Benefit in Kind for Electric Cars: Unlock Tax Perks

Electric cars are becoming more popular. Many people choose them for different reasons. One reason is the benefit in kind. This term refers to the extra value you get from your employer. It is important to understand how this works for electric cars.

What is Benefit in Kind?

Benefit in kind is a tax term. It means you receive something extra from your job. This could be a car, health insurance, or other perks. If you get a company car, you may have to pay tax on it. The tax amount depends on the car’s value and emissions.

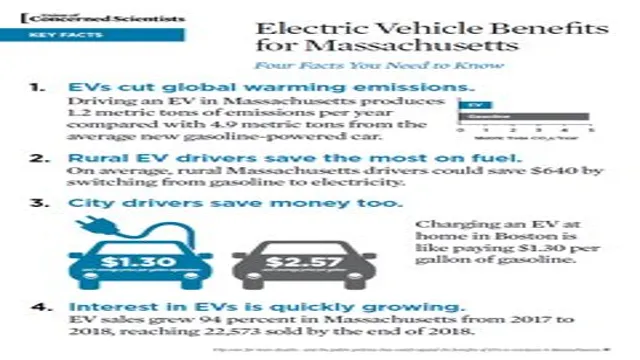

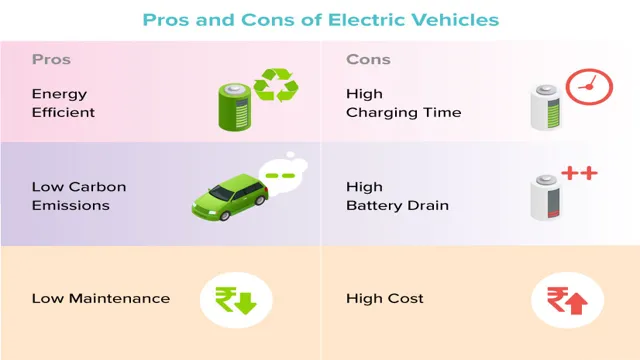

Why Choose Electric Cars?

Electric cars have many benefits. They are good for the environment. They create less pollution. They also cost less to run. Fuel prices for electric cars are lower than for gas cars. Many people enjoy these benefits.

How Does Benefit in Kind Work for Electric Cars?

Benefit in kind applies to electric cars too. If your employer provides you with an electric car, you may pay less tax. The tax rate is lower for electric cars. This makes them a good choice for many workers.

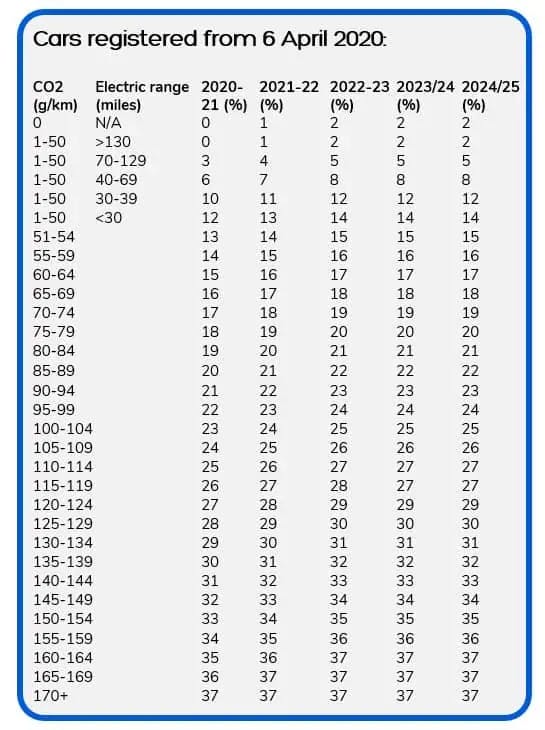

Tax Rates For Electric Cars

The government sets tax rates. These rates depend on the car’s emissions. Electric cars have zero emissions. This means they often have a lower tax rate. In 2023, the rate for electric cars is just 2%. This is very low compared to gas cars.

How To Calculate Your Benefit In Kind Tax

To calculate the tax, you need some information:

- Car’s list price

- Percentage rate for the car’s emissions

- Your tax bracket

First, find the car’s list price. Then, multiply it by the percentage rate. This gives you the taxable value. Finally, multiply this value by your tax rate. This will show how much tax you need to pay.

Example Calculation

Let’s say your electric car costs $30,000. The percentage rate for electric cars is 2%. Your tax bracket is 20%.

First, calculate the taxable value:

Now, calculate the tax:

You will pay $120 in tax for the year. This shows how low the tax is for electric cars.

Other Benefits of Electric Cars

Besides low taxes, electric cars offer other benefits:

- Lower running costs

- Less maintenance

- Silent operation

- Tax credits and grants

Lower Running Costs

Electric cars usually cost less to charge than to fill with gas. This means you save money every time you charge your car. It can be a big saving over time.

Less Maintenance

Electric cars have fewer moving parts. This means they often need less maintenance. You may not need to change oil. This can save you money and time.

Silent Operation

Electric cars are quiet. This makes driving more enjoyable. It also helps reduce noise pollution.

Tax Credits And Grants

Many governments offer tax credits. These can help you save money when you buy an electric car. Some places also offer grants to help with the cost.

Frequently Asked Questions

What Is Benefit In Kind For Electric Cars?

Benefit in Kind (BiK) is a tax on perks provided by employers. For electric cars, this tax is usually lower.

How Is Bik Calculated For Electric Vehicles?

BiK for electric vehicles depends on their value and emissions. Lower emissions mean lower tax rates.

What Are The Tax Rates For Electric Cars?

Tax rates for electric cars are lower than those for petrol or diesel. This encourages greener choices.

Are There Any Exemptions For Electric Cars?

Yes, electric cars often have lower or zero BiK rates. This makes them more attractive for employees.

Conclusion

Benefit in kind for electric cars is a great option. It can save you money on taxes. Electric cars also offer many other benefits. They are good for the environment and can save you money in the long run. If you are thinking of getting a company car, an electric car is a smart choice. Talk to your employer about this option. The benefits are clear and can help you a lot.

FAQs about Benefit in Kind for Electric Cars

1. What Is The Benefit In Kind Tax Rate For Electric Cars?

The tax rate for electric cars is currently 2%.

2. How Do I Calculate My Benefit In Kind Tax?

Multiply the car’s list price by the percentage rate. Then, multiply by your tax bracket.

3. Are There Other Benefits To Driving An Electric Car?

Yes, electric cars have lower running costs and require less maintenance.

4. Can I Get Any Tax Credits For Electric Cars?

Yes, many governments provide tax credits or grants for electric car buyers.

5. Why Are Electric Cars Better For The Environment?

Electric cars produce no emissions. This helps reduce air pollution.