Discover How You Can Save Big with the Benefit in Kind Electric Cars Calculator

Electric cars are gaining popularity as people begin to gravitate towards eco-friendly and cost-effective vehicles. If you’re considering making the switch, you might be wondering whether it’s worth it in terms of taxes and benefits. One thing to consider is the benefit in kind (BIK) tax – this is the tax you pay on perks you receive from your employer, such as a company car.

The good news is that electric cars are generally BIK tax-free until 2025, making them an attractive option for both employers and employees. In this blog post, we’ll explore how you can calculate your electric car BIK tax and discover the potential savings you could make. So, if you’re curious about how much you could benefit from making the switch to an electric car, grab a cup of coffee and let’s get started!

What is Benefit in Kind?

If you are considering purchasing an electric car, it’s important to understand what Benefit in Kind (BIK) is and how it may affect you. BIK refers to any non-cash perks or benefits that an employer provides to their employees in addition to their salary. This can include things like company cars, gym memberships, and health insurance.

When it comes to electric cars, the BIK rate is much lower than traditional combustion engine cars, making them a more appealing option for both employers and employees. In fact, employees who are provided with an electric company car may pay little to no tax on it, depending on its emissions. To calculate your BIK for an electric car, you can use a BIK electric car calculator which takes into account the make and model of the car, your personal tax bracket, and any additional perks or benefits you may receive.

With a lower BIK rate, electric cars are a financially viable option for both employers and employees looking to reduce their carbon footprint.

Explaining the tax concept of Benefit in Kind

Benefit in Kind is a term used in tax regulations that refers to any non-cash benefits supplied by an employer to an employee as part of their employment package. This could be anything from a company car, to free meals or accommodation, and even private healthcare or gym membership. The value of these benefits must be calculated and added to the employee’s taxable income, meaning they’ll pay more tax overall.

The idea behind Benefit in Kind is to ensure that employees are contributing their fair share to the costs of these benefits, rather than just receiving them tax-free. It’s important for employers to accurately report and calculate these benefits, as failing to do so can lead to fines and even legal action.

How is Benefit in Kind Calculated?

Calculating the benefit in kind for electric cars requires some understanding of the process. The benefit in kind is essentially the value of any additional benefits that employees receive from their employer beyond their ordinary salary. The benefit in kind for electric cars is calculated based on the vehicle’s list price, CO2 emissions, and the tax bracket an employee falls under.

The value of the benefit is then added to an employee’s salary and taxed accordingly. Fortunately, there are a variety of online calculators available to assist with this process. These calculators take into account the make and model of the car, its list price, and the employee’s tax bracket to provide an accurate calculation of the benefit in kind.

By using one of these calculators, both employers and employees can have a better understanding of the tax implications associated with the use of electric cars. So, if you’re considering providing electric cars as a benefit to your employees or you’re an employee who’s been offered an electric car, using a benefit in kind electric cars calculator can help you make an informed decision.

Factors that determine your electric car’s benefit in kind

As electric cars become more popular, it’s important to understand how Benefit in Kind (BIK) is calculated. BIK is determined by several factors, including the list price of the car when new, CO2 emissions, and the electric vehicle’s electric range. The list price of the car is critical, as it determines the percentage of BIK that is charged.

The higher the list price, the higher the percentage of BIK charged. The other significant factor is the electric range of the vehicle, which is used to determine the BIK percentage rate. The longer the electric range, the lower the BIK percentage rate.

The CO2 emissions also play a part, with zero-emission vehicles being taxed at a lower rate than petrol or diesel cars. The BIK rates vary each year, so it’s a good idea to double-check before making any big decisions. However, as electric vehicles continue to rise in popularity, the BIK rates are likely to become more favourable towards them.

Using online tools to calculate your benefit in kind

Calculating your benefit in kind (BIK) can seem like a daunting task, but with online tools, it can be a breeze. BIK is essentially the value of any non-cash benefits that you receive from your employer, such as a company car or private health insurance. The calculation of BIK takes into account various factors such as the value of the benefit, the duration of use, and your personal tax bracket.

However, online BIK calculators use sophisticated algorithms to quickly determine the exact amount you need to pay based on a few simple inputs such as your car type or any medical procedures you received. These tools are incredibly user-friendly and are a great way to take the guesswork out of calculating your BIK. The next time you’re wondering how much tax you need to pay, consider using an online BIK calculator to make the process easy and stress-free.

