Saving on Taxes: Understanding Benefit in Kind for Electric Cars as per HMRC Guidelines

Electric cars have gained significant popularity in recent years due to their eco-friendliness, low operating costs, and tax incentives. Among these incentives are benefits provided by HM Revenue and Customs (HMRC) in the UK. But what exactly are these benefits, and how can they make your transition to an electric vehicle (EV) more affordable? In this blog, we’ll take a closer look at the HMRC benefits for electric cars and how they can help you save money on your green journey.

Whether you’re planning to buy, lease, or rent an electric car, understanding these benefits will enable you to make an informed decision and maximise your savings. So, let’s dive in and explore the world of EV incentives!

What is Benefit in Kind?

Benefit in Kind (BIK) is a term used by HM Revenue and Customs (HMRC) to refer to any non-cash incentive received by an employee or a director from their employer. This incentive could include the use of an electric car as a company car. The BIK tax is applied when an employer provides a personal benefit or perk, which is not entirely necessary for an employee to carry out their job.

For instance, a company car is only necessary when the employee uses it primarily for business purposes. However, when it is used for personal journeys, this is considered a BIK and taxed as part of the employee’s income. In the case of electric cars, BIK is treated similarly to other company cars but has reduced tax rates and, in some cases, is entirely tax-free.

This tax relief is part of the government’s initiative to encourage the use of low-emission vehicles and reduce carbon emissions.

Explanation of Benefit in Kind for Electric Cars

Benefit in Kind (BIK) is a tax that employees have to pay for the benefits they receive from their employers. It is generally applicable to company cars and other perks, which the employees use for personal purposes in addition to their job-related functions. The BIK tax also applies to electric cars owned by companies and provided to employees for their private use.

To calculate the BIK tax for electric cars, the list price is multiplied by the BIK rate based on the recorded CO2 emissions. However, since electric cars are environmentally friendly and produce zero emissions, the BIK rate is currently set at 1% for the tax year 2021-22, and will increase to 2% in the following year. This makes electric cars an attractive option for both employers and employees, who can enjoy the benefits of owning and driving a zero-emission vehicle while also saving on taxes.

How are Electric Cars Taxed?

When it comes to electric cars, the way they’re taxed can be a bit tricky to understand. If you’re an employer providing an electric car as a company car, you’ll need to be aware of the benefit in kind tax implications. This tax is calculated based on the car’s list price and its CO2 emissions.

However, for electric cars registered after 6th April 2020, there is a 0% benefit in kind tax rate for the tax year 2020-202 This means that employees who have these vehicles as company cars won’t have to pay any income tax on them. It’s also essential to note that if the electric car has a range of over 130 miles, it can qualify for 100% first-year allowances for your business.

This can be a significant advantage for companies who are looking to replace their fleet with electric cars. So, if you’re considering getting an electric car, it’s worth checking out the tax benefits you may be entitled to.

Overview of Taxation for Electric Cars

As more and more people choose electric cars, understanding the taxation of these vehicles has become increasingly important. The answer to the question “how are electric cars taxed” is not a simple one, as it varies depending on which country and state you are in. However, in general, electric vehicles can earn drivers tax credits and incentives, especially if they are used for business purposes.

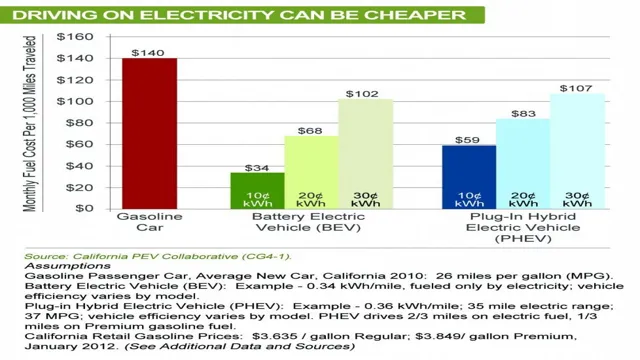

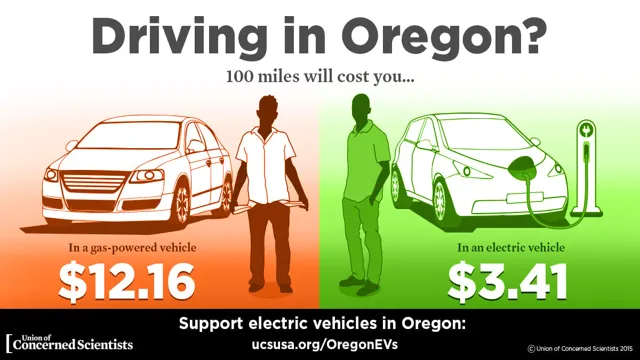

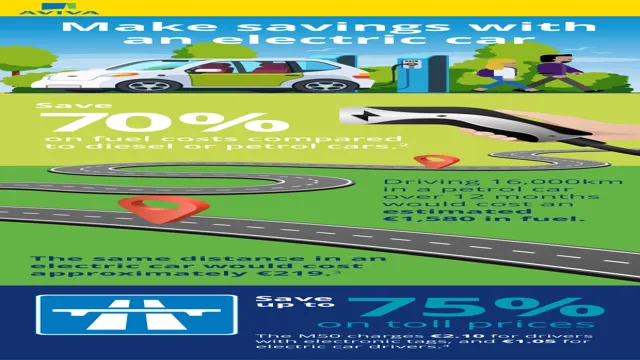

In some areas, there may also be additional taxes on the vehicle’s purchase price or annual fees based on its value. It’s important to research and understand the tax laws in your area to get a clearer picture of the costs and benefits of owning an electric car. Ultimately, while taxation may be a factor to consider, the environmental benefits and potential savings on fuel costs for electric vehicles make them an attractive option for many drivers.

