Powering Your Savings: Understanding the Benefit in Kind Electric Car Tax Exemption

Thinking of going electric with your car? One of the perks that come with owning an electric vehicle is the possibility of qualifying for tax exemptions. Yes, you read that right! Governments in several countries offer tax credits, rebates, and exemptions to incentivize the purchase and ownership of electric vehicles – and in this blog post, we’re diving into the details of electric car tax exemption. As awareness of environmental concerns increases, many people are looking to reduce their carbon footprint and become more sustainable in their daily commutes.

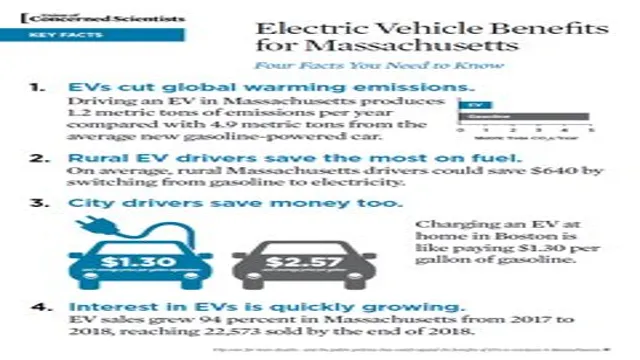

Electric cars have emerged as a popular option, thanks to their lower emissions, higher energy efficiency, and overall lower running costs. However, electric vehicles tend to come with a higher initial cost compared to traditional gasoline cars- but this is where the tax exemptions come in handy. Different countries and states have different tax policies surrounding electric vehicles, and we’ll be exploring some examples of these in detail in this post.

From the U.S. federal tax credit to state incentives, we’ll help you understand how much you can save by choosing an electric vehicle.

Whether you’re a first-time electric car buyer or already driving an EV, knowing the available tax incentives can help you make informed decisions about your next purchase, and maximize the benefits of owning an electric vehicle. So sit back, grab a cup of coffee, and let’s dive into the world of electric car tax exemption.

What is a Benefit in Kind?

If you’re an employer, you may have heard the term “benefit in kind” thrown around. But what exactly does it mean? Put simply, a benefit in kind refers to any non-cash perk that an employee receives as part of their job. This can include things like company cars, mobile phones, and health insurance.

However, if you’re considering offering your employees an electric car, there is a bonus benefit – electric cars are tax exempt! This means that both you and your employee could save money on taxes, which is always a win. So not only can you take pride in offering a sustainable and eco-friendly option to your team, but you can also save money in the long run.

Explanation of Benefit in Kind for Electric Cars

As an increasing number of individuals and businesses shift towards electric cars, it’s important to understand what a “Benefit in Kind” is and how it impacts those who choose to use these zero-emission vehicles. A Benefit in Kind (BIK) is a tax payment made by an employee on items that an employer provides, which have a perceived “value” beyond just their salary. When it comes to electric cars, the BIK is a tax on the benefit of using a company-owned, leased, or otherwise provided electric car.

This tax is calculated based on the car’s worth, the rate of the electric range, and CO2 emissions. Essentially, it’s a way for HMRC (Her Majesty’s Revenue and Customs) to ensure that employees who use these cars are paying their fair share of tax. While BIK can seem complicated, it is worth noting that electric cars typically have lower BIK rates than their petrol or diesel counterparts, making them a more cost-effective option for both employers and employees.

Tax Benefits for Electric Cars

If you’re thinking about purchasing an electric car, there are several tax benefits to consider. One of the most significant is the benefit-in-kind electric car tax exemption that was introduced in 2020. This means that company car drivers who opt for an electric vehicle are exempt from paying the benefit-in-kind (BIK) tax for the 2020-21 tax year.

This tax is usually charged on employees who receive an additional perk on top of their salary, such as a company car. However, electric cars are now classified as a “zero-emissions vehicle,” resulting in no tax being required. Not only does this mean you can save money, but it is also an excellent opportunity to do your bit for the environment by driving a cleaner car.

With electric cars becoming more accessible and affordable, it makes sense to take advantage of these tax benefits while also reducing your carbon footprint.

Salary Sacrifice Scheme

Are you considering purchasing an electric car? Did you know that there are tax benefits for driving electric cars through a salary sacrifice scheme? A salary sacrifice scheme allows employees to give up a portion of their salary in return for a non-cash benefit, such as a company car. Electric cars have several tax benefits, including a lower rate of company car tax and no fuel benefit charge if the car is charged at work. This means that electric cars can save you money on your taxes if you choose to lease or purchase one through a salary sacrifice scheme.

Plus, driving an electric car can also reduce your carbon footprint and help the environment. So, if you’re in the market for a new car, consider the tax benefits of an electric vehicle and how it might fit into a salary sacrifice scheme.

Company Car Tax Exemption

Electric cars offer significant tax benefits for companies in terms of car tax exemption. This can be an attractive proposition for businesses looking to reduce their carbon footprint and save money on vehicle expenses. The UK government’s commitment to reducing emissions means that electric vehicles will be seen as an essential investment for businesses in the long run.