Benefits of Owning an Electric Car

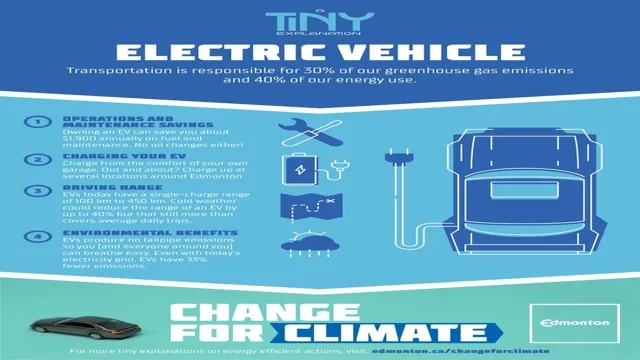

If you’re looking for a more environmentally friendly mode of transportation, then you might want to consider investing in an electric car. Not only do they produce zero emissions, but electric vehicles also come with a range of benefits that can help you save on costs in the long run. One of these benefits is the ability to use a benefit in kind electric cars calculator, which helps you determine the tax you’ll pay for using an electric car as a company vehicle.

In addition to tax savings, you can also save on fuel costs, as electric cars are significantly cheaper to recharge compared to gasoline or diesel vehicles. Another benefit of owning an electric car is the reduced maintenance fees. With fewer mechanical parts and no need for oil changes, electric vehicles require less maintenance, which can save you a significant amount of money in the long run.

Overall, owning an electric car can provide numerous benefits that not only benefit the environment but also save you money on taxes, fuel, and maintenance fees.

Financial and Environmental benefits of driving an electric car

Are you considering buying an electric car but unsure of the benefits it offers? Allow me to inform you about the financial and environmental benefits of driving an electric car. First off, owning an electric vehicle saves you money in the long run on fuel costs since they operate on electricity instead of gasoline. You also avoid the volatility of gas prices, making it easier to budget for your car maintenance expenses.

Moreover, EVs have fewer moving parts compared to traditional gasoline-powered cars, leading to reduced maintenance costs, and no oil changes. Another vital benefit of driving an electric car is its positive impact on the environment. Traditional gas-powered cars produce carbon dioxide emissions that contribute to climate change.

In contrast, EVs run on electricity generated from renewable sources that don’t produce carbon emissions, making them eco-friendly. The world is increasingly becoming aware of the urgency of protecting the environment, making electric cars a compelling choice for those who care about reducing their carbon footprint. In conclusion, owning an electric car has many benefits.

It’s not only an eco-friendly solution but also a financially savvy one. In the long run, you can save thousands of dollars on fuel and maintenance costs while being environmentally conscious. Still, interested in learning more about owning electric cars? Browse our website to learn more about electric cars, their pros and cons and which models best suit you and your lifestyle.

Reducing your carbon footprint with an electric car

If you’re looking to reduce your carbon footprint, owning an electric car can be one of the best choices you make. Not only do electric cars produce zero emissions, but they also offer a range of other benefits that make them a smart investment. For one thing, electric cars are much cheaper to operate than gas-powered vehicles, since they require much less maintenance and you don’t need to pay for gas.

Additionally, electric cars are usually eligible for tax incentives and rebates, making them an even more affordable option. Another benefit of owning an electric car is that they’re generally very quiet and smooth to drive, offering a relaxing and enjoyable driving experience. So, if you’re in the market for a new car and want to make a positive impact on the environment, an electric car is definitely worth considering.

Conclusion

So there you have it, folks – the benefit in kind electric cars calculator. Not only does it help you save money on taxes and other expenses, but it also encourages you to make a sustainable and environmentally friendly choice. With electric cars becoming more accessible and affordable as time goes on, we can all do our part in reducing carbon emissions and protecting the planet.

So why not give the calculator a try and see how much you can save? Who knows, you may even end up liking the feeling of driving a quiet and emission-free vehicle. Just don’t forget to wave at the gas pumps as you pass them by!”

Final thoughts on calculating your electric car’s benefit in kind

In conclusion, owning an electric car has numerous benefits that go beyond just the cost savings. The reduction in emissions is a huge factor in the overall positive impact on the environment. Additionally, the lower running costs and government incentives make an electric car an attractive option.

However, when calculating your benefit in kind for tax purposes, it is important to consider the specific details of your situation. Factors such as the list price, CO2 emissions, and accessories all play a role in determining the tax bracket. By taking the time to carefully evaluate your electric car’s benefit in kind, you can ensure that you are making a financially sound decision that also benefits the environment.

So, if you’re in the market for a new car, consider joining the electric vehicle revolution and enjoy the benefits that come with it.

FAQs

What is a benefit in kind for electric cars?

A benefit in kind for electric cars is a type of taxable benefit that employees receive for using a company-provided electric car for personal use.

How is the benefit in kind for electric cars calculated?

The benefit in kind for electric cars is calculated based on the car’s list price, CO2 emissions, and electric range. You can use an online benefit in kind calculator to calculate your electric car’s benefit in kind.

Is the benefit in kind for electric cars cheaper than for petrol or diesel cars?

Yes, the benefit in kind for electric cars is generally cheaper than for petrol or diesel cars because they have lower CO2 emissions, and thus incur lower tax rates.

Can employers offer employees interest-free loans to buy electric cars?

Yes, employers can offer employees interest-free loans to buy electric cars, up to a maximum of £10,000. This loan is considered a tax-free benefit in kind, and employees can pay back the loan through salary sacrifice.