Benefit in Kind for Electric Cars HMRC: Tax Perks Unveiled

Electric cars are becoming popular. Many people want to drive them. They are good for the environment. They also save money. But what about taxes? This is where Benefit in Kind (BIK) comes in. Let’s learn about BIK for electric cars and what HMRC says.

What is Benefit in Kind?

Benefit in Kind is a tax. It applies when you get a car from your employer. If you use the car for personal travel, you may need to pay tax. This tax is based on the car’s value and its emissions. The higher the emissions, the higher the tax.

Why Focus on Electric Cars?

Electric cars are different. They produce no emissions. This makes them better for our planet. Because of this, the tax rules are different. HMRC wants to encourage people to use electric cars.

How is BIK Calculated for Electric Cars?

HMRC has a special way to calculate BIK for electric cars. Here are the main points:

- First, the car’s list price is important.

- Second, the car’s CO2 emissions matter.

- Third, the BIK rate is based on these two factors.

List Price

The list price is the cost of the car. It includes options and extras. For electric cars, the list price can be high. But this does not always mean high BIK.

Co2 Emissions

Electric cars have very low CO2 emissions. Most have zero emissions. This helps lower the BIK rate. The lower the emissions, the lower the tax.

Current BIK Rates for Electric Cars

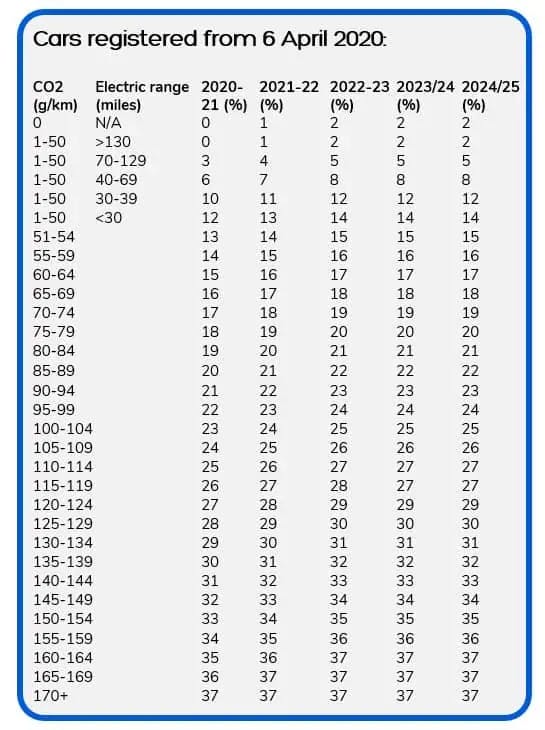

HMRC sets BIK rates each year. For electric cars, the rates are very low. Here is a table of BIK rates for electric cars:

| Tax Year | BIK Rate (%) |

|---|---|

| 2020/2021 | 0% |

| 2021/2022 | 1% |

| 2022/2023 | 2% |

| 2023/2024 | 2% |

As you can see, the BIK rates are very low. This makes electric cars a good choice. You pay less tax compared to petrol or diesel cars.

How Does This Benefit You?

Choosing an electric car can save you money. Here are some benefits:

- Lower tax bills.

- Less impact on the environment.

- Lower fuel costs.

- Less maintenance required.

Lower Tax Bills

With low BIK rates, you pay less tax. This means more money in your pocket. You can enjoy your car without worrying too much about taxes.

Less Impact On The Environment

Electric cars are cleaner. They do not pollute the air. This helps fight climate change. It is good for future generations.

Lower Fuel Costs

Charging an electric car is cheaper than buying petrol or diesel. You can save a lot of money over time. Many homes can charge cars easily.

Less Maintenance Required

Electric cars have fewer moving parts. This means they need less maintenance. You can save money on repairs.

Are There Any Disadvantages?

While electric cars have many benefits, there are some downsides:

- Higher upfront costs.

- Limited driving range.

- Charging infrastructure may be lacking.

Higher Upfront Costs

Electric cars can be expensive to buy. The list price is often higher than petrol cars. However, savings on tax and fuel can help.

Limited Driving Range

Some electric cars cannot drive long distances. You need to charge them often. Make sure to check the range before buying.

Charging Infrastructure

Sometimes, charging stations are not easy to find. This can make long trips tricky. Always plan your routes ahead of time.

Frequently Asked Questions

What Is Benefit In Kind For Electric Cars?

Benefit in Kind (BiK) is a tax on company car perks. It applies to electric vehicles provided by employers.

How Is Bik Calculated For Electric Cars?

BiK for electric cars is based on their value and CO2 emissions. Lower emissions mean lower tax rates.

What Are The Tax Rates For Electric Cars?

The tax rates vary yearly. For 2023/24, the rate is 2% for electric vehicles.

Do Electric Cars Have Lower Bik Rates?

Yes, electric cars have much lower BiK rates compared to petrol or diesel cars.

Conclusion

Benefit in Kind for electric cars is an important topic. HMRC has set low tax rates for electric vehicles. This encourages more people to choose electric cars. They are better for the environment and save money.

Before buying an electric car, think about the pros and cons. Electric cars can be a great choice. They offer many benefits, especially with lower tax rates.

As more people switch to electric cars, the future looks bright. Understanding BIK can help you make the best choice.

Next Steps

If you are interested in electric cars, do some research. Look at different models. Check your local charging options. Talk to your employer about BIK. This can help you make a smart decision.

Remember, driving an electric car is not just a trend. It is a step toward a greener planet. Together, we can make a difference.