Drive towards Tax Savings in Ireland with Electric Cars – All you need to know about Benefit in Kind Tax Exemption!

Driving an electric car is becoming a more popular option for many people as we all aim to reduce our carbon footprint. It’s not only environmentally friendly, but it can also be cost-effective thanks to the Electric Car Tax Exemption in Ireland. For those of you who might be unaware, this tax exemption refers to the Benefit in Kind (BIK) that electric car owners receive from the Irish government.

In essence, this means that you won’t be taxed on the car’s value as it’s considered a company car. So, if you’re considering purchasing an electric car, you might be wondering about the benefits and restrictions of the Electric Car Tax Exemption. In this blog, we’ll explain everything that you need to know about the tax exemption and how you can take advantage of this benefit.

What is an Electric Car Tax Exemption?

As more and more people switch to electric cars, one of the significant benefits of owning one in Ireland is the electric car tax exemption. This benefit in kind tax exemption means that businesses can offer a tax-free electric company car to employees. Also, an individual who purchases an electric car can save thousands of euros in motor tax and VRT exempt.

This tax exemption aims to promote the use of electric cars in Ireland as they produce fewer emissions and are eco-friendly. The Irish government has also taken measures such as installing thousands of charging stations nationwide to support the growth of electric cars, making it more convenient and practical for car owners to purchase and own an electric car. So, if you’re considering buying an electric car, take advantage of the electric car tax exemption and enjoy the benefits while also contributing to a greener future.

Explanation and Definition of Benefit in Kind Tax

Benefit in Kind tax (BIK) Benefit in Kind tax, or BIK, is a tax levied on employees by the government on benefits that they receive from their employer, other than monetary compensation. It includes the provision of cars, health insurance, housing allowances, and other non-cash benefits. One notable application of BIK tax is the Electric Car Tax Exemption policy, which exempts electric and low-emission vehicles from tax.

The policy aims to promote the use of electric vehicles as a means of reducing carbon emissions and cutting down on air pollution. With the exemption, electric cars now have lower running costs, making them more attractive to individuals and businesses. Moreover, the Electric Car Tax Exemption serves as an incentive for companies to adopt sustainable practices and invest in electric vehicle fleets.

As more people opt for electric vehicles, the environment benefits from reduced emissions, and individuals save money on reduced BIK tax payments.

What are the Benefits of Electric Car Tax Exemption?

Electric Car Tax Exemption An electric car tax exemption is a policy that exempts electric vehicle owners from certain taxes, such as sales tax, property tax, or annual registration fees. This benefit is a significant incentive for drivers to switch to electric cars and contribute to a more sustainable future. By providing such incentives, the government aims to reduce carbon emissions and improve air quality.

From a driver’s standpoint, the tax exemption can save them thousands of dollars over the lifetime of their electric vehicle. Additionally, the reduced maintenance costs and fuel expenses of electric cars make them an attractive choice for budget-conscious buyers. Overall, tax exemptions are a win-win situation for both the environment and electric vehicle owners, making the transition to sustainable transportation more accessible and affordable.

Electric Car Tax Exemption in Ireland: How Does it Work?

If you’re considering purchasing an electric car in Ireland, you’ll be happy to know that the government offers a benefit-in-kind tax exemption for such vehicles. This means that the employee or company car user won’t have to pay tax on the value of the car and any perks associated with it. The exemption lasts for 3 years, starting from the date the car is first registered and only applies to new electric cars, not secondhand ones.

This is a significant saving for anyone considering an electric car, especially since the benefit-in-kind tax rate can be as high as 40% for traditional petrol or diesel vehicles. The Irish government’s aim is to encourage the adoption of electric cars, reduce carbon emissions and ultimately contribute to a more sustainable future. So if you’re looking for an eco-friendly and cost-effective way to travel, an electric car is definitely worth considering.

Who Qualifies for Benefit in Kind Tax?

If you’re wondering about the benefit-in-kind (BIK) tax for electric cars in Ireland, congratulations – you’re thinking of making the switch! Electric cars are exempted from BIK tax, provided they have a range of at least 50km on a single charge. This means that if your employer offers an electric company car, you won’t have to pay any tax on it. And if you’re self-employed and use an electric car for business, you can also avail of the tax exemption.

This is a great incentive for people to switch to electric cars, as the savings on tax can be significant. Plus, you’ll be doing your bit for the environment, too. So if you’re considering an electric car, don’t forget to factor in the BIK tax exemption as one of the benefits.

How Much Tax Can You Save?

If you’re considering purchasing an electric car in Ireland, you may be wondering how much tax you can save. The good news is that electric car tax exemption is in place to encourage more people to switch from internal combustion engines to EVs. This means that you won’t have to pay Vehicle Registration Tax (VRT) or motor tax.

Normally, VRT is calculated as a percentage of the car’s Open Market Selling Price (OMSP), and can range from 7% to 36%. Motor tax, on the other hand, is based on the car’s CO2 emissions and can cost up to €1,200 per year. With the electric car tax exemption, you can save thousands of euros in taxes over the course of your electric car’s lifetime.

Plus, electric cars are much cheaper to run and maintain than their petrol or diesel counterparts, saving you even more money in the long run. So why not consider going electric and reap the benefits of tax savings and reduced running costs?

What are the Limitations and Exceptions?

Electric Car Tax Exemption Ireland If you’re thinking of buying an electric car in Ireland, you’ll be pleased to know that you can enjoy an electric car tax exemption. This exemption means that you won’t have to pay any Vehicle Registration Tax (VRT) or annual motor tax on your new vehicle. However, it’s important to note that not all electric cars are eligible for this exemption.