Comparison of Taxation between Electric and Non-Electric Cars

When it comes to taxation, there are some key differences between electric cars and non-electric cars. Electric cars, for example, may be subject to lower taxes in some areas. This is because they are considered to be more environmentally friendly than traditional cars that run on gasoline or diesel.

In some places, there may also be tax incentives available for those who purchase electric cars. The exact tax situation for electric cars will vary depending on where you live and the specific laws in your area. However, in general, electric cars are often taxed based on their overall value, just like traditional vehicles.

This means that if you purchase a more expensive electric car, you may be subject to higher taxes. One thing to keep in mind is that tax laws and regulations are always changing. This means that it’s important to stay up to date with the latest news and updates about electric car taxation.

By doing so, you can ensure that you are not missing out on any potential tax incentives or other advantages that may be available to you. In summary, while electric cars may be subject to some taxation, they may also offer certain tax advantages in some areas. It’s important to understand the specifics of how electric cars are taxed in your area, as well as any potential incentives that may be available to you.

By doing so, you can make an informed decision about whether an electric car is the right choice for you, both financially and environmentally.

Additional Benefits for Electric Car Owners

If you’re considering buying an electric car, it’s important to know that there are additional benefits available beyond just the environmental friendliness of the vehicle. One major benefit in kind for electric cars is the lower rate of Company Car Tax, which is determined by the vehicle’s carbon emissions. Since electric cars emit significantly less carbon than traditional gas-powered cars, drivers of electric vehicles can end up with significantly lower tax bills.

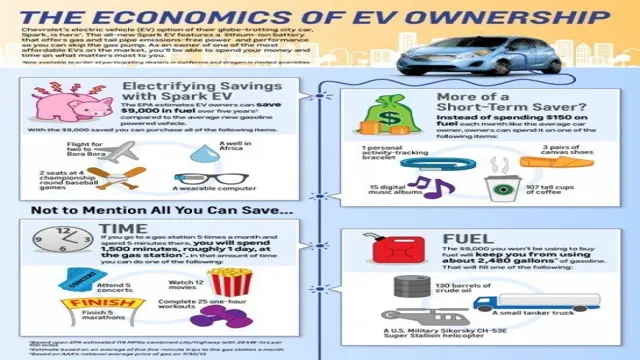

Additionally, the HMRC offers a tax exemption for workplace charging, meaning that companies can install car chargers for their employees without incurring any monetary benefit in kind charges. This can make charging your electric car at work a very convenient and cost-effective option. Overall, there are many financial advantages to owning an electric car beyond just the initial cost savings on fuel.

Charging and Parking Benefits

Electric car owners enjoy several benefits that set them apart from traditional gas-powered vehicle owners. One such benefit is the availability of free charging at select public charging stations. Many cities and businesses offer free or reduced-cost charging for electric car owners as a way to incentivize the use of environmentally friendly vehicles.

Additionally, electric car owners can save money on parking in certain areas that offer discounted or free parking for electric vehicles. Some businesses also offer priority parking for electric car owners, making shopping trips much more convenient. These benefits not only save the electric car owner money but also contribute to a more sustainable and eco-friendly transportation future.

So, if you are considering making the switch to an electric car, you can rest assured that your investment will provide more than just financial savings.

Company Car Tax Savings for Employers and Employees

When it comes to company car tax savings, electric car owners have an additional benefit compared to traditional gas-powered cars. One of the biggest advantages is the reduction in Benefit-in-Kind (BIK) tax rate, which is based on the CO2 emissions of the vehicle. Electric cars have no emissions, resulting in a lower BIK rate and significant savings for both employers and employees.

Another advantage is the exemption from road tax, saving electric car owners additional costs. However, it’s important to note that the cost of electric cars may be higher upfront, but the long-term savings make it a wise investment. Additionally, the government offers various incentives and grants to encourage the use of electric vehicles, making it an even more compelling option.

So, not only are drivers contributing to a greener future, but they’re also benefiting from cost savings in the long run.

Conclusion

In conclusion, when it comes to benefit in kind for electric cars, HMRC is sending a clear message: drive green, save green. Not only do electric cars bring numerous benefits to our environment, but they also offer significant savings when it comes to tax and other expenses. With zero emissions, cheaper running costs and favourable tax rates, electric cars are undoubtedly the future of motoring.

So, why not join the electric revolution and reap the many benefits that come with it? It’s good for the planet, good for your wallet, and above all, it’s just good common sense.”

FAQs

What is a Benefit in Kind for electric cars according to HMRC?

Benefit in Kind (BIK) is a tax that is paid when employees receive benefits that are not in the form of salary. According to HMRC, electric cars are subject to a BIK tax, which is calculated based on the car’s value and emissions.

Are all electric cars subject to a Benefit in Kind tax?

No, not all electric cars are subject to a BIK tax. Only those that emit CO2, whether through the battery or a range extender, are subject to the tax.

What is the rate of BIK tax for electric cars?

The rate of BIK tax for electric cars is currently set at 1% for the tax year 2021-22. This is significantly lower than the rate for petrol and diesel cars, which can range from 25-37%.

Can employers claim back the VAT on electric cars?

Yes, employers can claim back the VAT on the purchase of electric cars for their employees. However, this can only be done if the car is used exclusively for business purposes. If it is also used for personal use, then the VAT cannot be claimed back.