With a higher range and lower running costs than ever, electric cars are becoming more and more practical for business use. Additionally, the government’s plug-in car grant can offer up to £2,500 off the cost of an electric car, making them even more cost-effective. Companies can take advantage of these tax benefits to not only reduce their environmental impact but also boost their bottom line.

With so many advantages, it’s no wonder that electric cars are becoming increasingly popular among businesses.

Saving Money with Electric Cars

One of the many benefits of owning an electric car is the exemption from benefit in kind (BIK) tax. For company car drivers, this can be a significant saving as BIK tax is calculated based on a percentage of the car’s list price and the driver’s personal tax bracket. Since electric cars have zero emissions, they are considered to be environmentally friendly, and therefore enjoy an exemption from BIK tax.

This makes electric cars an attractive option for both individual and corporate buyers, providing a significant cost-saving over petrol or diesel vehicles. With the increasing popularity of electric cars, it’s no wonder why more people are making the switch and enjoying the financial benefits that come with it.

Cost of Ownership Comparison: Electric vs. Petrol Cars

When it comes to cars, people are always on the hunt for ways to save money. One way to do this is by opting for electric cars over petrol cars. Not only are electric cars better for the environment, but they also have a significantly lower cost of ownership.

Electric cars are much cheaper to maintain than petrol cars because they have fewer moving parts that require servicing. Additionally, the cost of electricity used to power electric cars is much lower than the cost of petrol for petrol cars. Over time, this adds up to significant cost savings, making electric cars a smart choice for those looking to save money without sacrificing performance or style.

It’s worth noting that the upfront cost of electric cars may be slightly higher, but the long-term savings make it a worthwhile investment. So, when it comes to cost of ownership, the winner is clear – electric cars.

Savings from Government Incentives

Electric cars can save you money in the long run, especially when it comes to government incentives. Many governments offer tax credits or rebates to people who purchase electric cars, making it a financially responsible decision. For example, in the United States, the federal government provides a tax credit of up to $7,500 for those who purchase an electric vehicle.

Moreover, some states offer additional incentives on top of the federal credit. These incentives can help significantly reduce the cost of owning and operating an electric car over time, making it a smart investment for those looking to save money while also being environmentally conscious. So, if you’re wondering whether buying an electric car is worth it, consider the savings you’ll reap from government incentives alone.

Conclusion

In conclusion, the benefit in kind electric car tax exemption is not just a perk for environmentally conscious individuals. It is a smart move towards sustainable transportation and a step in the right direction for reducing our carbon footprint. Plus, who wouldn’t want to save money on their taxes while cruising around in a silent, emission-free vehicle? So, hop on board the electric car trend and enjoy the ride, both for your wallet and the planet.

“

Benefits of Investing in an Electric Car

Electric Cars Investing in an electric car provides a range of benefits, with one of the most significant being the potential cost savings. By switching to an electric car, you can save money on fuel costs as electric cars run on electricity rather than gasoline. They are also more energy-efficient, so they require less maintenance, which can save you a lot of money in the long run.

Furthermore, electric cars often come with incentives, such as tax credits, rebates, and reduced registration fees, which can further reduce the overall cost. While the upfront cost of an electric car may be higher than a traditional gas-powered vehicle, the long-term savings make it a worthwhile investment. Not only can you save money, but you can also reduce your carbon footprint and contribute to a cleaner environment.

Overall, investing in an electric car can be a financially smart and environmentally conscious decision.

Impact on the Environment and Future Generations

Switching to an electric car can not only help save money on fuel expenses but also have a positive impact on the environment and future generations. Petroleum fueled cars release harmful pollutants into the air, contributing to smog and climate change, while electric vehicles emit no emissions. In addition, electric cars utilize renewable energy sources, such as solar and wind power, making them even more environmentally-friendly.

Making the transition to an electric car can also benefit future generations by reducing our dependence on finite natural resources and creating a more sustainable future. Plus, the advancements in technology have made electric cars more affordable, making them a viable option for anyone looking to make a positive impact on the planet while saving money in the long run. So, why not make the switch today and start reaping the benefits?

FAQs

What is a benefit in kind and how is it calculated for electric cars?

A benefit in kind or BIK is a tax payable on any additional benefits an employee receives from their employer. For electric cars, the BIK is calculated based on the car’s list price, CO2 emissions, and battery range.

Are all electric cars exempt from benefit in kind tax?

No, not all electric cars are exempt from BIK tax. The exemption only applies to electric cars with zero emissions, meaning those with a CO2 emissions of 0g/km, and a battery range of 130 miles or more.

Is there a time limit for the electric car tax exemption on benefit in kind?

Yes, the electric car tax exemption on BIK is currently set to end in 2025. However, this could potentially be extended or reviewed by the government.

Can employers still claim back VAT on electric cars even if they are exempt from benefit in kind tax?

Yes, employers can still claim back VAT on electric cars even if they are exempt from BIK tax. This is because the VAT rules are separate from the tax rules, and there is no restriction on claiming back VAT for electric cars.