Benefit in Kind on Electric Cars HMRC: Tax-Savvy Perks!

Many people are curious about electric cars. They want to know how they work. They also want to learn about taxes related to them. One important topic is “Benefit in Kind” (BIK). This article will explain BIK on electric cars in the UK. We will cover many points to help you understand better.

What is Benefit in Kind?

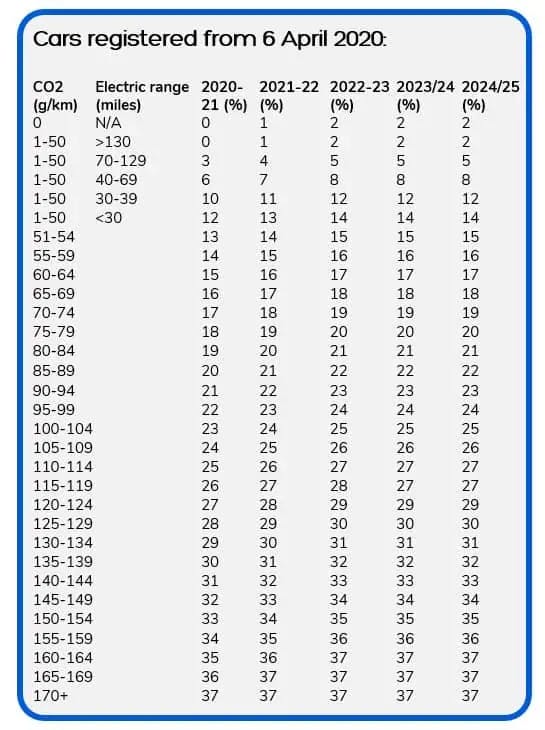

Benefit in Kind is a tax. It applies to employees who get perks from their jobs. These perks can be cars, health insurance, or other benefits. If you use a company car, you may pay BIK tax. This tax is based on the car’s value and its emissions.

How BIK Works for Electric Cars

Electric cars are different from regular cars. They produce no emissions. This means they are better for the environment. Because of this, the government encourages people to drive electric cars. One way they do this is by reducing BIK rates.

Lower Tax Rates

In the past, BIK rates were high for all cars. However, electric cars have lower rates. For example, in 2023, the BIK tax rate for electric cars is just 2%. This is much lower than regular cars.

Examples Of Bik Rates

| Car Type | BIK Rate 2023 |

|---|---|

| Electric Car | 2% |

| Petrol Car (Emissions 130g/km) | 30% |

| Diesel Car (Emissions 160g/km) | 37% |

As you can see, electric cars have a big advantage. The BIK tax is much lower. This means less money taken from your paycheck.

Why Choose Electric Cars?

There are many reasons to choose electric cars. Let’s look at some of the benefits.

1. Environmental Benefits

Electric cars help the environment. They do not produce harmful emissions. This helps reduce air pollution. Cleaner air is better for everyone.

2. Cost Savings

Driving an electric car can save you money. You pay less in taxes. Also, electric cars often have lower running costs. They are cheaper to charge than petrol or diesel cars.

3. Government Incentives

The UK government offers incentives for electric cars. These can include grants or tax breaks. This makes buying an electric car more affordable.

How to Calculate BIK Tax

Calculating BIK tax is simple. You need to know the car’s value and the BIK rate. Here is the formula:

BIK Tax = Car Value x BIK Rate x Your Tax Rate

Example Calculation

Let’s say your electric car is worth £30,000. The BIK rate is 2%. If you are in the 20% tax bracket, your calculation would look like this:

You would pay £120 in BIK tax for that year. This is much lower than a regular car.

How to Get an Electric Car

Buying an electric car is easy. You can visit a dealership. Many brands sell electric models. You can also look online.

Leasing Vs. Buying

You can either lease or buy an electric car. Leasing means you pay monthly for a car. At the end, you return it. Buying means you own the car. This is a good option if you want to keep it long-term.

Frequently Asked Questions

What Is Benefit In Kind For Electric Cars?

Benefit in Kind (BIK) is a tax on perks from your job. For electric cars, it applies to the private use of the vehicle.

How Is Bik Calculated For Electric Cars?

BIK is based on the car’s value and its CO2 emissions. Lower emissions mean lower tax rates.

Why Choose An Electric Car For Bik Tax Benefits?

Electric cars have lower BIK rates. This can save you money on taxes.

What Is The Current Bik Rate For Electric Cars?

The current BIK rate for electric cars is 2%. This rate applies for the tax year 2022/23.

Conclusion

Benefit in Kind on electric cars is important. Lower tax rates make electric cars more attractive. They save you money and help the environment.

If you are considering an electric car, think about BIK. Understanding how it works can help you make a better choice. Remember to consider all the benefits, like cost savings and government support.

Electric cars are the future. They offer many advantages. Make sure to do your research. Choose what is best for you. Enjoy driving an electric car!