Unlocking the Hidden Advantages of Benefit in Kind Electric Cars for a Greener Future

If you’re contemplating purchasing an electric car, then one of the benefits you might be interested in are the tax incentives that come with it. With various tax credits, deductions, and exemptions available for electric vehicles, you could potentially save thousands of dollars and reduce your overall tax liability. But what exactly are these tax benefits for electric cars, and how do they work? In this blog post, we’ll explore the ins and outs of electric car tax benefits, including federal and state incentives that can make the switch to an electric car an even more attractive option.

Overview

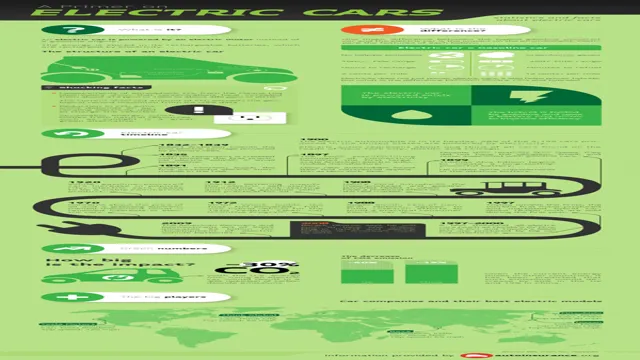

When it comes to owning an electric car, there are several benefits in kind that can offset the initial cost. Benefit in kind electric car refers to the perks offered to electric car owners such as tax relief, reduced insurance premiums, and lower fuel costs. These benefits are often the result of government incentives aimed at reducing the carbon footprint and promoting the use of electric vehicles.

Tax incentives, for example, can help lower the overall cost of an electric car. In some cases, an electric car may qualify for zero road tax cost and other perks. Moreover, electric cars are often cheaper to insure since they’re considered low-risk vehicles, reducing the overall cost.

The cost of electricity to charge an electric car is also significantly lower than the cost of fueling up a gasoline vehicle, providing additional savings over time. These benefits ultimately make purchasing an electric car a more cost-effective and environmentally-friendly option.

Explanation of Benefit in Kind

Benefit in Kind can often be a confusing topic for employees and employers alike. Simply put, Benefit in Kind refers to any non-monetary benefit provided to employees by their employer in addition to their salary or wages. These perks can include things like company cars, private healthcare, or even gym memberships.

However, it is important for both parties to be aware that these benefits are subject to taxation. Employers must report the value of these benefits to HM Revenue and Customs, and employees may see a reduction in their take-home pay as a result of the added tax. It’s important to note that the value of Benefit in Kind can vary greatly depending on the perk, and can often be a valuable addition to an employee’s overall compensation package.

How Electric Cars Qualify

Electric cars are becoming increasingly popular due to their eco-friendliness and cost-effectiveness. When it comes to qualifying for electric cars, there are various factors to consider. One of the main qualifications for electric cars is the vehicle’s range on a single charge.

The minimum range for an electric car to qualify varies depending on the state or country. Additionally, the battery capacity plays a crucial role in electric car qualifications. Another factor is the vehicle’s emission levels, which must meet specific standards to qualify as an electric car.

To benefit from tax credits and incentives, an electric car should be certified by the authorities as a qualified plug-in electric drive motor vehicle. The incentives are designed to encourage individuals to replace their gas-powered cars with electric ones, and it is a positive step towards achieving a sustainable future.

Savings

If you’re considering purchasing an electric car as your company vehicle, you could benefit from a reduced benefit in kind (BIK) tax rate. BIK is a tax paid on non-cash benefits that employees receive as part of their employment package, such as a company car. In the UK, the BIK rate for electric vehicles is much lower than for petrol or diesel cars, which means employees who use an electric company car will pay less tax.

Additionally, electric cars are exempt from vehicle excise duty, which can save you hundreds of pounds per year. And let’s not forget the savings on fuel costs – since electric cars run on electricity rather than petrol or diesel, they’re much cheaper to run. This can translate into significant savings for both you and your employer.

So not only is purchasing an electric car better for the environment, it can also be a smart financial move for your organization.

Lower Tax Liability for Companies

Lower Tax Liability for Companies – Maximize Your Savings As a business owner, one of your main goals is to maximize your savings, and one way to do that is to lower your tax liability. Reducing your tax bill not only increases your profits, but it also frees up more resources to grow your business. There are many strategies you can use to lower your tax liability, from taking advantage of tax deductions and credits to restructuring your business structure.

One popular tax-saving strategy is setting up a retirement plan for your employees. Not only does this benefit your workers, but it also gives you a tax deduction for contributions. Another effective strategy is investing in real estate, which gives you significant tax deductions and benefits, such as depreciation and mortgage interest deductions.

Furthermore, it’s important to stay up to date with the latest tax laws and regulations, as they can change frequently. Hiring a qualified tax professional can also help ensure you’re taking advantage of all available tax savings opportunities for your company. In conclusion, lowering your tax liability is a crucial step in maximizing your business profits.

