Kind company car electric. We hope this helps you understand better. Choosing the right car is important. Make sure to think about all your options.