To qualify, your car must fall under certain emissions criteria established by the Irish government. Additionally, there are a few exceptions to this exemption, such as for used electric cars and for electric cars bought outside of Ireland. Overall, though, the electric car tax exemption in Ireland is a great incentive for eco-conscious drivers who want to reduce their carbon footprint and save money on their car expenses.

Why Should You Consider Owning an Electric Car?

If you are looking for a more eco-friendly way to travel, you may want to consider owning an electric car. Not only do electric cars significantly reduce your carbon footprint, but they can also save you money in the long run. In Ireland, electric cars are eligible for benefit in kind (BIK) tax exemption, meaning that you will not have to pay any tax on the company car you use for your personal journeys.

This can result in significant savings compared to using a traditional petrol or diesel car. Additionally, electric cars are often cheaper to maintain and repair due to their simplified drivetrain and fewer moving parts. If you are worried about range anxiety, rest assured that many modern electric cars have a range of over 200 miles and also have access to a growing network of charging stations across the country.

With their numerous environmental and financial benefits, electric cars are a compelling choice for those looking to make a positive impact on the planet and their wallet.

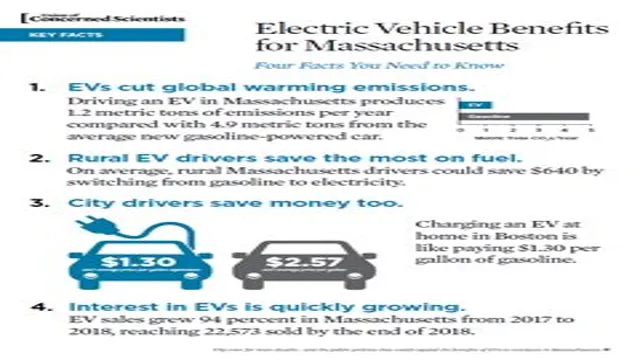

Environmental Benefits of using Electric Cars

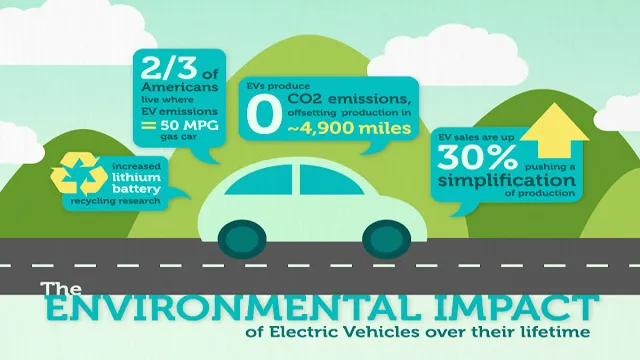

Electric cars have been gaining popularity in recent years, and for good reason. Owning an electric car comes with many environmental benefits that cannot be ignored. For starters, electric cars produce zero emissions, which means that they do not emit harmful pollutants into the air like traditional gas-powered cars do.

This means that electric cars can contribute significantly to reducing air pollution, improving air quality, and ultimately help combat climate change. As an added bonus, owning an electric car can also save you money in the long run, as they are less expensive to maintain and run on electricity instead of gasoline. So, if you are looking for a sustainable and cost-effective way to get around, consider investing in an electric car.

Your wallet, and the planet, will thank you.

Cost Savings and Incentives

Owning an electric car can have a multitude of cost savings and incentives, making it a compelling option for anyone in the market for a new vehicle. Firstly, electric cars run on electricity instead of gas, which can save you thousands of dollars in fuel costs over the lifetime of the vehicle. Maintenance costs are also typically lower due to fewer moving parts that require attention, such as oil changes.

Additionally, many states and municipalities offer tax incentives and rebates for purchasing electric cars, further reducing the upfront costs of owning one. These incentives can range from several hundred dollars to several thousand dollars, depending on where you live. Another perk of owning an electric car is access to specialized parking spots and charging stations in public areas, which can save you time and money when it comes to parking fees and finding a place to charge up.

All in all, owning an electric car can provide significant cost savings and incentives that make them an attractive investment for anyone in the market for a new vehicle.

Conclusion

In conclusion, the benefit in kind electric car tax exemption in Ireland is a shining example of government policies that promote sustainable living and clean energy. By encouraging the use of zero-emission vehicles, Ireland is taking a step towards a greener economy and healthier environment. Not only does this policy benefit the planet, but it also puts money back into the pockets of those who choose to go electric.

It’s a win-win situation that we can all feel good about. So, if you’re in the market for a new car, why not go electric and take advantage of this tax exemption? Your wallet and the planet will thank you!”

FAQs

What is a benefit in kind (BIK) for an electric car in Ireland?

A benefit in kind is a type of taxable benefit that an employee receives from their employer. In Ireland, there is a tax exemption for electric cars, which means that an electric car used for business purposes will not be subject to BIK tax.

Are there any restrictions on the type of electric car that qualifies for the tax exemption in Ireland?

Yes, in order to qualify for the tax exemption, the electric car must emit no more than 50g/km of CO2 and have a minimum electric range of 50km.

Is the BIK tax exemption for electric cars permanent in Ireland?

No, the BIK tax exemption for electric cars is currently scheduled to end in 2022. The Irish government has not yet announced any plans to extend or renew the tax exemption beyond this date.

Can companies claim the tax exemption for electric cars used for personal purposes in Ireland?

No, the tax exemption for electric cars in Ireland only applies to cars used for business purposes. If an electric car is used for personal purposes, it will still be subject to BIK tax.