Taking advantage of tax-saving strategies and staying informed about tax laws can help you achieve significant savings and increase your bottom line. So, start exploring your options today and discover how you can save more money for your company!

Employee Income Tax Savings

Employee income tax savings can be a vital aspect of maintaining financial stability, improving overall income, and building a savings account. By understanding how tax deductions work, employees can reduce their tax burdens and save more money, allowing them to invest in their future. A common misconception is that only the wealthy can save on taxes, but in reality, there are various deductions and credits available to middle and lower-income employees.

For instance, contributing to a 401(k) or IRA account can result in significant tax savings, as well as such expenses as education or healthcare costs. By maximizing tax savings opportunities, employees can keep more of their hard-earned money and use it to achieve their financial goals.

National Insurance Contribution Reduction

If you’re looking to reduce your National Insurance Contributions (NICs), then you may be able to save some money. The amount you have to pay in NICs depends on how much you earn, but there are ways to reduce this cost. For example, if you’re self-employed, you can claim a Class 2 NIC exemption if your profits are under a certain amount.

There are also other exemptions available for people who are over retirement age or have certain disabilities. By taking advantage of these exemptions, you can potentially save a significant amount of money each year. It’s important to keep in mind that you should always consult with a professional before making any decisions about your NICs.

They can help you navigate the complexities of the system and ensure that you’re getting the best deal possible. Overall, reducing your NICs is a great way to save money and take control of your finances.

Environmental Impact

Purchasing an electric car has numerous benefits, especially when it comes to the environment. One of the most notable benefits is the reduction in carbon emissions. With electric cars, harmful greenhouse gases are not produced, making them a more eco-friendly option compared to traditional gas-powered vehicles.

Additionally, electric cars also eliminate many of the pollutants and pollutants that are associated with conventional power sources, making them a cleaner option overall. One way to offset the cost of purchasing an electric car is by taking advantage of a benefit in kind electric car program. Essentially, this means that employers can provide electric cars as a company car and employees receive a tax break on the value of the car.

This not only incentivizes employees to opt for an eco-friendly option but also helps to make the transition to electric cars more affordable. By taking advantage of this program, companies can also reduce their own carbon footprint, making it a win-win situation for everyone involved.

Reduced Emissions & Smog

Reduced emissions and smog have become a hot topic among environmentally conscious citizens. It’s critical to recognize that the consequences of poor air quality can be devastating to both human health and the environment. As a result, reducing emissions and smog has become a top priority for many governments and organizations worldwide.

Thankfully, there are already many initiatives and measures in place that are having a significant impact on reducing these emissions. For example, the increasing implementation of electric vehicles and renewable energy sources like solar and wind power are reducing the carbon footprint on the environment by decreasing the amount of harmful pollutants produced by fossil fuels. However, it’s important to remember that reducing emissions and smog is a collective effort that requires everyone’s participation.

Whether it’s by choosing to utilize public transportation or investing in a solar panel, every small step we take can ultimately make a significant difference in protecting our environment.

Less Noise Pollution & Commuting Stress

One of the major benefits of remote work is its positive impact on the environment. With fewer people commuting to and from work, the level of noise pollution and traffic on the roads is significantly reduced. This not only has a positive impact on the environment but also on individuals who no longer have to endure the stress of commuting in heavy traffic or crowded public transport.

Additionally, remote work eliminates the need for a physical office space, reducing the carbon footprint of businesses. Overall, remote work has the potential to drastically reduce our impact on the planet, providing a more sustainable way of working for the future. So, if you’re looking to make a positive impact on the environment, consider ditching the office and joining the remote work revolution.

Conclusion

In conclusion, choosing an electric car as your company car may seem like just another financial decision, but it also has a positive impact on the environment. By reducing emissions and promoting sustainability, you are not only benefiting yourself but also benefiting society as a whole. Plus, let’s face it, driving an electric car just feels cool and futuristic – it’s like having a personal spaceship! So why not enjoy the perks of a benefit in kind electric car while simultaneously doing your part to save the planet?”

FAQs

What is a benefit in kind for an electric car?

A benefit in kind for an electric car refers to the tax liability that arises when an employer provides an employee with an electric company car that may also be available for private use.

How is the benefit in kind value of an electric car calculated?

The benefit in kind value of an electric car is calculated based on its list price, CO2 emissions, and electric range. The lower the CO2 emissions and the longer the electric range, the lower the benefit in kind value.

Can an employee opt-out of a company electric car to avoid the benefit in kind tax?

Yes, employees can opt-out of a company electric car to avoid the benefit in kind tax. However, they will then be responsible for paying for their own car and associated costs.

Are there any exemptions or reductions for the benefit in kind tax on electric cars?

Yes, the benefit in kind tax on electric cars is currently exempt from national insurance contributions, and there is a reduced rate for electric cars with low CO2 emissions and longer electric ranges. Additionally, from April 2020 the benefit in kind tax will be reduced to 0% for pure electric cars.